Richard Beddard: Two companies to prosper through the pandemic

Our companies analyst has found these ‘special’ businesses with qualities in short supply.

9th April 2020 16:03

by Richard Beddard from interactive investor

Our companies analyst has found these ‘special’ businesses with qualities in short supply.

From now on I’m going to try and bring you something old and something new (and special) every week in an attempt to increase the number of shares I score and rank.

The old thing will be the annual re-appraisal of a business I have scored before that we are following because it meets most of my criteria for long-term investment. The new thing will be something about a new share. It will describe what has attracted me to the business, the reason I have put it in the queue of companies to research and score.

Today, two companies that may prosper through the pandemic...

Anpario: Annual review

Anpario (LSE:ANP) manufactures natural animal feed additives that improve animal health and increase meat production.

The additives work in a number of ways: they include important nutrients, they bind with toxins to prevent animals from digesting them, and they turn the gut into a more hostile environment for pathogens.

Growth promotion is a role that has largely been played by cheaper antibiotics, a practice that is forbidden or is being discouraged with varying degrees of success worldwide because antibiotic growth promoters increase antibiotic resistance in pathogens with damaging consequences for animal and human health.

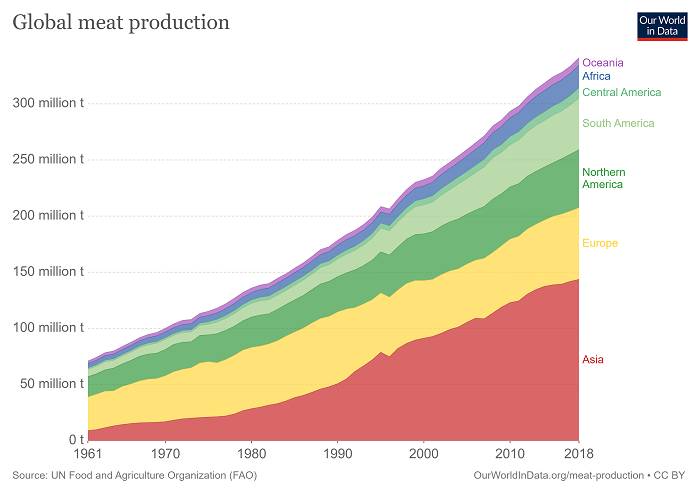

Anpario is a force for good in animal husbandry, an industry which has grown dramatically over the last 50 years because of population growth and an increase in the quantity of meat we eat per capita:

Given this benign backdrop it is somewhat surprising the company is not growing faster. Since 2013, and the last of three acquisitions that established the group in its current form, revenue has only increased 12%.

That may be because Anpario has discontinued low-margin activities like contract manufacturing for other suppliers and sold an organic animal feed business. In terms of profit growth (51% over the same period), things look a little better.

Agriculture is a capricious market though. Progress is intermittent because the farmers who buy agricultural supplies must contend with the fluctuating prices of the commodities they consume and produce, and disease as well as the usual economic turbulence.

Overall revenue increased 3% in the year to 2019, but Anpario reported depressed sales in China because of an outbreak of African Swine Fever that started in 2018. The disease, which is spreading across Asia, Anpario’s biggest regional market, has resulted in a cull of the hog herd and restrictions on transport.

Over the long-term, the epidemic may boost Anpario’s coffers as Chinese customers restock, because ASF is one of many diseases the company’s products help to control. In the USA sales were flat in 2019 because the trade dispute with China reduced agricultural exports, and the country’s largest dairy farmer went bankrupt.

Anpario, which manufacturers in Worksop, says it is trading normally through the Covid-19 pandemic, expects to manage any temporary disruptions (like the cancellation of trade shows and, potentially, disruptions to shipping), and hopes to benefit indirectly from Government financial support to farmers aimed at securing the food supply.

Does Anpario make good money?

Score [2]

- Yes. Anpario has averaged a 27% return on capital since 2013

- Cash conversion is fairly strong (71%, averaged over the same period).

What could stop it growing profitably?

Score [1]

- Most years, something holds profit growth back, but Anpario has suffered no big contractions in its relatively short history

- The competitive landscape is confusing. Farmers can give antibiotics to sick animals, providing a loophole that is widely exploited

- Anpario also has significant competitors like Alltech and Biomin

- Minimal financial obligations mean the risk from within is negligible

- Anpario may be a force for good in animal husbandry, but meat consumption is a factor in climate change, and over-consumption may be a factor in ill-health. Efforts to reduce it may intensify.

How does its strategy address the risks?

Score [2]

- For a small company, Anpario is diversified. It has products for most kinds of livestock and sells them around the world.

Source: Anpario

- The company collaborates with universities and major customers to produce research validating its products (but so do rivals)

- Having established direct sales offices in some territories, Anpario is taking more control of distribution. It has also established Anpario Direct, allowing farmers to buy in small quantities online.

- Anpario is seeking to make an acquisition (and has substantial cash reserves to pay for it). More scale would probably increase Anpario’s efficiency.

Will we all benefit?

Score [2]

- I have visited and corresponded with the company and gained a favourable impression

- The board is experienced and not extravagantly remunerated.

Are the shares cheap?

Score [0.4]

- Fair value, a share price of 380p values the enterprise at about £75 million, or 20 times adjusted profit.

A total score of 7.4 ranks Anpario 14th out of the 30 shares in my Decision Engine. It tests my patience, but I think it’s probably a good long-term investment.

While the shares aren’t cheap, Anpario is in a Covid-19 resistant industry, and has a large cash surplus. These are qualities in short supply.

Something special: Spirax Sarco

One of the lessons investors are learning as a result of the pandemic is that companies that do something essential are less affected during stock market dislocations. Of course, determining how essential something is is a matter of opinion (and each crisis is different), but it makes the job easier if companies explain themselves well.

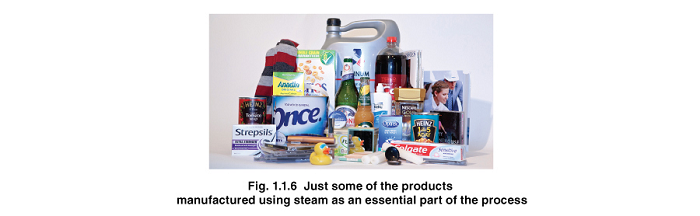

Spirax-Sarco (LSE:SPX) is such a company. It makes steam systems for industry. Though steam-powered factories take us back to the nineteenth century, Spirax Sarco has a whole section of its website entitled “Learn about steam”. Steam, it says, is also a twenty-first century choice for power production, heating and sterilising. The equipment may well be essential:

“...steam is the preferred choice for industry today. Name any well-known consumer brand, and in nine cases out of ten, steam will have played an important part in production.”

Source: Spirax Sarco

If steam is “the preferred choice for industry” then it ought to be big business. It turns out it is. Spirax Sarco is a FTSE 100 constituent. The company’s biggest customer is the pharmaceutical industry (18% of revenue) followed by food (17%) and manufacturers (13%).

The numbers from the 2019 annual report suggest Spirax Sarco is special. My calculations show a return on operating capital of 37% and a return on total invested capital of 17% (after factoring in its investment in acquisitions at their original cost).

Cash conversion, the percentage of profit earned as cash flow, was 77%. These are the statistics of an impressive business, and though my data is preliminary, it looks as though Spirax Sarco has performed well for many years.

Two stats are slightly more off-putting. Total financial obligations were 69% of operating capital in 2019, which is high by historical standards, probably due to acquisitions. The shares are pricey too. They trade on an enterprise multiple of about 28 times adjusted profit. This high valuation reflects the fact that so far the share price has barely been dented by worries about the pandemic.

I’ve work to do yet, but the company’s history dates back to the steam age, and it surely has specialist know-how and a good reputation.

Richard owns shares in Anpario.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.