Richard Beddard: this UK innovator’s strategy has to prove itself

11th February 2022 15:23

by Richard Beddard from interactive investor

Although this specialist manufacturer leads the market, it seems to be struggling to expand its product’s reach into pastures new. How serious is that, asks our columnist.

Victrex (LSE:VCT)’s longstanding strategy to develop new products has not yet delivered a substantial proportion of revenue. It is trying to do a difficult job, and the pandemic has delayed progress. Maybe that is all there is to it.

Mega material

Victrex makes a polymer, PEEK, that is stronger, lighter, more hardwearing and less wasteful to manufacture components from than metal. It is often used in equipment we take for granted, sometimes as a carbon fibre composite.

Planes, for example, use less fuel if, as many of the big ones do, they incorporate lightweight PEEK brackets, fasteners and hydraulic tubing. This saves airlines money and reduces the amount of carbon dioxide they emit into the atmosphere. Some cars have PEEK gears, which are not only lighter but quieter than metal ones. PEEK is used in smartphone speakers, and the impellers in Dyson Cyclone vacuum cleaners are made from it.

The material has found a place in our bodies too, with lightweight chemically resistant PEEK cages used to fuse damaged spines. Unlike its main competitor for human implants, titanium, PEEK is of a similar stiffness to bone, which reduces stress on the spine.

Victrex does not just make a useful material, though, it invented PEEK in the 1970s and manufactures more of it than the rest of the industry combined. Its long experience and many patents demonstrate industry dominance and an unrivalled depth of expertise.

It knows how to hold on to this experience too. Voluntary staff turnover increased to 7% from 5% in the year to September 2021, probably due to voluntary redundancies during the pandemic, but generally the company is successful in retaining staff.

Employees are well paid. The median pay of the company’s predominantly scientific and technical UK workforce was £54,000 (including bonuses), just under a 30th of the chief executive’s total remuneration in 2021. Nearly all staff are enrolled in share schemes and bonus plans.

Mixed results

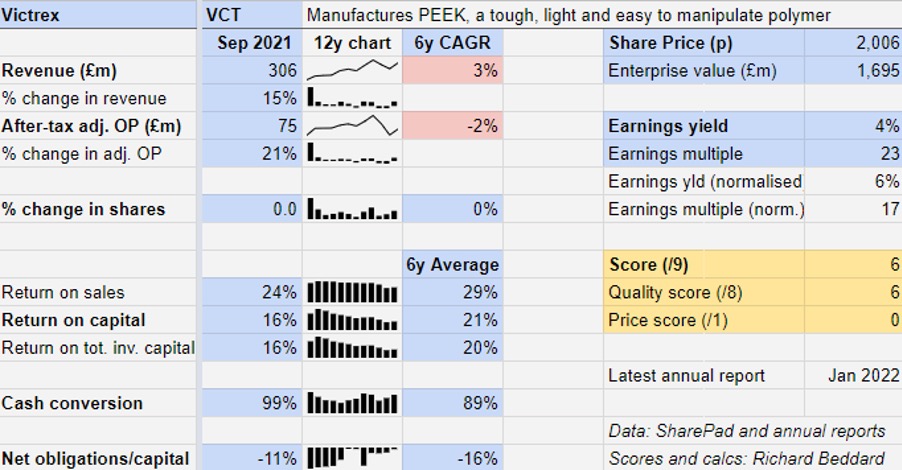

Victrex is reaping less of a reward than it used to from its expertise, however. Costs have risen further than revenue, which itself has only grown at a compound annual growth rate (CAGR) of 3% a year over the last six years. Profit has fallen.

While a 16% return on capital and extremely strong balance sheet show Victrex is still a very healthy business, throughout the first half of the 2010s Victrex was twice as profitable.

Past performance is not a guide to future performance.

Against that, there are many reasons to view the last two years as an aberration.

The pandemic disrupted most of Victrex’s industrial and medical markets, although with the exception of aerospace they are recovering now. Along with aerospace, medical revenue was most affected due to the cancellation of operations, which had a disproportionate impact on profit as the company earns high profit margins from implant products.

Mini programmes

So these have been a tough couple of years, during which Victrex has continued investing, customers have bought less PEEK, and trials for new products have been delayed.

But Victrex’s profitability had weakened somewhat even before the pandemic, which puts its strategy of developing new applications, parts that use PEEK, in the spotlight.

- 10 stocks that could protect investors from inflation

- Our outlook for 2022: key topics and investment ideas for the year ahead

Seven “mega-programmes”, each promising £50 million of annual revenue at their height, are making slow progress. Commercialising new applications is difficult work. The company is trying to usurp tried-and-tested metals, and although switching to a PEEK component improves performance and reliability, trying something new is also risky.

In engineering and medical applications Victrex has to prove change is worth the risk to component manufacturers, their customers and the regulators. To accelerate adoption of PEEK it has invested, forming joint ventures with manufacturers and occasionally acquiring them.

As long ago as 2014, Victrex believed its then five mega-programmes would reach meaningful revenue of £1 million to £2 million two to five years later. By 2021, seven years later, only three of an enlarged group of seven mega-programmes have reached this milestone, which is itself insignificant in comparison to Victrex’s total revenue of over £300 million. None have surpassed it by much.

Revenue from all new products since 2014 is stuck at 4% of total revenue, where it has been for four of the last five years.

The three mega-programmes that have made it to first base are Magma m-pipe, a corrosion-resistant pipe used in oil exploration; loaded brackets for planes; and automotive gears that reduce vibration as well as weight.

Victrex has made such slow progress convincing the fragmented dental market to adopt PEEK bridges and dentures that it has downgraded its dental programme from mega status.

The company does not say when it expects £50 million revenue from the mega programmes, probably because it does not want to make itself a hostage to fortune.

Scoring Victrex

Perhaps all that is required for Victrex to be a good investment is patience from shareholders, giving markets time to recover from the pandemic and the company’s investments in research & development and capacity to bear fruit. But Victrex’s determination to kick-start new applications is, in part, a response to greater competition in established ones such as smartphones.

While more diversified competitors have less expertise and less capacity, they may be cutting away at Victrex’s hems more quickly than the company is commercialising new grades of PEEK that it can protect with new patents and commercial agreements.

Competition may also come from materials with similar properties, although Victrex sees the possibility for collaboration or investment as an opportunity rather than a threat.

While I waver about a strategy that has yet to prove itself, it is unsettling that the company’s longstanding chairman is retiring and its finance director is leaving to join another listed materials company, Morgan Advanced Materials.

These departures are occurring only four years after the company’s co-founder and chief executive retired and the previous finance director left the business. I wonder whether some of the leavers are motivated, in part, by the fact that growing Victrex appears to be very hard work.

Despite these risks, I think the market remains Victrex’s to lose, and to do that it must keep pushing the boundaries of what is technically and commercially possible, something that as the industry leader it is in a strong position to do.

Does the business make good money? [2]

+ High return on capital

+ High profit margin

+ Strong cash flow

What could stop it growing profitably? [1]

+ Very strong finances

? Creeping competition

? Dependency on part manufacturers to develop new applications

How does its strategy address the risks? [2]

+ Continuing development of PEEK and composites

+ Builds capacity ahead of demand

+ Investment in manufacturing

Will we all benefit? [1]

+ Retains employees

? Board changes

? Typically high levels of executive remuneration

Is the share price low relative to profit? [0]

? A share price of £19.61 values the enterprise at 17 times normalised profit.

The company scores 6 out of 9, suggesting it should be a good long-term investment, but it has gone down somewhat in my estimation.

Victrex ranks 17 out of 40 shares in my Decision Engine.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in Victrex.

For more information about Richard’s scoring and ranking system (the Decision Engine) and the Share Sleuth portfolio powered by this research, please read the FAQ.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.