Share Sleuth: the FTSE 100 stock I have added to the portfolio

Richard Beddard has reduced exposure to a top performer and invested the proceeds in a new holding.

8th April 2021 15:35

by Richard Beddard from interactive investor

Richard Beddard has reduced exposure to a top performer and invested the proceeds in a new holding.

This month, I have made two minor adjustments to the Share Sleuth portfolio which may make it a little less hare-like, and a little more tortoise-like.

Trading Treatt

I reduced the size of Share Sleuth’s holding in Treatt (LSE:TET), one of the portfolio’s best-performing shares.

- Invest with ii: Top UK Shares | Share Tips & Ideas | Open a Trading Account

According to SharePad, the software I use to track the portfolio, Treatt has earned a return of more than 600% since I added it six years ago in March 2015. It has earned an annualised return of 39%.

- Share Sleuth: why I am not giving up on this share

- Share Sleuth: the 10 trades I made in 2020

- How to be a better investor: Lesson 1

Treatt processes essential oils and other mostly natural flavours used in soft drinks. While much of its business trades commodity citrus oils, for many years now it has been developing unique and more profitable ingredients for drinks companies.

The story is unchanged and to my mind very positive. Growth should accelerate once Treatt has moved into its new headquarters, a once-in-a-generation investment in a facility that will enable it to invent many more flavours to quench our insatiable thirst for novelty and sweetness without the sugar. But as Treatt has prospered, so too has its share price, which is the reason I am trimming the holding.

Since Treatt had grown even faster than the portfolio as a whole, it accounted for a bigger proportion of it in March, just under 7%.

And at just shy of £10, it values the enterprise at about £109 million, which is 43 times adjusted profit for the year to November 2020.

Since high share prices multiples are penalised by my scoring and ranking system, Treatt had fallen to a rank of 29 in my Decision Engine.

This rank does not tell me that Treatt is a bad long-term investment, just that there may be 28 better ones, and consequently some of the money invested in Treatt might be more wisely invested elsewhere.

Such is my respect for the company and its management, I chose to trim the portfolio’s holding by my minimum trade size (2.5% of the value of the portfolio).

On 22 March, I disposed of 459 shares at a price of £10.75, raising £4,706.23 after deducting £10 in lieu of broker charges. The remaining holding of 763 shares is worth over £7,000 or about 4% of the total value of the portfolio.

Buying Bunzl

Little more than a week after I disposed of the Treatt shares I added shares in Bunzl (LSE:BNZL), a supplier of everyday consumables such as packaging and safety equipment to businesses and organisations across North America and Europe.

I had reviewed Bunzl favourably earlier in the month, but I did hesitate before pulling the trigger, wondering whether it is too boring for Share Sleuth.

The company is one of only two FTSE 100 shares in the portfolio (the other is Next (LSE:NXT)) and its growth is contingent on acquiring smaller distributors to increase its product range and geographic reach.

It is unlikely to set the portfolio alight like Treatt. Whereas Treatt has been through something of a revolution, Bunzl is growing incrementally, by doing more of the same thing.

- FTSE 100 interview: Bunzl benefits from Covid shift

- Richard Beddard: nerdy but essential changes to the Decision Engine

- Your chance to win £1,000: take part in the Great British Retirement Survey

But the risks are lower too. Bunzl has been executing the same strategy successfully for nearly two decades and since its aspirations are global it should be able to continue for a long time.

Treatt is a hare, and Bunzl is more of a tortoise, but I think it is probably a good idea to have both in a diversified portfolio. We all know who wins in the fable, but I prefer to hedge my bets.

On 31 March, I added 201 shares in Bunzl at a shade over £23.28. The total cost including charges in lieu of broker fees (£10) and stamp duty (£23.40) was £4,713.56, about 2.5% of the total value of the portfolio.

The diversity of companies in Share Sleuth gives me confidence, which is why I chose to add a new share, rather than more of Howdens (LSE:HWDN), the kitchen supplier, or Goodwin (LSE:GDWN), a manufacturer of steel castings and machined products.

They are also ranked highly by my Decision Engine and perhaps under-represented in the portfolio.

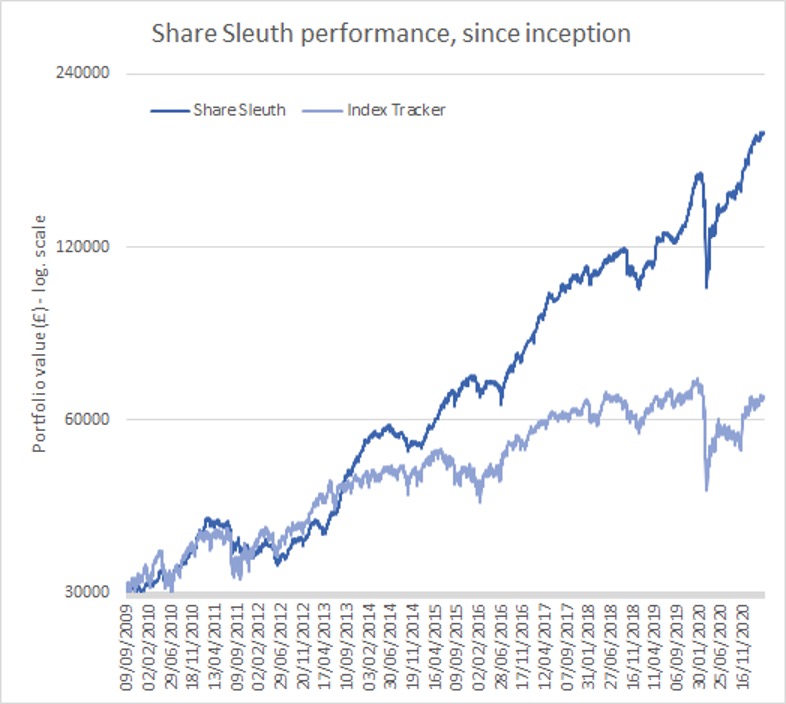

Share Sleuth performance

At the close on Thursday 1 April, just before the Easter holiday, it was valued at £190,690, which is 536% more than the notional £30,000 invested over the course of its first year starting in September 2009.

A £30,000 investment in accumulation units of a FTSE All-Share index tracking fund would be worth £65,825, a gain of 119% over the same period.

The cash balance is £6,161, about 3% of the portfolio’s total value, sufficient to purchase a new holding, or top up an existing one, at my minimum trade size of 2.5%.

Share Sleuth | Cost (£) | Value (£) | Return (%) | ||

Cash | 6,161 | ||||

Shares | 184,529 | ||||

Since 9 September 2009 | 30,000 | 190,690 | 536 | ||

Companies | Shares | Cost (£) | Value (£) | Return (%) | |

ANP | Anpario | 1,874 | 6,593 | 10,963 | 66 |

BMY | Bloomsbury | 1,256 | 3,274 | 3,668 | 12 |

BNZL | Bunzl | 201 | 4,714 | 4,744 | 1 |

BOWL | Hollywood Bowl | 1,615 | 3,628 | 3,634 | 0 |

CHH | Churchill China | 341 | 3,751 | 5,166 | 38 |

CHRT | Cohort | 1,600 | 3,747 | 9,840 | 163 |

D4T4 | D4t4 | 1,528 | 3,509 | 4,966 | 42 |

DWHT | Dewhurst | 735 | 2,244 | 12,863 | 473 |

FOUR | 4Imprint | 190 | 3,688 | 4,769 | 29 |

GAW | Games Workshop | 76 | 218 | 7,646 | 3,407 |

GDWN | Goodwin | 266 | 6,646 | 7,874 | 18 |

HWDN | Howden Joinery | 748 | 3,228 | 5,576 | 73 |

JDG | Judges Scientific | 159 | 3,825 | 10,049 | 163 |

JET2 | Jet2 | 456 | 250 | 5,935 | 2,274 |

NXT | Next | 106 | 6,071 | 8,601 | 42 |

PZC | PZ Cussons | 1,870 | 3,878 | 4,993 | 29 |

QTX | Quartix | 1,085 | 2,798 | 5,913 | 111 |

RM. | RM | 1,275 | 3,038 | 2,933 | -3 |

RSW | Renishaw | 92 | 1,739 | 5,952 | 242 |

SOLI | Solid State | 1,546 | 4,523 | 12,832 | 184 |

TET | Treatt | 763 | 1,082 | 7,020 | 548 |

TFW | Thorpe (F W) | 2,000 | 2,207 | 7,000 | 217 |

TRI | Trifast | 2,261 | 3,357 | 3,392 | 1 |

TSTL | Tristel | 750 | 268 | 4,800 | 1,689 |

VCT | Victrex | 534 | 10,812 | 12,004 | 11 |

XPP | XP Power | 240 | 4,589 | 11,400 | 148 |

Table notes: added Bunzl. Costs include £10 broker fee, and 0.5% stamp duty where appropriate. Cash earns no interest. Dividends and sale proceeds are credited to the cash balance. £30,000 invested on 9 September 2009 would be worth £190,690 today. £30,000 invested in FTSE All-Share index tracker accumulation units would be worth £65,825 today. Objective: To beat the index tracker handsomely over five-year periods. Source: SharePad, 1 April 2021.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in Treatt.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.