Richard Beddard: why Games Workshop makes my list of top 10 shares

9th September 2022 11:57

by Richard Beddard from interactive investor

Despite a sharp drop in share price, Richard’s enthusiasm for the business is unchanged since last year and this £2 billion company remains one of his favourite stocks.

How quickly stock market darlings turn into villains.

If you were to judge by the near 40% decline in the share price, something must have gone wrong at Games Workshop (LSE:GAW).

But apart from some logistical problems as the global economy emerged from the pandemic, the business is still performing at a very high level.

New normal is much like the old normal

Past performance is not a guide to future performance.

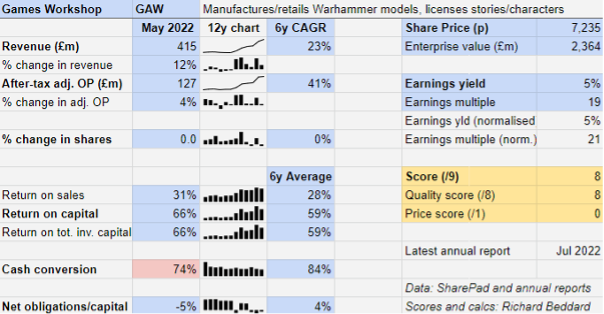

We should not be surprised that growth in revenue of 12% is below the six-year compound average growth rate of 23%, or that Games Workshop’s remarkable return on capital of 66% was lower than it was in the year to May 2021.

That year was an exceptional year in which locked down fans of Warhammer, Games Workshop’s fantasy modelling and wargaming universe, had the time and money to scale up their armies.

- Invest with ii: Top UK Shares | Share Prices Today | Open a Trading Account

In 2022, as commerce struggled to catch up with the new normal and Russia launched a war in the Ukraine, Games Workshop lost about 1% of sales in Russia and paid high freight costs due to the chaotic shipping situation.

It also wrote down the value of obsolete stock due to shipping delays.

In its previous annual report for the year to May 2021, which followed the launch of the ninth edition of Warhammer 40,000 in July 2020, the company wrote:

“It is worth noting that the launch year of a new Warhammer 40,000 edition is normally the financial high point... until the next edition of Warhammer 40,000.”

The eighth edition was launched in 2017, three years earlier, and the internet rumour mill puts the next one in 2023, probably because it fits the pattern of the previous cycle.

If that means the summer of 2023, we can hope for a surge in profitability in Games Workshop’s financial year ending in May 2024.

In the meantime, interest in the hobby is maintained with refinements: the release of new stories, rulebooks, miniatures, books, magazines and partworks.

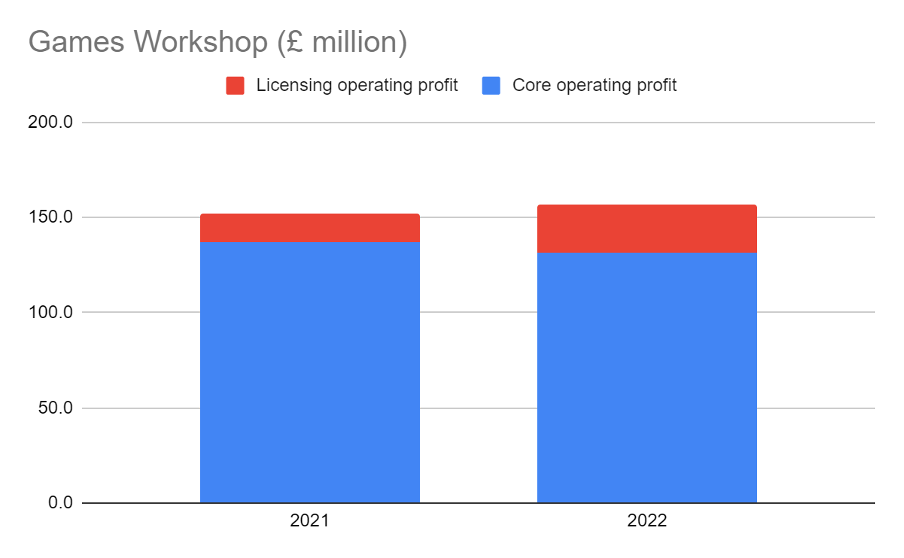

Although Games Workshop increased revenues from the sale of miniatures and associated products, it made slightly less profit from them than it did the previous year.

Overall profit grew thanks to an increase in royalties received from licensees of its stories and characters, video game makers in the main:

Past performance is not a guide to future performance.

Licence revenue is fantastically profitable because the company is reselling the intellectual property it has already developed. Games Workshop converted 91% of licence revenue into operating profit, compared to a still marvellous 34% profit margin for the core business in 2022.

Long-term though, licence revenue is not a substitute for growth in the core business. It depends on Games Workshop growing its legions of collectors and gamers, because these are, in the main, the people that will live out the stories in other media.

Although Games Workshop appears to be getting more out of its intellectual property, the most important statistics remain the growth in core revenue and the profitability derived from it.

Core revenue increased by 10% to £386.8 million in 2022. Five years ago in 2017, it was £158 million.

Going its own way

Perhaps the biggest risk is that painting fantasy and science fiction models, collecting them, and fighting battles with them is a fad.

The company’s remarkable change of gear in the middle of the last decade and the response of the share price should rightly get investors’ spidy senses tingling.

But it is not a fad. The first edition of Warhammer was released in 1983, and Games Workshop has shown us what a fad looks like, when in the Noughties it licensed the right to make a Lord of the Rings game.

Because of the immense popularity of the films released around that time, sales took off and the company invested as though its new recruits were permanent. Much of the interest died off, when the films ended their run in cinemas, leaving Games Workshop with less revenue and a higher cost base from which it took years to recover.

The company still makes and sells Lord of the Rings miniatures, but they merit only one mention in passing in the annual report even though a prequel series, by some estimates the most expensive TV production ever, is currently being streamed by Amazon’s Prime Video.

Games Workshop’s popularity in recent times has been all about Warhammer, or to be precise two variants of it, Warhammer 40,000, a futuristic version of the original Warhammer fantasy game, and Warhammer Age of Sigmar, a rebooted version of Warhammer fantasy, that based many of its newer elements on the more popular Warhammer 40,000.

- 10 FTSE 100 momentum stocks for uncertain times

- Do British prime ministers influence economic growth?

The company singles out “Media” as one of three risks that could damage the business, although since it does not harbour much of an ambition to promote third party intellectual property any more, it is concerned with how faithfully its own characters and stories are represented in video games, TV and film.

The other risks Games Workshop worries about most are IT, which may already inflicted minor damage on the business, and social responsibility.

In January, the company paused the roll out of a new Enterprise Resource Planning (ERP) system, a reminder perhaps of how complicated Games Workshop’s business is.

The company, which has predominantly male customers and employees, says it is looking for ways to address climate change and diversity and equality without “greenwashing” or being “politically correct”.

The fine line it is treading may be informed by Games Workshop’s characteristic determination to do things its own way, as well as criticism from fans of other fantasy universes like Marvel, as they have invented more diverse characters and stories.

There has also been a backlash against the diverse characters in reviews of Amazon’s Lord of the Rings prequel, although that has not stopped it attracting enormous audiences.

Relentless strategy

Games Workshop calls its strategy “More Warhammer. More Often”, which is appropriate because the company is seeking to exploit every aspect of its intellectual property.

Its previous strategy was less expansive, relying on the invention of ever more complex and expensive miniatures, often for nostalgic middle-aged ex-gamers with the money to spend hundreds of pounds on each model.

The company has introduced simpler game rules, low-cost starter kits, and engaged with customers more warmly online, through warhammer-community.com, an online repository of news, articles, comics, tv, and video tutorials.

A year ago, it launched a subscription service, providing exclusive content and miniatures, which it says is still at an early stage.

As Games Workshop has developed more stories and characters, and they have grown in popularity, the licensing opportunity has also grown, particularly in partnership with video game developers.

- Shares for the future: my best long-term investment ideas

- Richard Beddard: a share to own through thick and thin

In total, licensees have 12 video games under development and much of the increase in licence income recognised in 2022 was minimum income guarantees on multi-year contracts signed during the year, which bodes well for the future.

Although the annual report does not mention Eisenhorn, a TV series the company is writing, Games Workshop confirmed it was in talks with distribution partners in January.

There is no other wargaming business that approaches Games Workshop in scale, so as the company has become an industry, it has had to build most of the capabilities itself.

The result is vertical integration. Games Workshop controls almost every aspect of design, manufacturing, marketing, distribution and sales, which probably makes it a complex business to run, but also a very difficult business to replicate.

As befits a unique business, it has no intention of acquiring any other businesses.

By fanatics, for fanatics

It is unusual to read a boss apologising in the annual report, but Games Workshop is an unusual company.

In this year’s report chief executive Kevin Rountree apologised for reduced service levels to the company’s Australian and Asian subsidiaries due to shipping challenges, and because it “didn’t do a great job managing expectations”.

He also blamed his poor forecasting, in part, for the associated write-down in stock values.

Sometimes I wonder if his phrasing betrays a messiah complex. He seems to take responsibility for everything. Better that though, than blame somebody or something else whenever something goes wrong.

More likely, it reveals the company’s belief that its prosperity is in its own hands, and it is reassuring to see Games Workshop’s list of strategic priorities for the current year starting with training and development.

Shareholders do well out of the company’s policy to distribute truly surplus cash as special dividends and the company does not hide how much it pays directors within complicated Long Term Incentive Plans (LTIPs).

Both executive directors have been employees since the 1990s, and lower down its flat corporate structure Games Workshop employs fans and rewards them amply when it does particularly well.

Its self-described purpose is to: “...make the best fantasy miniatures in the world, to engage and inspire our customers, and to sell our products globally at a profit. We intend to do this forever.”

Rountree says the ultimate test of its forever ambition is a high return on capital, making it the kind of business I would like to be invested in forever.

Scoring Games Workshop

My enthusiasm for the business is unchanged since last year. It is unique and it has captured the imaginations of large numbers of collectors, modellers and gamers in the US, the UK, Australia and New Zealand, and growing numbers elsewhere.

Does the business make good money? [2]

+ High return on capital

+ High profit margin

+ Strong cash conversion

What could stop it growing profitably? [2]

+ Extremely strong finances and resilient business model

+ Competitors are orders of magnitude smaller

+ Unlikely to stray from self-sustaining strategy (see below)

How does its strategy address the risks? [2]

+ Vertical integration

+ Broadening and deepening IP

+ International growth

Will we all benefit? [2]

+ Very experienced management

+ Employs hobbyists, and rewards them

+ Self reliant culture

Is the share price low relative to profit? [0]

+ It is reasonable. A share price of £72.35 values the enterprise at about £2.4 billion, about 21 times normalised profit.

A score of 8 out of 9 indicates Games Workshop is a good long-term investment.

It is ranked 7 out of 40 stocks in my Decision Engine.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in Games Workshop.

For more information about Richard’s scoring and ranking system (the Decision Engine) and the Share Sleuth portfolio powered by this research, please read the FAQ.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.