Seven consistent funds up 100% over the past three years

Of the 10 funds that top the consistency charts, seven have doubled investors’ money over three years.

15th February 2021 15:21

by Douglas Chadwick from ii contributor

Saltydog Investor finds 10 funds that top the consistency charts, seven of which have doubled investors’ money over the three-year period.

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

At Saltydog Investor, we provide information designed to help DIY investors manage their own portfolios.

We focus on funds, rather than stocks and shares, and provide performance data each week covering funds, investment trusts and exchange-traded funds (ETFs).

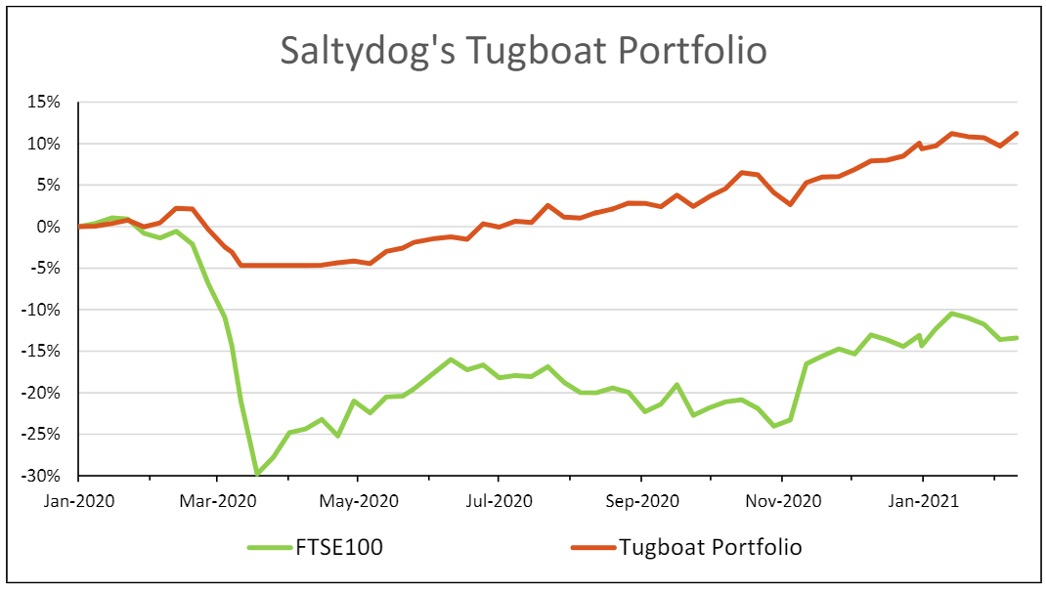

To help our members understand how the data can be used, we also run a couple of demonstration portfolios. The first, Tugboat, was launched in November 2010. The plan was to run it in such a way that it avoids any major market falls, but makes gains when markets go up.

- How Saltydog invests: a guide to its momentum approach

- Saltydog takes risk off the table, but is ready to reinvest

- Why Saltydog is preparing to reduce UK exposure

In just over 10 years our initial investment has grown from £40,000 to nearly £75,000. It has gone up by 87%.

To control the overall volatility, we review our holdings each week. This means that we can react very quickly to changing conditions. This time last year, over 90% of the portfolio was invested in funds, with the balance in cash. Within three weeks we were able to move to 100% cash and avoided the worst of the coronavirus crash.

Past performance is not a guide to future performance

One of the disadvantages of the way in which we manage this portfolio is that it is fairly time-consuming. Every week we evaluate all the data, although we do not necessarily make changes.

We understand that there are some people who appreciate our momentum-driven approach, but do not feel that they can allocate the time required every week. That is why, in August 2019, we produced our first ‘6 x 6’ report. We wanted to find funds that had performed consistently well over the last three years, and were looking for a return of 5% every six months. It is very unusual to find a fund that has managed to achieve the target in all six of the six-month periods, but we can usually find a handful that have done it five out of six times.

We update the report every three months, and have just completed our latest analysis, which covers the three years up until the end of January 2021. On this occasion, there are no funds that have achieved the elusive six out of six, but there are 10 funds that have only missed out on one period. There are a further 81 funds that have beaten the target four out of six times.

Here are the top 10 funds.

| Saltydog Investor 6x6 Report - February 2021 | Feb 18 | Aug 18 | Feb 19 | Aug 19 | Feb 20 | Aug 20 | 3-year return |

| to | to | to | to | to | to | ||

| July 18 | Jan 19 | July 19 | Jan 20 | July 20 | Jan 21 | ||

| Funds which have risen by 5% or more in five out of six periods | |||||||

| Baillie Gifford L/T Global Growth | 9.1% | -6.6% | 17.1% | 10.4% | 46.1% | 33.9% | 158% |

| Baillie Gifford Positive Change | 11.5% | -5.2% | 16.2% | 11.3% | 39.0% | 32.9% | 153% |

| GAM Star Disruptive Growth | 17.4% | -6.1% | 21.8% | 5.7% | 15.1% | 35.4% | 121% |

| Polar Capital Global Technology | 13.7% | -0.9% | 23.4% | 5.1% | 28.0% | 17.2% | 119% |

| Smith & Williamson Artificial Intelligence | 15.3% | -5.5% | 28.2% | 6.3% | 21.9% | 20.9% | 119% |

| Fidelity Global Technology | 11.2% | 0.0% | 21.9% | 7.0% | 14.8% | 23.8% | 106% |

| L&G Global Technology Index | 11.9% | -5.2% | 27.9% | 9.4% | 15.6% | 18.4% | 103% |

| Aberdeen Global Tech | 6.8% | -5.9% | 27.5% | 8.5% | 14.1% | 24.3% | 97% |

| Janus Henderson Global Technology | 9.6% | -5.1% | 27.4% | 6.1% | 11.7% | 19.0% | 87% |

| Legg Mason IF CB Global Infrastructure Inc | 5.5% | 5.6% | 16.0% | 5.2% | -3.5% | 6.7% | 40% |

Data Source: Morningstar

Five funds are from the ‘Technology and Telecommunications’ sector. One, Smith & Williamson Artificial Intelligence, is from the ‘Specialist’ sector, although it is also a technology fund. Three funds are from the ‘Global’ sector and the final one is from the ‘Global Equity Income’ sector.

Seven of these funds have gone up by more than 100% in the last three years.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.