Share Sleuth: building a cash pile to go shopping in the sales

Richard Beddard has reduced one holding and sold another to build a ‘war chest’ to take advantage of the sell-off making many of his favourite shares more attractive from a valuation standpoint.

9th April 2025 08:59

by Richard Beddard from interactive investor

I decided my trades for March on Tuesday 25th. It was the day before Chancellor Rachel Reeves’ Spring Statement. It came a week or so before uncertainty about tariffs would culminate in US president Donald Trump’s “Liberation Day”.

With the portfolio falling in value, it was not a good backdrop for rational decision-making. I tried to put these events out of my mind. I have a system and share prices are only one of many inputs. Another is Taylor Swift. Listening to her songs is a coping mechanism!

- Invest with ii: Open an ISA | ISA Investment Ideas | Transfer a Stocks & Shares ISA

With £4,631 cash, and a minimum trade size of £4,693, there was, technically, not quite enough cash to add to Share Sleuth’s holdings unless I simultaneously reduced or liquidated something.

Holdings to add, or add to

As usual, I used my Decision Engine, which ranks shares by the scores I have given them and recommends trades based on the sizes of the existing holdings.

The top eight shares were ineligible to trade. Four, Howden Joinery Group (LSE:HWDN), Latham (James) (LSE:LTHM), Thorpe (F W) (LSE:TFW) and Dewhurst Group (LSE:DWHT), were close to their ideal holding sizes.

Three shares, Howden Joinery, top scoring Churchill China (LSE:CHH), and Macfarlane Group (LSE:MACF), publish their annual reports at this time of year and will be re-scored soon.

- Stockwatch: Buffett, Trump, China and trading tactics

- Stockwatch: four defensive shares to consider amid market wreckage

Oxford Instruments (LSE:OXIG) and Renew Holdings (LSE:RNWH) were the two remaining ineligible shares this month. Like the other six, I have traded them in the last year or so, and I am reluctant to trade more frequently.

My table of potential additions started with ninth-ranked Renishaw (LSE:RSW) and ended with Dunelm Group (LSE:DNLM), ranked 20. In total, I considered eight shares. Four of them, the bottom four would be new additions.

# | company | * | score | ihs | hs | % | max-ts |

9 | 8.2 | £12,010 | £6,260 | 3.3% | £5,751 | ||

11 | 8.1 | £11,687 | £6,052 | 3.2% | £5,635 | ||

12 | 8.1 | £11,659 | £6,165 | 3.3% | £5,493 | ||

13 | 8.0 | £11,263 | £3,121 | 1.7% | £8,142 | ||

16 | 7.7 | £10,049 | £10,049 | ||||

17 | 7.6 | £9,925 | £9,925 | ||||

19 | 7.6 | £9,750 | £9,750 | ||||

20 | 7.6 | £9,617 | £9,617 |

Scores and stats: Richard Beddard. Data: ShareScope and annual reports.

Click on a share's name to see a breakdown of the score (scores may have changed due to movements in share price)

Shares marked with an asterisk (*) have been re-scored.

Of the existing holdings, Renishaw scored highest, narrowly beating Porvair (LSE:PRV), which I scored the previous week, and Jet2 Ordinary Shares (LSE:JET2).

Focusrite (LSE:TUNE), the only other share to score 8.0 or more, was the smallest holding of the four. The difference between its ideal holding size (ihs) and the actual holding size (hs), the maximum trade size (max-ts), was greatest, making it an attractive candidate.

For years, my scores have told me vinyl flooring manufacturer James Halstead (LSE:JHD), is a good business, but the shares have been far too expensive. Now the share price was 50% below its peak, I ought to have been excited.

I am not, because the company is dependent on international trade like Renishaw, which manufactures high-tech machine tools, Porvair, which makes filters for industry, planes and laboratories, and Focusrite, which mostly makes digital music creating and recording equipment.

- When markets fall, here’s what to avoid doing

- Shares for the future: here’s how I rank this simple AIM stock

It is not my style to be influenced by world events or the state of the economy. Normally I go with the scores, trusting that in 10 years’ time everything we worry about now will be a footnote in history.

But I cannot remember a time when 20 shares have scored 7.5 or more. My rule of thumb is shares with a score of 7 or more are probably good value and there are an unprecedented 27 of them in the Decision Engine.

As prices have fallen, the price component of the shares in the Decision Engine has risen.

Although that brings more businesses that I have given relatively high scores for quality into the buy zone, with the potential for turmoil building, I felt I could defer decisions to add shares to the portfolio.

Holdings to reduce or liquidate

The list of potential reductions and liquidations included just two shares, which the portfolio wanted me to liquidate because of their low scores.

Their ideal holding sizes were 1.3% and 1.1% respectively, which was below my 2.5% minimum trade/holding size.

Garmin Ltd (NYSE:GRMN) manufactures GPS-enabled devices for tracking and navigation. Celebrus Technologies (LSE:CLBS) operates a customer data platform that helps companies with online marketing and fraud detection in real time.

Both shares owed their low scores to very high share prices. Garmin shares were valued at 37 times normalised profit, giving the share a price score of -2.4. Celebrus shares cost 30 times normalised profit, and the price score was -1.7.

I love Garmin’s fitness watches and pretty much everything about the business except its Taiwanese manufacturing base. Celebrus’ software is unique, but I do not understand the market well enough to be confident that it is differentiated enough to deliver the growth traders anticipate.

After much to-ing and fro-ing about Garmin, I decided to liquidate both holdings.

Trade

Of course, I slept on the decision. Then, because US markets do not open until the afternoon, I ruminated over lunch. Finally, on Wednesday 26 March, I disposed of 53 shares in Garmin.

The price, translated from dollars to pounds was £169.30p, which raised just shy of £8,963 after deducting £10 in lieu of fees.

Garmin was a successful trade. ShareScope tells me it returned 110% including dividends, which is 32% annualised over nearly three years.

I also liquidated Share Sleuth’s Celebrus holding of 1,528 shares.

The actual price, quoted by a broker, was just over 210p, which raised £3,208 after deducting £10 in lieu of fees.

Celebrus was a comically ineffectual trade considering how much ink I have spilled on it. It returned 2.5% including dividends, which is 0.5% annualised over nearly five years.

Share Sleuth performance

I feel a bit like a surfer trying to stay afloat in a tsunami. Agonising about the qualities and prospects of businesses feels futile when our world views are changing and markets are melting down.

I don’t think it is futile. Times of stress reveal strengths and weaknesses in businesses and give us the opportunity to learn more about them. Good businesses, and good investors, will already be adapting.

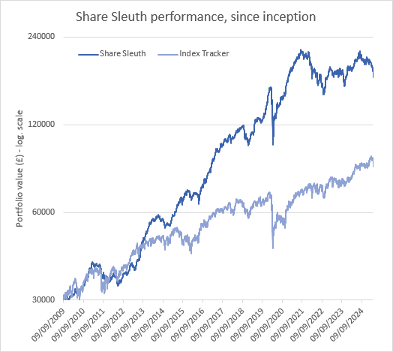

At the close on Friday 4 April, Share Sleuth was worth £174,694, 482% more than the £30,000 of pretend money we started with in September 2009.

The same amount invested in accumulation units of a FTSE All-Share index tracking fund would be worth £86,125, an increase of 187%.

Past performance is not a guide to future performance.

After dividends paid by Treatt (LSE:TET) and Garmin, Share Sleuth’s cash pile is £16,832.

The minimum trade size, 2.5% of the portfolio’s value, is £4,367.

Share Sleuth | Cost (£) | Value (£) | Return (%) | ||

Cash | 16,832 | ||||

Shares | 157,861 | ||||

Since 9 September 2009 | 30,000 | 174,694 | 482 | ||

Companies | Shares | Cost (£) | Value (£) | Return (%) | |

AMS | Advanced Medical Solutions | 1,965 | 4,503 | 4,087 | -9 |

ANP | Anpario | 1,124 | 4,057 | 3,597 | -11 |

BMY | Bloomsbury | 845 | 3,203 | 4,656 | 45 |

BNZL | Bunzl | 201 | 4,714 | 6,050 | 28 |

CHH | Churchill China | 1,495 | 17,228 | 6,952 | -60 |

CHRT | Cohort | 861 | 2,813 | 10,315 | 267 |

DWHT | Dewhurst | 938 | 6,754 | 9,146 | 35 |

FOUR | 4Imprint | 116 | 2,251 | 3,816 | 70 |

GAW | Games Workshop | 66 | 4,116 | 8,679 | 111 |

GDWN | Goodwin | 133 | 3,112 | 8,219 | 164 |

HWDN | Howden Joinery | 1,476 | 10,371 | 10,044 | -3 |

JET2 | Jet2 | 456 | 250 | 5,399 | 2,060 |

LTHM | James Latham | 1,150 | 14,437 | 11,903 | -18 |

MACF | Macfarlane | 3,533 | 5,005 | 3,413 | -32 |

OXIG | Oxford Instruments | 241 | 5,043 | 3,827 | -24 |

PRV | Porvair | 906 | 4,999 | 6,016 | 20 |

QTX | Quartix | 3,285 | 7,296 | 6,340 | -13 |

RNWH | Renew Holdings | 689 | 4,902 | 4,389 | -10 |

RSW | Renishaw | 234 | 6,227 | 5,394 | -13 |

RWS | RWS | 2,790 | 9,199 | 2,991 | -67 |

SCT | Softcat | 326 | 4,992 | 5,063 | 1 |

SOLI | Solid State | 5,009 | 6,033 | 7,388 | 22 |

TET | Treatt | 763 | 1,082 | 2,400 | 122 |

TFW | Thorpe (F W) | 4,362 | 9,711 | 12,650 | 30 |

TUNE | Focusrite | 2,020 | 14,128 | 2,828 | -80 |

VCT | Victrex | 292 | 6,432 | 2,301 | -64 |

Notes

26 March: Liquidated Celebrus and Garmin

Costs include £10 broker fee, and 0.5% stamp duty where appropriate

Cash earns no interest

Dividends and sale proceeds are credited to the cash balance

£30,000 invested on 9 September 2009 would be worth £174,694 today

£30,000 invested in FTSE All-Share index tracker accumulation units would be worth £86,125 today

Objective: To beat the index tracker handsomely over five-year periods

Source: ShareScope, close on Friday 4 April 2025.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns all the shares in the Share Sleuth portfolio.

For more on the Share Sleuth portfolio, please see Richard’s explainer.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.