Richard Beddard: what I’ve learned about this education stock

Our columnist studies RM Resources – which looks like a good long-term investment.

19th March 2021 15:14

by Richard Beddard from interactive investor

Our columnist studies RM Resources – which looks like a good long-term investment.

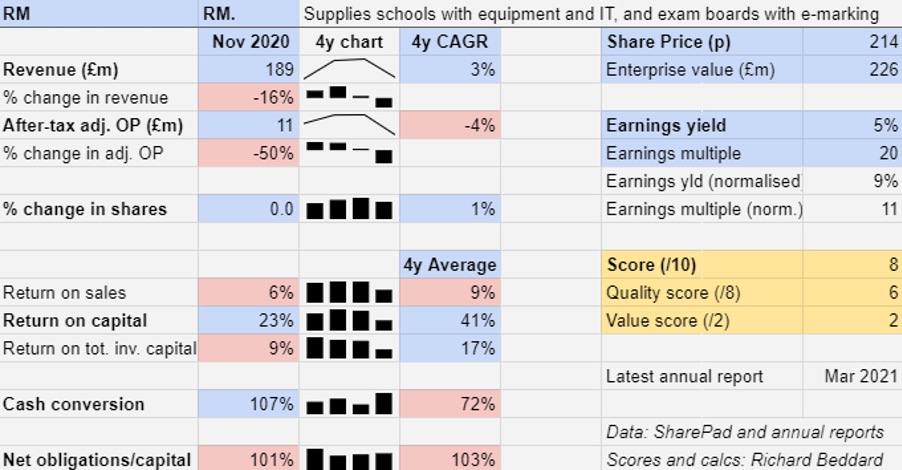

The pandemic has arrested RM Resources (LSE:RM.)’ nascent recovery. The company endured a 16% reduction in revenue and a 50% drop in profit in the year to November 2020.

But the figures for the group mask a divergence in the performance of its individual businesses.

Selling ‘stuff’

RM Resources was once again the villain. This business sells stuff to schools, everything from glue and paints to robots, through two brands: TTS and Consortium (acquired in 2017). Since kids were not at school for much of the year, so-called curriculum resources were not a spending priority.

TTS is a decent business, with its own brands, and at the time of the acquisition Consortium was less profitable. Since they combined, the division’s margins have declined in successive years, a trend that strengthened during the pandemic.

RM says TTS outperformed competitors during 2020, but the Consortium brand underperformed. Overall, divisional revenue fell 19% and adjusted operating profit fell 77%.

It remains a mystery why RM invested so much to turn RM Resources into its lowest-margin division but it completes the rationalisation of five distribution centres into one new and purpose-built facility later this year.

Perhaps the efficiencies delivered by that project will be a turning point.

Examinations

RM Results, the smallest, most profitable, and only division that has grown revenue and profit in recent years, supplies online marking systems to exam boards. In 2019, it acquired online testing software to provide a complete online assessment system, which the company believes will be the next big leap.

- Richard Beddard: two intriguing shares ripe for the Decision Engine

- Richard Beddard: a share to keep tabs on

Covid-19 has interrupted the division's growth though. Revenue fell 16% in the year as exams were cancelled, RM lost out on the volume element of fees under existing contracts and it agreed fewer new contracts. Profit fell 24%.

IT services and software

RM Education has spent most of the last decade in recovery mode as it completed often onerous long-term contracts to supply IT to schools. In 2020 it completed the last of these contracts, the main reason for a 9% fall in revenue and an 11% drop in profit.

Schools remained operational during the pandemic, albeit sometimes remotely, and RM continued to manage its IT and supply its cloud-based software systems.

The division earns considerably less revenue than it used to, but it is more profitable. Perhaps shareholders can look forward to revenue growth now too.

Helped by the suspension of the dividend and the sale of one of RM Resources’ distribution centres, RM reduced net borrowings in 2020. Yet its net obligations as a proportion of capital employed were higher than average. A big movement in the defined benefit pension deficit did the damage.

Regular annual payments of more than £4 million into the company’s pension funds to plug the deficit are a drain on cash flow most years, but RM conserved cash in 2020 and despite the pension payment and the repayment of furlough money, it achieved a cash conversion ratio of more than 100%.

Cash flow may come under pressure over the next year or two as the company moves into its new distribution hub and implements a new IT system, but the effect on RM’s balance sheet will be offset by the sale of two distribution centres, soon to be surplus to requirements.

Any recovery in the current financial year will be muted. The first four months are almost over, and schools have only just opened. This summer’s exams are cancelled. Once again, circumstances are testing investors’ patience.

Scoring RM

Despite RM’s chequered past, and afflicted present, there may be hidden value in the business. It has long experience as a supplier to UK education, and it is creating value through the development of its own products, software, and services. Many of these address the future.

That said - it is a distributor, software developer and consultancy, it sells stuff, software and hardware in the UK and abroad. Its customers include nurseries, schools, trusts and examination boards. Much of the coding and administrative work is done in India.

It is not obvious that these businesses fit well together, so management has its hands full and investors have to work hard to establish where the potential lies. My money is on RM Results, but the other two divisions have been under a cloud and may yet flourish.

Chief executive David Brooks leaves at the end of March. He joined the company as a graduate trainee and worked his way up. The appointment of Neil Martin, chief financial officer, as his successor shows RM still creates opportunities for its own.

I am keeping a wary eye on executive pay, though. Basic pay of £400,000 for the chief executive is substantial, but only the beginning. He can earn up to £1.4 million once performance-related bonuses and share options are included.

This variable element of pay is excluded from comparisons with the median pay for all UK employees, which was £33,000 in 2020.

Does the business make good money? [1]

+ High return on capital

? Profit margins dampened by RM Resources

? Cashflow reduced by pension deficit repayments

What could stop it growing profitably? [1]

− Pension funds, leases, and borrowing must all be serviced

? Complex blend of business models

? Buyers (schools and nurseries) are aggregating

How does its strategy address the risks? [2]

+ Efficiency: consolidation of distribution centres

+ Developing own intellectual property: software / branded products

+ International growth

Will we all benefit? [1]

+ Highly rated by employees on recruitment sites

? Managers do not own significant holdings

? High executive pay

Is the share price low relative to profit? [2]

? The enterprise is valued at 20 times adjusted profit, but profit is temporarily depressed by the pandemic

A total score of seven out of 10 means RM probably is a good long-term investment.

Renishaw: what he said...

Responding to my dismay at the prospect of Renishaw (LSE:RSW) vanishing from the stock market when the founders and majority shareholders find a buyer, a reader, Colin, emailed to point out an irony.

Their majority holding, which for so long had protected the company from a takeover, is the reason the company will lose its independence. Colin is concerned that not only that he will miss out on Renishaw’s prosperous future but that another innovative British technology company might succumb to foreign ownership.

He has petitioned the company and its advisers to think laterally in pursuit of their goal of honouring Renishaw’s tradition. His suggestion is that it merges with another British technology company, say Spectris (LSE:SXS), Oxford Instruments (LSE:OXIG), or Halma (LSE:HLMA), thereby creating a new British champion and preserving the dream of the continued involvement of loyal shareholders like him (and me).

He suggests the outgoing founders might find it easier to sell their shares in the market if they owned a smaller part of a larger business, or the bigger business might buy them out.

Ever the romantic, I find myself drafting an email to the company saying, basically, what he said.

Richard owns shares in RM.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.