Share Sleuth: Games Workshop trimmed and a contrarian buy

Richard Beddard’s introduced a new share into the portfolio. To make room, he’s taken some profits on a long-term winner.

5th March 2025 09:41

by Richard Beddard from interactive investor

Credit: Newscast/Universal Images Group via Getty Images.

My trading day in February fell on Monday 17 February. At risk of oversharing, I was recovering from minor surgery (all good, thanks!). Although I rarely listen to music while working, I was playing Ludovico Einaudi through noise-cancelling headphones to block out the sound of builders renovating our house.

I share these background notes not to elicit sympathy, but to reveal my state of mind. My emotions have been fluctuating and, while it is nice to believe investors are 100% rational beings, we know that is not true.

- Invest with ii: Open a Trading Account | Cashback Offers | Free Regular Investing

Barring the crazy onset of the pandemic, I also cannot remember a time when the zeitgeist has been more disrupted than since the Trump administration came to power in the US. It looks like my faith in good businesses to adapt is going to be tested again.

Despite conditions making it difficult to keep a cool head, I was in a positive state of mind on Monday 17th. It was a brilliant sunny day, noise cancellation actually works.

Having a system that mostly pre-programmes trades helps too.

Weighing two buys and three sells

To prepare for the trade, I considered two numbers: the Share Sleuth portfolio’s cash balance of £4,100 and the portfolio’s minimum trade size, which was £4,900 (2.5% of the portfolio’s total value).

Since the cash balance was insufficient to fund a trade, I needed to remove or reduce a holding if I was to add shares.

The Decision Engine tells me which of my top 40 shares I can trade meaningfully. This time, 11 of the 40 shares in my Decision Engine were available. The other 29 are excluded because of two preferences and one rule.

I prefer not to trade shares more than once a year, so the Decision Engine excludes shares last traded in the previous 11 months. This stops me from rushing. Because I re-evaluate shares once a year, I think it’s a bad idea to trade more frequently than that.

I also prefer not to trade shares that will publish annual reports soon, because a new annual report is the trigger to reevaluate a share.

When I am very confident, I have occasionally gone against these preferences, but I do not break the rule, which is to trade meaningful amounts. This means I will not compromise on the minimum trade size unless I am liquidating a small holding.

This table shows all the trades that were available to me at more than the minimum trade size of £4,900, after applying these preferences:

# | Company | * | score | ihs | hs | % | max-ts |

8 | 8.2 | £12,519 | £12,519 | ||||

10 | 8.0 | £11,770 | £3,767 | 1.9% | £8,003 | ||

13 | 7.5 | £9,907 | £9,907 | ||||

14 | 7.4 | £9,469 | £9,469 | ||||

15 | 7.4 | £9,444 | £14,570 | 7.4% | £(5,126) | ||

20 | 7.1 | £8,331 | £8,331 | ||||

21 | 7.1 | £8,231 | £8,231 | ||||

22 | 7.0 | £7,825 | £2,829 | 1.4% | £4,996 | ||

25 | 6.8 | £7,099 | £7,099 | ||||

32 | 5.9 | £0 | £5,560 | 2.8% | £(5,560) | ||

37 | 5.4 | £0 | £3,400 | 1.7% | £(3,400) |

Scores and stats: Richard Beddard. Data: ShareScope and annual reports.

Click on a share's name to see a breakdown of the score (scores may have changed due to movements in share price)

Shares marked with an asterisk (*) have been re-scored, click the asterisk to find out why.

The first four columns in this table show the share’s rank, name, an asterisk (*) to explain if I have updated the score, and its score. The higher the score, the more confident I am that a share is a good long-term investment. Low-scoring shares are more speculative.

The second four columns show the ideal holding size (ihs), the actual holding size (hs), the holding size as a percentage of the portfolio’s total value, and the maximum trade size (max-ts).

The ideal holding size is determined by the share’s score. The higher the score, the higher the ideal holding size (see the Share Sleuth explainer for the formula).

Renew Holdings (LSE:RNWH), ranked eighth and the highest-ranked share available to trade, had a maximum trade size of £12,519, the same as its ideal holding size. This is because the portfolio held no Renew shares.

- Insider: buying at a FTSE 250 faller and high-flyer Rolls-Royce

- 10 hottest ISA shares, funds and trusts: week ended 28 February 2025

Hollywood Bowl Group (LSE:BOWL), James Halstead (LSE:JHD), Auto Trader Group (LSE:AUTO), YouGov (LSE:YOU) and Victrex (LSE:VCT) scored 7.0 or more, and could also have been considered. I rarely invest the maximum amount in a new holding. More likely, I would use the minimum trade size.

Tenth-ranked Focusrite (LSE:TUNE) had a maximum trade size of £8,003, which is the difference between the ideal holding size of £11,770 and the actual holding size of £3,767.

In terms of additions, I am most interested in the highest-scoring companies. A new investment in Renew, or an additional investment in Focusrite looked like the best options. They were the only shares that scored 8.0 or more.

The Decision Engine recommended I reduce the holding in Games Workshop Group (LSE:GAW) even though with a score of 7.4 it is in the buy zone. The maximum trade size is £5,126, representing the difference between the share’s ideal holding size of £9,444 and the actual holding size of £14,470.

It also recommended that I liquidate Share Sleuth’s holdings in Bloomsbury Publishing (LSE:BMY) and Celebrus Technologies (LSE:CLBS). Their scores are not high enough to justify holding the shares because the formula that determines the ideal holding size evaluates to less than 2.5% of the portfolio’s total value.

Hello, Renew

I slept on the decision. Then, on Tuesday 18 February, I reduced the portfolio’s holding in Games Workshop from 100 shares to 66.

All three shares in the firing line brought something different to the portfolio. Bloomsbury is the only publisher, Celebrus is the only software house, and there is only one Games Workshop.

The Decision Engine rated Games Workshop highest, but there was also much more money at risk. The Games Workshop holding was worth £14,570 compared to a near-minimum holding of £5,560 in Bloomsbury and a subscale holding of £3,400 in Celebrus.

The actual price, quoted by a broker, was £145.72p, which raised £4,944 after deducting £10 in lieu of fees.

Having trimmed Games Workshop, it remains slightly above its ideal holding size.

Source: ShareScope. ‘B’ indicates an addition of shares to the portfolio. ‘S’ indicates a reduction in the holding. Share Sleuth has held a Games Workshop holding continuously since 2009.

I also added 689 shares in Renew. It maintains, repairs and upgrades the UK’s road, rail, water and energy infrastructure.

Renew has many of the hallmarks of a good business. It has been highly profitable, has strong finances and a focused strategy.

Nevertheless, I feel Renew is a contrarian investment because infrastructure spending is largely funded by the government, and it is not clear, at least to me, how the UK can afford all the demands on its stretched public finances.

- Stockwatch: is the UK bank share boom over?

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

The magic, but also maybe imaginary, bullet is growth, which may require more infrastructure spending.

Maintenance and repair, Renew’s meat and drink, is necessary just to keep things running. The company describes this work as “non-discretionary”, but that does not mean the government won’t demand more for our money.

The actual price, quoted by a broker, was 710p and the total investment cost £4,902 after deducting £10 in lieu of fees.

Share Sleuth performance

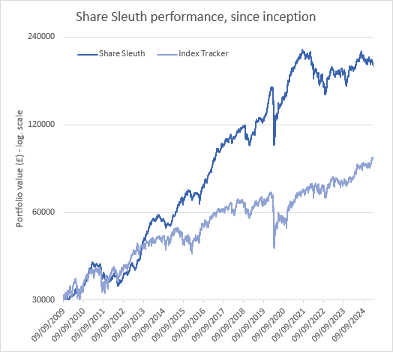

At the close on Friday 28 February, Share Sleuth was worth £191,053, 537% more than the £30,000 of pretend money we started with in September 2009.

The same amount invested in accumulation units of a FTSE All-Share index tracking fund would be worth £92,644, an increase of 209%.

Share Sleuth | Cost (£) | Value (£) | Return (%) | ||

Cash | 4,586 | ||||

Shares | 186,470 | ||||

Since 9 September 2009 | 30,000 | 191,056 | 537 | ||

Companies | Shares | Cost (£) | Value (£) | Return (%) | |

AMS | Advanced Medical Solutions | 1,965 | 4,503 | 4,166 | -7 |

ANP | Anpario | 1,124 | 4,057 | 5,114 | 26 |

BMY | Bloomsbury | 845 | 3,203 | 5,155 | 61 |

BNZL | Bunzl | 201 | 4,714 | 6,770 | 44 |

CHH | Churchill China | 1,495 | 17,228 | 8,522 | -51 |

CHRT | Cohort | 861 | 2,813 | 9,342 | 232 |

CLBS | Celebrus | 1,528 | 3,509 | 3,744 | 7 |

DWHT | Dewhurst | 938 | 6,754 | 10,318 | 53 |

FOUR | 4Imprint | 116 | 2,251 | 6,032 | 168 |

GAW | Games Workshop | 66 | 4,116 | 9,438 | 129 |

GDWN | Goodwin | 133 | 3,112 | 9,097 | 192 |

GRMN | Garmin | 53 | 4,413 | 9,632 | 118 |

HWDN | Howden Joinery | 1,476 | 10,371 | 11,409 | 10 |

JET2 | Jet2 | 456 | 250 | 6,407 | 2,463 |

LTHM | James Latham | 1,150 | 14,437 | 12,305 | -15 |

MACF | Macfarlane | 3,533 | 5,005 | 3,657 | -27 |

OXIG | Oxford Instruments | 241 | 5,043 | 4,618 | -8 |

PRV | Porvair | 906 | 4,999 | 6,541 | 31 |

QTX | Quartix | 3,285 | 7,296 | 5,157 | -29 |

RNWH | Renew Holdings | 689 | 4,902 | 4,541 | -7 |

RSW | Renishaw | 234 | 6,227 | 6,763 | 9 |

RWS | RWS | 2,790 | 9,199 | 3,448 | -63 |

SCT | Softcat | 326 | 4,992 | 4,916 | -2 |

SOLI | Solid State | 5,009 | 6,033 | 6,637 | 10 |

TET | Treatt | 763 | 1,082 | 3,063 | 183 |

TFW | Thorpe (F W) | 4,362 | 9,711 | 13,042 | 34 |

TUNE | Focusrite | 2,020 | 14,128 | 3,939 | -72 |

VCT | Victrex | 292 | 6,432 | 2,698 | -58 |

Notes

18 Feb: Reduced Games Workshop holding, added new Renew holding

Costs include £10 broker fee, and 0.5% stamp duty where appropriate

Cash earns no interest

Dividends and sale proceeds are credited to the cash balance

£30,000 invested on 9 September 2009 would be worth £191,056 today

£30,000 invested in FTSE All-Share index tracker accumulation units would be worth £92,644 today

Objective: To beat the index tracker handsomely over five-year periods

Source: ShareScope, close on Friday 28 February 2025.

After dividends paid during the month from Cohort (LSE:CHRT), Dewhurst Group (LSE:DWHT), Focusrite, Games Workshop, Jet2 Ordinary Shares (LSE:JET2), RWS Holdings (LSE:RWS), Solid State (LSE:SOLI), and Victrex, Share Sleuth’s cash pile is £4,586.

The minimum trade size, 2.5% of the portfolio’s value, is £4,776.

Past performance is not a guide to future performance.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns all the shares in the Share Sleuth portfolio.

For more on the Share Sleuth portfolio, please see Richard’s explainer.

Contact Richard Beddard by email: richard@beddard.net or via his website.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.