Richard Beddard: why this top performer is near bottom of my ‘buy’ list

5th November 2021 15:00

by Richard Beddard from interactive investor

Our columnist finds a lot to like about this manufacturing business, but growth isn’t on the list. And there’s another fly in the ointment you need to be aware of.

Before we even consider the many positive qualities of James Halstead (LSE:JHD), we should acknowledge two things that may dull the prospect of investing in the manufacturer of vinyl flooring.

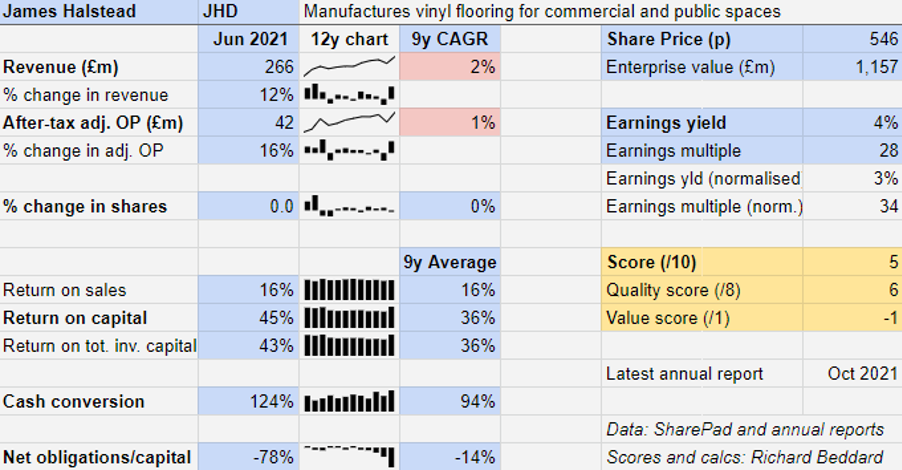

The first is growth. Profitable though James Halstead is, the summary below shows that over the last nine years the company has grown revenue at a compound annual growth rate (CAGR) of 2%, and profit at a CAGR of 1%.

Past performance is not a guide to future performance

Admittedly, this is an unfavourable period to choose. James Halstead grew much faster before 2013, so lengthening the period we are measuring would improve the growth rate.

However, 2013 is something of a watershed; moreover, although revenue increased 12% and adjusted profit increased 16% in the year to June 2021, much of this growth merely reversed the contraction experienced during the first lockdown in the previous financial year.

The other fly in the ointment is the share price, which values the enterprise at nearly £1.2 billion or about 28 times adjusted profit.

This is a growth multiple and therein lies the conundrum. With no growth, it would take 28 years for James Halstead’s profits to double our money.

Apart from the lack of growth, James Halstead’s financial performance is excellent. Return on Capital is consistently high, and so is cash conversion. It has no conventional debt and abundant cash.

The company’s international success also indicates it is better at making and selling vinyl flooring than its larger, more diversified international competitors. Every year, its annual report tells of sales in far-flung places.

This year it highlights Knattspyrnufélagið Fram (“perhaps the largest football stadium in Iceland”) and India’s now famous Serum Institute for vaccine manufacturing. In 2021, James Halstead earned over 60% of revenue abroad, mostly in Europe and Scandinavia.

I love the simplicity of the business, and its integration. James Halstead manufactures vinyl flooring in Bury and Teesside, and markets it mostly to commercial and public sector customers, architects, and specifiers, which it supplies through stockists (distributors) who install the flooring.

Despite its reliance on stockists, James Halstead employs a direct sales force to present the product to end customers, bringing sales to stockists and enhancing its reputation with them and their customers. This, it says, improves the prospect of repeat business.

This specialised and integrated approach is probably the reason for James Halstead’s high levels of profitability.

There are things manufacturers can do to differentiate vinyl. James Halstead sells varieties with particular acoustic or safety properties, for example, and a range of styles, but chemically one manufacturer’s vinyl is indistinguishable from another’s.

The company’s strategy emphasises quality, durability and availability, honouring its founder’s mantra: “Quality is when the customer comes back, not the product”.

The third attribute, availability, came to the fore during the pandemic. High stock levels, normally maintained to supply large projects off the shelf and smooth production pressures, meant that James Halstead continued to supply stockists despite disruption at its factories and supply constraints.

Some of these constraints were due to Covid 19, which denied James Halstead labour and raw materials derived from the production of aviation fuel, but in addition Hurricane Ida took out a massive PVC plant in Louisiana, which reduced global PVC supply and increased prices.

The company is not unique in being able to continue to supply customers under duress, but maybe James Halstead was unusual in the flooring industry. It believes it took market share in the UK, Europe and Australia, for example, and it was voted flooring manufacturer of the year by the Contract Flooring Association, which represents the contractors that install vinyl flooring.

The company also won praise from the NHS for its ability to supply temporary hospital wards, vaccination centres, test facilities and vaccine factories.

Scoring James Halstead

The pandemic has tested companies, and James Halstead has passed. It faces lingering cost inflation, supply shortages and the challenge of rebuilding stock, but the company has emerged with an enhanced reputation among suppliers and customers.

This has allowed it to source raw materials, pass on the cost to customers and gain market share.

It also has positive things to say about the environmental impact of the PVC it uses. 80% of it is from renewable sources, recycled or produced from biomass rather than petrochemicals. Additionally, James Halstead says, PVC requires less energy to manufacture than any other commodity plastic.

- The Week Ahead: M&S, Burberry, AB Foods

- Subscribe to the ii YouTube channel here for all the latest interviews and analysis

I applaud the board’s decision to issue share options to executives at their market value (rather than at no cost). In a sense, that means they are required to create value before they receive the reward.

But I also note that the board can waive the requirement for profit growth to exceed the retail price index for the options to be awarded.

The company says this is because of the potential impact of lockdowns on profit, and the need to reward hard work in trying circumstances, but it does not do anything to reassure me that profit growth will increase in future.

Does the business make good money? [2]

+ High Return on Capital

+ Strong profit margins

+ Good cash conversion

What could stop it growing profitably? [1]

+ Very strong finances, very stable cash flows

+ Focused integrated model outcompetes rivals

− Limited opportunities for organic growth

How does its strategy address the risks? [1]

+ Integrated manufacturing and sales enhances reputation

? No appetite for diversification

? No appetite for acquisitions

Will we all benefit? [2]

+ Family owned, experienced management

+ On good terms with customers and suppliers

+ Staff are shareholders, retention is high

Is the share price low relative to profit? [-1]

? No. A share price of £5.46 values the enterprise at nearly £1.2 billion or about 28 times adjusted profit.

I admire the way James Halstead sticks to its knitting and, given its less profitable time 20 and more years ago as a mini-conglomerate, I can understand why it might regard diversification warily.

But vinyl flooring appears to be a mature business, and the combination of slow growth and a high share price reduces the attraction of James Halstead as a long-term investment.

Its score of 5/9 means it probably is a good long-term investment, but not one of the best. In relative terms it is ranked 38 out of the 40 companies I follow.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

For more information about Richard’s scoring and ranking system (the Decision Engine) and the Share Sleuth portfolio powered by this research, please read the FAQ.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.