Richard Beddard: this smooth operator is not without a few wrinkles

Efficiency is why this firm is highly profitability, and it’s building brand awareness so it can continue growing. Richard Beddard offers his view on this small-cap.

18th August 2023 15:00

by Richard Beddard from interactive investor

When it comes to peddling white goods, Marks Electrical (LSE:MRK) has big competitors: a market leader in Currys (LSE:CURY), a respected name in John Lewis, and an online insurgent, AO World (LSE:AO.), that until recently was chasing growth at all costs.

Unlike Curry’s and John Lewis, Marks Electrical sells only online. It is also highly profitable.

- Invest with ii: Top UK Shares | Share Tips & Ideas | Cashback Offers

This profitability stems from how it makes money. Although it is online, Marks Electrical focuses its resources on those parts of the business that come into direct contact with customers so it can provide a seamless retail experience.

It employs homegrown e-commerce systems that keep prices competitive, and delivers in customised vehicles, maintained and fuelled from its central headquarters and 24/7 distribution centre next to the M1 near Leicester.

Crews of two deliver to over 90% of the UK population the next day, seven days a week, for free if the item costs over £500.

Free next-day delivery often makes Marks Electrical the cheapest and fastest option.

It is so profitable because it is so efficient. Marks Electrical mostly sells premium bulky white goods from a wide range of manufacturers such as Bosch, Samsung and Rangemaster. They require two-person delivery, and Marks Electrical uses only third-party couriers for small electrical items.

Direct delivery of bulky expensive products means they are not unloaded and reloaded in transit, reducing damages and the frequency of delays.

The company’s top four categories are all bulky appliances: cooking (30%), refrigeration (25%), washers and dryers (19%) and dishwashers (8%) account for nearly 85% of sales.

Drivers and installers are well trained and motivated. Marks Electrical says it prioritises employee retention and promotion from within. It raised pay by 9.5% on average in the year to March 2023 and by 4.6% this year.

Customers are impressed by the service they get. The company's founder and chief executive Mark Smithson is protective of its Trustpilot score of 4.8 and has said he scrutinises every bad review.

Another key performance indicator, the percentage of returning customers, also demonstrates how the business operates.

A total of 25% of customers in 2023 bought again from Marks Electrical within 12 months.

Profit margin is key

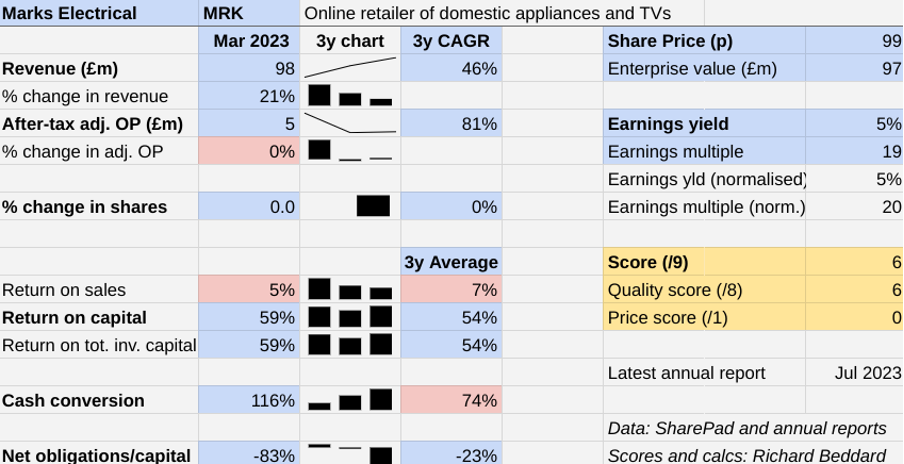

Revenue increased 21% but profit was flat and cash conversion was very strong at 116%. The company had more cash than financial obligations at the year end.

In a year in which fuel and energy costs were high and labour costs increased, profit margins eroded from 6% to 5%, but this is more than sufficient to deliver healthy returns if it can be sustained.

According to industry data quoted by Marks Electrical, the electricals market is stagnant. Whether the company would keep growing through a recession though, is untested.

As an online retailer, demand was boosted by the pandemic, which closed rival physical retailers. The price of online advertising also fell, reducing marketing costs.

Demand may hold up in a recession because, Marks Electrical says, 80% of revenue comes from distressed purchasers - people whose TVs have blown up, for example. However, revenue might be impacted as customers trade down to cheaper models.

This, I fear, would damage profit because of the fixed costs inherent in operating its own distribution network.

At the company’s AGM last week, Marks Electrical reported revenue up 31% in the first four months of the year compared to the same period a year previously, which would be good news for profit if margins have stabilised.

Getting the word out

To continue growing, Marks Electrical needs to get the word out. Although it has nearly doubled its share of the Major Domestic Appliance market to 3% since the beginning of the pandemic, and made a small 0.6% dent in the Consumer Electronics market, it could make much bigger inroads if only we knew about it.

TV and brand advertising is uneconomic for small online businesses that often rely on product adverts on Google, but by the time of its flotation, Marks Electrical had grown big enough to justify the spend.

In March 2022, the company reported only 7% of the population had heard of it but thanks to TV campaigns, by putting the Marks Electrical name on the back of London buses and in stations and airports, and painting its vans in a vibrant new livery, YouGov surveys reveal that UK brand awareness reached 15% by March 2023.

- Stockwatch: buy if you accept this share’s high risk/reward profile

- Insider: FTSE 250 boss tops up stake after windfall

Additionally, it can grow by adding more value. During the year, Marks Electrical recruited and trained an in-house gas and electrical installation team, which provides next-day installation to 65% of us, giving it more control of the customer experience and creating another potential profit source.

It is also broadening the product range by selling consumer electronics.

This gives the company more products to sell its growing customer base. But the range expansion also strikes a discordant note. It does not utilise the company’s heavy investment in its own delivery capability, which gives it less control of the customer experience.

There is a good reason for this. It is not economical for two-man crews to drive around the country delivering gaming consoles and headphones.

Scoring Marks Electrical

Marks Electrical has a coherent, vertically integrated business model and its strategy builds on that platform.

Last year I wrote that the next time my family needed a cooker, fridge, or a TV, the first place I would look would be the Marks Electrical website. In fact, it was our washing machine that gave out.

We ordered a new one from Marks Electrical, it arrived the next day, and it has worked well ever since, a seamless retail experience.

But for two rather imponderable wrinkles, I would have added the shares to the Share Sleuth portfolio by now. Many times I have wondered whether they are sufficient to stop me.

I am unnerved by the fact that we have only witnessed Marks Electrical performing as a listed company during advantageous times. Only more time can show us what will happen during a recession.

And I am also put off by the almost absolute control of founder Mark Smithson, who owns 74% of the shares.

I have every reason to believe he is good for the business, as founders often are, but controlling shareholders can almost effortlessly take good businesses private on the cheap if things do not go well for a while, forcing minority shareholders out at the worst possible time.

Does the business make good money? [1]

+ Highly profitable

+ Decent cash conversion

− Short history

What could stop it growing profitably? [2]

? Strong finances but recession risk

+ Larger but less-focused competitors

+ Diminishing dependence on Google advertising

How does its strategy address the risks? [2]

+ Installation is new opportunity to add value

? Broadening range of consumer electronics

+ Brand advertising

Will we all benefit? [1]

+ Owner managed

− Owner has controlling interest

+ Remuneration not excessive

Is the share price low relative to profit? [0]

+ No. A share price of 99p values the enterprise at £97 million, about 20 times normalised profit.

A score of 6 out of 9 indicates that Marks Electrical is fairly valued.

It is ranked 33 out of 40 stocks in my Decision Engine.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

More information about Richard’s investment philosophy and how he implements it.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.