Richard Beddard: this top 10 stock is helping shape the future

Its mind-blowing tech is used to push the boundaries of what’s possible, and strong finances should see it prosper even through recessions. But it supplies China and the CEO just retired. Richard Beddard shares an update on a favourite stock.

8th September 2023 15:15

by Richard Beddard from interactive investor

In seven years managed by chief executive Ian Barkshire, Oxford Instruments (LSE:OXIG) has prospered, but his retirement on the first day of this month raises questions about the company's future.

- Invest with ii: Top UK Shares | Free Regular Investing | Open an investment Account

Investing in the cutting edge

Oxford Instruments makes x-ray, electron and magnetic resonance analysis systems, atomic force and Raman microscopes, scientific cameras, and cryogenic (very cold) environments for industry and academic researchers.

Its products enable the analysis and manipulation of materials down to the atomic and molecular level.

In its most recent financial year, which ended in March, the company released a version of its Cypher atomic force microscope (AMF) for researchers in battery technology. It allows the direct observation of chemical processes while batteries are being used.

The same brand of AMF is also used for fault finding in the semiconductor industry, one of the company's biggest markets. Oxford Instruments supplies etching and deposition systems, two critical processes in the manufacture of microchips.

Most of Oxford Instruments’ semiconductor revenue comes from systems for manufacturing compound semiconductors made from more than one element, gallium nitride and indium phosphide, for example. These are more powerful than the ubiquitous silicon chip.

- Stockwatch: why I’ve tweaked my rating on microchip star Nvidia

- FTSE 100 dividend stocks will pay out almost £16bn in September

Oxford Instruments provided the cryogenic home for the UK's first commercial quantum computer built by Rigetti in 2021, and it is working with nearby Oxford Quantum Circuits to provide the first commercial quantum computer in a Japanese data centre.

As a supplier of technologies we rely on to develop better cancer cures, identify pollution in the oceans, invent better forms of concrete and steel, and enable faster more powerful computers, Oxford Instruments can truly claim to be helping to shape the future.

Making money from the future comes at a cost, the investment required to invent cutting-edge products with commercial appeal.

A final flourish

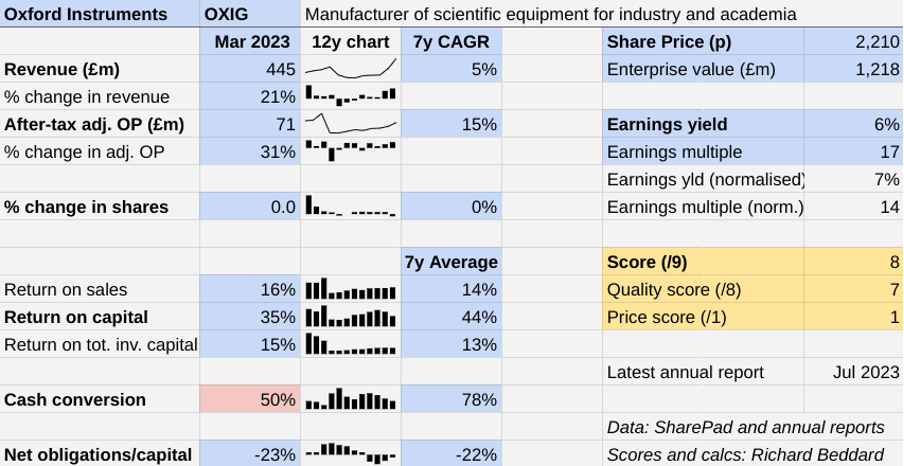

Helped a little by currency movements, Mr Barkshire's last full year was a final flourish. Revenue and profit grew 21% and 31% respectively in the year to March 2023.

The ex-chief-executive's full-term scorecard shows a 15% compound annual growth rate in profit.

Return on capital in 2023 was 35%, which is lower than the 44% average achieved during his time in charge, partly because of a surge in investment in 2022 and 2023 which has increased the denominator of the calculation, capital, even more than profit.

We probably do not need to be concerned about this, 35% is very respectable, and much of the investment has not even started generating a return yet.

Capital expenditure was just £8 million in 2021, but in 2023, it was £38 million, mostly reflecting the cost of a new semiconductor facility near Bristol, which will double Oxford Instruments' production capacity when it opens later this financial year. In 2023, the company spent over £30 million on the facility, and it expects to spend another £10 million on it.

The investment goes some way to explaining why cash returns were only 50% as a proportion of adjusted profit, much lower than usual.

Another reason was the familiar leakage of cash into Oxford Instruments' defined benefit pension scheme, which could come to an end soon. These projections are riddled with uncertainty, but the fund is in surplus and the company reckons it will be self-financing by 2026.

Oxford Instruments can afford the investment, and to put its pension scheme on a firmer footing. Its cash balance, although lower at the year end, considerably outweighed all its financial obligations.

That is a good thing because investment defines the strategy, and the short-term outlook is at least positive. Oxford Instruments reported continuing momentum in July, and at the year end in March orders were 21% higher than the preceding year.

Horizon

The Horizon strategy was the prescription issued to right an acquisitive period in Oxford Instrument's history that delivered debt, but not sustained growth.

The strategy emphasises “market intimacy” (insight into high-tech markets so Oxford Instruments develops relevant products) and “relentless innovation”, based on what the company has learned.

It is coincidental with a rise in research and development (R&D) spending from 7% of total revenue in 2017 to 9% in 2021 and 2022. Although R&D increased in absolute terms in 2023, it fell as a proportion of revenue to 8%.

The R&D programme has been directed at products and services with broad research or manufacturing applications in preference to specialised products for individual customers often in fundamental research. It continues to meet the individual needs of customers by providing bespoke add-on modules to these products.

- Shares for the future: four more shares I think are good value

- Arm Holdings reveals how much its shares might cost in $52bn IPO

For example, Oxford Instruments repurposed its etch and deposition processing systems designed for semiconductor research into a volume manufacturing technology. Hence, the ramp up in production capacity.

The company says its BC43 benchtop microscopy system is both cheaper and easier to use than research microscopes but produces comparable results. It can be used for a much wider range of purposes, including in large markets like pre-clinical trials.

This more commercial R&D has been funded by efficiency gains, for example through the improvement, localisation and digitisation of after-sales service, the company's smallest but most profitable division.

Unsurprisingly, Oxford Instruments has also focused on recruiting and motivating highly qualified staff, and staff turnover was reassuringly modest at 9% for the year.

Under Mr Barkshire, the company only made one acquisition, WITec, a manufacturer of Raman microscopes, in June 2021, which it could easily afford from the cash its more focused operations were earning.

Despite its self-sufficient strategy and broad customer-base, Oxford Instruments must contend with forces outside its control.

The company should prosper through recessions due to its strong finances and diverse customers, split roughly 50/50 between academic and commercial customers.

Perhaps the biggest external risk is geopolitical. It earns about a quarter of revenue from China, its second-biggest market after the US, where trade rivalries are becoming more vexatious.

Oxford Instruments says it is experiencing more export licence refusals for cryogenic systems, presumably as the UK along with other Western countries restricts China's access to advanced technologies including those related to quantum computing.

New Horizons

I find changes of management at successful businesses unsettling, particularly when the new appointment comes from outside.

Mr Barkshire was a materials scientist who joined Oxford Instruments in 1997. Given that Oxford Instruments' products and customers do science, his credentials were reassuring as he sought to make the business more commercial.

The new chief executive appears to be a more conventional manager. He has come from TT Electronics, a supplier of electronics to the aerospace and defence industries, and before that he led the aerospace and security division at Cobham.

Maybe this is what the company needs to continue its commercial journey, but I would be concerned if acquisitions, a hallmark of Mr Tyson's nine years as chief executive of TT, returned as a major driver of growth.

Scoring Oxford Instruments

Gavin Hill, chief financial officer, was appointed at the same time as Mr Barkshire, and has been on the same journey.

I hope the company stays focused on Horizon, but until we can judge the new chief executive's actions there will be an additional question mark in my generally positive scoresheet for Oxford Instruments.

Does the business make good money? [2]

+ High return on capital

+ Decent profit margin

+ Good average cash conversion

What could stop it growing profitably? [1]

+ Low recession risk: strong finances, diverse customers

? Difficult to score competitiveness

? Geopolitical risk (24% of revenue from China)

How does its strategy address the risks? [2]

+ Focus on products with large markets, many applications

+ R&D spend improves competitiveness

? Acquisitions

Will we all benefit? [2]

? New chief executive

+ Self-reported employee engagement scores high

+ Key Performance Indicators (KPIs) reflect strategy and culture

Is the share price low relative to profit? [1]

+ Yes. A share price of £22.10 values the enterprise at about £1.2 billion, 14 times normalised profit.

A score of 8 out of 9 indicates Oxford Instruments is a good long-term investment.

It is ranked 9 out of 40 stocks in my Decision Engine.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

More information about Richard’s investment philosophy and how he implements it.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.