Richard Beddard: why I like this AIM share with hidden potential

16th July 2021 16:18

by Richard Beddard from interactive investor

Our companies analyst evaluates a firm preparing for a future when hydrogen is a significant energy source.

In the 1980s, James Cropper (LSE:CRPR), a centuries-old family owned Lakeland paper-maker went beyond paper, and the wood pulp it is made from, when it created a new business, Technical Fibre Products (TFP). TFP makes sheets from substances such as carbon fibre that improve the performance of composite materials.

Now, nearly four decades on, TFP has gone beyond fibre.

Beyond fibre

TFP’s technical fibre products have many characteristics: strength, fire resistance, insulation and electrical properties, for example. Perhaps the most famous destination for TFP products is sporting goods such as tennis rackets, but perhaps the most promising is as a substrate for the Gas Diffusion Layer in hydrogen fuel cells.

Hydrogen fuel cell technology may revolutionise transport by providing a clean source of energy and an alternative to batteries.

In addition to materials for fuel cells, TFP also supplies technical fibre products that improve the durability and functionality of wind turbine blades. Renewable energy such as wind is a prerequisite for using hydrogen as a store of energy because it is a source of green power for the electrolysers that convert water to hydrogen, which can be converted back into energy later by fuel cells.

When TFP took over PV3 Technologies in January, it acquired a third “entry point” into the hydrogen economy because PV3 (now TFP Hydrogen Products) supplies materials for water electrolysers as well as fuel cells. The acquisition represents a step beyond fibre because TFP Hydrogen Products supplies electrochemical materials like catalysts and coated electrodes.

- Shares for the future: building a forever portfolio

- Read more Richard Beddard articles here

- Check out our award-winning stocks and shares ISA

At the time of acquisition, PV3 was loss-making, but James Cropper is preparing for a future when hydrogen is a significant energy source. Twenty per cent of TFP’s revenue already comes from hydrogen products and, TFP says, 50% of the world’s hydrogen fuel cells incorporate its materials.

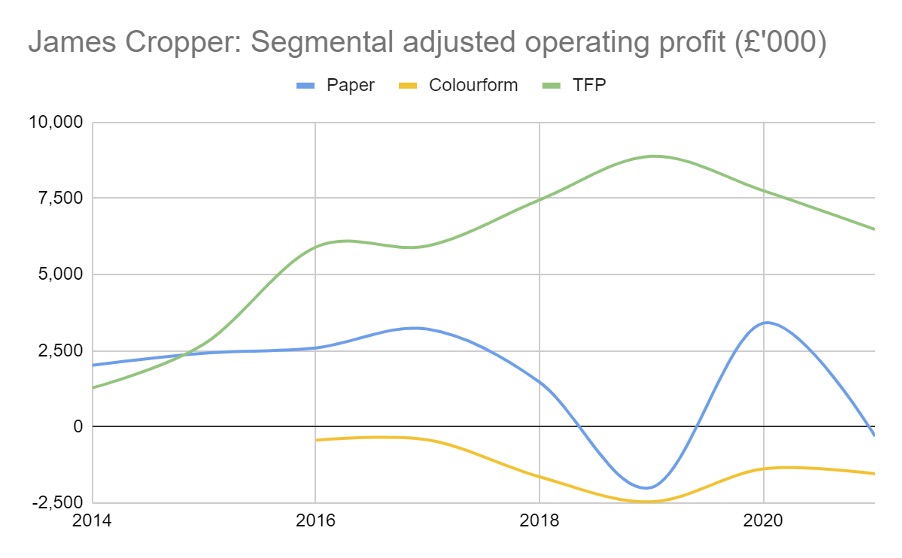

These days, TFP is James Cropper’s main source of profit, although the paper business is more than twice its size in terms of revenue and the number of employees who work for it. The paper division is also innovating, bringing its expertise to premium recycled, coloured, textured, and shaped paper and packaging.

Colourform, the third and much younger business in the group, specialises in bespoke moulded packaging for luxury brands. It has yet to make a profit, although it has grown revenue to £2.8 million from a standing start in 2016.

Past performance is not a guide to future performance. Source: James Cropper annual reports

Returns are no match for the story

Despite, or perhaps because costly innovation has yet to bear fruit, the results for the group are unexciting.

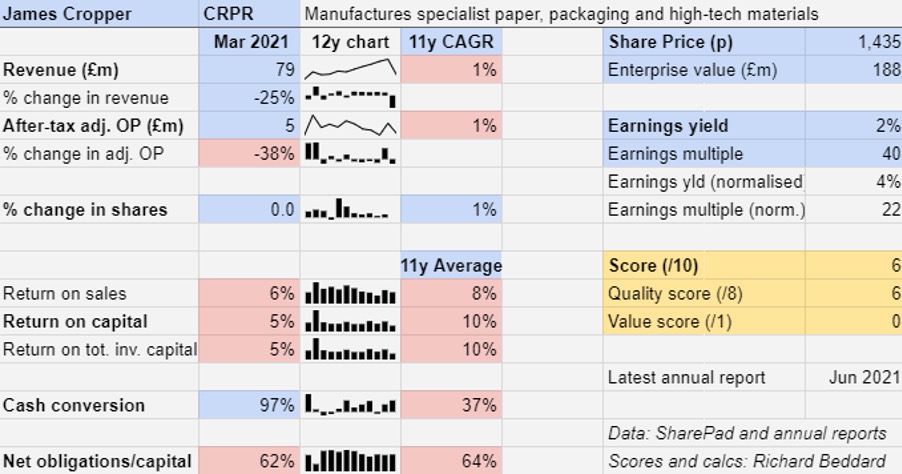

Return on sales average 8%, and return on capital 10% over the last 11 years. Average cash conversion is very weak due to investment and payments to plug the deficit in the company’s substantial and underfunded pension scheme.

The pandemic has not been kind to James Cropper either. A 25% reduction in revenue led to a 38% reduction in adjusted profit in the year to March 2021, excluding the cost of voluntary redundancies and legal costs relating to the acquisition of PV3, but including money received in state support during the pandemic.

The company generated lots of cash in comparison to the reduced profit because the company suspended substantial investment programmes and pension deficit reduction payments. Both drains on cash flow have now resumed.

In the paper division, revenue fell 32% and the business made a small operating loss. Colourform grew revenue 9%, but losses widened.

TFP is carrying the group. Its revenue fell 7% and adjusted profit fell 11%. Perhaps unsurprisingly sales into the aerospace market suffered most. Sales of fuel cell products continued to grow though, and unlike the other businesses, TFP still made a handsome return on sales of 26%.

Scoring James Cropper

Despite these figures, I like James Cropper. It has taken paper-making technology in surprisingly innovative directions. It says it makes materials with purpose, reducing the cost and increasing the efficiency of green energy, and sourcing fibre sustainably. The paper division has recycled 58 million coffee cups into packaging for luxury fashion brand Burberry (LSE:BRBY).

Although the investment required to get to this point is depressing profit, it might secure James Cropper a more profitable future.

- Subscribe to the ii YouTube channel and catch all our latest interviews and video content

- Read more of our content on UK shares here

Meanwhile, the pandemic has accelerated the company’s transition away from commodity paper products as it reduces costs, focuses on more profitable paper niches such as recycled, coated and embossed paper, and increases capacity at its two growing businesses, TFP and Colourform. The increasing use of recycled paper is reducing James Cropper’s exposure to fluctuating pulp prices.

The company has restructured the three businesses, Paper, TFP and Colourform, so they are separate vertically integrated entities with their own strategies. As well as focusing them, it will save £2 million in annual running costs in the paper division.

Does the business make good money? [1]

? Modest return on capital

? Modest return on sales

˗ Weak cash conversion

What could stop it growing profitably? [1]

? Financial obligations (mostly leases and pension deficit)

? Competition (especially paper making)

? Sensitivity to pulp prices in paper making

How does its strategy address the risks? [2]

+ Innovation of niche products

+ Rationalisation of paper making

+ Vertical integration

Will we all benefit? [2]

+ Explains itself well

+ Celebrates achievements of staff

+ Experienced board is not overpaid

Is the share price low relative to profit? [0]

? A share price of £14.35 values the enterprise at about 22 times normalised profit.

With a score of 6 out of 9, James Cropper probably is a good long-term investment but it is shackled to a large pension scheme that drains resources. While TFP operates in many niches, the investment case also requires confidence in the development of a hydrogen economy that only exists in parts today.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

For more information about my scoring and ranking system (the Decision Engine) and the Share Sleuth portfolio powered by this research, please read the FAQ.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.