Richard Beddard: we can’t do without this small-cap money machine

20th May 2022 14:51

by Richard Beddard from interactive investor

These shares aren’t necessarily cheap, but our columnist believes the business is a compelling investment.

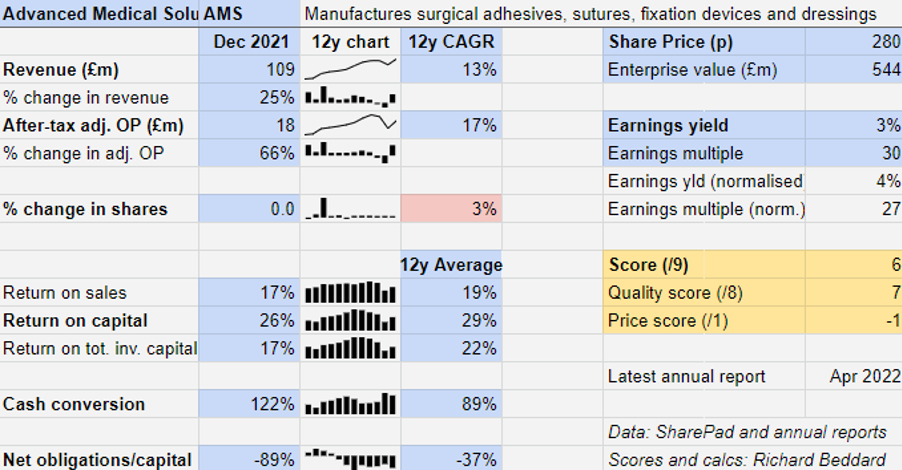

Advanced Medical Solutions (LSE:AMS) has been buffeted by competitive pressures and the pandemic in recent years, but the investment case is intact.

Holding us together

The company makes tissue adhesives, internal fixation devices, and sutures that hold us together after surgery. It also makes dressings that help wounds heal.

Its biggest brand is LiquiBand, a skin adhesive that contributed sales of £33 million, 30% of total revenue, in the year to January 2021.

For many patients, adhesives are a kinder solution than sutures. They protect the wounds, sometimes removing the need for a dressing. And they do not need to be removed.

Dressings mop up excess fluid and control infection by incorporating antimicrobials. AMS’s own brand is ActivHeal but mostly it manufactures for other brands.

Money machine

Even in the year to December 2020, the first year of the Covid 19 pandemic when profit halved due to a dramatic reduction in routine surgery, Advanced Medical Solutions earned a decent 16% return on capital.

Past performance is not a guide to future performance.

In the year to December 2021, revenue surpassed pre-pandemic levels, although without the £6 million contribution from acquisitions it would have been flat.

Although profit recovered, it still fell 18% short of profit in 2019 and 24% short of peak profit in 2018.

The company reports only a partial recovery in non-essential surgery like hernias and wound treatment, which means its manufacturing facilities are operating more efficiently than they were in 2020, but less efficiently than they were before.

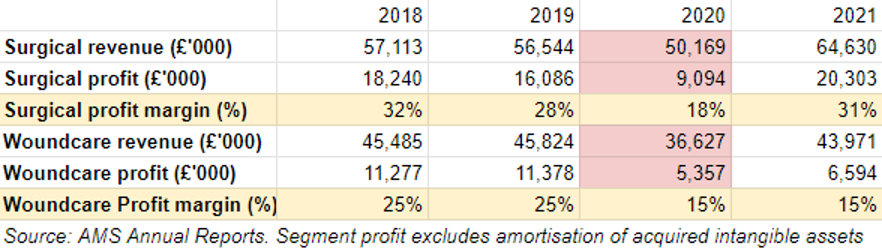

In terms of the numbers, more than half of the business, the Surgical division that makes tissue adhesives and sutures, has recovered.

Woundcare, which makes dressings, still has some ground to make up, with revenue down a little compared to pre-Covid levels in 2018 and 2019, and still depressed profit margins.

Past performance is not a guide to future performance.

Apart from the diminished but lingering impact of Covid-19 on wound treatment volumes, the only drag on the division’s results reported by AMS was the renegotiation of an exclusive manufacturing contract that temporarily halted orders for a novel silver alginate antimicrobial dressing.

Sales have resumed at a lower level, and on a non-exclusive basis. This allows AMS to market the antimocrobial dressing to other customers, although the company has not quantified the opportunity.

Competitive threats

Perhaps the biggest risk AMS faces in this lucrative market is competition.

The company has big rivals including Johnson & Johnson (NYSE:JNJ), Smith & Nephew (LSE:SN.), and 3M (NYSE:MMM), as well as low-cost competitors who undercut the big brands on price.

Customers – hospitals - also band together into buying groups to reduce the cost of supplies.

The end of a long run of profit growth came in 2019, not 2020, the result of competitive pressure.

AMS lost ground to competitors in the US, when buying groups opted for cheaper products than LiquiBand.

The company said new product launches would raise revenue again and tighter regulations would stymie some of its low-cost competition. It seems likely that has happened.

During the year, AMS launched quick-drying LiquidBand Rapid. That contributed to a 45% increase in LiquiBand sales, which are just above the levels achieved in 2018 and 2019.

- Richard Beddard: it’s worth paying up for this small-cap share

- Richard Beddard: a high scoring small-cap I really like

Although it was originally slated for the end of 2021, AMS expects to launch LiquiBandXL in the US, its largest market, during the second half of 2022. LiquiBand Fix8 should follow in 2023.

LiquiBand XL marks AMS’s entry into the large wound closure market and LiquiBand Fix8 is an adhesive that fixes hernia mesh through a minimally invasive device. AMS says it is less painful than staples or tacks and reduces recovery time.

Not only is LiquiBand very profitable, it has a 20% share by volume in the US, demonstrating the company's products can thrive in a competitive market.

Development led

AMS says a decline in sales from products launched in the last five years to 13% is related to Covid 19, but this metric has been in decline since 2018, when new products accounted for 25% of revenue.

The decline may also have been caused by a period of underinvestment. In 2017, AMS spent just over 4% of revenue on research and development. Since then it has more than doubled its efforts.

In 2020 and 2021, R&D was about 9% of revenue and the company has increased its target from two to three product launches a year. These products, it says should satisfy an unmet need.

The company is also striving to meet increasingly stringent regulations, which, once secured, are a barrier to lower cost competition.

It must secure Medical Device Regulation certificates necessary to maintain access to EU markets after 2024, when a new regulatory regime comes into force.

As well as the opportunities to grow LiquiBand, AMS has continued the development of Seal-G a novel internal sealant that minimises gastrointestinal leaks after bowel surgery. All being well, Seal-G should be approved later this year, and subsequently rolled out in Europe.

AMS secures product approvals around the world. Having achieved approval for LiquiBand in India in 2020, sales commenced through a partner in 2021.

Augmented by acquisitions

In recent years the company has also acquired products and capabilities.

In 2019 it bought Sealantis, the original developer of Seal-G.

Late the same year it acquired Biomatlante and a patented portfolio of surgical products including synthetic bone substitutes, collagen membranes and bioabsorbable screws.

Raleigh Coatings, acquired in 2020, was a supplier. It applies silicone coatings and perforations to dressings.

AMS hopes bringing the capability in-house will reduce manufacturing costs and enable it to develop better products, supporting two strategic pillars: operational excellence and innovation.

The company's most recent acquisition has yet to complete. It is AFS, an Austrian distributor of surgical devices.

This will extend AMS' direct sales footprint beyond its biggest markets, which is another strategic goal.

So far, the acquisitions have been modest, supporting innovation and acquiring new products to commercialise so they may well add value as intended.

AMS continues to earn a high Return on Total Invested Capital, including the value of acquisitions at cost.

Care, Fair, Dare

The company's catchy cultural slogan, Care, Fair, Dare, sounds better than it reads.

Culture is another strategic pillar, and the company demonstrates its seriousness by publishing employee retention and engagement scores.

Employee retention of 90% in 2021 was the same as it was in 2018. Employee engagement is 76%.

The stewards of this culture can claim some credit for the company's success.

Chris Meredith joined in 2005 and became chief executive in 2011. Chief financial officer since 2019, Eddie Johnson, joined in 2011.

Score

Despite competitive and pandemic induced pressures, AMS is quite a compelling investment.

It is a vertically integrated product developer, manufacturer, and direct seller (in some of its markets), so its fortune is largely in its own hands.

And it makes products we cannot do without, profitably.

As is so often the case, there is a sting in the tail. That sting is the share price, which, coupled with the loss of the contract to manufacture silver alginate dressings, tempers my enthusiasm.

Does the business make good money? [2]

+ High return on capital

+ High profit margin

+ Strong cash conversion

What could stop it growing profitably? [1]

+ Awash with cash

? Failure to renew manufacturing contracts

? Big competitors

How does its strategy address the risks? [2]

+ Innovation: three new product launches a year

+ Vertical integration, and operational improvement

? Diversification

Will we all benefit? [2]

+ Improves patient outcomes

+ Experienced board

+ Culture: Care, Fair, Dare is a strategic pillar

Is the share price low relative to profit? [-1]

+ No. A share price of 274p values the enterprise at about £530 million, about 26 times normalised profit.

A score of 6 out of 9 indicates AMS is probably a good long-term investment.

It is ranked 27 out of 40 stocks in my Decision Engine.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

For more information about Richard’s scoring and ranking system (the Decision Engine) and the Share Sleuth portfolio powered by this research, please read the FAQ.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.