Richard Beddard: what’s a $19bn company doing in my portfolio?

24th June 2022 15:49

by Richard Beddard from interactive investor

The numbers match the story that goes with this business, one which Richard has experience of as a customer. Here’s the explanation for its inclusion in the Decision Engine.

If you thought last week’s write up of newly listed Marks Electrical (LSE:MRK) was a step outside my comfort zone, this week I have taken a giant leap out of it by cajoling the data on New York Stock Exchange (NYSE) listed Garmin (NYSE:GRMN) out of its annual reports and into my Decision Engine spreadsheet.

It is the first overseas stock I have put through the scoring process, and the business also dwarfs the others.

My experience as a customer is my way into the investment. My Garmin leaves my wrist once a week, for less than an hour, while it charges.

- Want to buy and sell international shares? It’s easy to do. Here’s how

- Top 10 things you need to know about investing in the US

More than a sports watch company

Garmin is known to me for its GPS enabled sports watches, but it makes devices for fitness, adventure, boats, planes and cars.

A selection of products recently featured in Garmin press releases that you may not associate with the company includes bow sights for archers, smart pedals, golf watches that pair with club sensors, bike computers, dive computers, satellite communications devices, autopilots, flight decks, chartplotters (pictured below), and dog tracking devices.

Source: Garmin: “The ECHOMAP UHD2 series offers our best-in-class sonar, industry-leading mapping and fish-finding features that allow anglers to fish like a local.”

A true stalwart

Despite declining sales in the Auto and Aviation divisions during 2020, and only partial recovery in 2021, Garmin’s numbers were largely untroubled during the pandemic because of booming wearable sales, particularly to cyclists.

This year, demand is normalising across the company’s divisions, and Garmin anticipates 10% revenue growth. It may find it more difficult to grow profit due to high freight costs, rising pay and the strong dollar, which resulted in a decline in operating profit in the first quarter of 2022 relative to the previous year.

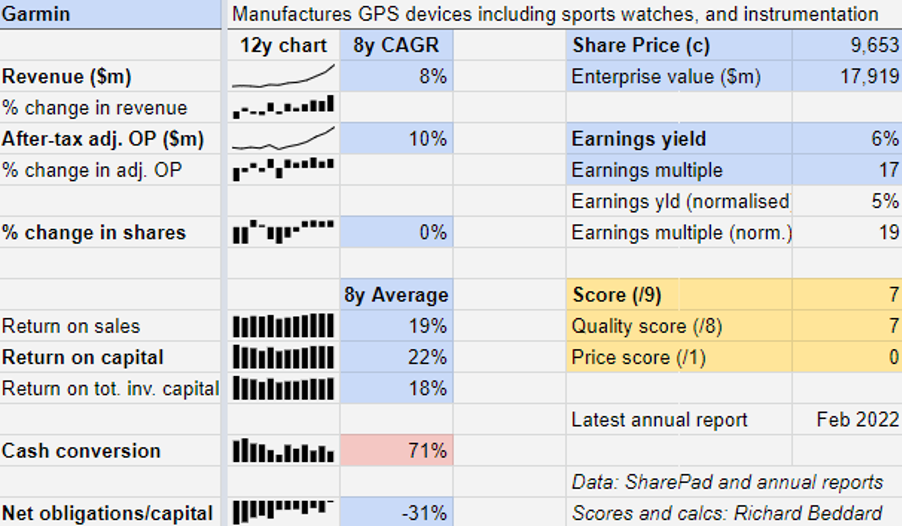

Garmin has closed every year in the last 12 with a net cash position. Return on capital routinely hits 20%, and although average cash flow after capital expenditure does not quite meet my arbitrary threshold of 75% of adjusted profit, it is not far off.

In 2021, the company used up cash near the year end building up stock for product launches. More generally, heavy investment in product development and the fact that the company chooses to own most of its property, probably explains why average cash conversion is less than 100%.

Meanwhile, it has invested its cash well, growing profit at a compound annual growth rate of 10% over the last eight years. Before that it suffered a period of contraction, although the circumstances were unusual.

The contraction was precipitated in 2007/8 by the smartphone revolution which coupled Google Maps with GPS to provide a free alternative to the sat nav, a market that Garmin had pioneered.

- Can this US tech stock come up smiling?

- Richard Beddard: an exciting new company for my Decision Engine

Flies in the ointment

Perhaps echoing the past, the big obvious risk today comes from the same quarter. It is Apple (NASDAQ:AAPL), which owns a smart watch business that is bigger than all of Garmin, and Google’s Fitbit.

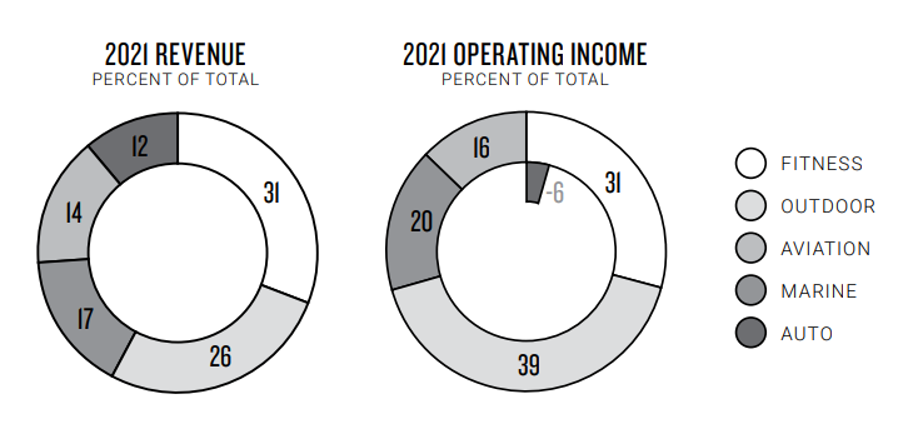

Garmin’s auto division is losing money. The company still supplies sat navs profitably to consumers, but it is a challenging market, and its business supplying manufacturers of auto infotainment systems is loss-making and sub-scale.

With geopolitical rivalries growing, one thing we might lose some sleep about in future is the location of Garmin’s principal manufacturing facility in Taiwan, where it manufactures the highest volume products.

This is mitigated to an extent by other manufacturing facilities in the Netherlands, Poland and the US, but not by its facility in China.

Investing in the future

Garmin survived the gutting of the market for satnavs because it made so many other products, most of them with location-based technologies like GPS at their core.

Today, it organises itself into five divisions, and although Fitness is the biggest by revenue, accounting for 31% of the total, Outdoor is the most profitable, bringing in 39% of operating income.

Source: Garmin Annual Report

Watches also feature in Outdoor, the second biggest segment, along with location tracking devices, but they stand out from more generic smartwatches because of high-end features like ruggedisation, satellite communication, all-terrain navigation, and solar charging.

Garmin’s diversification is a source of comfort. The annual report lists up to a dozen major competitors in each division and the notable thing is no company appears in more than one list.

Just to illustrate the diversity, it competes with Apple (Fitness), Tag Hauer (Outdoors), Thales (Aviation), Raymarine (Marine), and Panasonic (Auto).

Even in the high-profile fitness watch market, Garmin may be able to hold its own because it comes at the market from a different angle to Apple, which makes a single watch with mass appeal.

Garmin is focused on producing specialised watches, and ranges of watches, and I think this should result in better products for these specific purposes.

- Discover more articles by Richard Beddard here

- Why I’m seriously tempted to buy this tech stock at this price

- The investments that will keep growing – even during a recession

At the moment, though, the problem division is auto. The company has doubts about the future of the consumer market, which is currently profitable but in decline, and auto infotainment equipment manufacturers of which it has not yet secured enough customers to justify the investment it has made.

Not surprisingly, the auto business is the smallest, contributing 12% of total revenue. Perhaps more surprisingly the company continues to invest so that it can reach critical mass.

This may be an indication of Garmin’s willingness to take short-term pain for long-term gain, or perhaps it does not know when to give up.

Investment, though, is another cornerstone of Garmin’s strategy. In the last three years it has spent between 16% and 17% of total revenue on research and development (R&D).

This, it says, combined with vertically integrated operations that enable collaboration between the company’s engineers in the USA and its manufacturing facilities in Taiwan and elsewhere, allows Garmin to design and bring to market superior products more quickly and cheaply than competitors.

A puny Garmin is a good watch

I am biased. I wear one of the puniest Garmins, a Forerunner 55, and am impressed by how much value is bundled in it and the accompanying app.

All the sports obsessed members of my family and many friends have Garmins, and it drives the shrinking minority with other passions to rebellion when we prattle on comparing stats like VO2 max, and predicted times over various race distances.

Garmin’s mission is to be an enduring company by creating superior products. Our experience validates the second half of that statement, and the company’s history validates the first half.

Founded in 1989, Garmin has developed GPS enabled devices almost since the technology was first declassified and made available for free by the US government.

The company was founded by two men. Gary Burrell, the “Gar” in Garmin and Dr Min Kao, the “Min”. Mr Burrell has died, although his son has a substantial shareholding and a seat on the board.

Mr Kao is the executive chairman, and also a substantial shareholder.

Chief executive Clifton Pemble has worked at Garmin since 1989, when he joined as a software developer.

There is tremendous experience in that boardroom, and, I suspect, their constancy has enabled a strong culture to develop.

The first element of Garmin’s strategy is to hire the best people, reward them handsomely, provide them with career opportunities and an environment that encourages long-term contributions.

Scoring Garmin

I like Garmin. The numbers match the story.

Does the business make good money? [2]

+ High return on capital

+ High profit margins

+ Decent cash conversion

What could stop it growing profitably? [1]

+ Financially strong and limited recession risk

+ Threat of Apple and Google perhaps overstated

− Location of manufacturing in Taiwan

How does its strategy address the risks? [2]

+ Heavy investment product development

+ Niche products target diverse markets

? Relocating manufacturing would probably be painful

Will we all benefit? [2]

+ Very experienced management

+ Employee friendly

? Swiss domicile (see below)

Is the share price low relative to profit? [0]

+ It is fair. A share price of $96.53 values the enterprise at about $18 billion, 19 times normalised profit.

The score comes with caveats. This is my first time scoring Garmin, it is big, and it is overseas, and as well as the unfamiliarity those things bring, there is another wrinkle.

Garmin is listed and primarily operates in the US, but headquartered in Switzerland, which may complicate the payment of dividends.

Garmin pays the dividend to overseas investors from reserves, which enables it to avoid withholding tax levied on dividends paid to overseas investors.

At the current rate of depletion, we should enjoy withholding tax-free dividends for many years, but Garmin offers no guarantee.

If the situation changes, it may be possible but tiresome to reclaim some or all of the tax from the Swiss authorities.

Despite these caveats, I think a score of 7 out of 9 indicates Garmin is a good long-term investment.

It is ranked 11 out of 40 shares in my Decision Engine.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in Garmin.

For more information about Richard’s scoring and ranking system (the Decision Engine) and the Share Sleuth portfolio powered by this research, please read the FAQ.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.