Sales miss damages BT share price

A failure to meet City expectations in the second quarter has been punished by investors who bailed out of the telecoms giant. Graeme Evans runs through the numbers.

7th November 2024 13:42

by Graeme Evans from interactive investor

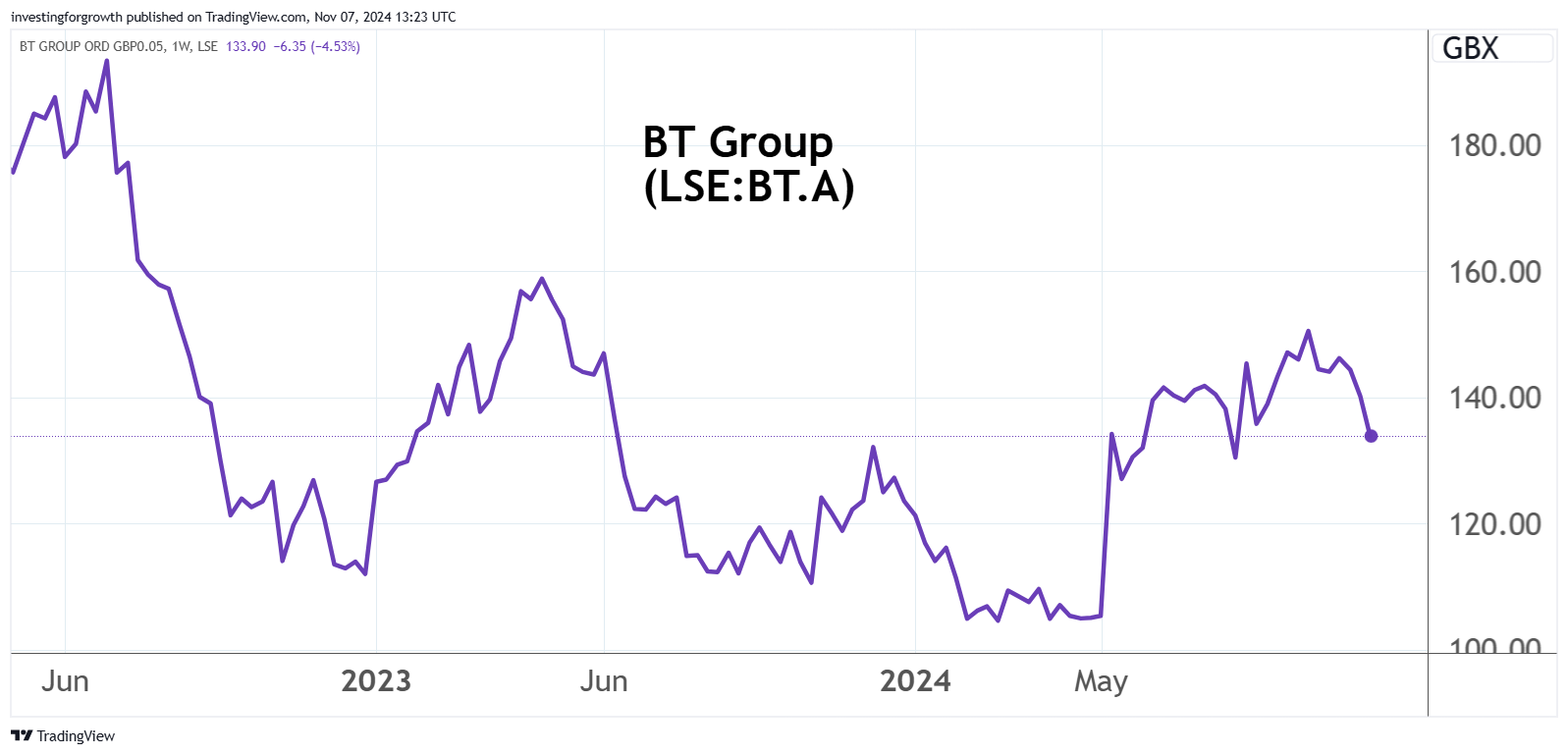

A dividend increase today provided small comfort for BT Group (LSE:BT.A) shareholders as they contemplated another year without a meaningful recovery in stock market fortunes.

The shares reversed 10.45p to 131.7p, returning the widely held investment to where it was in August after a second-quarter revenue decline of 3.1% came in well below City forecasts.

- Invest with ii: Top UK Shares | Share Tips & Ideas | Cashback Offers

The performance, which was driven by pressure at BT’s business communications division, offset record-breaking progress in the roll-out of full fibre broadband.

The Openreach division has now reached 16 million premises — equivalent to half the UK — and, with the build cost continuing to reduce, it has increased this year's target to 4.2 million.

That’s a key part of the investment case, given that BT has reached an inflection point in its long-term strategy by passing peak capital expenditure on the roll-out. It’s also achieved a £3 billion cost and service transformation programme a year ahead of schedule.

Chief executive Allison Kirkby said today that BT’s modernisation and a focus on connecting the UK put the company in a strong position to “generate significant value for all our stakeholders.”

She reiterated the company’s full-year guidance on earnings, capital expenditure and cash flow, but scaled back revenues expectations to now show a decline in the 1-2% range rather than the modest rise seen previously.

- Trump victorious: these UK stocks are also big winners

- UK stocks suffer election hangover as ITV slumps

- Share Sleuth: performance over 15 years, and a share sale

- ii view: John Wood shock triggers share price crash

The downgrade was driven by non-UK assets and pressures in the corporate and public sector as Business division revenues fell by 6.8% in the second quarter.

Consumer revenues were 1.7% lower in the quarter, reflecting a slightly lower broadband base and a competitive retail environment. Openreach revenues rose 2%, driven by inflation-linked price increases and an improving mix of full-fibre in its broadband base.

Across the six months to 30 September, revenue fell 3% to £10.1 billion and pre-tax profits declined 10% to £967 million. Adjusted earnings per share rose 4% to 10.7p.

BT intends to pay a dividend of 2.4p a share on 5 February, an increase of 4% that’s in line with its policy to pay 30% of the previous year’s total. It distributed a full-year dividend of 5.69p a share in September, which was fully covered by free cash flow.

- Stockwatch: a tax warning for UK and US investors

- How IHT on pensions could impact your retirement choices

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

As part of today’s update, the company issued longer-term guidance in which it forecast cash flow growing from this year’s expected to £1.5 billion to £2 billion by 2027 and about £3 billion by the end of the decade.

Today’s performance leaves BT’s share price 8p higher than its starting point for the year, having been 190p in the summer of 2022. It also unwinds the recovery seen since August, when competition fears were fuelled by Sky’s broadband deal with alt-net provider CityFibre.

Source: TradingView. Past performance is not a guide to future performance.

Sky is the largest customer of BT’s regulated Openreach division, spending a reported £950 million a year to supply its six million internet customers with fibre broadband.

The launch of its broadband services on the CityFibre network comes as the alt-net supplier targets a footprint of at least eight million premises over the coming years.

UBS, which has a Sell rating on the stock, said following the results: “The bull case is based on free cash flow inflecting as capital expenditure peaks, but we think the market is overlooking material risks.”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.