Share Sleuth: the double trade that cleared my cash pile

With the portfolio having £10,000 in cash, Richard Beddard considered where to put the money to work, increasing exposure to two holdings.

4th July 2024 09:23

by Richard Beddard from interactive investor

This month’s trading day happened uncharacteristically early in the month on Thursday 13 June. It was prompted by greed, which is rarely a good thing!

On the day, the portfolio had a virtual cash balance of just over £10,000, enough to fund two trades of at least 2.5% of the portfolio’s total value - a lower limit I call the Minimum Trade Size (MTS). The MTS was a shade under £5,000.

- Invest with ii: What is a Managed ISA? | Open a Managed ISA | Transfer an ISA

Additions

The decision to schedule my day of deliberation so early was prompted by scoring Churchill China (LSE:CHH), which I sent for publication the same day.

Due to a decline in its share price, Churchill China had been sitting at the top of the Decision Engine table for months. For much of that time I had been contemplating buying more shares even though this would breach one of my guidelines.

Source: SharePad. A ‘b’ indicates an addition to the portfolio’s holding.

The guideline requires me to avoid trading shares if I have traded them in the previous year or so. I last added Churchill China shares in November 2023, little more than six months ago.

The guideline protects me from overconfidence. But I had just re-evaluated Churchill China and it retained its high score. I felt the re-evaluation was my safeguard against overconfidence.

A better formulation of the guideline, the one I will use from now on, is that I should not trade a share that I have already traded since I last scored it (I score each share once a year).

- Best UK stocks, sectors and markets in first half of 2024

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

I had a second reason for wanting to add to the holding in Churchill China. The Share Sleuth portfolio is underweight most of the highly ranked shares and I feel a strong urge to redeploy money into them.

That is the logic of the Decision Engine. Shares at the top of the table are undervalued. Shares near the bottom are fairly valued and occasionally overvalued. Money needs to gradually flow from the bottom of the list to the top of the list to earn the best returns.

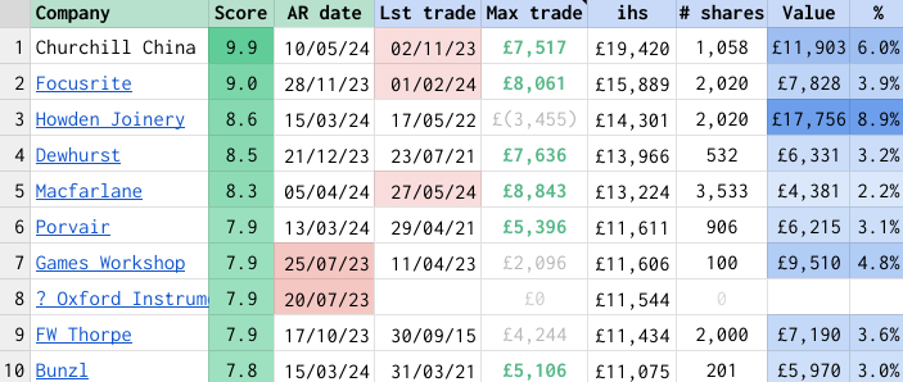

But I get ahead of myself. This was top of the table on Thursday:

Notes: Max trade = the trade required to make the value of the holding equal the ideal holding size, ihs = ideal holding size (see the link at the bottom of the article for how it is calculated), # shares = number of shares held in Share Sleuth, Value = value of holding, % = Value of holding as a percentage of the total value of the portfolio

To follow my chain of thought, we need to start with the Max trade column, which shows how much I would have to add to a holding or remove from it so that its size is equal to its ideal holding size. The ideal holding size is determined by the share’s score. The higher the score, the larger the holding up to a maximum of 10% of the total value of the portfolio.

To get top-ranked Churchill China to its ideal holding size, I would have to buy £7,517 worth of shares, which is more than the minimum trade size, and why the trade is lit up in green.

The next highest share that would not break my reformulated trading guideline was Dewhurst Group (LSE:DWHT), which predominantly makes and distributes lift components.

The Decision Engine would have us add up to £7,636 worth of Dewhurst shares.

I did not overthink the decision. The portfolio had enough cash to make two trades of £5,000 so I decided to add to both holdings.

Source: SharePad. A ‘b’ indicates an addition to the portfolio’s holding. An “s” indicates a reduction. Share Sleuth has held shares in Dewhurst continuously since the portfolio came into being in 2009.

The double trade would empty Share Sleuth’s treasury.

Reductions

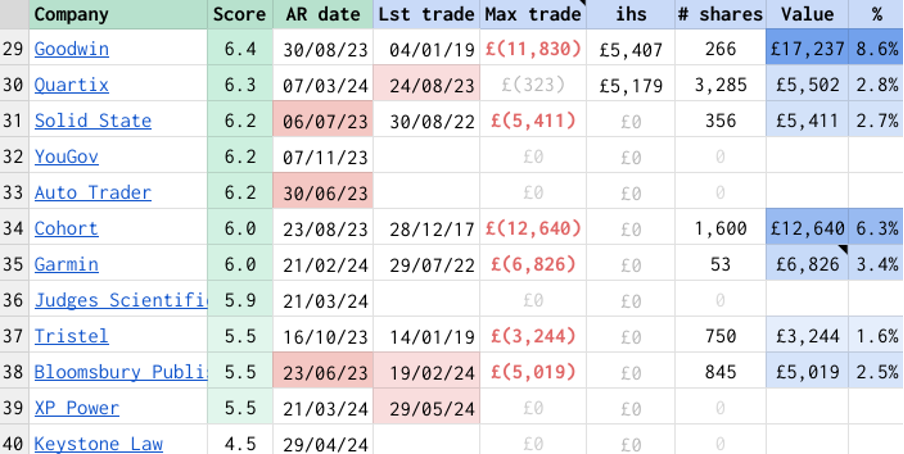

Next month, my focus will turn to liberating cash from the bottom of the table to redeploy into table-topping shares. There is plenty of liberating to be done.

These were the holdings the Decision Engine wanted me to reduce in size, or liquidate (highlighted in red in the Max trade column):

Notes: Max trade = the trade required to make the value of the holding equal the ideal holding size, ihs = ideal holding size (see the link at the bottom of the article for how it is calculated), # shares = number of shares held in Share Sleuth, Value = value of holding, % = Value of holding as a percentage of the total value of the portfolio

With the exception of Goodwin (LSE:GDWN), which is a mini-manufacturing conglomerate, the scores of the shares are so low the ideal holding size is less than 2.5% of the value of the portfolio.

Such small holdings are not meaningful, and the Decision Engine is putting me in the agonising position of liquidating some of its hardest-working shares. They score low scores because of their high share prices, not because they are poor businesses.

I find it hard to imagine a portfolio without Bloomsbury Publishing (LSE:BMY), Garmin Ltd (NYSE:GRMN), Cohort (LSE:CHRT), or Solid State (LSE:SOLI).

That will be what I think about next month. It will be painful.

Double trade

Of course, I slept on my decisions. Then on Friday 14 June I added 437 shares in Churchill China.

The actual price, quoted by a broker, was 11.43p, which cost £5,005 after deducting £10 in lieu of fees.

I also added 406 shares in Dewhurst. There are two classes of Dewhurst share, the ordinary shares (DWHT) and the non-voting ‘A’ shares (DWHA). I added DWHT, but it is worth pointing out that the A shares generally trade at a discount and earn the same dividend, so the yield on the A’s will be higher.

- 18 FTSE 100 stocks about to return billions in dividend income

- Stockwatch: a rare income stock capable of capital growth

The actual price, quoted by a broker, was 12.29p, which cost £5,001 after deducting £10 in lieu of fees.

Both shares are illiquid, which means I experienced the pain of registering an immediate paper loss of 2% for the Churchill China trade and over 3% for Dewhurst.

I think in the distant future when I sell the shares, it will have been worth it.

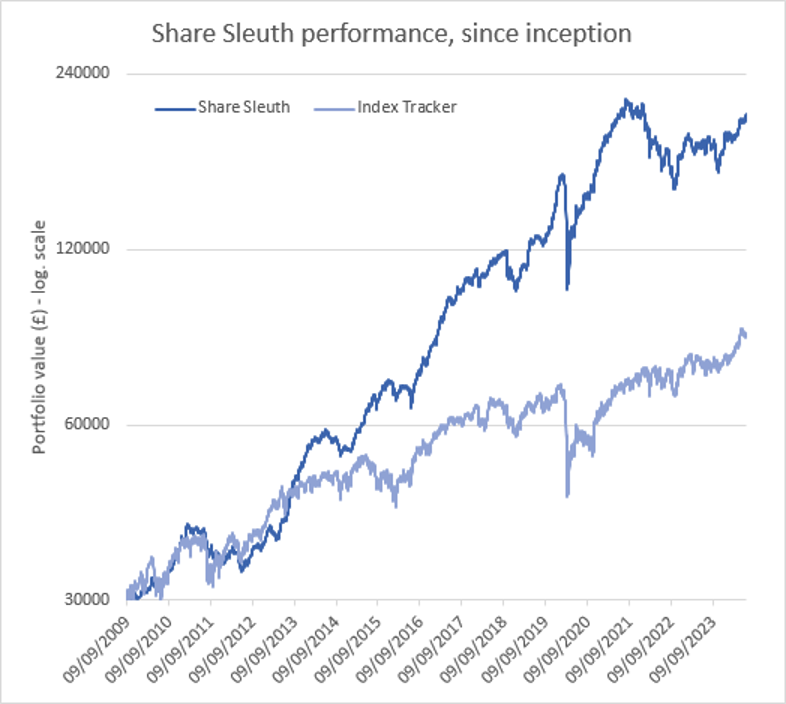

Share Sleuth performance

At the close on Friday 28 June, Share Sleuth was worth £202,703, 576% more than the £30,000 of pretend money we started with in September 2009.

The same amount invested in accumulation units of a FTSE All-Share index tracking fund would be worth 85,968, an increase of 187%.

Past performance is not a guide to future performance.

After dividends paid during the month from Advanced Medical Solutions Group (LSE:AMS), Churchill China, Garmin, and Victrex (LSE:VCT), Share Sleuth has £416 in cash.

The minimum trade size, 2.5% of the portfolio’s value, is £5,068.

Share Sleuth | Cost (£) | Value (£) | Return (%) | ||

Cash | 416 | ||||

Shares | 202,288 | ||||

Since 9 September 2009 | 30,000 | 202,703 | 576 | ||

Companies | Shares | Cost (£) | Value (£) | Return (%) | |

AMS | Advanced Medical Solutions | 1,965 | 4,503 | 4,205 | -7 |

ANP | Anpario | 1,124 | 4,057 | 3,400 | -16 |

BMY | Bloomsbury | 845 | 3,203 | 5,290 | 65 |

BNZL | Bunzl | 201 | 4,714 | 6,050 | 28 |

CHH | Churchill China | 1,495 | 17,228 | 16,968 | -2 |

CHRT | Cohort | 1,600 | 3,747 | 12,000 | 220 |

CLBS | Celebrus | 1,528 | 3,509 | 3,568 | 2 |

DWHT | Dewhurst | 938 | 6,754 | 11,162 | 65 |

FOUR | 4Imprint | 116 | 2,251 | 6,798 | 202 |

GAW | Games Workshop | 100 | 4,571 | 10,670 | 133 |

GDWN | Goodwin | 266 | 6,646 | 21,333 | 221 |

GRMN | Garmin | 53 | 4,413 | 6,812 | 54 |

HWDN | Howden Joinery | 2,020 | 12,718 | 17,746 | 40 |

JET2 | Jet2 | 456 | 250 | 5,969 | 2,288 |

LTHM | James Latham | 750 | 9,235 | 9,300 | 1 |

MACF | Macfarlane | 3,533 | 5,005 | 4,204 | -16 |

PRV | Porvair | 906 | 4,999 | 5,980 | 20 |

PZC | PZ Cussons | 1,870 | 3,878 | 1,848 | -52 |

QTX | Quartix | 3,285 | 7,296 | 5,010 | -31 |

RSW | Renishaw | 234 | 6,227 | 8,658 | 39 |

RWS | RWS | 2,790 | 9,199 | 5,240 | -43 |

SOLI | Solid State | 356 | 1,028 | 5,304 | 416 |

TET | Treatt | 763 | 1,082 | 3,277 | 203 |

TFW | Thorpe (F W) | 2,000 | 2,207 | 6,740 | 205 |

TSTL | Tristel | 750 | 268 | 3,431 | 1,179 |

TUNE | Focusrite | 2,020 | 14,128 | 7,979 | -44 |

VCT | Victrex | 292 | 6,432 | 3,346 | -48 |

Notes

17 June: Added to Churchill China and Dewhurst

Costs include £10 broker fee, and 0.5% stamp duty where appropriate

Cash earns no interest

Dividends and sale proceeds are credited to the cash balance

£30,000 invested on 9 September 2009 would be worth £202,703 today

£30,000 invested in FTSE All-Share index tracker accumulation units would be worth £85,968 today

Objective: To beat the index tracker handsomely over five-year periods

Source: SharePad, close on Friday 28 June 2024.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in Churchill China and Dewhurst

See our guide to the Decision Engine and the Share Sleuth Portfolio for more information.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.