Scrap state pension triple lock to deal with ballooning deficit, says think tank

Any attempt to reduce spending post-crisis must be equally shared among generations, says the Social Mar…

14th April 2020 12:24

by Tom Bailey from interactive investor

Any attempt to reduce spending post-crisis must be equally shared among generations, says the Social Market Foundation.

The state pension triple lock should be scrapped to help pay for the government’s response to the coronavirus crisis, according to the Social Market Foundation (SMF). This, the think tank argues, would ensure any attempt to reduce spending post-crisis is equally shared among generations.

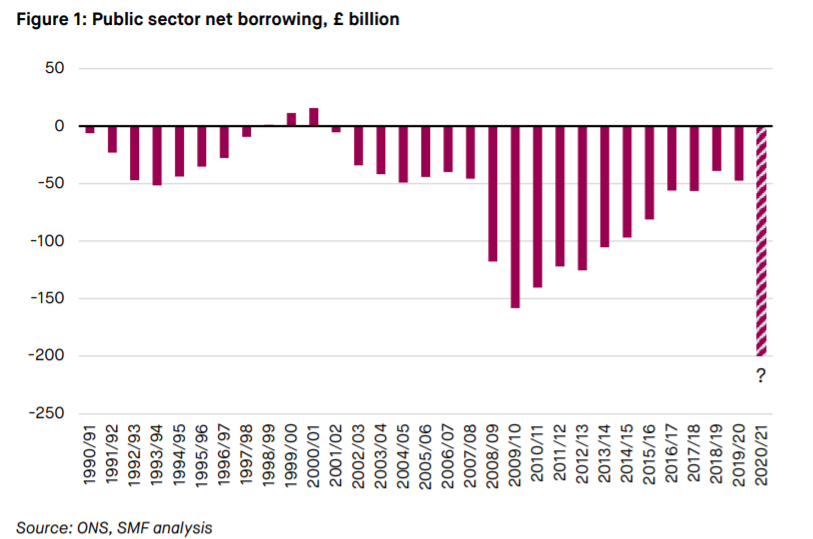

The SMF estimates the UK’s government annual deficit could reach £200 billion per year, due to the various spending increases and programmes the government has announced to try and stem the economic fallout of the lockdown. In contrast, in the financial year ending March 2019, the deficit was £41.5 billion.

So far, bond markets do not appear to be punishing this expected increase in borrowing, with gilt yields still at near-historic lows. However, the SMF anticipates the government embarking on a new austerity programme of spending cuts and tax increases to address this expected build up in public debt, once the crisis is over.

Any new austerity programme, however, must see costs spread across generations, says the SMF. Scott Corfe, the SMF’s research director, notes: “Quite rightly, society is making sacrifices to protect its elderly right now. There is a clear case for intergenerational reciprocation when it comes to meeting the fiscal costs of the crisis in the years ahead.”

- Your essential guide to: the state pension and how the goalposts will shift in future

A key way to ensure this “intergenerational reciprocation”, the SMF says, is to scrap the current state pension triple lock system. Introduced by the Conservative and Liberal Democrat coalition government in 2011, the triple lock guarantees the state pension rises in line with either the rate of inflation, average growth of earnings or by 2.5%, whichever is highest.

This April the state pension rose by 3.9%, the biggest annual increase since 2012. The 3.9% increase was based on wage growth figures for the three-month period to July 2019.

The SMF argues that in the post-coronavirus recovery the state pension will become too expensive to be maintained.

The SMF report notes: “In the post-crisis world of slow, painful recovery, a triple lock ensuring a 2.5% minimum rise in pensions would constitute enormous generosity to pensioners, at a time when working-age adults face low or no wage growth and significant unemployment.”

- Controversial call for state pension to be means-tested

In place of the triple lock, the SMF calls for a ‘double lock' system. This would see the state pension rise in line with either average earnings or inflation, with no default 2.5% growth guarantee. The SMF estimates this could contribute to £20 billion worth of savings over the next five years. They note: “Pensions would still rise, but less quickly, reducing the fiscal burden on the working-age population.”

Corfe adds: “The crisis has emphasised our obligations to other generations, even in the face of personal sacrifice. This spirit must be maintained when the dust settles – with the economic costs of responding to the crisis shared fairly across the generations.”

Such a change to policy, however, will not be politically easy. In recent years, major political parties have mostly shied away from proposing any changes to the triple lock. In particular, the Conservative Party pledged in its December 2019 election manifesto to defend the triple lock.

The current crisis, however, may now make changing the triple lock more politically feasible, says Ian Browne, a pensions expert at Quilter.

He notes: “Reforms to the state pension triple lock have long been mooted around times of budgets and general elections, but with the unprecedented times we find ourselves in it is rightly being brought up again as something that needs to be changed to ensure intergenerational fairness.

“With the increased borrowing from the government to help pay for the coronavirus lockdown, there has arguably never been a better time politically to replace the triple lock as government finances come under increasing pressure.”

Prior to coronavirus, other organisations called for radical changes to be made to the state pension. Both the International Monetary Fund and Organisation for Economic Cooperation and Development argue it should be means-tested in order to help address the strain that an ageing population is putting on the state pension.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.