Richard Beddard: supplier to Prince and Van Halen gets top marks from me

6th January 2023 14:18

by Richard Beddard from interactive investor

This company’s numbers are excellent, it is run by enthusiasts and industry legends, and products have appeared on the main stage at Glastonbury. Our columnist explains why the shares are such a hit with him.

After a hurly-burly pandemic when Focusrite (LSE:TUNE)’s products were in high demand around the world, business is returning to a new normal. The new normal may be better than the old normal, though, and the old normal was good.

Focusrite designs equipment for making and playing sound. It has grown through the acquisition of niche businesses in recent years, but the biggest business by far remains the original one, Focusrite.

- Invest with ii: Share Dealing with ii | Top UK Shares| Cashback Offers

Focusrite’s famous brands are Scarlett and Clarett, interfaces that connect instruments, microphones and headphones to computers where musicians record, produce and edit music.

Scarlett is an entry level product, and the company claims it makes more records than any other interface.

It has also added a podcasting interface, Vocaster, to the range, and Focusrite Pro caters for the professional market.

Other brands design instruments such as synthesisers, grooveboxes, studio monitor speakers, and loudspeaker systems for playing music at venues and events, and publish downloadable music making apps, which have small but growing subscription options.

Year to August 2022

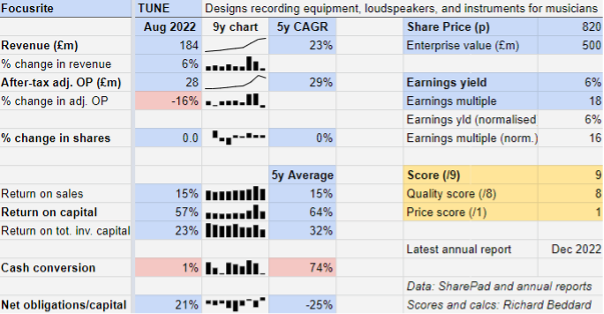

Although Focusrite achieved a 6% increase in revenue in the year to August 2022, it was helped by acquisitions. Adjusting out their impact and that of currency fluctuations results in a decline of 3%.

This is a creditable performance considering the extraordinary circumstances of the pandemic. Many of the company’s businesses benefited from lockdowns as musicians and podcasters bought kit so they could record and share from home.

Martin Audio, the UK’s largest manufacturer of loudspeakers used principally at live events and concert venues has bounced back strongly from the pandemic. Its speakers graced the main stage at Glastonbury once again but even so, we might have expected a bigger reduction of revenue in 2022 than actually occurred.

Surging freight and component costs ate into profit though, which fell 16%. Profit margins remain higher than pre-Covid because, the company says, it is selling more directly, to dealers or consumers, rather than through distributors. It has raised prices and controlled costs, and tariffs are lower too.

Stock more than doubled during the year, though, which gobbled up cash. This was mostly due to a return to historic stock levels after the previous two years when stock ran down and cash conversion was over 100%.

But longer-lasting trends may be evident in the rise in stock too. Focusrite is holding higher than average stocks of raw materials to combat shortages, and higher than historic levels of finished goods because it is supplying more dealers and consumers directly. For example, it launched its own Australian distribution business during the year requiring it to hold over £2 million in stock.

- Watch our video: An AIM share to own in 2023

- Share Sleuth: sticking to my knitting after worst yearly performance

Barring the rise in net financial obligations, which result from spending on stock and acquisitions and are not at worrying levels, the numbers are excellent and close to the impressive five-year average.

They may be a testimony to the acquisitions, which have diversified the group but not apparently diluted profitability.

One thing to keep an eye on is capitalisation of development costs. Firms smooth out the cost of developing new products by treating the expense as an asset rather than deducting it immediately from profit. The asset is amortised over a number of years, a legitimate accounting judgement that matches cost to expected revenue and consequently lifts profit in the short term.

In 2022, Focusrite capitalised £7.9 million of costs but its amortisation charge was only about half as much.

Increased investment is a good thing as long as the anticipated sales materialise, otherwise the investment will be written off. Given Focusrite’s track record, I think we can rest easy.

Geopolitical risk

Shortages hit ADAM Audio hardest in 2022, because the business was unable to source components for its new A Series studio monitor. This delayed shipping of the largest launch in the brand’s history, and required it to weather five months in which supplies of the older AX model were limited and the new model was unavailable.

For product, component and raw material supply, a China dependency may be problematic if the deteriorating geopolitical situation becomes entrenched. The good news is Focusrite is alive to the risks.

Although it uses contract manufacturers in China and Malaysia for high volume products like Scarlett, it has in-house manufacturing capabilities closer to home in the UK and Germany, and also uses a contract manufacturer in San Francisco. It says it monitors alternative supply arrangements.

The risk report singles out neodymium, a metal used in the strong magnets in loudspeakers, microphones and electronic musical instruments, which is only sourced in China.

The company says it is seeking an alternative material and, should it find one, this may give it a new competitive advantage.

Singular purpose

Focusrite’s “single purpose” is to “remove barriers to creativity”.

This is essential because musicians are not all technically savvy. If the products are to appeal to more people, they must be easy to set up and use. Customers need to feel confident in Focusrite’s 24/7 worldwide support and that their equipment will remain relevant due to frequent updates.

The company’s commitment to R&D is reflected in the fact that it employs more staff devoted to this activity than it does in sales, the second biggest category.

By improving, simplifying and supporting products, the company is learning more about its customers and growing its core market, even while it is expanding into new ones.

- Richard Beddard: my investment philosophy explained for the first time

- This is what the ideal share for 2023 looks like

- 10 small-cap shares to lead a recovery in 2023

It has entered new markets through the acquisition of a handful of businesses in recent years and it is applying the same philosophy to them. For example, Martin Audio, acquired in 2019, supplies professional sound systems for bands on tour, concert stadia and places of worship. In 2021, it launched a sub-brand, Optimal Audio, which designs loudspeaker systems for small commercial venues like bars and coffee shops that work out of the box. Optimal made a modest profit in its first year.

Focusrite acquired the rights to Oberheim and resurrected the venerable synthesiser brand in 2022. It also acquired Linea, a manufacturer of amplifiers and digital signal processors used in Martin Audio’s speaker systems.

Securing supply is another emerging priority, evident in this acquisition and in the company’s quest for alternative sources of components and raw materials. The company says it also communicates directly with semiconductor manufacturers, rather than relying solely on distributors.

Its growing emphasis on direct sales to dealers and consumers fits in with its customer service ethos and our increasing predilection for buying online.

I find these elements of vertical integration reassuring at a time of uncertainty. They also give Focusrite more opportunities to distinguish its already highly distinguished brands.

Industry legends

Recognising that the key to designing, selling and supporting great products is the recruitment and motivation of the people who perform these functions, the first element of Focusrite’s strategy is to create a great place to work.

Many of the company’s employees are musicians, audio engineers and podcasters. Tim Caroll, the company’s chief executive, says the company promotes from within wherever possible.

Focusrite measures employee satisfaction using the employee Net Promoter Score (eNPS), which asks employees how likely they would be to recommend their employer to a friend. A preponderance of detractors results in a negative score (the minimum score is -100) and a preponderance of promoters results in a positive score (the maximum score is 100).

Focusrite says this year is the first year it has surveyed the whole group, and although its score is positive, a score of +18 is underwhelming. Perhaps staff are somewhat unsettled because the company has been through a period of substantial change due to the unpredictable times we live in and the integration of a number of acquisitions.

Customers, though, are out-and-out promoters. When asked if they would recommend it, the company scores an NPS of +71.

Tim Caroll, a former professional keyboard player and vice president at Avid, the software often used by customers of Focusrite interfaces, is the company’s chief executive. It is good to see him demonstrating Focusrite is run at the highest level by enthusiasts. During the year he bought an OB-X8 Synthesiser, albeit at a substantial discount to the near £5,000 retail price.

Made by Oberheim, whose synthesisers were used on tracks like 1999 by Prince and Jump by Van Halen, the OB-X8 is the brand’s first new product for 40 years.

- Why these could be 10 of the most reliable shares for investors in 2023

- This is what 2023 has in store for AIM’s £1bn companies

Focusrite acquired the rights and intellectual property of the Oberheim brand during the year, and is collaborating with founder and inventor Tom Oberheim to develop new products.

The continued involvement of founding engineers like Oberheim brings authenticity and know-how to Focusrite’s brands. This is true of Focusrite's other acquisition during the year, Linea, and Sonnox, a manufacturer of software plugins for audio processing, acquired after the year-end.

It means that some of Focusrite’s subsidiaries are not only run by enthusiasts but industry legends.

Sadly, it lost one of them when Dave Smith, founder of Sequential and leader of the synthesiser brand’s engineering team, died in May 2022. Mr Smith designed the famous Prophet-5 synthesiser in the 1970’s.

Another is Phil Dudderidge, the inventor of a leading brand of mixing consoles in the 1970’s. He bought the assets of Focusrite in the late 1980’s, floated it in 2014, and serves as the company’s non-executive chairman. He is also its biggest shareholder with a majority 33% holding.

Mr Dudderidge takes pride in the fact that Scarlett, the company’s entry level inexpensive audio interface, has enabled many musicians to record music for the first time at home, at much lower cost than renting out a studio.

No doubt his contacts and reputation have encouraged other luminaries to join the business.

Vocaster, the new podcasting interface, is Focusrite’s first product to be made from recycled plastic and shipped in compostable bags padded with bio-based foam packaging.

Other more environmentally sustainable products will follow, the company says.

Scoring Focusrite

I think Focusrite is a very good business, because it is building from a position of strength. It is reinvesting the money from its highly regarded audio interfaces into other highly regarded brands and broadening their appeal too.

I am not a musician and never have been, but it is hard not to read the annual report without thinking about becoming one!

Does the business make good money? [2]

+ High return on capital

+ Decent profit margins

? Cash conversion may come under pressure from growing stock levels and increased development costs

What could stop it growing profitably? [2]

+ Strong finances

+ Strong competitor

? Supply chain weaknesses

How does its strategy address the risks? [2]

+ Acquisition of similar businesses

+ Innovation

+ Seeking alternative sources of supply

Will we all benefit? [2]

+ Very experienced management

? Employees could be more engaged

+ Credible looking route to carbon neutrality

Is the share price low relative to profit? [1]

+ Yes. A share price of 820p values the enterprise at about £500 million, about 16 times normalised profit.

A score of 9 out of 9 indicates Focusrite is a good long-term investment.

It is ranked 2 out of 40 stocks in my Decision Engine.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in Focusrite.

For more information about Richard’s scoring and ranking system (the Decision Engine) and the Share Sleuth portfolio powered by this research, please read the FAQ.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.