Richard Beddard: this small-cap share will survive and prosper

18th June 2021 15:47

by Richard Beddard from interactive investor

It’s been heavily impacted by Covid, but there’s a lot to like about this great company, which our companies analyst thinks should be a good long term investment.

Last year, when I scored Churchill China (LSE:CHH), I said that Covid-19 was likely to overshadow the company’s resurgence over the past decade, but the resurgence story is more significant to long-term investors.

Churchill China makes crockery for the hospitality industry, so unsurprisingly its revenue and profit was hammered like its customers’ in the year to December 2020, and this year will probably be a difficult one too.

I am going to stick to my guns though. The big story is how Churchill China has gained competitive advantage over rivals. The pandemic, I hope and expect, will prove to be an interruption.

Case study in competitive advantage

Unable to compete with cheap Chinese imports, shortly after the turn of the century Churchill China chose to focus on its strengths: the unique materials and methods it had developed since it was founded in 1785 to manufacture hard wearing plates.

It gradually withdrew from the retail market, where hardiness was less valued, and focused on the hospitality industry, where plates must withstand many thousands of dishwasher cycles.

- Two valuable lessons for every investor

- The ii Family Money Show with Gabby Logan: watch the Richard Curtis interview here

- 10 speculative high-flying stocks beating the market

- Open an ISA with interactive investor. Click here to find out how

Unlike you and me, hotel and restaurant owners are repeat customers, which gave Churchill China the opportunity to build a reputation not just for good products, but also good service. Customers want to know replacement cups, plates, and bowls will be available when they need them.

Earlier this century, the hospitality sector was dominated by plain white tableware. The European market, Churchill China’s most obvious export market, was dominated by large and very efficient German manufacturers.

Technical breakthroughs at Churchill China though allowed it to add colour and texture to plates as part of the manufacturing process, allowing it to produce so-called “value added” plates it could charge more money for, without adding much to the cost of production.

It is sales of these value added products to Europe that has powered Churchill China’s resurgence.

The changing shape of Churchill China

It may seem hard to believe after a year in which we have often been unable to do it, but Churchill China’s resurgence coincided with a boom in eating out. As restaurants and hotels sought to improve the experience, they seized on more attractive plates as a means of framing the food.

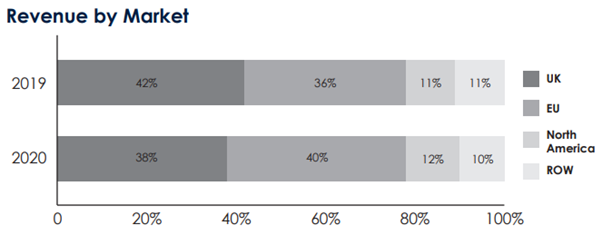

Putting aside a drastic decline in revenue and profit, two statistics summarise Churchill China’s success. For the first time, the company achieved a greater proportion of its sales in the EU than in the UK, where it is market leader, as growth in market share in the EU offset some of the pandemic effect:

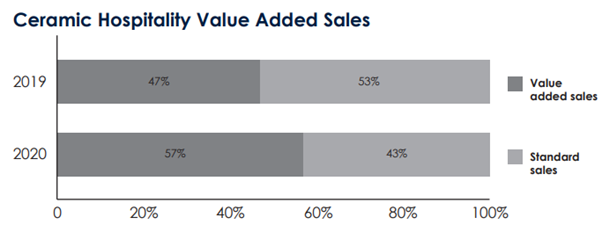

And, for the first time, it sold more patterned and textured plates than the standard product:

Repeated investment in robotic manufacturing, and in staff development, have also lowered costs and increased what the company is capable of.

This, I believe, is the story that long-term investors should focus on. What follows is the bit we must resign ourselves to...

Surviving 2020

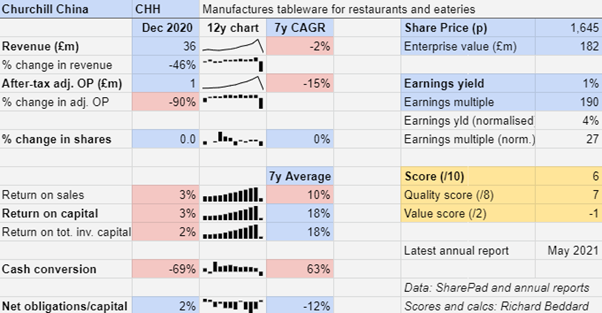

Revenue declined 46% and profit declined 90% in the year to December 2020, reversing a decade-long growth trend in which the company had not just increased revenue and profit, but grown profit faster than revenue and capital employed, resulting in higher profit margins and returns on capital.

Profit fell further than turnover in 2020 because of the high fixed costs of its factories.

Although Churchill China reduced production, to maintain efficiency it made more tableware than it needed and it also, perhaps, reduced staffing levels by less than it could have (the company employed 4% fewer staff at the end of the year than at the beginning of the year).

These decisions mean it is in a good position to supply demand as it returns.

Sub-par cash conversion is partly the result of investment, and partly the result of payments to plug the deficit in the company’s defined benefit pension scheme. One day, these should end!

The alarming cash conversion ratio in 2020 is misleading. The cash outflow was small. It looks large because the profit, with which it is being compared, was also small.

The company finished the year with a fraction more financial obligations than cash on its balance sheet, but it still has no conventional debt and few lease obligations. The deterioration occurred because Churchill China’s pension deficit doubled and its cash balance dropped a little.

Unsurprisingly the first three months of 2021 were quiet. The UK was in lockdown and so, to varying degrees, was Europe. Since then Churchill China says orders have picked up, although it remains wary of further developments in the pandemic.

- How the AIM market took over the world in 2020

- Inflation watch: nowhere to hide for savers following cost of living shocker

- Read more of our content on UK shares here

To say the share price values the enterprise at 150 times adjusted profit in 2020 is true, but also meaningless as the profit figure is a pandemic anomaly. My normalised ratio, which values the enterprise at 27 times adjusted profit is better but may also be too high.

The calculation is based on average Return on Capital (RoC) over a seven-year period in which Churchill China became substantially more profitable. RoC grew from 14% to 28% in 2019, due, I believe, to a strengthening of its competitive advantage.

I see no reason why Churchill China should not be as profitable as before, if not more, once we have learned to live with Covid-19 without shutting down restaurants. The company believes it will emerge from the pandemic with a greater market share.

Scoring Churchill China

No surprise, I like Churchill China. It has a unique product and is continuously investing to improve it.

Such is its confidence in European demand for crockery from Stoke-on-Trent that it does not believe Brexit will undermine it, although it does complicate things.

Does the business make good money? [2]

ᐩ High return on capital

ᐩ Improving profit margin

? Cash conversion dampened by payments into pension fund

What could stop it growing profitably? [1]

+ Strong balance sheet

? Covid-19 will drag on performance in 2021 and perhaps beyond

? UK trade relations with the EU

How does its strategy address the risks? [2]

+ Ongoing investment in materials and manufacturing process

+ Geographical expansion

+ New logistics hub in Rotterdam

Will we all benefit? [2]

+ Very experienced board (CEO 30 years, FD 29 years)

+ Staff development central to strategy

+ Communicates well with shareholders

Is the share price low relative to profit? [-1]

? A share price of £16.45 values the enterprise at 27 times normalised profit.

The consensus view of investors and traders, as indicated by the share price multiple, seems to be that Churchill China will survive and prosper.

I agree. A score of 6 out of 9 suggests it is a fair price, and Churchill China should be a good long term investment.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor. He owns shares in Churchill China.

For more information about my scoring and ranking system (the Decision Engine) and the Share Sleuth portfolio powered by this research, please read the FAQ.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.