Share Sleuth: how I decided to make this double trade

Richard Beddard explains the thought process that led him to reduce a holding, and add to his highest-scoring share.

4th September 2024 09:31

by Richard Beddard from interactive investor

When I sat down to ponder trades on Thursday 29 Aug it was so hot I had to retreat inside to think clearly. There was cash burning in my pocket too.

The portfolio’s £12,189 cash pile came from the disposal of half its holding in Goodwin, an engineering company, a month ago, and a slew of dividends. These included a special dividend from Latham (James) (LSE:LTHM), the timber importer and distributor.

- Invest with ii: What is a Managed ISA? | Open a Managed ISA | Transfer an ISA

Time to buy

Since the Share Sleuth’s minimum trade size is £5,169, 2.5% of the total value of the portfolio, it could easily afford two new additions (or a really big one).

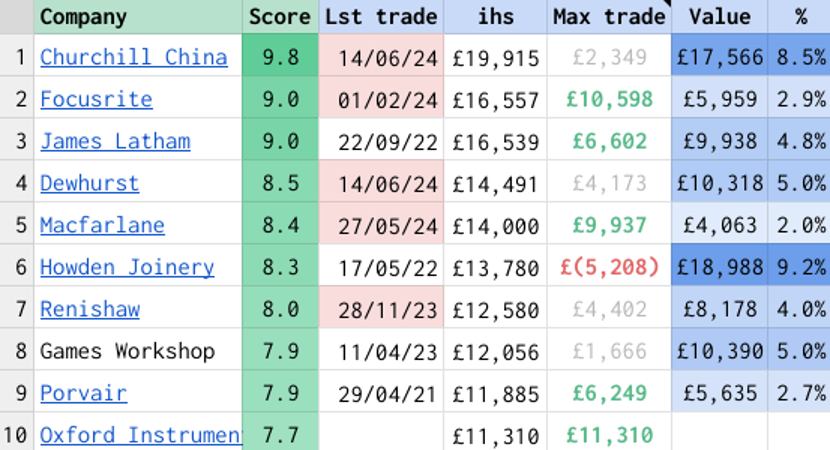

Source: Richard Beddard/Decision Engine

Unless I broke my rules, the only shares available to the portfolio among the top 10 were James Latham (rank 3, score 9), filtration and laboratory equipment maker Porvair (LSE:PRV) (rank 9, score 7.9), and nano-tool manufacturer Oxford Instruments (LSE:OXIG) (rank 10, score 7.7).

I could add to these holdings because I had not traded the shares in the prior 11 months, and they are not due to be re-scored shortly.

Most importantly, the value of each holding is significantly below its ideal holding size. This is determined by the share’s score using a formula described in the guide linked at the end of this article. To add more shares, the actual holding size has to be at least £5,176 (the minimum trade size) lower than the ideal holding size. These opportunities are highlighted in green in the table above.

At a push, I could add shares in electronic music equipment mini-conglomerate Focusrite (LSE:TUNE) (rank 2, score 9) and packaging supplier Macfarlane Group (LSE:MACF) (rank 5, score 8.4). The only thing preventing these trades is my preference not to trade the same share more than once every year or so, which is a rule I break occasionally.

But I traded Macfarlane three months ago, which is too soon for a share I am still getting to know

And Focusrite recently dropped its third profit warning since I scored it last December. If profit warnings come in threes as they say, this would be a buying opportunity. But I need more confidence than an aphorism can give me, and that will only come if I re-evaluate the share.

So far, things have not gone as I imagined:

Source: SharePad. Each “b” is an addition to the Share Sleuth portfolio

Porvair is probably a good long-term investment, but James Latham and Oxford Instruments caught my eye.

Lathams is enticing because it has the highest score, so technically it is the best long-term investment.

But the portfolio does not have an Oxford Instruments holding, so the discrepancy between the holding size of zero and the share’s ideal holding size is the largest of the three candidates.

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

- Insider: blue-chip directors eye more progress

Something troubled me about adding more Lathams. Just a nagging instinct.

The portfolio’s biggest holding was Howden Joinery Group (LSE:HWDN) (rank 6, score 8.3).

Lathams is a timber importer and distributor, it also manufactures timber products Howdens turns into kitchen cabinets, and also sells joinery products such as doors and skirting boards.

Since the two companies’ fortunes may be connected, I hesitated.

But the size of the Howdens’ holding was so big it exceeded the share’s ideal holding size by more than £5,176, so an opportunity presented itself.

The excess was only slightly bigger (£5,208), but it allowed me to increase the value of the holding in Lathams without increasing the combined value of the two holdings.

I have swapped about £5,200 of Howdens for £5,200 of Lathams.

Adding Lathams, reducing Howdens

Of course, I slept on the decision. Then, on Friday 30 August, I did the double trade.

I added 400 James Latham shares at a price of £12.98, which cost Share Sleuth £5,202. And I reduced the portfolio’s holding of Howden Joinery by 544 shares at a price of 957.34p, which raised £5,197.93. Both prices were quoted by a broker and the total values of the transactions each include a £10 charge in lieu of broker fees.

Diversification conundrum

My concern about owning large holdings of similar shares provoked a smidgen of self-doubt.

This unease was also fuelled (inadvertently) by a wonderful email from a reader. The email was wonderful because it was from a scorer, and I do not think there are many of us.

It was also wonderful because it compared our systems, which provokes lots of thoughts.

In passing thought, my correspondent remarked that a high proportion of the companies in the Decision Engine are manufacturers. That is particularly true if you lump in the distributors.

Most of the companies I score in the Decision Engine make, assemble, or supply physical components or products.

- Stockwatch: time to back this high-yielding small-cap?

- Shares for the future: a high-quality firm like no other

If we make the broadest distinction, between product and service companies, there a few service companies in the Decision Engine.

Keystone Law Group Ordinary Shares (LSE:KEYS) is a law firm, but I did not have the courage to give it a particularly high score. Softcat (LSE:SCT) is a distributor of software, so not a physical product, and the value it adds is largely advice. I have never had the courage to add it to the Share Sleuth portfolio.

Within the portfolio, most of the companies supply products with a service element. The boundary is so blurred at some firms, they evade even this simplest of classifications. Celebrus Technologies (LSE:CLBS) and Quartix Technologies (LSE:QTX) supply IT as a service. Are they product companies or service companies?

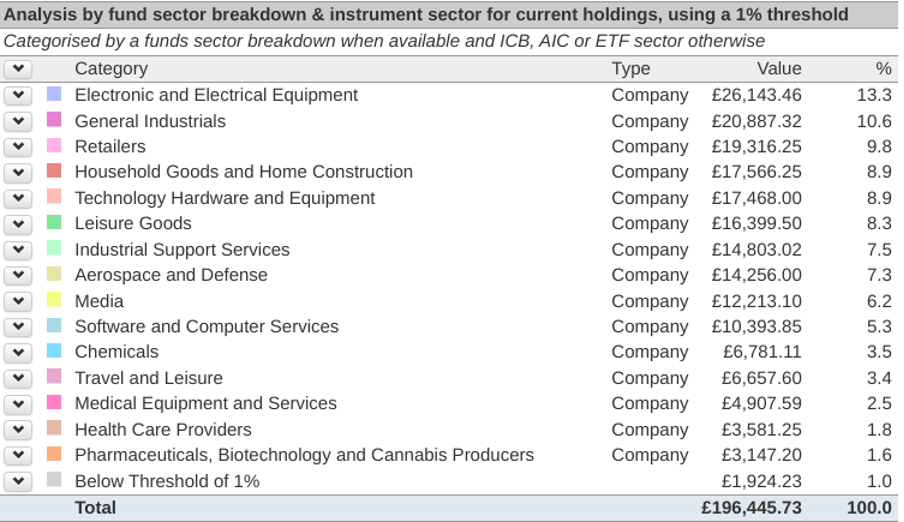

Broader classifications suggest the portfolio is quite well diversified.

Source: SharePad

But I find it harder to work out what makes service companies special (distinctive), and consequently whether their strategies are plugging weaknesses and building on strengths (directed).

It would be comforting to include more service companies in the Share Sleuth portfolio, but only when I can gain confidence in them.

It is quite a conundrum. Ultimately, if we follow a system, we will find similar companies and reduce diversification. That is the point.

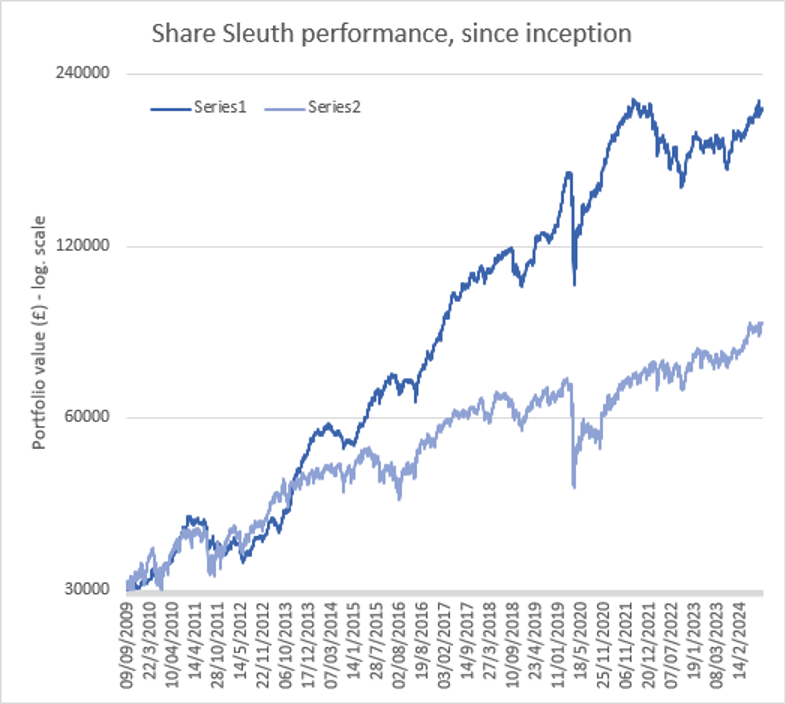

Share Sleuth performance

At the close on 30 August, Share Sleuth was worth £208,035, 593% more than the £30,000 of pretend money we started with in September 2009.

The same amount invested in accumulation units of a FTSE All-Share index tracking fund would be worth £88,635, an increase of 195%.

Past performance is not a guide to future performance.

After the trades, a special dividend from James Latham and dividends paid during the month from Bloomsbury Publishing (LSE:BMY), Celebrus, Dewhurst Group (LSE:DWHT), James Latham, Porvair, and Treatt (LSE:TET), Share Sleuth’s cash pile is £12,185.

The minimum trade size, 2.5% of the portfolio’s value, is £5,201.

Share Sleuth | Cost (£) | Value (£) | Return (%) | ||

Cash | 12,185 | ||||

Shares | 195,850 | ||||

Since 9 September 2009 | 30,000 | 208,035 | 593 | ||

Companies | Shares | Cost (£) | Value (£) | Return (%) | |

AMS | Advanced Medical Solutions | 1,965 | 4,503 | 4,913 | 9 |

ANP | Anpario | 1,124 | 4,057 | 3,091 | -24 |

BMY | Bloomsbury | 845 | 3,203 | 6,033 | 88 |

BNZL | Bunzl | 201 | 4,714 | 7,115 | 51 |

CHH | Churchill China | 1,495 | 17,228 | 17,193 | 0 |

CHRT | Cohort | 1,600 | 3,747 | 14,208 | 279 |

CLBS | Celebrus | 1,528 | 3,509 | 4,317 | 23 |

DWHT | Dewhurst | 938 | 6,754 | 10,318 | 53 |

FOUR | 4Imprint | 116 | 2,251 | 6,113 | 172 |

GAW | Games Workshop | 100 | 4,571 | 10,460 | 129 |

GDWN | Goodwin | 133 | 3,112 | 9,496 | 205 |

GRMN | Garmin | 53 | 4,413 | 7,391 | 67 |

HWDN | Howden Joinery | 1,476 | 10,371 | 14,052 | 35 |

JET2 | Jet2 | 456 | 250 | 6,726 | 2,591 |

LTHM | James Latham | 1,150 | 14,437 | 14,893 | 3 |

MACF | Macfarlane | 3,533 | 5,005 | 4,116 | -18 |

PRV | Porvair | 906 | 4,999 | 5,726 | 15 |

PZC | PZ Cussons | 1,870 | 3,878 | 1,915 | -51 |

QTX | Quartix | 3,285 | 7,296 | 6,077 | -17 |

RSW | Renishaw | 234 | 6,227 | 8,295 | 33 |

RWS | RWS | 2,790 | 9,199 | 4,983 | -46 |

SOLI | Solid State | 356 | 1,028 | 4,859 | 373 |

TET | Treatt | 763 | 1,082 | 3,632 | 236 |

TFW | Thorpe (F W) | 2,000 | 2,207 | 7,280 | 230 |

TSTL | Tristel | 750 | 268 | 3,581 | 1,235 |

TUNE | Focusrite | 2,020 | 14,128 | 6,060 | -57 |

VCT | Victrex | 292 | 6,432 | 3,008 | -53 |

Notes

30 August: Added more James Latham. Reduced Howden Joinery

Costs include £10 broker fee, and 0.5% stamp duty where appropriate

Cash earns no interest

Dividends and sale proceeds are credited to the cash balance

£30,000 invested on 9 September 2009 would be worth £208,035 today

£30,000 invested in FTSE All-Share index tracker accumulation units would be worth £88,635 today

Objective: To beat the index tracker handsomely over five-year periods

Source: SharePad, close on Friday 30 August.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in James Latham, Howden Joinery and most of the shares in the Share Sleuth portfolio.

See our guide to the Decision Engine and the Share Sleuth Portfolio for more information.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.