Richard Beddard: this share’s fighting for a place in my top 10

27th May 2022 14:43

by Richard Beddard from interactive investor

It’s not especially cheap, but our companies analyst likes this uncomplicated business and thinks it’s a good long-term investment.

4imprint (LSE:FOUR) is tweaking its unusual and simple business as it grows in scale and learns from the pandemic. It may be becoming an even more formidable competitor.

The company connects customisers of promotional goods to the organisations that give them away at workplaces, training events, fundraisers, trade shows and exhibitions.

Promotional goods are branded freebies, handed out to promote businesses and causes, and reward employees. We are talking about a huge and growing range of products exemplified still by T-shirts and coffee cups. 4Imprint’s largest category is clothing.

Customisers import blank products, usually from the Far East, and print them with corporate logos.

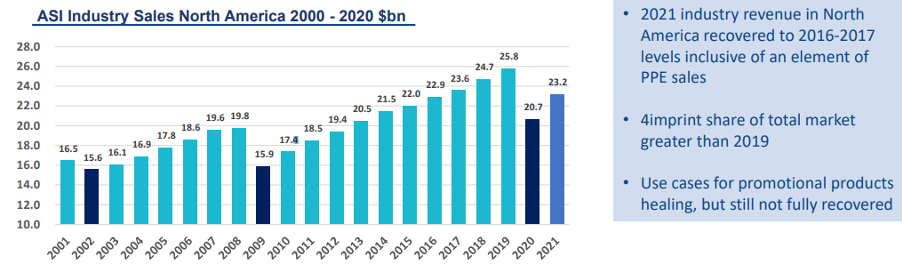

98% of revenue is earned in the US, where 4Imprint is one of the largest of about 26,000 distributors, and it is probably fair to say people like their promotional freebies. $23.2 billion (£18 billion) was spent on them in 2021.

The rest of 4Imprint operates in the UK and Ireland.

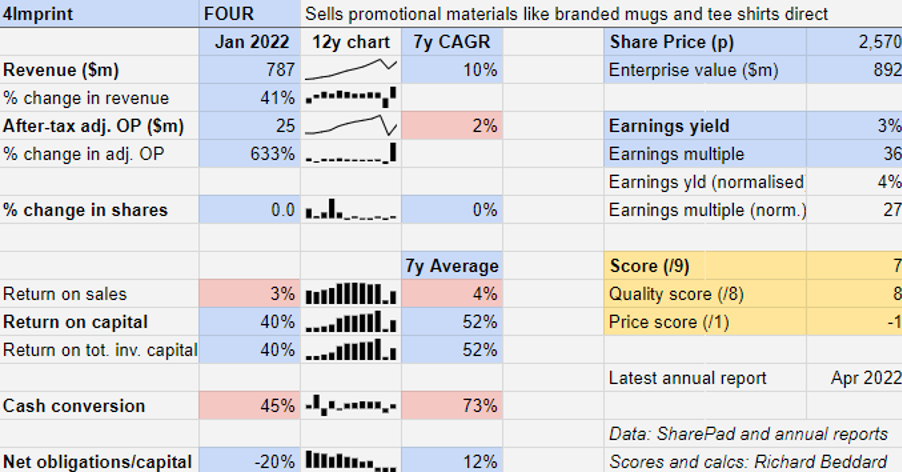

Growth story dented not holed

The pandemic caused a sharp decline in revenue and a sharper still decline in profit in 2020 and dented a compelling growth story. Over the last seven years, 4Imprint has grown revenue at a Compound Annual Growth Rate (CAGR) of 10% and profit at only 2%.

Although the company’s performance has rebounded somewhat in 2021, revenue was 9% below 4Imprint’s pre-pandemic high in 2019, and profit was 44% lower.

Profitability reduced because selling promotional goods is a low margin business. The product is not very special, but the efficient way 4Imprint sells it is. 4Imprint is at its most efficient when it is selling in large volumes.

- Richard Beddard: we can’t do without this small-cap money machine

- Read more from Richard Beddard here

Low profitability during the pandemic was also a choice. 4Imprint could have defended profitability by cutting costs. It does not have high fixed costs in terms of factories and warehouses. Most of the manufacturing and customisation is outsourced and shipped directly to customers from the suppliers.

But 4Imprint treated staff as fixed costs. Because of its financial strength it had no need to lay them off or cut salaries. The cost of employing more staff than it needed temporarily is an investment. Lay-offs demoralise employees, a hidden cost, and re-recruiting when business picks up is expensive and would delay the recovery.

Past performance is not a guide to future performance.

Two years of weak cash generation have also dented 4Imprint’s record of achieving similar cash returns to profit.

In 2020, this was due to a large payment into the company’s pension scheme, which now has modest liabilities. In 2022, it was due to a build up in stock and receivables towards the year-end due to supply chain pressures.

These problems are likely to be temporary and one indication the recovery will continue is orders.

4Imprint received the second biggest total ever in 2021, beaten only by 2019. In the first four months of 2022, orders were strongly ahead of the comparative figure in 2019.

4Imprint says this year, it should for the first time earn more than $1 billion in revenue. That compares to $861 million in 2019.

Is working from home a threat?

Other things being equal, profitability should recover now that revenue has, employees have returned to workplaces and events are taking place again.

Other things may not be equal though. Many employees have not returned to the workplace full time.

Fewer face-to-face meetings may reduce the circumstances in which freebies are handed out, but employers may seek to cement their relationships with employees and customers in far-flung places through more useful, higher-quality, and more sustainable branded goods that they want to keep such as fleece jackets.

This may be one of the reasons for an increase in average order value over the last few years.

While the market is always evolving, one thing will remain true. Businesses cut their marketing spending during recessions, which will continue to impact 4Imprint’s profitability periodically.

Sales of promotional goods are impacted by recession. Source: 4Imprint full-year results presentation (March 2022)

4Imprint’s policy of maintaining very strong finances enables it to weather recessions without laying off valuable employees and recover more quickly than competitors. Along with an efficient business model, this explains 4Imprint’s faster growth than rivals.

Since 2015, 4Imprint has grown revenue 58%. Industry revenue has grown 5%.

Tweaks to the marketing model

The company was an early adopter of direct marketing, sending out regular “Blue Boxes” of catalogues and samples to customers and prospective customers instead of field sales people.

A slick website and proprietary IT systems connect customers to products, which 4Imprint rarely handles. The company’s brand is printed and shipped by 4Imprint’s suppliers.

Efficient systems and motivated employees enable it to offer companies certainty in the form of money back guarantees if deliveries are late, cheaper elsewhere, or the customer is not satisfied.

As the pandemic struck, 4Imprint was experimenting with its marketing spending, which up to then was mostly spent on print catalogues and advertising on Google.

The new innovation was TV advertising, which the company says has been very effective at conveying its customer-centred ethos.

The pandemic accelerated this shift because the cost of TV advertising fell and there was little point in printing and sending brochures and samples to empty offices.

- Global dividends hit new record, but outlook uncertain for 2023

- How Terry Smith is investing as markets crash

This lower-cost marketing mix produced a greater return in terms of revenue per dollar spent.

The flipping of 4Imprint’s marketing spend from print mailings to an emphasis on brand marketing has been enabled by 4Imprint’s growth, it is now of sufficient scale to make mass-marketing worthwhile.

As the biggest direct marketer, and one of the biggest promotional goods companies, scale may have created a new competitive advantage because TV advertising is probably unavailable to rivals dependent on increasingly costly online advertising.

Scale has also enabled the company to create its own brands, which sit between generic products and high-end brands like Nike and Carhart. The aim is to create brands that cost not much more than generic ones to source, but sell for a little less than the big names, which 4Imprint also supplies.

Own brands also build loyalty, and because they are unique to 4Imprint, Google searches for them return fewer rivals.

Treat others as you would wish to be treated

4Imprint describes itself as a people first business, its culture is based on a golden rule, to treat others as you would wish to be treated yourself.

This was demonstrated by its decision not to cut staff or pay during the pandemic.

Although the two executive directors are well paid, remuneration is restrained in comparison to many UK companies. This is particularly impressive since in many respects it is a US business, where executive pay is even higher.

Although the company reinstituted bonuses and pay rises for staff in the year 2021, it did not bring them back for directors, which the board noted is “an approach which reaffirms a key element of the 4Imprint culture”.

Chief executive pay was 15 times median US pay, where most employees are located, although the ratio will rise again once the chief executive’s bonus is reinstated.

Scoring 4Imprint

I like 4Imprint. It is an uncomplicated business with a prudent approach to finance.

By treating employees and customers better and being more efficient, it can grow just by doing more of what it already does, tweaking the formula as circumstances change and the market evolves.

This culture is probably deeply embedded, built over more than two decades by its chief executive officer Kevin Lyons-Tarr and chief finance officer David Seekings.

The key indicators they choose to measure the businesses’ performance suggest they remain preoccupied with 4Imprint’s long-term growth.

Does the business make good money? [2]

+ High average return on capital

? Modest profit margins

+ Decent cash conversion

What could stop it growing profitably? [2]

+ Very strong finances

+ Customers cut promotional spending in recessions

? Potential impact of working from home

How does its strategy address the risks? [2]

+ Investment in people and technology

+ Shift to brand marketing as it acquires scale

? Acquisitions are a strategic option

Will we all benefit? [2]

+ CEO and CFO are very experienced

+ Employee policies are enlightened

? Commitment to private investors/UK listing

Is the share price low relative to profit? [-1]

+ No. A share price of £25.70 values the enterprise at about £890 million, about 27 times normalised profit.

A score of 7 out of 9 indicates 4Imprint is a good long-term investment.

It is ranked 11 out of 40 stocks in my Decision Engine.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in 4Imprint.

For more information about Richard’s scoring and ranking system (the Decision Engine) and the Share Sleuth portfolio powered by this research, please read the FAQ.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.