Richard Beddard: a share to own through thick and thin

26th August 2022 15:00

by Richard Beddard from interactive investor

This former ugly duckling has cemented its credentials as a profitable growth company. Richard Beddard assesses prospects for its attractiveness as an investment.

More than a decade of profitable growth has turned Solid State (LSE:SOLI), once a bit of an ugly duckling, into something of a stock market stalwart.

Now the company hopes to transform its Power division and international operations with a big US acquisition, spearheading another period of growth.

- Read about how to: Open a Trading Account | How to start Trading Stocks | Top UK shares

Diverse markets

Solid State’s subsidiaries Steatite, Active Silicon, and Customer Power manufacture ruggedised computers, battery packs, cameras, communications equipment and antennae supplying a wide range of industrial, healthcare, transport and defence customers.

It also distributes electronic components through subsidiaries Solid State Supplies, Pacer and Willow Technologies.

Growth on growth

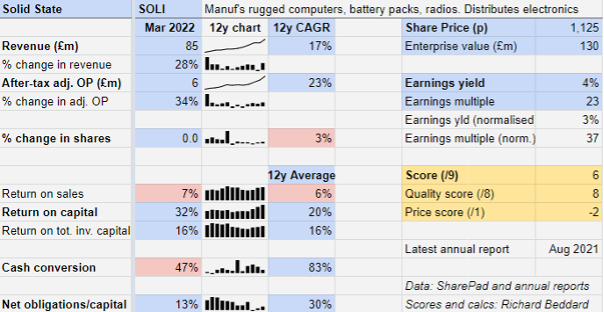

The company’s 28% revenue growth in the year to March 2022 was augmented by rapid growth from two acquisitions made towards the end of its financial year ending in March 2020. Excluding the new acquisitions, it grew revenue by 5%.

All being well, Solid State will receive a further boost from the acquisition of Custom Power last month. Because it happened after the year end, the acquisition is not reflected in the numbers in my table, which puts the year to March 2022 in the context of the last 12:

2022’s results were a significant improvement on 2021, which was an improvement on 2020. Return on capital of 32% was well above average, and the average of 20% shows Solid State has been a highly profitable business.

Over the past 12 years, acquisitions and endeavour have resulted in compound annual growth in revenue of 17%, and 23% compound annual growth in profit. That dwarfs the dilution of shareholders, required to fund the acquisitions. The compound annual growth rate of shares in issue for the year to March 2022 is 3%.

In cash terms, Solid State is also highly profitable, converting 83% of profit to cash in a typical year. 2022 was not typical though. The company stocked up and paid suppliers early to secure components. This used up more cash, reducing cash conversion to 47%.

Solid State has passed the test facing distributors and manufactures through two years of disruption by sourcing components and manufacturing products efficiently.

It has cemented its credentials as a profitable growth company. No doubt it has won the loyalty of customers old and new.

Although some orders have been delayed by supply hold-ups, the company says Covid-impacted industrial customers are recovering, governments are investing in defence technology, and recent acquisitions have increased its involvement in growth markets benefiting from the 5G roll-out and the proliferation of specialised electric vehicles.

Acquisition risks...

Solid State has made no secret of its desire to make bigger acquisitions, but as it does so it is paying fruitier multiples for bigger, more profitable companies. There is a risk the company might overpay, mitigated perhaps by the fact that it has successfully cut its teeth on many smaller acquisitions.

The basic rationale for acquisitions is that the whole is greater than the sum of its parts.

For example, in June, Steatite won a contract with Transport for London (TfL) to supply a CCTV system that monitors the platform edge on the Piccadilly Line. Newly acquired Active Silicon will supply much of the imaging technology.

In fact, the company says it underestimated the potential of Active Silicon and its other acquisition in 2021, Willow, part of the components business.

- 10 things to know about investing in volatile markets

- Richard Beddard: what will follow this UK share’s annus mirabilis?

As part of the larger group they posted like-for-like revenue growth of 45% and 26%, respectively (although there is an element of recovery from the pandemic in those figures too).

Large acquisitions are not only costly though, they can destabilise a business if, for example, they preoccupy management or the mothership has taken on too much debt to finance its purchases.

The complexity of businesses increases as they grow, requiring them to develop new strategies.

...And strategic shifts

Custom Power is near the opposite end of the scale from the small underachievers Solid State used to acquire earlier this century.

Its price tag will be between £32 million and £36 million, once the company has finished paying instalments and an earnout of up to £4 million (the precise amount depends on how Custom Power performs under Solid State’s ownership).

To put the price in perspective, it is more than five times as much as Solid State earned in 2022 in profit and cash terms. Custom Power earned $29 million in revenue in 2021. By comparison, Solid State’s Power division earned less than £9 million in 2022.

The company has avoided incurring too much debt by asking investors to stump up most of the cash through a discounted placing, but to my mind because of its size Custom Power is Solid State’s riskiest acquisition to date.

Risk works both ways, of course. If the acquisition is successful, the positive impact of such a large business will be disproportionate. As a manufacturing business it earns higher margins than Solid State’s distribution businesses, and being so big it might improve the group’s profitability ratios.

The company says Custom Power meets all the requirements of its strategy.

It manufactures specialised and semi-custom battery packs for companies such as Honeywell, Lockheed Martin and Philips Medical, which will provide new products for existing customers and new customers for Solid State’s existing power products made by its Steatite subsidiary in the UK.

Custom Power trades and manufactures in the US though, where Solid State is seeking to expand, and also uses contract manufacturers in Mexico.

In addition, Custom Power brings the group new engineering capabilities and owns its own brands, which tend to attract higher margins.

Semi-custom own brand products are a relatively new element in Solid State’s published strategy. They may be simplifying factors as the company grows because products that can be easily customised and sold are more efficient to make and can be designed into products more quickly than starting from scratch with each new customer.

It is a strategy followed to great effect by power adapter manufacturer XP Power Ltd (LSE:XPP) over the last decade.

Acquisitions will only add up to more than the sum of their parts though, if Solid State has a coherent vision of what it does.

The company specialises in difficult things, supplying equipment that is complex, hazardous, or requires data to be kept secure. Handling lithium batteries and sensitive data alike both require customisation, accreditations and specialist skills that reduce competition.

In distribution, Solid State adds value too by pre-configuring components ready for customer’s production lines and sourcing and storing obsolete products.

In both manufacturing and distribution, expertise is a major selling point.

Looking after employees and customers

Solid State’s growth through the pandemic is partly due to its strong finances, which enabled it to stock up and secure supply. This and the fact that it has been able to mitigate the impact on cashflow by receiving payment from some customers early, shows the strength and flexibility of its relationships.

To support international expansion and enable it to remain at the forefront of technology, the company sees the recruitment and training of employees as a strategic imperative.

It is raising pay by at least 5% in the current financial year and has also pledged a one-off payment to help with energy bills. Without putting a number on it, the company claims low staff turnover.

Solid State’s biggest impact on the environment comes from shipping components and products, but these emissions are hard to quantify so the company has yet to calculate the impact. As a preliminary measure, it says it is exploring the possibility of shifting more inbound freight by sea, rather than air.

Scoring Solid State

I like Solid State. It quietly went about building manufacturing and customisation capabilities in the UK, doing the difficult work that could not easily be exported, while many companies offshored.

Now customers are looking to source components and equipment closer to home, it may benefit.

Whatever the future holds though, Solid State is a well-managed and diversified business. I believe it should prosper through thick and thin.

Does the business make good money? [2]

+ High and improving return on capital

? Modest profit margin

+ Strong cash conversion

What could stop it growing profitably? [1]

+ Strong finances

? Complexity of business may hinder growth

? Big acquisitions are more risky

How does its strategy address the risks? [2]

+ International expansion

+ Focus on own brands and more scalable semi-custom products

? Smaller acquisitions have added value, hopefully a big one will too

Will we all benefit? [2]

+ Experienced chief executive is a significant shareholder

+ Invests in people and know-how

+ Communicates well with shareholders

Is the share price low relative to profit? [-2]

+ No. A share price of £11.35 values the enterprise at about £131 million, about 37 times normalised profit.

A score of 5 out of 9 indicates Solid State is a good business, but its attractiveness as an investment is reduced by the share price.

My normalised profit figure may be too conservative, though. It is extrapolated from the 12-year average of 20% return on capital. Solid State has been more profitable than that in recent years and if it can sustain current levels of profitability it will be a more attractive investment.

Based on 2022’s number, Solid State’s share price is about 23 times profit. In using normalised profit in my score I have erred on the side of caution.

Solid State is ranked 35 out of 40 stocks in my Decision Engine.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in Solid State.

For more information about Richard’s scoring and ranking system (the Decision Engine) and the Share Sleuth portfolio powered by this research, please read the FAQ.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.