Richard Beddard: why this is my number one stock

8th October 2021 14:01

by Richard Beddard from interactive investor

It’s the highest-scoring share in his portfolio, but what makes this £250 million AIM company so special?

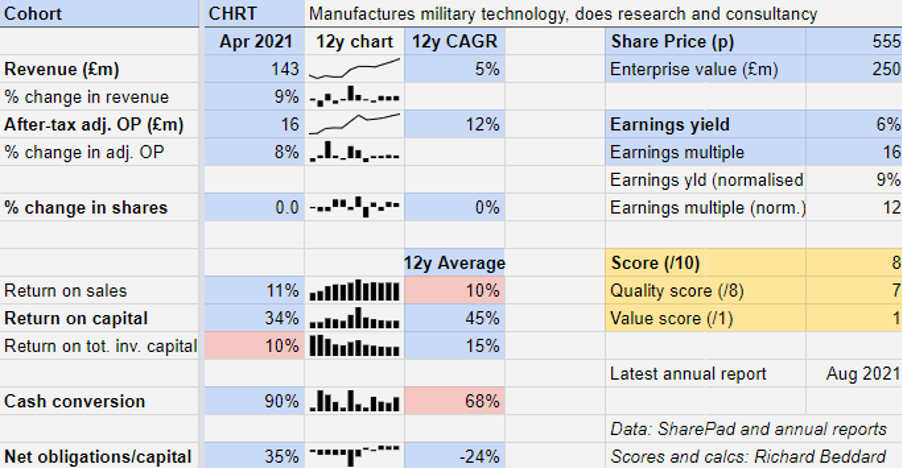

Thanks to a new acquisition, the seventh since Cohort (LSE:CHRT) listed in 2006, the defence technology company achieved an 8% increase in adjusted profit in the year to April 2021.

Without the acquisition of ELAC, profit would have contracted very slightly, but with some justification Cohort is upbeat about its prospects for 2022 and beyond.

ELAC is a German manufacturer of sonar systems for submarines. It recently won a £42 million contract to supply equipment, training and technical services to two new Italian submarines.

Six businesses, three home markets

The acquisition gives Cohort a third home market after the UK, where four of its businesses are based, and Portugal, the home of EID, which is a manufacturer of army and naval communications systems.

The jewel in Cohort’s crown though remains MASS. Acquired for £13 million in 2006, it earned just under £40 million in revenue (28% of the total) and nearly £9 million in adjusted operating profit in 2021 (47% of the total), very slightly down on the previous record-breaking year.

MASS provides databases and training to help customers securely manage and interpret the vast amount of data required by military and security operations.

While MASS is a reliable earner, performance at Cohort’s other businesses are more variable. EID had a good year fulfilling orders and contributed handsomely to profit, but it did not replace many of those orders due to delays in Portuguese defence programmes. This does not bode well for 2022.

- Shares for the future: three top stocks and reducing IHT

- Check out our award-winning stocks and shares ISA

Chess is suffering growing pains. The company makes electronic components like platforms and cameras for surveillance, tracking and targeting systems. It struggled to deliver some orders and although revenue increased, costs increased more so profit decreased. Cohort says management and process changes will return the company to profitable growth.

SEA, a somewhat sprawling supplier of military and transport products, training, research and consultancy, has suffered most from delays in defence projects over the years.

In 2021, revenue fell again, partly because its products are also used to enforce bus lanes and parking restrictions and there was less traffic during the pandemic. During the year SEA sold its subsea business, orders have recovered, and cost savings from a prior restructuring should improve profitability.

Revenue and profit grew at MCL, and the company is experiencing an upsurge in orders from the Ministry of Defence following the recent defence review. It sees opportunities to support the new Ranger Regiment, which is being established to conduct unconventional action.

MCL sources and customises equipment, often for UK special forces.

Good results, good prospects

In aggregate, Cohort remained highly profitable, earning a return on capital of 34%. It raked in cash too, although cash conversion is likely to revert to more normal levels in 2022.

Past performance is not a guide to future performance.

Confirmed orders in August account for 82% of total revenue anticipated in the year to April 2022, which Cohort expects to improve a little despite the shrinking of EID’s order book. Thereafter it is more optimistic.

The company’s optimism is informed partly by developments in the market, which may grow significantly. Geopolitical tension abounds in respect of Russia, China and Islamist paramilitaries, and the Defence Command Paper published in March announced a significant uplift in UK defence spending.

Many of the government’s spending priorities match Cohort’s capabilities including the UK nuclear deterrent, ISTAR (Intelligence, Surveillance, Target Acquisition, and Reconnaissance), modernisation of the army, more ships for the navy, and increased spending on technology.

Scoring Cohort

I like Cohort. It is highly profitable and has grown reasonably strongly since it listed in 2006, in what has generally been a period of tight defence budgets.

MASS’ performance backs up Cohort’s assertion that it has “rare or unique” capabilities.

As defence priorities have changed, so have Cohort’s. Its focus on technology keeps it relevant and as the Ministry of Defence (MoD) has opted to fill more training and support roles in-house, Cohort has become more product focused.

Since products are easier to export than services, this strategy has also enabled Cohort to target export markets, reducing its dependence on the UK defence budget. For the first time, less than 50% of Cohort’s revenue was ultimately derived from UK MoD contracts in 2021.

Although acquisitions have contributed to Cohort’s growth, they have been funded by profit from existing businesses, each new acquisition contributing to the cost of the next one. Unlike more profligate acquisition strategies, this one has a greater chance of being sustainable.

The management team put in place around the time of the flotation in 2006 had long experience dealing with the MoD, and it is still substantively in place today.

But Cohort is also complicated. Its six businesses supply a wide array of products, training, research, advice and support to a relatively small list of customers. Often they enter long-term fixed-price contracts, which can turn out to be more complicated than anticipated, and more costly to fulfil.

Apart from MASS, which routinely makes the most profit, the performance of the other businesses is variable as contracts tend to be large and episodic. For example, EID’s revenue will decline substantially in 2022 following the fulfilment of orders for an intercom system that delivered 50% of revenue in 2021.

Hitherto, one of Cohort’s strengths has been the autonomy of its six subsidiaries.

The businesses operate independently, which motivates their managers and enables them to respond nimbly to customers without passing decisions through a costly central bureaucracy. Only high value contracts (worth more than £5 million) require the board’s sign-off.

Cohort sees itself as an enabler, picking the right managers and providing capital and encouragement so its subsidiaries innovate and share knowledge and customers. SEA and ELAC make complimentary sonar systems for example, and Cohort hopes they will be able to sell each others’. Meanwhile, at Chess, Cohort has stepped in to help management work out how to control projects better.

Customers like dealing with small agile companies, but also value the security conferred by the larger well-financed group. Small businesses can all too easily slip out of existence, putting long-term supply in jeopardy.

At the moment, Cohort offers the best of both worlds, but in a presentation to analysts in July, chief executive Andy Thomis acknowledged that the bigger the company gets, the greater the imperative to coordinate and manage from the centre.

He said: “At some point we will need to think about whether the current decentralised structure is right for an ever enlarging group but we have a considerable way to go before we reach that point.”

It is reassuring that Cohort recognises the challenge. Maybe it will be able to adapt.

Does the business make good money? [2]

+ High returns on capital

+ Decent profit margins

? Acceptable cash flow

What could stop it growing profitably? [1]

+ Strong finances

? Multi-year fixed price contracts can backfire

? Will have to adapt autonomous business model as it grows

How does its strategy address the risks? [2]

+ Large contracts get board level scrutiny

+ Export drive reduces dependence on MoD

+ Autonomous subsidiaries are responsive to customers

Will we all benefit? [2]

+ Very experienced executives not overpaid

+ Employees encouraged to join share schemes.

+ Communicates well with shareholders

Is the share price low relative to profit? [1]

+ Yes. A share price of 555p values the enterprise at £250 million, about 16 times adjusted profit in 2021 and 12 times adjusted profit had Cohort earned its average return on capital over the last 12 years.

Cohort is not the most straightforward of business, but a score of 8 out of 9 means I think it is a good long-term investment.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in Cohort.

For more information about Richard’s scoring and ranking system (the Decision Engine) and the Share Sleuth portfolio powered by this research, please read the FAQ.

Contact Richard Beddard by email: richard@beddard.net or on Twitter:@RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.