Richard Beddard: why I want Bloomsbury to succeed

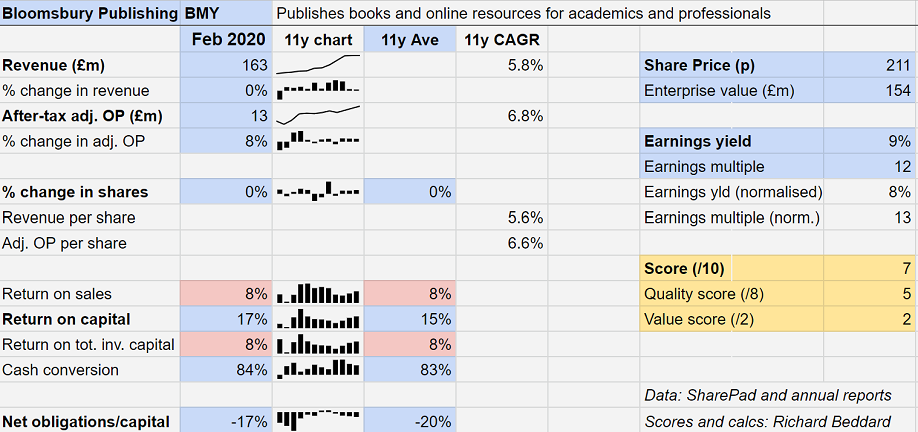

Harry Potter generates stable earnings and shares are cheap, but are they a good long-term investment?

26th June 2020 15:57

by Richard Beddard from interactive investor

Harry Potter generates stable earnings and the shares are cheap, but are they a good long-term investment?

Bloomsbury Publishing (LSE:BMY)'s strategy flows from a wonderful principle: to publish works of excellence and originality.

Reassuringly, and perhaps belatedly, because staff give the 34-year-old company mixed reviews on online recruitment sites, the company’s recent annual report makes engaging staff a strategic imperative.

Editors and publicists work with authors to turn their manuscripts into books and sell them. Trained, motivated and well supported staff should enhance the firm’s reputation so more authors come to Bloomsbury, which is good because acquiring copyright is the first step in publishing works of excellence.

Were staff telling management something? Bloomsbury’s score derived from online staff reviews has declined. Source Glassdoor.co.uk, average of 60 reviews

The other end of the publishing pipeline is selling books and journals, which, in the age of the Internet, means Bloomsbury must digitise and globalise.

Harry Potter and the conundrum of growth

The company has long had a problem. Its biggest publishing asset, the rights to the Harry Potter series of books are neither digital nor global. JK Rowling herself owns the digital rights, and the books are published by other publishers outside the UK.

Although the company does not disclose revenue or profit from Harry Potter titles, they surely make an enormous contribution to Bloomsbury’s profit.

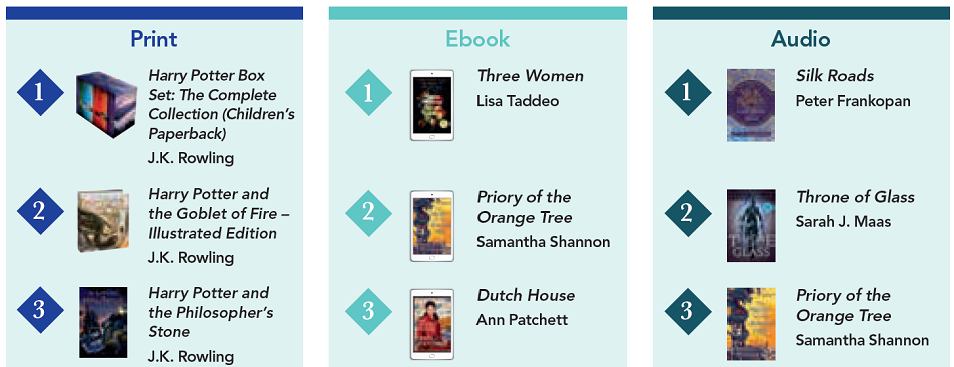

The company sustains interest and sales with new illustrated editions and spin-offs. Its bestselling print title is the Harry Potter Box Set, and Harry Potter titles also occupy second, third and four other positions in Bloomsbury’s top ten selling consumer print titles.

While Harry Potter does not feature in the eBook and Audiobook charts, these are modest revenue earners compared to print.

Children’s books, the division in which Harry Potter sits, is historically by far the most profitable part of the company.

Source: Bloomsbury Publishing Annual Report 2020

But Potter’s adventures are over, so Bloomsbury has diversified in search of growth. It channelled the money earned from the franchise into other authors and built up another division: Academic and Professional, beginning with the acquisition of Methuen Drama in 2006.

Since then it has added more than 20 publishers and imprints, most of them small and specialist, including two either side of the end of the financial year in February.

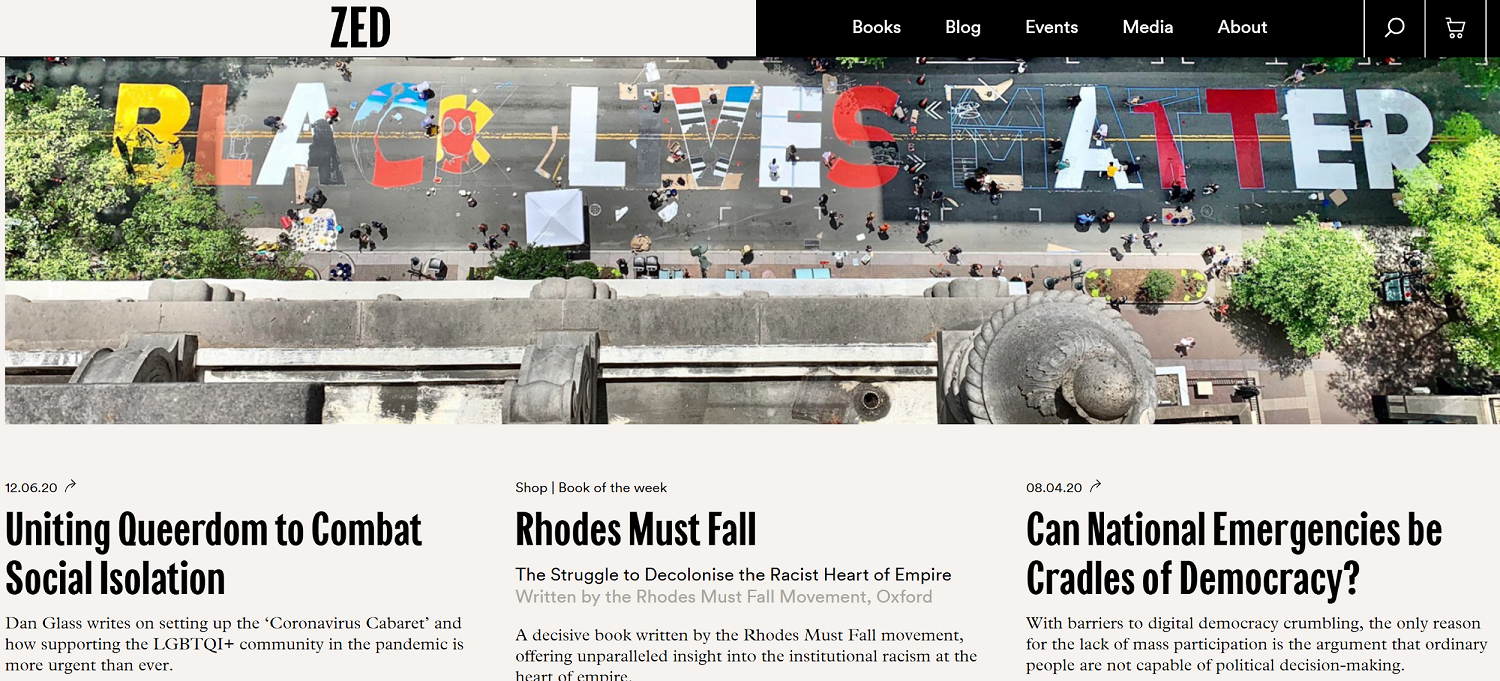

The first, Oberon Books, is a drama publisher that Bloomsbury folded into Methuen Drama in December 2019. The second is politics and social science publisher Zed Books, which Bloomsbury acquired in March 2020.

Exquisitely timed? Bloomsbury acquired Zed books on the cusp of a national emergency as interest in racial and gender politics surged. Source: https://www.zedbooks.net/home/

Second source of magic

In the year to February 2020, Harry Potter sales were flat, but the company sold fewer children’s titles due in part to a lull from the hitherto prolific young-adult author Sarah J. Maas.

The Academic and Professional division stepped up, though, moving Bloomsbury towards its objective of balance between unpredictable consumer publishing - a few titles become blockbusters and most do not - and more dependable earnings from Academic and Professional publishing:

| Revenue (£’000) | Profit (£’000) | Profit margin | |||||

|---|---|---|---|---|---|---|---|

| Feb-20 | Feb-20 | Feb-20 | Feb-19 | Feb-18 | Feb-17 | Feb-16 | |

| Children's trade | 59,354 | 7,400 | 12% | 15% | 17% | 18% | 14% |

| Adult | 37,416 | 1,649 | 4% | 3% | -1% | -2% | 2% |

| trade | |||||||

| Academic & Professional | 43,123 | 4,906 | 11% | 8% | -1% | 5% | 11% |

| Special Interest | 22,897 | 1,974 | 9% | 3% | 10% | 4% | 11% |

| Content Services | -22% | -10% | 11% | 38% | |||

Since 2016, Bloomsbury has been knitting together its arts and humanities titles, a digitally underserved niche, into collections of digital resources.

The investment has weighed on the Academic and Professional division’s profitability (see table), but this year Bloomsbury made its first profit from digital resources, and the Academic and Professional division drew closer to revenue parity with Bloomsbury’s engine room, children’s books.

It also closed the gap in terms of profit margins, which were 11%. If digital resources contribute £5 million in profit from £15 million in revenue by February 2022 as Bloomsbury hopes, Academic and Professional may well have become its most profitable division, which, due to the acquire and digitise strategy, has no obvious limits to growth.

The fly in the segmental ointment is Adult Trade. The profit margin this year is higher than in recent years, but at 4% it is pretty thin.

Bloomsbury thinks the division, which sells novels and non-fiction titles, can do better. Perhaps the new divisional editor-in-chief Paul Baggaley, recruited from Macmillan in a move described in The Bookseller as “a coup for Bloomsbury”, will lead the way.

Work in progress

The company is work in progress. Adding the cost of many small acquisitions to Bloomsbury’s capital base means, as yet, it is only making an adequate after-tax return on total invested capital.

Covid-19 is a worry too. Bloomsbury was quick to raise funds from investors and bolster its finances as countries locked down and bookshops closed, and it passed on the dividend for the first time in 25 years.

Longer-term, the pandemic could accelerate the shift to online sales, which is good news for academic publications, but maybe not for consumer titles because of the trade’s increasing dependence on Amazon, which dominates online retail.

Universities face challenges too. If the pandemic persists, funding may fall as governments cut budgets and overseas students stay home.

But Bloomsbury was in a reasonably strong financial position going into the crisis, and it has also created goodwill by providing free access to online educational resources to schools and universities during the lockdown.

Since the beginning of March, the company has set up thousands of trials for almost a thousand different institutions. It must be hoping a good number subscribe, when the dust settles.

I must admit to bias. I want Bloomsbury to succeed. I’m a writer. Once upon a time I worked for an academic publisher.

The notion that writing and information has commercial value is attractive. And there is no better way to spend an idle hour than browsing the shelves of Waterstones. Often Bloomsbury titles stand out.

Does the business make good money? [2]

+ Decent returns on capital, prospect of improvement

+ Good cash conversion

What could stop it growing profitably? [1]

+ Strong finances, increasingly stable earnings

? Price of acquisitions may not be justified by subsequent returns

? Market power of Amazon in online book and ebook sales

? Demand for Open Access publications in academia

? Potential reduction in University funding due to pandemic

How does its strategy address the risks? [1]

+ Academic and Professional division brings stability and growth

+ Digitisation should unlock returns from acquisitions

? Bloomsbury supports alternative channels to Amazon

? It already publishes Open Access texts (for a fee)

? “Flexible sales models” will accommodate cash-strapped universities

Will we all benefit? [1]

+ Information and books contribute to a healthy society

+ Employee engagement is core strategy

+ Annual report open about risks

? Mixed reviews from staff on online recruitment sites

− Founder and chief executive very highly paid

Are the shares cheap? [2]

+ Yes. A share price of 211p values the enterprise at £154 million, about 12 times adjusted profit. The earnings yield is 9%

A score of 7/10 probably means Bloomsbury is a good long-term investment. It is ranked 17 out of 32 shares I track with the Decision Engine.

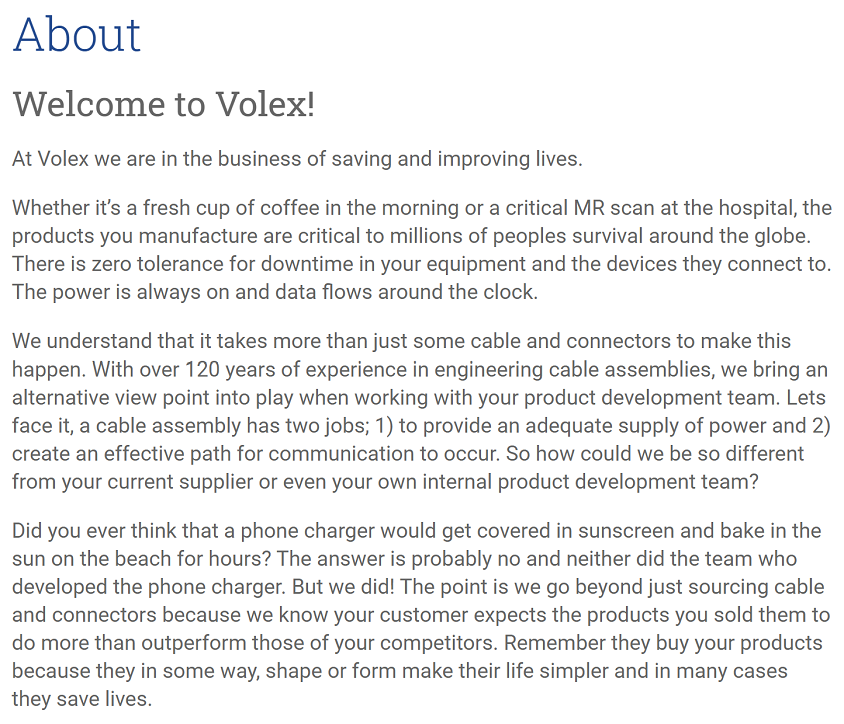

Volex

For much of this century, Volex (LSE:VLX) has been a shrinking low-margin business that supplies power cords and electric cabling. You may be thinking it’s an unlikely candidate for investment and, to be honest, I don’t know much about it, so let me let Volex sell itself. This is its ‘about’ page:

Anyone that can make cabling sound interesting is worth listening to. I’d hire Volex’s copywriter, and I might take a look at the investment...

Richard owns shares in Bloomsbury Publishing.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.