Richard Beddard: a small-cap share with plenty of questions to answer

14th April 2022 14:46

by Richard Beddard from interactive investor

Despite needing a lengthy transition phase to get up to speed, this business could still be a good long-term investment currently available at a low price.

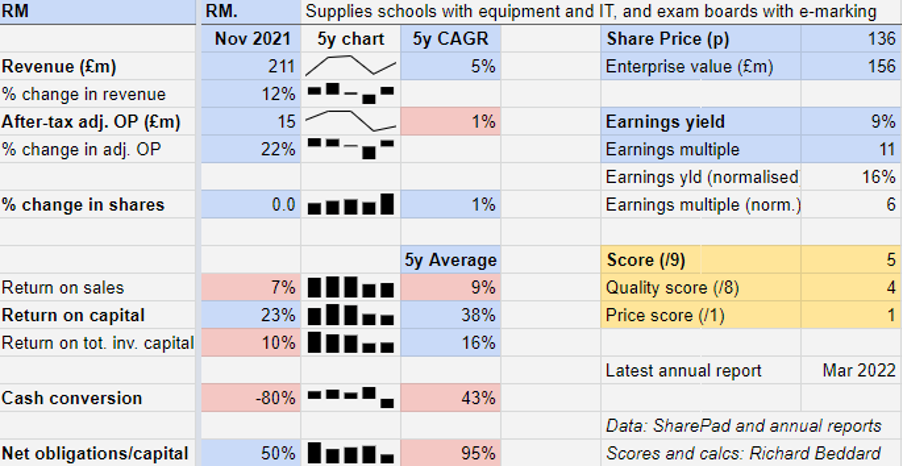

Although revenue in the year to November 2021 increased at RM (LSE:RM.), the company has some way to go before profitability returns to the levels achieved before the pandemic.

Then it has to address a problem that has dogged it much longer: growth.

A year of living dangerously

The supplier of products, IT, and services to schools and exam boards spent heavily, while it earned less due to school closures and exam cancellations.

Past performance is not a guide to future performance.

Revenue increased by 12% and adjusted profit increased by 22% compared to the previous year, which was also impacted by the pandemic. That year, revenue declined by 16% and profit by 48%.

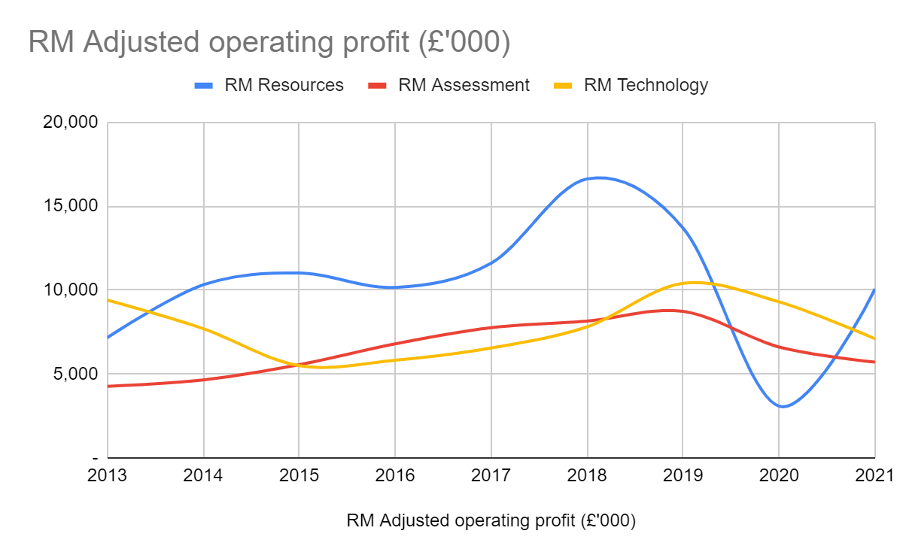

Profit and consequently Return on Capital is heavily adjusted to remove the impact of substantial one-off costs, mostly relating to the replacement of the company’s IT systems. This makes the figures something of a best-case scenario.

The subjectivity of profit is illustrated by the chasm between profit and cash flow: how much money the company made, stripped of adjustments and accounting judgements.

RM’s cash flow, which also includes the £4.5 million cost of payments into its underfunded pension scheme, turned negative.

Although Return on Capital appears to be high, RM is not adequately converting profit into cash or growth.

A series of unfortunate events

Throughout its history, RM has been grappling with events outside its control. It made its name in the 1980s as a manufacturer of personal computers for schools, but as PCs standardised it switched to supplying the big computer brands.

In the 2000s the company supplied hardware and software to UK schools through the Building Schools for the Future programme, a government scheme to modernise schools that was scrapped abruptly in 2010. This left RM with a dwindling legacy of contracts, many of them not particularly profitable.

It had only just seen the back of the last of these contracts when the pandemic started, leading to school closures and exam cancellations. The recovery, a long time coming, was over before it had even started.

- Stockwatch: is this 9% dividend yield too good to be true?

- Share Sleuth: new addition takes number of holdings up to 30

As the business evolved, it also diversified through acquisition.

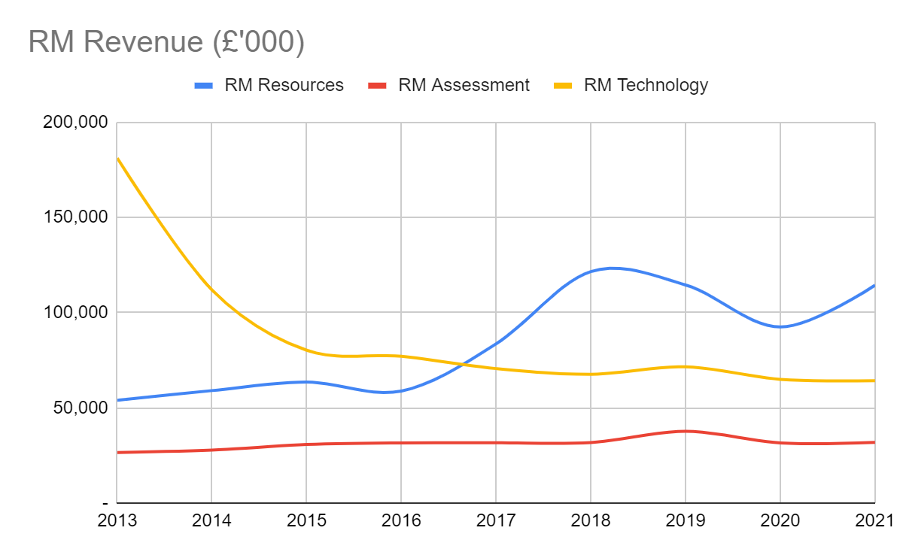

Today, RM owns three distinct businesses, which it recently renamed.

RM Resources supplies primary schools with all manner of equipment, from robots for children to program to Pritt Stick.

RM Technology (formerly RM Education) supplies primary and secondary schools with IT: Managed computer networks, cloud-based school management software, and hardware.

RM Assessment (formerly RM Results) supplies examination boards and professional associations with testing and marking software as a service.

Source: RM Annual Reports. Past performance is not a guide to future performance.

RM Resources became the company’s biggest division by revenue and profit in 2017 when it acquired a rival, Consortium, and combined it with an earlier acquisition, TTM. The acquisition also made RM Resources the biggest UK distributor of educational materials.

The oldest of the three divisions is RM Technology. For most of the last decade revenue contracted as it ran down long-term and often unprofitable contracts agreed the decade before.

Both businesses earn most of their revenue in the UK, where the company estimates RM Technology has a 12% market share and RM Resources has 9% market share.

The biggest opportunity may be RM Assessment. It was the only part of the business growing organically before the pandemic and, although it has contracted over the last two years, it still earns the highest profit margin.

Past performance is not a guide to future performance.

Assessment is a global market and mostly still done on paper, so the opportunity for digitisation is great (RM thinks it is a matter of when, not if).

But we do not know who the winners in this nascent market will be, and the loss of RM Assessment’s contract with examination board AQA in 2020 is a reminder that competition can come from RM’s own customers. AQA insourced the contract.

Strategy reset

RM says the pace of change is accelerating. The role of technology in education is increasing and the size of the Multi Academy Trusts (MATs) running schools is too.

The experience of the pandemic has showcased the advantages of online systems and assessment, not just when schools are closed, but because IT improves efficiency and data.

Larger trusts mean centralised procurement, which will put greater demand on suppliers to provide a cheaper and more consistent service. Big suppliers like RM may be relatively well placed to meet these demands.

RM’s response to these challenges is inwardly focused, aimed at raising RM’s efficiency to, or beyond, the level of its peers.

In the name of efficiency, it is pressing ahead with the rationalisation of RM Resources’ warehouses to an automated one near Nottingham, which should be fully operational by the end of this year.

The company is also migrating its many IT systems to a new one that will, it says, reduce costs to the level that some of its competitors achieve.

Having appointed former finance director Neil Martin as chief executive in March 2021, and recruited Mark Berry as chief financial officer in September, the company is hiring new senior managers in all three businesses.

- Richard Beddard: what I’ve learned about this education stock

- FTSE 100 winners and losers in a turbulent first quarter

It intends to use this refreshed platform of people and technology to sell more to more customers.

By combining the e-commerce platforms of RM Resources’ two brands, it expects to sell more of each brand to customers of the other.

It also hopes to make the three business units more than the sum of their parts, but this is where the strategy becomes more aspirational and less specific.

The businesses largely serve different markets with different products, and I wonder how they can help each other, if they really are better together, and what differentiates them individually from their competitors.

Transition phase

The speed of the turnaround will also depend on external factors. It coincides with an increase in school funding, but also high levels of wage inflation in India where RM employs software developers and administrative staff.

The company says it is moving into an 18-month to two-year transition phase while the new people and systems get up to speed.

A “performance phase” should follow, when RM will achieve what it has been unable to achieve for decades: sustainable growth.

This goal must not be derailed again, because RM’s finances have been weakened by heavy investment in new systems and a warehouse, and a long series of unfortunate events.

Does the business make good money? [1]

? High but heavily adjusted return on capital

? Modest profit margin

? Weak cash conversion

What could stop it growing profitably? [1]

? Complexity

? Pension and debt repayment may constrain investment

? Competition, particularly in assessment

How does its strategy address the risks? [1]

ᐩ Simplification of IT and warehousing

? Not clear RM can be more than the sum of its parts

? Strategy fixes problems, but may not create advantage

Will we all benefit? [1]

? New management

? Focus on employee engagement but no published stats

? Executive pay

Is the share price low relative to profit? [1]

+ Yes. A share price of 136p values the enterprise at about £156 million, only 6 times normalised profit and 11 times adjusted profit in 2021.

A score of 5 out of 9 suggests RM may be a good long-term investment, but to do that it must first turn itself around. The number of question marks in my score demonstrates my uncertainty.

It is ranked 36/40 stocks in my Decision Engine.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in RM.

For more information about Richard’s scoring and ranking system (the Decision Engine) and the Share Sleuth portfolio powered by this research, please read the FAQ.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.