Saltydog takes risk off the table, but is ready to reinvest

Saltydog sold some funds after stock-market falls. But is looking to reinvest as markets stage a recovery

8th February 2021 13:58

by Douglas Chadwick from ii contributor

Saltydog sold several funds following stock-market falls. But is now looking to reinvest as markets stage a recovery.

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Last week our Saltydog demonstration portfolios sold several funds. The HSBC Monthly Income fund and the Threadneedle Managed Equity Income fund, from the UK Equity and Bond Income sector, and the Merian UK Equity Income fund, from the UK Equity Income sector.

As a result, our most cautious portfolio, the Tugboat, now has around a third of its value in cash. In the slightly more adventurous Ocean Liner, it is just under a quarter.

During the last week of January, stock markets around the world fell by around 3.5%. Much of it was attributed to a few American investors using a social media network, called Reddit, to encourage private investors to support the price of a failing high street video games retailer, GameStop (NYSE:GME). The business was struggling, and a couple of large hedge funds were betting against them by ‘shorting’ the share price. The private investors pushed up the price of the shares, forcing the hedge funds to cover their positions at a huge loss. Joe Public 1, Hedge Fund Managers 0...it was always going to make the headlines.

- How Saltydog invests: a guide to its momentum approach

- Why Saltydog is preparing to reduce UK exposure

- Emerging market funds are back in form

I’m not convinced that it was the only reason for the downturn, but it was definitely the best story in town.

The global economy does have more structural problems. Over the last year, growth forecasts have been cut in response to the coronavirus pandemic and government debts have soared. The US, on its own, is pumping $120 billion (£87 billion) into the economy each month and central banks around the world all have a similar approach. Much of this ‘new’ money has found its way into the equity markets and it is worth noting that last year, when much of the world was in shutdown, stocks on the Nasdaq went up by more than 40%. You can imagine why, the minute anything looks a bit fishy, investors are happy to cash in some of their profits.

Past performance is not a guide to future performance.

It is always difficult to know what to do when stock markets suddenly fall. Do you hold on and hope that things will recover, or head for safety?

The fund management industry usually advises private investors to ride out the storms, on the basis that over the long term stock markets have tended to go up, and that timing the market is too difficult. At Saltydog, we disagree. We believe in reacting to market conditions. We are happy to reduce our exposure to the markets if they start to show signs of falling. We may end up buying back in again if markets recover, and we could miss out on some of the rebound, however this approach does protect us from more severe market corrections.

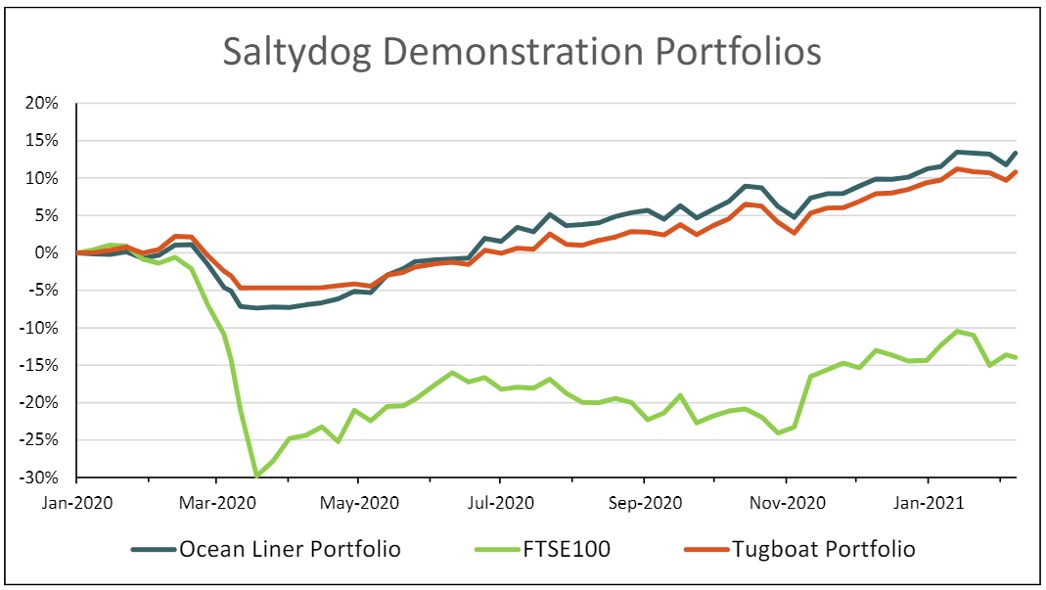

It certainly helped in the first quarter of last year when stock markets fell dramatically. The FTSE 100 went down by nearly 25% and has still not fully recovered.

On this occasion, the sell-off appears to have been short-lived and last week stock markets around the world started to recover. Our portfolios, which had been dropping, also headed back towards the all-time highs that we saw in the middle of January.

Past performance is not a guide to future performance.

This week, we will consider where to reinvest. In the final quarter of last year, the UK equity sectors were performing well and that was where we were investing. More recently the China/Greater China sector has been giving the best returns and so a few weeks ago we bought the New Capital China Equity fund.

It will be interesting to see if this trend towards the emerging markets continues, or whether the UK funds make a comeback.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.