Richard Beddard: why this is one of my six favourite shares

10th June 2022 15:00

by Richard Beddard from interactive investor

This company has conjured consistent profitability and reasonably consistent growth, and our companies analyst is a big fan.

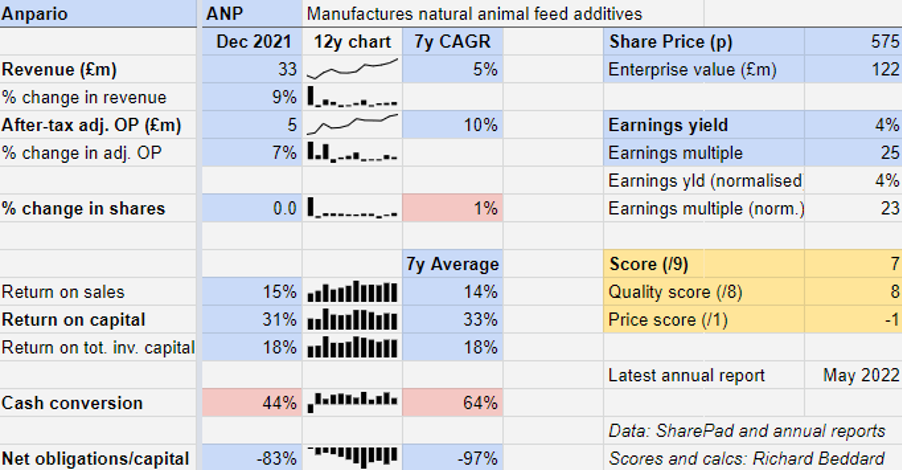

Developments in China, and a 32% rise in sales there, support the case for investing in Anpario (LSE:ANP).

China introduced a ban on the use of antibiotic growth promoters in animal feed in 2020. These are used to prevent disease in farm animals, so they produce more meat, milk, and eggs.

Other things being equal, improving productivity is a good thing, but antibiotic growth promoters cause antimicrobial resistance in pathogens. This means antibiotics used to treat disease are becoming less effective in animals and humans.

Increasingly tight regulation around the world is creating an opportunity for alternatives.

Natural growth promoters

Anpario makes natural animal feed additives designed to improve the health and increase the weight of farm animals so they are more productive.

The additives contain plant extracts such as oregano oil to improve animal gut health, acidifiers that kill germs like salmonella in the animal gut, and toxin binders which render fungi growing in feed indigestible.

The delivery mechanism can be as important as the ingredients. For example, proprietary carrier matrixes are required to deliver acidifiers so they are active the full length of the animal gut.

- 15 cheap shares value fund managers are backing

- Stockwatch: time to back this controversial owner’s £3bn empire

- Share Sleuth: topping up the share I have most conviction in

Anpario additives also replace other hazardous chemicals in animal feed, like formaldehyde and zinc oxide. The EU is banning the use of zinc oxide in piglet feed to control diarrhoea from this month.

In addition, natural animal additives can improve the quality of animal derived foods. For example, meat milk and eggs from animals enriched with the Anpario’s newly launched Optomega Algae additive contain higher levels of omega-3 fatty acids.

Growing organically

Anpario is the product of a series of acquisitions between 2006 and 2012.

Since then, it has prioritised profitability over revenue growth, disposed of a relatively unprofitable organic animal feed business, ended low margin contract manufacturing, and consolidated its range under the Anpario brand.

Past performance is not a reliable indicator of future results.

In the year to December 2021, revenue grew 9% and adjusted operating profit grew 7% even as the company dealt with higher freight and raw material costs, a stronger pound and export bottlenecks.

It achieved this partly through price rises, and partly because other costs, principally travel and marketing, have been lower during the pandemic. Face to face meetings will return more strongly in 2022 and thereafter, but not, the company expects, to pre-pandemic levels.

Cash-conversion was weaker than usual in 2021, though, as the company stocked up on raw materials and finished goods due to shortages.

Seeing competition everywhere

Anpario has conjured consistent profitability and reasonably consistent growth from an inconsistent market.

Revenue depends on the prosperity of farmers, which in turn is affected by the prices they get for their produce, the cost of inputs like animal feed, and outbreaks of disease, which sometimes require farmers to cull animals.

It has also achieved prosperity in the face of reluctance from farmers to give up antibiotic growth promoters because they are so cheap. The enactment, implementation, and enforcement of regulation has been patchy around the World.

The EU led the way by banning antibiotic growth promoters in 2006, but farmers still treat unhealthy animals with antibiotics and this can lead to the misuse of veterinary antibiotics as growth promoters.

- Shares for the future: hold fire until you see the whites of their eyes

- Read more from Richard Beddard here

Competition comes in other forms too: Vaccination, better farm hygiene, and other natural feed additive manufacturers like Alltech in the USA, and Biomin in Austria.

Though Anpario is a valuable part of the mix keeping farms healthy and productive, ultimately, its undoing might be another kind of food: plants.

Globally, meat consumption is expected to increase for decades as developing world populations grow in size and prosperity.

But in Europe, where meat consumption is on the wane, meat and dairy are perceived by many as unhealthy, cruel, and a factor in climate change.

Making animals healthier

Anpario has a role to play in addressing each of these concerns.

By replacing antibiotics, and producing more nutrient rich foods, natural animal feed additives play a role in improving human and animal health.

Farms that produce more from less also have smaller environmental footprints than they would otherwise, and healthy animals produce less methane, a greenhouse gas.

While livestock is at the forefront of climate and health concerns, Anpario earns approximately 60% of revenue from chicken farms, which are less carbon-intensive. Some of these produce eggs, which is less carbon-intensive than broilers.

Anpario’s diversification also insulates it somewhat from the vacillating short-term fortunes of farmers. As well as poultry and swine (approximately 20% of revenue), Anpario feeds animals as diverse as dairy cattle (approximately 7% of revenue), fish (approximately 4% of revenue), and racing pigeons (approximately 1% of revenue).

Aquaculture is likely to become a more significant market as Anpario targets Indonesian shrimp and fish farmers, and it is also trialling existing products to sell into the ruminant and pet food markets.

- Read more of our content on UK shares here

- Insider: this FTSE 250 company is a high-class act

- How Terry Smith is investing as markets crash

One of the newly launched Optomega Algae’s key selling points is that it is derived from a sustainable non-animal source, which is liked by pet food formulators. An older version of Optomega is derived from fish oil.

On a continental scale, Anpario’s biggest market is Asia, where it earns 36% of revenue, followed by Europe (28%) and the Americas (25%).

Rather than relying solely on distributors overseas, Anpario is vertically integrating. It has wholly owned subsidiaries in the major meat producing regions of the US, China, and Brazil. It has acquired distributors elsewhere and set up websites to sell direct to smaller customers.

In 2021, Anpario set up new subsidiaries in Mexico, New Zealand and Vietnam.

Face to face sales enable Anpario to sell the science, using the results of its collaborations with universities and major customers to demonstrate the efficacy of its products. Local stocks also secure supply and support the wider distributor network.

Meanwhile, the company’s restrained approach to acquisitions in recent years, coupled with the evident profitability of its earlier ones, suggests that it is being highly selective, which bodes well for the future.

Scoring Anpario

I like Anpario. As it evolves, the company’s strategy to improve the health of animals, humans, and the environment is becoming clearer and the numbers indicate that it can do this while growing profitability.

“Natural” is not synonymous with “sustainable”, but Anpario’s development of the Optomega product so it is derived from algae rather than overexploited fish is an example of the company’s direction of travel.

Another example is Aquatice, a fish food additive shelved by Anpario over a decade ago. Aquatice uses fish pheromones to stimulate fish to eat more food but the high quantities of fish meal in fish food meant they were stimulated enough.

Today, nutritionists are turning to soya and insects as sources of protein instead of fishmeal, but fish find this diet less appetising, so Anpario is dusting off the Aquatice project, in the hope its time has come.

Currently two-thirds of Anpario’s products are derived from sustainable sources, but it is aiming for 100%.

One day humanity may decide that meat and dairy are unsustainable, however they are produced, and radically reduce its consumption.

My guess is that day is a long way off, and it may move further into the future if farms and suppliers like Anpario continue to innovate.

Does the business make good money? [2]

+ High return on capital

+ High profit margins

? Cash conversion

What could stop it growing profitably? [2]

+ Very strong finances

+ Diversified across capricious markets

? Changing attitudes towards animal products

How does its strategy address the risks? [2]

+ Diversification of products and markets

+ Direct sales emphasis

+ Acquisitions

Will we all benefit? [2]

+ Focus on health and sustainability

+ Experienced management

+ Trains and promotes from within “wherever possible”

Is the share price low relative to profit? [-1]

+ A share price of 575p values the enterprise at £122 million, about 23 times normalised profit.

A score of 7 out of 9 suggests Anpario is a good long-term investment.

It is ranked 6 out of 40 shares in my Decision Engine.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in Anpario

For more information about Richard’s scoring and ranking system (the Decision Engine) and the Share Sleuth portfolio powered by this research, please read the FAQ.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.