Richard Beddard: why I remain a believer in this small-cap share

13th January 2023 15:02

by Richard Beddard from interactive investor

There’s no need to view one set of ‘iffy’ results from this interesting company with alarm. Our optimistic columnist thinks there are probably sunny uplands ahead.

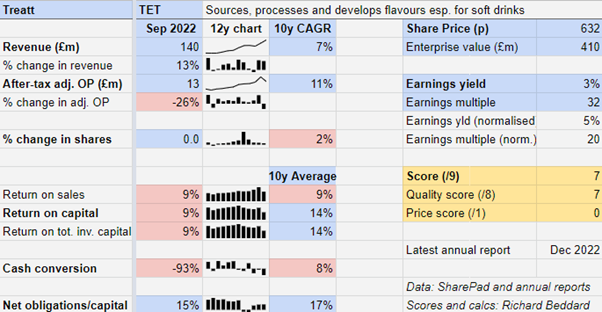

There is a shocking amount of pink in my summary table of Treatt (LSE:TET)’s performance for the year to September 2022, despite revenue growth of 13%.

After a surge in 2021, profit margins fell back to pre-pandemic levels, and return on Capital of 9% was the lowest in the 12 years I have calculated it.

Cash flowed out of Treatt.

- Invest with ii: Open a Stocks & Shares ISA | ISA Investment Ideas | Transfer a Stocks & Shares ISA

Treatt extracts natural flavours and aromas from fruit, vegetables, herbs, spices and flowers and sells these ingredients to international flavour houses and multinational beverage companies.

Out of flavour

We can examine the dramatic decline in return on capital through the 26% fall in the calculation’s numerator, profit, and the 25% rise in its denominator, average capital employed.

There are three reasons for the fall in profit: large foreign exchange losses on hedging contracts (compared to substantial gains in 2021), a dramatic decline in revenue from highly profitable tea flavours (compared to rapid growth in 2021), and rising costs that Treatt did not pass on in full to customers.

Hedges are supposed to protect a company from foreign exchange volatility, but Treatt says the scale of the losses on these contracts was the result of being over-hedged, a situation it has now corrected

Most of Treatt’s flavour categories grew in 2022 but the standout was citrus, which is Treatt’s largest and least profitable category. Much of its citrus sales are relatively undifferentiated, grades of orange oil for example, and although the increase in citrus revenue more than made up for the loss of revenue from tea, it was less profitable.

Tea flavours are mostly consumed in the USA, Treatt’s biggest market, as iced tea. The company launched a new range of tea extracts in 2021 aimed largely at the hard seltzer market (canned alcoholic drinks). It initially sold very strongly, but petered out just as quickly, only temporarily bumping tea’s contribution up from 6% of sales in 2020 to 11% in 2021, and back down to 6% in 2022.

Despite the unexplained failure of “hard” tea flavours, Treatt says sales destined for non-alcoholic tea flavoured beverages are still growing.

Inflation in ingredients prices, pay rises, and a double-digit percentage increase in staff, also weighed on profit as the company filled vacancies from 2021. It also prepared for growth in its new coffee category, which it expects to grow dramatically in 2023 having secured a humongous contract worth several times the value of the nascent coffee business in 2022.

Having failed to pass on the cost increases in full, Treatt says it is pricing long-term contracts with more rigour now.

Although the decline in profit takes us back to the year before the pandemic, it is the increase in capital employed that has caused return on capital to fall to unprecedented levels. This is due to massive investment, and the period of inflation and shortages we are living through.

Building and re-equipping Treatt’s new headquarters and factory in Bury St Edmunds and extending its other facility in Florida has consumed an enormous amount of capital. Total expenditure over the last six years was just over £74 million, compared to £8.5 million over the previous six-year period.

The good news is capital expenditure is normalising now these projects are completing. In 2022 it was £12 million, about half of peak spending in 2020.

The bad news is investment in property and equipment was one of three significant uses of capital in 2022.

Capital was also required to fund receivables - money owed by customers - which increased substantially due to a rise in sales near the year end, and more stock as the company secured supply.

Room for optimism

Since these iffy results are a reversal in a long-term trend of improved profitability, it would be easy to view them with alarm. There is, however, room for optimism.

Due to its international footprint and dependence on agricultural commodities, Treatt’s profitability will always be susceptible to fluctuations in the value of currencies and the prices of raw materials, but they were exacerbated by self-inflicted errors in 2022 that the company has moved swiftly to correct.

Now Treatt has moved out of its cramped and poorly laid out post-war headquarters and into a modern and extendable facility, it should operate more efficiently. New laboratories will enable innovation and collaboration with customers on unique flavours.

This is the vision Treatt sold investors when it raised money to build the headquarters, and the result, it said, would be more consistent cash generation from less commodified products, and higher returns on capital from stronger customer relationships and more profitable products.

Big customer risk

The company still faces challenges to bring this vision about.

Although Treatt is not beholden to any single company, the big flavour houses and beverage companies are often much larger than Treatt. Its largest customer, a beverage company Treatt has traded with for more than 25 years, contributed £15.2 million to revenue, 11% of the total in 2022.

Big customers are in a powerful position to push down Treatt’s prices, capping profitability, and pay it slowly, requiring it to fund more working capital.

The company is also dependent on the supply of agricultural commodities, which is impacted by the weather, and extreme weather events are becoming more common due to climate change. Its Florida HQ could also be a climate risk, due to the increasing frequency and severity of hurricanes.

Given Treatt’s expertise in sourcing and trading essential oils, it is in a good position to source ingredients and its headquarters in the UK ensures it can operate if business is interrupted in Florida.

Encouragingly, Treatt has dropped a longstanding concern from its list of principal risks this year. The commodification of citrus flavours is no longer a significant concern because, over many years, the company has increased the refinement of its citrus products and diversified away from the category.

Today, less than half of revenue is from citrus, and only 17% of revenue is “minimally processed” and, therefore, traded as a commodity.

From investment in buildings to R&D

Although there is little Treatt can do about its weak position relative to big customers, it can improve profit margins by becoming more efficient and raise prices by becoming more attractive and indispensable to them.

This is the goal of its strategy.

Flavours represent a small proportion of the overall cost of manufacturing beverages, but they are also vital, especially as we seek to reduce the amount of sugar in them.

Treatt’s strategy is to help drive innovation in fast moving sections of the market like health drinks, energy drinks, and ready to drink iced-tea, cold-brew coffee, and cocktails, by using its expertise in sourcing and extracting flavours.

Despite the surprising collapse in tea revenue in 2022, it believes these products should enable it to earn higher profits more consistently.

- Seven ways to pay less tax in 2023

- My ISA goals for 2023: why I’m feeling ‘queasy’ but quietly confident

Treatt is also putting more emphasis on synthetic aromas, which it develops with a chemicals company, as they develop molecules that can make plant-based meat alternatives more flavoursome.

Now the company has the facilities to innovate and collaborate with customers, its emphasis is switching from investment to manufacturing efficiently and spending on innovation. It is promising to treble research and development spending over the next five years.

People first

The new headquarters is a watershed moment in a strategy initiated by Daemmon Reeve, who started his career at Treatt and worked his way up to become chief executive in 2012.

From the outset, the strategy put staff first. Every year since 2014, Treatt has given all employees who have worked for more than a year free shares. They can also buy shares out of pre-tax income and receive matching shares. The company pays UK employees at least a living wage and provides a wealth of training opportunities.

That said, voluntary employee turnover increased from 9% to 17% in 2022, a statistic that needs following but may reflect suppressed job seeking during the pandemic and a subsequent bounce as it abated.

It is six years since I followed Mr Reeve into a meeting where he told local businesspeople: “If you concentrate on the numbers in the business, nothing changes. If you focus on the people, everything changes.”

Last year was a reminder that numbers do matter. Hopefully, the zeal with which the new chief finance officer Ryan Govender has tightened up policies and processes regarding pricing and foreign exchange contracts, will help deliver the results the people deserve.

Scoring Treatt

Look beyond 2022 and there are probably sunny uplands ahead. It may take a year or two for that to become obvious, but I remain a believer.

Does the business make good money? [1]

- Decent and growing return on capital (except in 2022)

- Profit margin could be stronger

- Poor cash conversion due to investment

What could stop it growing profitably? [2]

- Strong finances

- Differentiated products

- Big customers

How does its strategy address the risks? [2]

- More R&D

- Operational excellence

- Closer collaboration with large customers

Will we all benefit? [2]

- Experienced chief executive

- People first policies

- Executive remuneration

Is the share price low relative to profit? [0]

- The price is reasonable. A share price of 632p values the enterprise at about £410 million, about 20 times normalised profit.

A score of 7 out of 9 indicates Treatt probably is a good long-term investment.

It is ranked 14 out of 40 stocks in my Decision Engine.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in Treatt

For more information about Richard’s scoring and ranking system (the Decision Engine) and the Share Sleuth portfolio powered by this research, please read the FAQ.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.