Share Sleuth: the company I cannot bring myself to sell

8th December 2021 11:02

by Richard Beddard from interactive investor

Richard Beddard explains that his decision to hold on to a firm that’s been hit hard by the pandemic is based on wishful thinking, rather than judgement.

For the second consecutive month, I have not made any changes to the Share Sleuth portfolio. In admitting this fact, I feel the need to explain myself, a bit like the governor of the Bank of England writing a letter to the chancellor because inflation has diverged too far from its target.

This is odd, since I am not supposed to trade every month. One trade a month is my limit, not a target.

Since the goal of the portfolio is to buy shares in good companies at reasonable prices and hold them for the long term and I have been running Share Sleuth for more than 12 years, you might expect the portfolio to be relatively settled. The only new money that enters is from dividends, and with Share Sleuth valued at around £200,000, it might realistically produce about £5,000 of income a year. Therefore, new money will only fund about one trade a year based on my minimum trade size of 2.5% of the portfolio’s value.

- Richard Beddard: why I’m upgrading this mid-cap share

- Shares for the future: my top 40 stocks after dumping this one

- Richard Beddard: why this top performer is near bottom of my ‘buy’ list

Normally, I would feel no shame at having turned down the opportunity to trade. It is not a consequence of laziness or complacency. As you may have read, every week on interactive investor I have been scoring and ranking companies as usual. Inactivity is a sign of success. As established holdings are reappraised each year and not found wanting; it becomes harder for new shares to dislodge them.

Jet2 blues

This month, I do feel a modicum of shame, though, because I am in a situation and I do not know how to get out of it. Uncertainty, indecisiveness, navel-gazing, regret: these are not the kind of emotions investing pundits share very often. We exude confidence and authority otherwise why would people believe us?

The answer to that question is, I hope, because when we confess to weakness we are being honest, and in the spirit of honesty I have to tell you that I have considered selling the portfolio’s holding in Jet2 (LSE:JET2), but I could not bring myself to.

In coming to that conclusion, I have ignored the logical outcome of my investing process, the company’s score, which for most of this year has been less than five out of nine, a level below which I consider a share to be speculative.

When it comes to flying families on holiday to the Mediterranean, Jet2 is peerless. As it has expanded departure slots from airport to airport over the last decade, the fleet, revenue, profit and share price have not only grown extraordinarily, but the company’s growth must surely have had a hand in the demise of Thomas Cook, which has created a void for Jet2 to fill.

It has not been able to fill it because of the pandemic, and the grounded planes created a financial void as the airline and package holiday company promptly handed passenger’s cash back. That void has to be filled to keep its planes operational and crews ready for take-off. It has been filled by shareholders and lenders with more cash than the company earned in the prior decade.

The bullish scenario is that the pandemic diminishes from here, near normal service is resumed in the summer of 2022 and Jet2 fills that void. The bearish scenario is that we lurch back into lockdowns. Then Jet2’s survival depends on the confidence of investors and lenders, and the scary thing about that is the confidence of this investor is being sorely tested.

When I scored Jet2 in August, I gave it a 4 out of 9. If reason were to prevail, I would have removed the shares from the portfolio then, but the dilemma presented by a beautiful business in an impossible situation has been sufficient to produce a stalemate, hence my inactivity.

As I ponder this dilemma for the umpteenth time, news of the Omicron variant has frozen my brain more deeply. One minute we are told this variant might evade vaccines and send lots more of us to hospital or worse. The next minute we are told it is the variant we have been hoping for, one that replaces all the others with something no more deadly than the common cold.

One of the unwritten rules governing my trading is not to bet on particular scenarios. I want to own shares in companies that can prosper through thick and thin, yet here I am betting on the outcome of the pandemic even though there are companies lining up for investment.

I feel much less conflicted about Cohort (LSE:CHRT) and PZ Cussons (LSE:PZC), both of which are underrepresented in the portfolio and score 8, and Quartix (LSE:QTX), which is also underrepresented and scores 7.

- Top 25 most-traded companies on AIM

- Friends & Family: ii customers can give up to 5 people a free subscription to ii, for just £5 a month extra. Learn more

But I want Jet2 to succeed. I admire the prescience of its strategy to marry the business model of a low-cost airline to package holidays. I admire the flamboyant chairman who founded the business, the matter-of-fact chief executive, and the finance director who has patiently responded to many of my emails over the years. I admire the way it has handled passengers through the pandemic and revved itself up to fly at every opportunity. I have never been on a package holiday in my life, but given the hassle of travel these days my next overseas holiday might well be one.

Perhaps the only thing that can break this stalemate is emotion. Lest that seem reckless, Share Sleuth can afford a bit of speculation. Jet2 is 2.4% of a well-diversified portfolio.

I could probably hide my bet in a system that is generally performing nicely and nobody would be any the wiser, but I want to make it clear this “decision” is not about skill or judgement but wishful thinking.

The late, great, film critic Roger Ebert said something in an interview that I aspire to. He said: “I'm reluctant to tell you that I cry because it makes me look like a sap. You know, because critics are always crying and I want to be the critic that is too tough to cry. But if I did cry during that movie, then I have to tell you that happened. If I was aroused during an erotic scene, I have to tell you that happened. If I laughed, I have to tell you it's funny. I went to see Jackass, a shameful movie, and I laughed all the way through it. I have to tell you that. I'm the guy. I was in the theatre and I have to be honest.”

I’m reading the annual reports, and working out businesses, and I have to be honest too. Just do not expect me to tell you if a share arouses me.

Share Sleuth performance

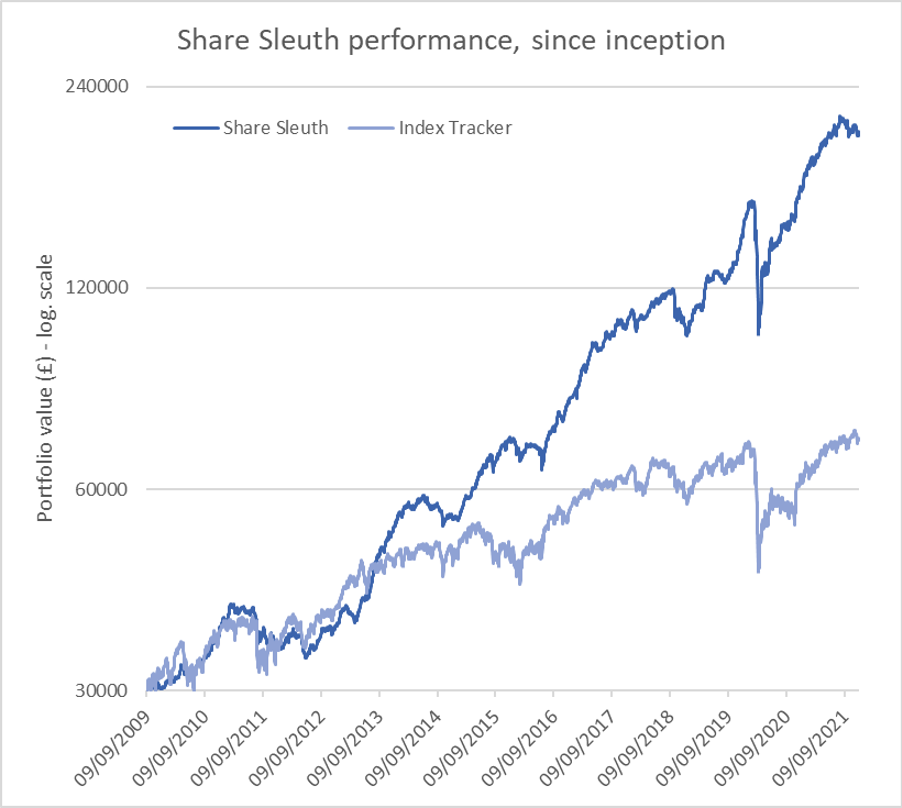

On Monday 7 December, the Share Sleuth portfolio was worth £205,020, which is 583% more than the notional £30,000 invested during the year following the first portfolio additions in September 2009.

The same amount invested in accumulation units of a FTSE All-Share index tracking fund would have appreciated to £71,755 over the same period.

The portfolio’s cash balance has swelled to £3,954 thanks to dividends from Anpario (LSE:ANP), Bloomsbury Publishing (LSE:BMY), F W Thorpe (LSE:TFW), Games Workshop (LSE:GAW), Howden Joinery (LSE:HWDN), Judges Scientific (LSE:JDG), PZ Cussons (LSE:PZC) and Renishaw (LSE:RSW).

There are insufficient funds to add a new share, or more shares in an existing member of the portfolio, because my minimum trade size of 2.5% of the portfolio’s total value is about £5,000.

Share Sleuth | Cost (£) | Value (£) | Return (%) | ||

Cash | 3,954 | ||||

Shares | 201,066 | ||||

Since 9 September 2009 | 30,000 | 205,020 | 583 | ||

Companies | Shares | Cost (£) | Value (£) | Return (%) | |

ANP | Anpario | 1,124 | 4,057 | 7,980 | 97 |

BMY | Bloomsbury | 2,676 | 8,509 | 9,420 | 11 |

BNZL | Bunzl | 201 | 4,714 | 5,793 | 23 |

BOWL | Hollywood Bowl | 1,615 | 3,628 | 3,795 | 5 |

CHH | Churchill China | 341 | 3,751 | 5,968 | 59 |

CHRT | Cohort | 1,600 | 3,747 | 9,280 | 148 |

D4T4 | D4t4 | 1,528 | 3,509 | 4,599 | 31 |

DWHT | Dewhurst | 532 | 1,754 | 7,528 | 329 |

FOUR | 4Imprint | 190 | 3,688 | 5,320 | 44 |

GAW | Games Workshop | 76 | 218 | 7,209 | 3,207 |

GDWN | Goodwin | 266 | 6,646 | 9,217 | 39 |

HWDN | Howden Joinery | 1,368 | 8,223 | 12,156 | 48 |

JDG | Judges Scientific | 159 | 3,825 | 12,179 | 218 |

JET2 | Jet2 | 456 | 250 | 4,900 | 1,860 |

LTHM | James Latham | 400 | 5,238 | 5,000 | -5 |

NXT | Next | 106 | 6,071 | 8,671 | 43 |

PRV | Porvair | 906 | 4,999 | 6,378 | 28 |

PZC | PZ Cussons | 1,870 | 3,878 | 3,777 | -3 |

QTX | Quartix | 1,085 | 2,798 | 4,177 | 49 |

RM. | RM | 1,275 | 3,038 | 2,576 | -15 |

RSW | Renishaw | 92 | 1,739 | 4,118 | 137 |

SOLI | Solid State | 986 | 2,847 | 10,895 | 283 |

TET | Treatt | 763 | 1,082 | 8,889 | 721 |

TFW | Thorpe (F W) | 2,000 | 2,207 | 9,460 | 329 |

TRI | Trifast | 2,261 | 3,357 | 3,177 | -5 |

TSTL | Tristel | 750 | 268 | 3,281 | 1,123 |

VCT | Victrex | 534 | 10,812 | 13,083 | 21 |

XPP | XP Power | 240 | 4,589 | 12,240 | 167 |

Table notes:

No additions or disposals in the last month.

Costs include £10 broker fee, and 0.5% stamp duty where appropriate.

Cash earns no interest.

Dividends and sale proceeds are credited to the cash balance.

£30,000 invested on 9 September 2009 would be worth £205,020 today.

£30,000 invested in FTSE All-Share index tracker accumulation units would be worth £71,755 today.

Objective: To beat the index tracker handsomely over five-year periods.

Source: SharePad, 6 December 2021.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in Jet2.

For more information about Richard’s scoring and ranking system (the Decision Engine) and the Share Sleuth portfolio powered by this research, please read the FAQ.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.