Richard Beddard: a share that’s easy to like, but should you buy it?

This £600 million company has a commendable focus and could clean up over the long term. But two years into a turnaround strategy, our columnist tells us what he thinks and how he scores the mid-cap firm.

17th November 2023 14:49

by Richard Beddard from interactive investor

PZ Cussons (LSE:PZC) is busy simplifying a complex business and focusing it on brands that will deliver profitable long-term growth, but you must look beyond recent and forthcoming financial results to see it.

- Invest with ii: Top UK Shares | How to Start Trading Stocks | Open a Trading Account

Brands for life

The company makes, promotes and sells soap, baby, and beauty products “where the customer shops”, through supermarkets, online, and via its own sites.

These are products it believes people will pay more for if the product and its marketing have special qualities.

Its biggest geographical markets are the UK, Australia and New Zealand, Nigeria and Indonesia. Although the revenue split is roughly 50-50 between mature developed economies and developing economies, the less economically stable developing countries have faster growing populations and more potential for growth.

With the exception of St Tropez, a fake tan brand which is big in the USA, the company’s nine “Must Win” brands have strong presences in one or more of its four “priority” markets.

They include Carex, the UK’s number one hand wash brand; Premier, Nigeria’s biggest soap brand; Morning Fresh, which has a 50% share of the washing-up liquid market in Australia; and Original Source body wash.

But PZ Cussons is also growing its geographical footprint. It launched Original Source in Spain through Carrefour and another retailer in 2023, and Childs Farm, a baby and toddler skin care brand acquired in 2022 launched in the US on Amazon.

Despite double-digit revenue growth, Australia’s biggest brand of baby food, Rafferty’s Garden, has been quietly relegated to one of 13 portfolio brands that also includes one of its most famous names, Imperial Leather.

Portfolio brands are run for cash, which is invested in the “Must wins”.

To make good money, PZ Cussons requires many capabilities in sourcing, manufacturing, product development, marketing and sales, but there is a problem.

For much of the last decade, PZ Cussons was getting worse at making money. The verdict of new management in 2020, was that it had neglected many of these capabilities, and thanks to the growth in popularity of discount retailers and online shopping, the market was a lot more competitive.

Brands under siege

While PZ Cussons has well-known brands with sizable market shares, brands have never been so challenged.

The turnaround strategy, to simplify and focus, was born in 2021, a year after the current chief executive joined the business.

Simplification is most evident in the company’s supply chain and in its Nigerian operations and brands, while PZ Cussons is focusing on improving all of its brands through innovation, marketing and an aspiration to convert them to B Corp status by 2026.

During the year, children’s skin care brand Childs Farm launched Slumbertime, a combination of bath soak, massage lotion, and sleep mist designed to send babies and toddlers to sleep. It also launched Cussons Creations, a value brand, to fill a void in discount stores that sister brand Imperial Leather had been drifting into. The idea is to return Imperial Leather to its former status as a premium brand.

The company is also beefing up its social media presence, and fully embracing Amazon as a sales channel.

Achieving B Corp certification, a set of environmental, social and governance standards set by the non-profit organisation B Lab, is no mean feat, but PZ Cussons gained valuable experience when Childs Farm was certified three months after PZ Cussons acquired it.

The company’s other brands are taking smaller steps, reducing plastic in packaging, and innovating low-impact packaging like Carex Refill pouches and the Morning Fresh Bottle for Life.

Proposed new long-term executive incentives are a step forward. The company will award restricted shares, which in-line with the company's ethos is simpler and fairer than the previous long-term incentive plan (and incentives at most other companies).

- Share Sleuth: better to buy high-quality firms amid recession fears

- Stockwatch: takeover bids imply stock market in recovery mode

Restricted shares cannot be traded for five years. The value of the shares depends on their performance, which over that time scale should reflect the performance of the business.

Unlike the dominant form of long-term incentive plan, there are no annual performance targets governing the amount of share awards, which introduces short-termism into the formula.

Restricted shares are also fairer because employees, senior managers below board level, also receive them, albeit in lower quantities.

A degree of fairness extends further down the organisational hierarchy. Even though the bulk of employees are employed in production roles, the median UK employee earns a £45,000 salary and total pay of £54,000, staff are promised fulfilling careers with leadership at all levels. They are allowed to finish work at 1pm, and the company scores well on internal employee engagement scores.

Since the people will deliver the strategy, success may breed success, attracting more talent.

The strategy is only two years old though, and, in many respects, B Corp status and the company’s decarbonisation have not got far beyond the planning stage.

The board is still fresh and unproven. Chief financial officer Sarah Pollard joined a year after the chief executive in 2021 and chairman David Tyler joined in November 2022. They are supported by a growing cadre of new senior managers recruited to beef up PZ Cussons environmental and marketing credentials.

A decade of contractions means it does not feel like PZ Cussons is building from a position of strength. But on the other hand, while muddied, the numbers suggest PZ Cussons has never been a bad business.

Investing by the numbers

The pandemic impacted year to May 2020 was PZ Cussons’ lowest ebb in the last 12 years, when it achieved a return on capital (RoC) of 15% compared to an average of 21%.

The numbers are clouded by disposals, which have impacted revenue negatively but helped the company’s finances, and the pandemic, which generated extraordinary revenue and profit from Carex but was negative for beauty brands like St Tropez.

Inevitably, as the pandemic has ebbed, so has demand for Carex, and other brands have recovered.

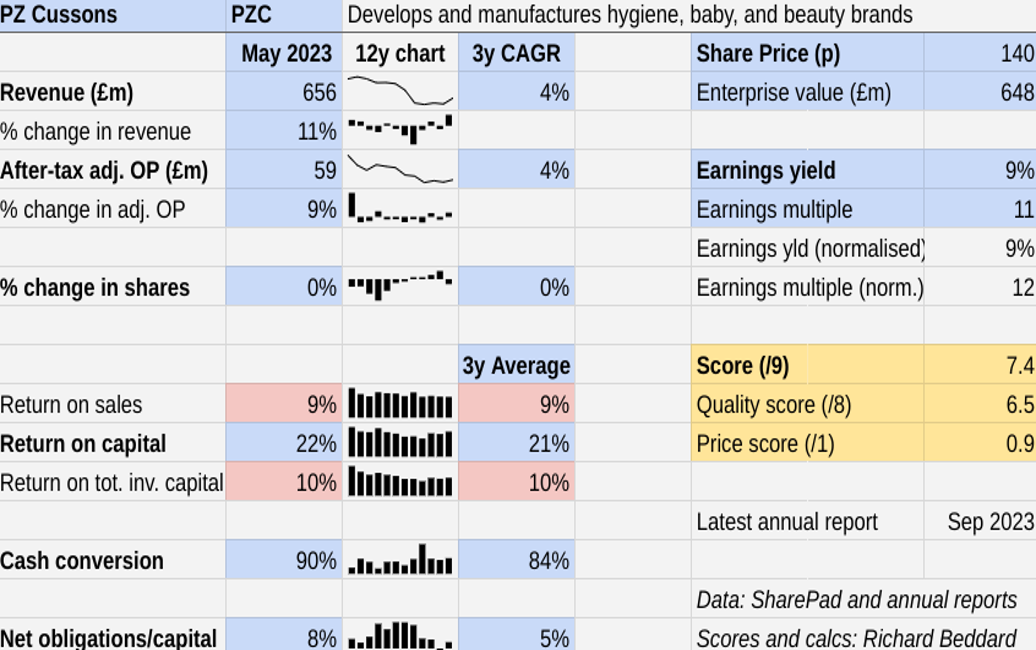

The charts in the table below show how PZ Cussons has performed over the last 12 years, but in the calculations the baseline is 2021, the year in which the current strategy was introduced.

Since then, the numbers look remarkably stable, with profit margins at 9%, return on capital hovering above 20%, and the company growing revenue at a three-year compound annual growth rate of 4%.

Sadly, next year that pattern will be broken.

Having simplified the Nigerian business, restored profitability and built up a £200 million cash pile there, albeit trapped by currency controls, the company experienced a dramatic devaluation in the currency when Nigeria switched from a fixed to a floating exchange rate.

Almost overnight it devalued by nearly 50%, and it has not recovered much since.

The Nigerian business represented 39% of revenue in 2023, and had the results been calculated with a 40% lower exchange rate, the company would have earned nearly £15 million less adjusted profit (20% less profit).

The value of the group’s cash at the year end, most of it in Nigeria, would have declined in value by about 32%.

Unsurprisingly, these numbers indicate PZ Cussons would have been less profitable and financially strong in 2023, but reassuringly it would still have been profitable and financially sound.

- Richard Beddard: a new score for my top 10 company

- The Income Investor: two dividend stocks with capital growth potential

Return on capital would have been 15% instead of 22% and all of the company’s financial obligations would have been worth 14% of operating capital instead of 5%.

Because the devaluation happened after the year end, its impact will be felt in lower profit and cash in the current year’s results, depending on what the average exchange rate is.

Now that the currency is floating freely, the impact of exchange rate fluctuations should be more gradual, and cash should be easier to repatriate.

I must admit I failed to give the risk of accumulating cash trapped by currency controls the attention it deserved last year.

If, as PZ Cussons believes, economic reform in Nigeria leads to economic growth, the prospects for business in a country with a large fast-growing population will have improved.

Compared to the impact of the Nigerian devaluation, it almost seems insignificant to mention the numbers are also confounded by adjustments relating to the company’s restructuring and impairments in the value of assets, most significantly perhaps to Sanctuary Spa.

Sanctuary Spa is a “Must Win” brand but its balance sheet value was reduced by £16.5 million in 2023 after a relaunch failed to meet expectations.

Scoring PZ Cussons

PZ Cussons is simultaneously easy to like and difficult to hold.

The focus on simplicity, innovation, people and purpose are commendable, but two or three very eventful years is not enough to be confident it is working.

Generally, where I have marked PZ Cussons down, it is not because of a failure of vision, it is because of the severity of the challenges it faces.

The Past (dependable) [2]

● Profitable growth: Business has contracted [0]

● Strong finances: Good cash conversion, low net financial obligations [1]

● Through thick and thin: In 12 years, RoC has not fallen below 15% [1]\

The Present (distinctive) [2]

● Discernible business: Big brands, strong purpose [1]

● With experienced people: Engaged employees, newish management [0.5]

● That creates value for customers: Increasingly distinctive and sustainable products [0.5]

The Future (directed) [2.5]

● Addressing challenges: Discounters, Internet competition [0.5]

● With coherent actions: Innovation, simplification, purpose [1]

● That reward all stakeholders fairly: Far sighted remuneration policy [1]

The price (discounted?) [0.9]

+ Yes. A share price of 140p values the enterprise at about £648 million, about 12 times normalised profit.

A score of 7.4 out of 10 indicates PZ Cussons is probably a good long-term investment.

It is ranked 23 out of 40 stocks in my Decision Engine.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in PZ Cussons

More information about Richard’s investment philosophy and how he implements it.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.