A share to buy and one to hold

Overseas investing expert Rodney Hobson gives his view on two European stocks that are household names.

3rd April 2024 09:56

by Rodney Hobson from interactive investor

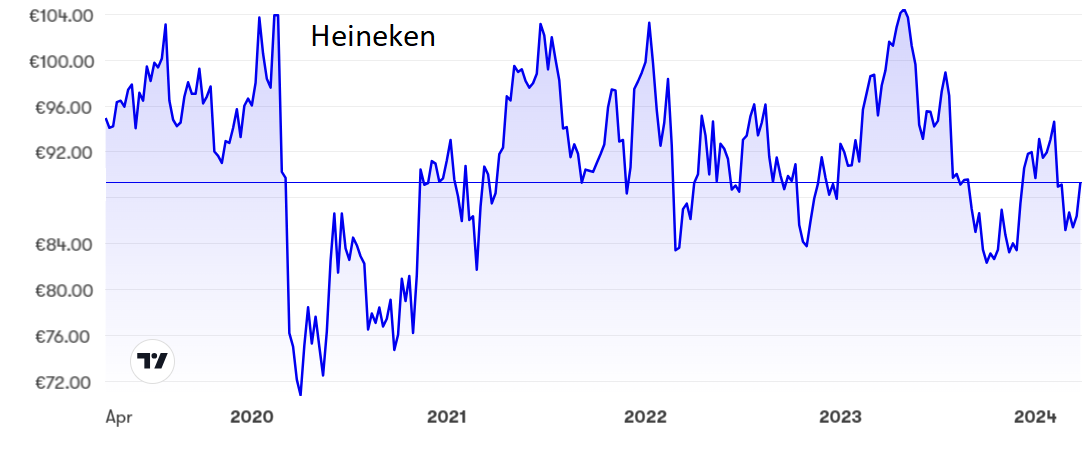

Beer brewer Heineken NV (EURONEXT:HEIA) has seen revenue rise and profits fall, which is the wrong way round for investors. Nonetheless, a sharp drop that greeted its latest figures has been reversed, suggesting that the situation is not so dire after all.

Certainly Heineken, the world’s second-largest brewer best known for its beer that allegedly refreshes the parts that other beers cannot reach, put on a brave show by claiming that it had “made excellent progress” last year, with revenue rising 4.9% to €36.4 billion.

- Invest with ii: Open a Stocks & Shares ISA | Top ISA Funds | ISA Offers & Cashback

The big problem was that the cost of raw materials and other running costs, particularly for energy, increased by 7.8%, there was a big leap in depreciation, a hefty write-down in the value of its southern Africa division and, with interest costs soaring, a doubling of finance costs. For good measure, Brazil upped the tax rate that the brewer has to pay there.

Heineken tried to pass on these extra costs in the form of higher prices, but this met with a mixed reaction from customers and volumes shrank compared with an admittedly strong previous year.

Source: interactive investor. Past performance is not a guide to future performance.

So, net profit slipped 14% to €2.3 billion, prompting a sharp reduction in the final dividend to €1.04 a share. As the interim had been increased, it meant the total for the year was stable at €1.73. However, shareholders must be rightly disappointed that their income for the full year merely marked time, although the total was at least well covered by earnings per share at €4.66. Some analysts had actually expected worse.

Heineken plans to prioritise further revenue growth in the year ahead, which is fair enough, but it is rather less optimistic in terms of profits. Operating profit is projected to rise by a single-digit percentage but net profit by somewhat less. Analysts had been expecting near double-digit growth in operating profit. It might be easier to be optimistic if chief executive Dolf van den Brink used less waffle in his pronouncements.

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

- Stockwatch: what would a US takeover mean for this FTSE 100 firm?

- 10 hottest ISA shares, funds and trusts: week ended 29 March 2024

Heineken shares have bounced around between €70 and €140 over the past five years and are currently somewhere in the middle of that range at €90. There does seem to be a floor around €83 but on the other hand the upside looks severely restricted, with €100 seemingly unattainable any time soon.

The price/earnings ratio is a little toppy at 21.8 and the yield is 2.15%. Both figures are all right but not overwhelming.

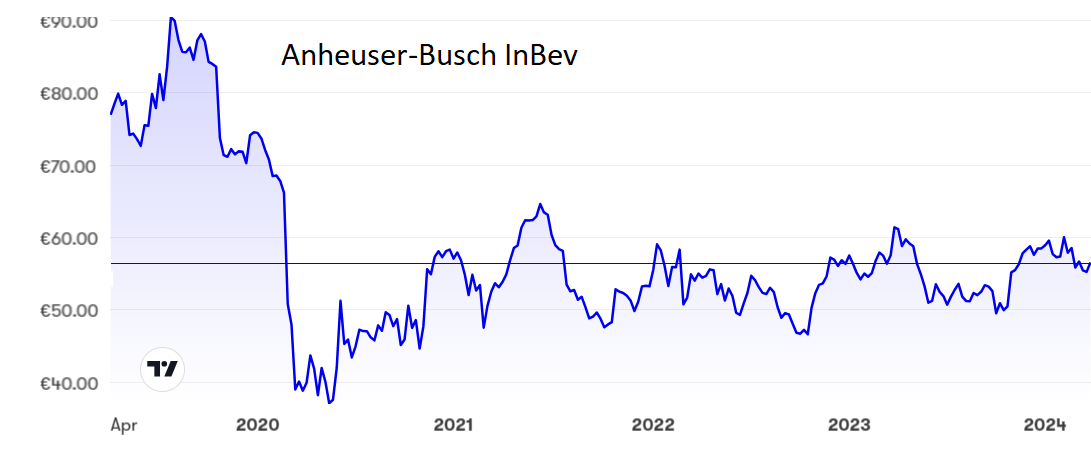

It was a similar picture at larger rival Anheuser-Busch InBev SA/NV (EURONEXT:ABI), which saw revenue increase 2.8% to $59.4 billion but profits down 9.2% at $6.9 billion, with rising costs again to blame. The big problem was in the United States, where revenue declined 9.5% and profits slumped 23%. Demand was also softer in Europe, but here at least sales and profits edged higher.

Source: interactive investor. Past performance is not a guide to future performance.

It seems that, as with Heineken, higher prices have discouraged sales. Beer volumes slipped 1.7%. Emerging markets fared better, with China and Brazil leading the way.

The shares peaked at €90 in mid-2019 before slumping alarmingly below €40 just nine months later. Although they have picked up a little, they have struggled to get past €60 – not surprisingly as at the current €56 the p/e is 23.5 and the yield 1.3%, both figures being less attractive than at Heineken.

Hobson’s choice: I have more than once rated AB InBev a buy below €50 and a sell at €58, advice that still stands. So, currently this is a hold. I much prefer Heineken with its superior fundamentals. I said the shares were fully valued at €97 last year, so at a lower level they just about merit a buy.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.