Richard Beddard: two intriguing shares ripe for the Decision Engine

Our columnist pores over two providers to the medical industry.

12th March 2021 15:29

by Richard Beddard from interactive investor

Our columnist pores over two providers to the medical industry.

Having worked myself through a backlog of recently published annual reports, I am in the rare position of not having any companies to score this week.

The Decision Engine, the list of scored and ranked shares I use to help me run the Share Sleuth portfolio, is up to date. None of the Decision Engine candidates I am getting to know better have published reports lately.

Here then is a preview of two medical shares that may join the Decision Engine in the not too distant future.

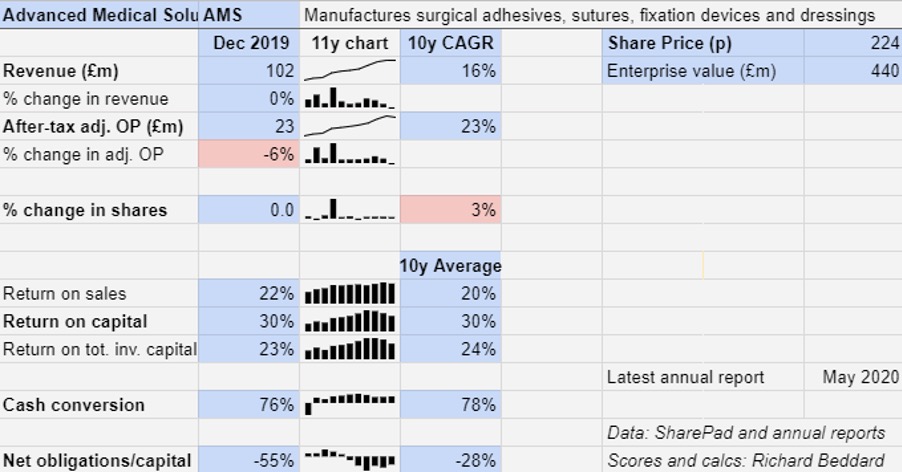

Advanced Medical Solutions

Advanced Medical Solutions (LSE:AMS) makes tissue adhesives, sutures, internal fixation devices and dressings used to help wounds and surgery heal.

Its biggest brand is LiquiBand®, a skin adhesive used in place of stitching. Skin adhesives are kinder to patients than sutures. They can be used internally, do not need to be removed, and protect wounds - sometimes meaning no need for dressings.

Cash rich, highly profitable for many years and a hitherto cautious acquirer of similar businesses, AMS could be a good long-term investment:

Until 2019, AMS’ growth record was unblemished. It may be blemished somewhat more when it reports results for 2020 next week.

I feel somewhat insecure about AMS’ competitive position though. Among its rivals are giant multinationals like Johnson & Johnson (NYSE:JNJ) and, closer to home, Smith & Nephew (LSE:SN.).

These companies, including AMS and others, may be an oligopoly protected by regulators in the US, UK and Europe, but the incumbents are reliant on increasingly stringent regulation to keep cheaper products at bay.

Customers and hospitals also group together to drive a harder bargain with suppliers of consumables like AMS.

- Richard Beddard: a share to keep tabs on

- Share Sleuth: why I am not giving up on this share

- Shares for the future: a dozen good businesses

AMS publishes its full-year results next week, and it should follow up with an annual report in May. The company expects revenue of £86.5 million for the year to December 2020, 15% below 2019, and analysts expect profit to fall nearly 50%.

Last year will be the second year of lower profit. Unlike 2019, when AMS lost ground to competitors in the US, the fall in revenue in 2020 was the result of Covid-19, which reduced the amount of routine procedures conducted by hospitals.

AMS says a US recovery is under way, led by new product launches. Evidence in the 2020 results that it has won back business may reassure me about the company’s competitive position.

Its wider prospects depend on successful vaccine roll-outs. The US and the UK are AMS’s biggest single country markets, responsible for 54% of revenue in 2019. Since they are rapidly rolling out vaccines, recovery in 2021 and 2022 seems plausible.

Bioventix

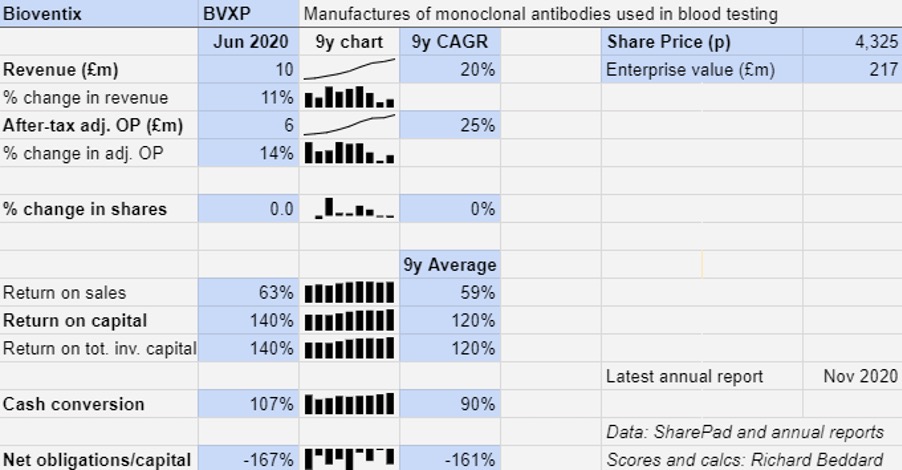

Bioventix (LSE:BVXP) is one of those ‘heads I win, tails I will not lose much’ shares. Its long-term growth prospects are uncertain, but it is very unlikely to contract for many years.

The company makes monoclonal antibodies used in blood testing machines. They react to irregularities in patients' blood, helping doctors to diagnose disease.

Bioventix sells antibodies by the gram, but it earns most of its revenue from royalties. Its customers are manufacturers of blood testing machines, a market dominated by large companies such as Siemens, Abbott, Roche and Beckman Coulter. These companies supply hospitals and other testing facilities.

It takes years of research and development to produce and test new antibodies, and even longer to get them approved by regulators. Sometimes the company does the research on its own, and sometimes it does it under contract for one of the machine makers. Its biggest money spinner by far is a test for vitamin D deficiency, although Bioventix has been saying for years that revenue growth from this antibody is flattening (vitamin D revenue grew 10% in the year to 2020).

Once antibodies are approved for use with a particular machine, they are very unlikely to be substituted for an alternative, giving Bioventix a reliable stream of royalty payments for many years. These payments depend on the number of tests, rather than the amount of antibodies used, which is important because blood testing machines are becoming more efficient.

While future profits are underwritten by past research, long-term growth depends on Bioventix’s considerable research and development spending producing widely adopted antibodies, which it does not always do. The Vitamin D antibody is exceptional, and its best prospect for growth is a test developed for Siemens for Troponin, a protein that indicates heart disease.

Troponin may take over from Vitamin D, as the company’s main source of growth but it is still in the early stages of commercialisation. The antibody earned Bioventix £330,000 in revenue in 2020 compared to £4.8 million for the Vitamin D antibody.

Beyond Troponin, growth in the period 2025-2035 largely depends on research Bioventix is doing now, which is risky because of the length of time it takes. Alternative tests can come to market, often developed by Bioventix’s own customers. These can invalidate or reduce the value of a project. In the year to June 2020, Bioventix removed three projects from a research pipeline costing about 11% of revenue a year because they are no longer demanded by customers.

While Bioventix is the leader in cloning antibodies in sheep, other technologies exist. The company admits that some customers are using rabbits effectively, and while it says synthetic antibody technology is less of a direct threat, it is improving.

The results of past research are more than impressive, though. The last three months of the 2020 financial year were during the pandemic, when routine testing in hospitals gave way to the emergency treatment of Covid-19 patients. Nevertheless, Bioventix grew revenue and profit over the year (albeit less than it has in the past).

Judging by profitability and its balance sheet, it is a stronger business than ever:

There is one more number that marks Bioventix out as exceptional. It only has 16 employees, 12 scientists and four administrative staff, not all of whom are full time. Its new executive finance director, Bruce Hiscock, is a part-timer.

That a manufacturer employing 12 (full-time equivalents), earned more than £10 million of revenue and more than £6 million profit by selling between 10 and 20 grams of a product in 2020 blows my mind. However, the fact that so much know-how is in the hands of so few people is also somewhat alarming.

We are in the dark about how Bioventix has performed so far in the year to June 2021. It only updates the market every half-year, and it should publish a report for the half-year to December 2020 later this month.

Like many investors, I will be looking at the growth rates of vitamin D and Troponin sales, and unless I see something very unexpected, I suspect I shall be adding Bioventix to the Decision Engine.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.