Richard Beddard: why I give this company my maximum score

This extraordinarily profitable and cash-generative business publishes the most remarkable set of results he looks at routinely, and every year our columnist fails to find fault with them. Find out what he really think about the company here.

15th September 2023 15:26

by Richard Beddard from interactive investor

Games Workshop has a new chairperson, John Brewis. His first sentence in this year’s annual report starts: “Games Workshop is a great company...”

It is not hyperbole, or the zealousness that goes with new beginnings. Neither is it preparing the way for some kind of admission. Games Workshop Group (LSE:GAW) has not fallen on hard times.

- Invest with ii: Top UK Shares | Share Tips & Ideas | Open a Trading Account

It probably is a great company, which is why this year, like last year, I am giving the business a maximum score, although its qualities as an investment also depend on the share price.

Games Workshop invented Warhammer, a tabletop fantasy wargame that brings massed armies to bear, in the 1980s. The company makes money by manufacturing and selling intricate models and paints, books, magazines and card games.

It also licenses characters and stories to video-game companies and Amazon.com Inc (NASDAQ:AMZN) has secured the rights to a TV series, although there is no news about that in this year’s annual report.

Warhammer is a niche hobby, but global niches can be big. In 2023, Games Workshop earned nearly half a billion pounds in revenue, 78% of it outside the UK, and converted 30% of that into profit.

From good to great

To understand the challenges facing Games Workshop, I think it helps to understand its history. More than 20 years ago, the company launched a The Lord of The Rings game under licence from Warner Brothers, the studio that made the famous Peter Jackson film series.

While the films were enjoying their run, the game did very well, inspiring Games Workshop to build bigger stores and divert some of its attention from Warhammer.

This growth was a bubble, and when interest in the films declined, so did interest in the game. Some of the fans had become modellers, or gamers, but not enough of them to justify the investment.

Games Workshop still sells The Lord of The Rings models, but we rarely read about it in the annual report. This year is the exception that proves that rule, Games Workshop released The Battle of Osgiliath, a box set.

There is no The Lord of The Rings equivalent of Warhammer Community, Games Workshop’s relentless online marketing platform, Warhammer Plus, its £5.99 a month subscription service, which grew to 136,000 members this year, or the Warhammer YouTube channel.

The company focuses on Warhammer for two reasons.

The first is that Games Workshop owns Warhammer. If it needs more characters, and more stories, it invents them on a pretty regular schedule, producing new models every week, and wholesale revisions to each of its two game universes every three years or so. This is the reason Games Workshop employs more than 300 designers.

- Dividend news keeps Games Workshop shares on track to hit record high

- Stockwatch: I rate these three stocks at inflection point a ‘buy’

To give one example of how much invention there is. In February, the company released The End and the Death, a novel in The Horus Heresy, a storyline in the Warhammer 40,000 science-fiction setting. It was the first part of what the company describes as a climactic finish to a series that started in 2006, 90 novels ago.

The second reason Games Workshop focuses on Warhammer is that although hobbyists probably have an interest in science fiction, or fantasy, the settings of Warhammer 40,000 and Warhammer Age of Sigmar, the fantasy setting, they probably come to the hobby because of the game, or the modelling, or both.

This is the reason Games Workshop operates its own stores, more than 500 of them, where many customers painted their first model or played their first game. Warhammer is intertwined with social and craft elements that can make it a lifelong hobby.

To grow, Games Workshop needs to feed the hobby, and this is where things get complicated because Warhammer controls design, manufacture, distribution and marketing as well as the intellectual property. It is a lot to get right.

It seems as if Games Workshop is always offending somebody, whether it is independent retailers who cannot get the product they want, customers who think the models are too pricey, or fans who want to animate their own versions of Games Workshop stories and characters, but are not allowed to under the company’s intellectual property guidelines.

- Richard Beddard: this top 10 stock is helping shape the future

- Portfolio diversification in action: see how it really works

The interesting thing about Games Workshop is that it is so self-sufficient, the basic business problem of how much value to give customers and resellers is pretty much all it needs to worry about beyond, of course, IT, manufacturing, distribution and so on.

The biggest risk is not competitors, or recession, it is that the company will get something under its own control wrong.

Sometimes, I think it has. The chief executive before Kevin Rountree was Tom Kirby. After the shock of the Lord of the Rings’ years, he favoured expensive and intricate models bought by the company’s oldest and most well-heeled customers. They were very profitable, but did little to grow the popularity of the hobby, gamers rebelled on bulletin boards, and the company was profitable but did not grow.

Its subsequent flourishing has coincided with its re-engagement with customers, particularly online, the simplification of game rules to make things easier for beginners, and the design of models and box sets to suit most pockets.

2023 and beyond

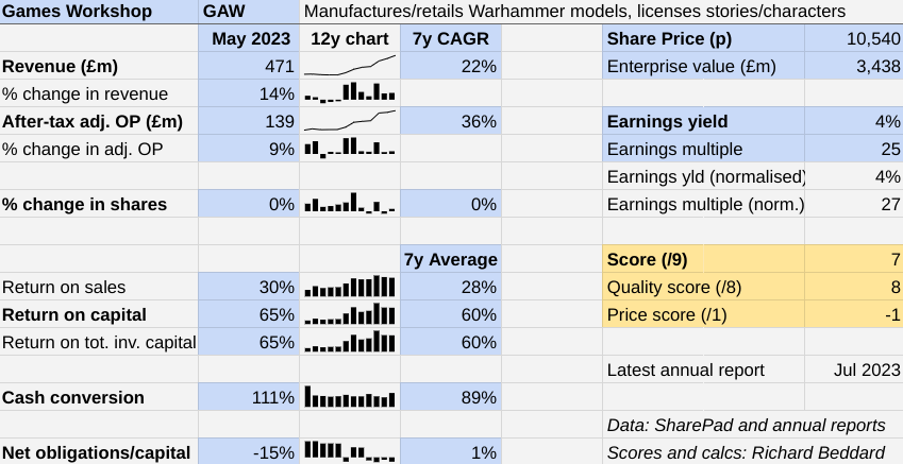

I really do not need to say much about the numbers. They are the most remarkable set I look at routinely. The company is extraordinarily profitable and cash generative.

It would be amazing were Games Workshop to match the growth rate of the last seven years over the next seven years, but also unlikely.

Helped by currency movements, double-digit revenue and profit growth this year was below the heady seven-year averages, but those seven years incorporate some truly remarkable years.

Profit doubled in 2017 and doubled again in 2018 as Games Workshop began to fulfil its potential under Kevin Rountree. It increased by nearly 70% when Warhammer became a favoured pastime during the pandemic.

Nevertheless, I believe the potential for growth is, to an unusual degree, in Games Workshop’s own hands.

The current financial year ought to be a good one. The biggest event in the company’s multi-year schedule is the launch of a new edition of Warhammer 40,000, and the company launched the tenth edition in June.

Games Workshop hyped it up with cinematic trailers on its social media sites, and once again, the company has focused on simplifying the rules to make things easier for beginners, while embellishing it with new storylines, and new models.

Surely, we can expect sales to follow.

Scoring Games Workshop

Every year I fail to find fault with Games Workshop, and every year I feel complacent.

It is a complex, vertically integrated business, and there is a lot that could go wrong operationally.

Most years the company fesses up to something that has not gone as well as it should. Last year it incorrectly forecasted how much product it needed in Australia, this year the revamp of the company’s online store is behind schedule, but the profits keep rolling in.

Does the business make good money? [2]

+ High return on capital

+ High profit margin

+ Strong cash conversion

What could stop it growing profitably? [2]

+ Strong finances

+ Little competition

? Complexity

How does its strategy address the risks? [2]

+ Focus on own intellectual property

+ Finding new ways to exploit it

+ Vertical integration

Will we all benefit? [2]

+ Very experienced management

+ Employees receive equal profit share

+ Self reliant culture

Is the share price low relative to profit? [-1]

+ No. A share price of £105.40 values the enterprise at over £3.4 billion, about 27 times normalised profit.

Despite the high price, a score of 7 out of 9 indicates Games Workshop is a good long-term investment.

It is ranked 19 out of 40 stocks in my Decision Engine.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in Games Workshop

More information about Richard’s investment philosophy and how he implements it.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.