Richard Beddard: a share with a lot on its plate

Portmeirion may be a good long-term investment, but it might not be a comfortable one.

19th June 2020 15:37

by Richard Beddard from interactive investor

Portmeirion may be a good long-term investment, but it might not be a comfortable one, believes our companies analyst.

Portmeirion's (LSE:PMP) plans to spend the 10 million-or-so pounds the company raised by selling new shares to investors earlier this month, is a vigorous response to challenges old and new.

The company famously manufactures classic British tableware like Portmeirion Botanic Garden and Spode Christmas Tree, venerable designs that sell well abroad as well as at home (Botanic Garden appeals to South Koreans, while Americans buy Christmas Tree).

In 2017, Portmeirion diversified into home fragrances through the acquisition of Wax Lyrical, and last year it bought Nambé a designer of tableware and kitchenware that takes its cues from the Native American villages of New Mexico.

Inspired by pueblos: Nambé. Source: Portmeirion annual report 2019

Ten years ago, Portmeirion was a straightforward proposition. It had a fantastically popular design (Botanic Garden) and, during the Great Financial Crisis, it had bought two other famous, but less well managed ceramic brands, Spode and Royal Worcester, out of administration.

Owning Portmeirion shares required faith that it could increase the popularity of Botanic Garden and newer ranges based on patterns licensed from designers like Sophie Conran, while continuing the revival of Spode and Royal Worcester. Owning Portmeirion today, requires faith that it can still do these things, and quite a lot more.

Spending priorities

The first two of five bullet points itemising what Portmeirion will spend the new money on shows how much things have changed.

First, Portmeirion wants to improve the next-day delivery capability of its warehouse, which serves online customers of the company’s own websites and Internet retailers. Prior to the Covid-19 pandemic, online sales had risen to 30% of total sales in the UK and the USA (Portmeirion’s two biggest markets).

The pandemic has accelerated the trend. In April 2019, when physical stores were closed, online sales through Portmeiron’s websites were double their level a year earlier.

Second, Portmeirion wants to extend the Wax Lyrical production line to produce a new product category: sanitisers and soaps. In response to the pandemic, Wax Lyrical has already repurposed its candle filling line to fill bottles with sanitiser premixed in a tent erected on the side of the factory.

The knowledge Portmeirion gained has given it the confidence to create a range of relatively highly priced scented soaps and lotions, giftware primarily, like Crabtree and Evelyn.

The other three spending priorities are more humdrum. Portmeirion’s Canadian distribution partner has lost interest and Portmeirion will probably buy it out.

The company also plans to improve manufacturing efficiency. The extent it can do any of these things successfully must depend on a fifth intention: to maintain a strong balance sheet.

That depends on how the pandemic progresses. While many of us are staying at home and staring at shabby crockery, the economic consequences of the virus may prevent us from splurging on fancy new dishes.

Portmeirion went into the pandemic with a weaker balance sheet than usual, having splurged on Nambé and doubled capital expenditure to supply over a thousand new and exclusive products for its South Korean distributor.

Large increases in stock and receivables, which the company expects to unwind, also hobbled cash flow, and Portmeirion swung from a modest net-cash position to substantial net-debt at the year-end in December.

Money well spent?

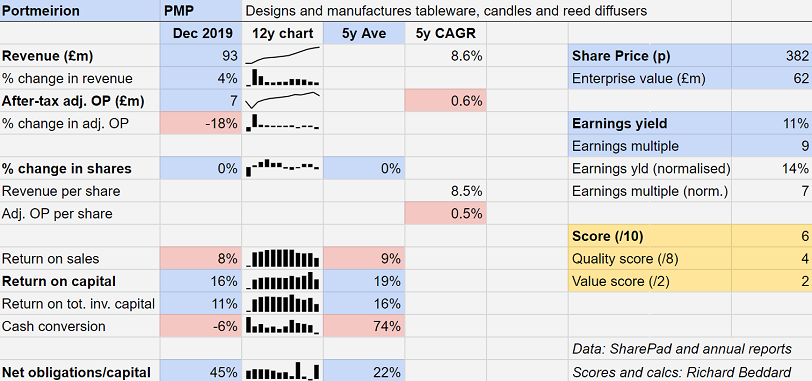

The company is pushing forward on many fronts, but it is hard to tell whether the money it has already spent was well spent. Over the last five years, revenue, aided by acquisitions, has increased at a compound annual growth rate (CAGR) of just under 9%, but profit increased just 0.6% CAGR.

There are at least two culprits, South Korean sales, which have been declining since 2014, and Wax Lyrical, Portmeirion’s first big diversification, which may be a ‘diworseification’.

In South Korea, Botanic Garden is highly prized, which has brought Portmeirion’s distributor there into competition with distributors elsewhere who, against Portmeirion’s terms, are flooding the South Korean market.

Despite refusing to supply some distributors, Portmeirion has been unable to completely shut this trade down, which is why it is developing exclusive products for its South Korean distributor.

Perhaps 2020 will be the year the strategy pays off. It needs to because sales of Botanic Garden may be falling. The company doesn’t always give precise numbers, but in 2019 it disclosed sales of “over £25 million”. In 2015, Botanic Garden earned Portmeirion £33 million.

Likewise, scented candles and reed diffusers. In 2015, its last year of independence, Wax Lyrical earned £13.8 million revenue and operating profit of 2.1 million.

The operating profit margin was 15%. The figures for 2019 are less encouraging. Home fragrances earned Portmeirion revenue of £14.8 million, but operating profit was £1.1 million. The operating margin was 7%.

Portmeirion hoped to make Wax Lyrical popular overseas but progress has been slow. The company says it has established new export markets that should ‘come to fruition’ in 2020.

They need to. Wax Lyrical cost Portmeirion £18 million. Growing from a base of £2 million annual operating profit it might have been a good investment. At £1 million, we’re looking at 18 years just to cover the cost.

Last year, Portmeirion paid £9.4 million for Nambé, which contributed £31,000 in post-tax profit between July and December. It’s got quite a bit to do to make this acquisition work too.

Strategic shift

Portmeirion’s heritage is in design and it still maintains that products and brands are its "key economic drivers", although it is placing much less emphasis on their Britishness, and it is pushing many more products and brands.

In a more globalised and competitive world, scale and distribution appears to be the big challenge. It’s too early to tell whether Portmeirion will be a winner or loser as customers switch to the Internet.

The company has an opportunity to reach more of them, but it must develop new capabilities in marketing and fulfilment.

The Internet also gives customers more choice and makes it easier for them to compare prices. Portmeirion is proliferating products and brands because scale, it believes, will make distribution more efficient: it can sell more products to more customers at proportionally less cost.

Establishing scale comes at a cost though, and I’m not sure that it has been worth it.

When the way a company needs to change doesn’t flow from the things it’s already good at, I feel anxious, and my anxiety is reflected in Portmeirion’s score:

Does the business make good money? [1]

? Adequate returns on capital and cash conversion most years

? Trending lower recently

What could stop it growing profitably? [0]

- High fixed costs impact profitability in recessions

- Heightened competition due to Internet and leakage between markets

? Venerable brands not growing

? Cost and potential of acquisitions

How does its strategy address the risks? [1]

+ Investment in online and fulfilment capabilities

? Investment in new products to maintain appeal of existing brands

? Acquisitions to make more efficient use of distribution channels

? Proliferation of distribution channels (direct, retail, distributors)

Will we all benefit? [2]

? Board members have modest/very modest shareholdings

? Committed to paying the National Living Wage

+ Values long service. New CEO and FD were internal appointments.

+ Investors in People gold level accredited

+ Share option/bonus schemes for staff

Are the shares cheap? [2]

+ A share price of 382p values the enterprise at about £62 million, about nine times adjusted profit.

A score of 6 out of 10 suggests the company may be a good long-term investment, but it has a lot on its plate so it’s not a very comfortable investment.

Portmeirion is ranked 24th out of 32 shares in my Decision Engine.

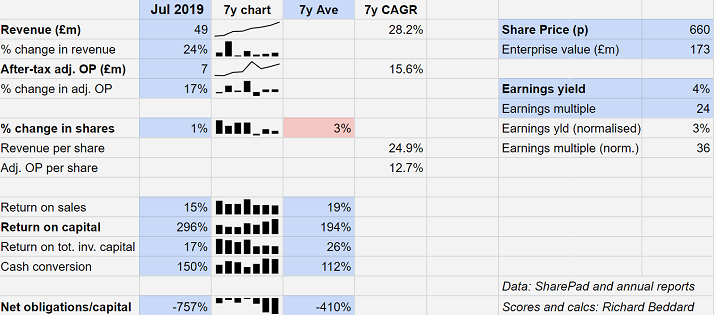

Seven years of Tracsis

I’m getting closer to scoring Tracsis (LSE:TRCS), which I profiled in March. Tracsis provides software and services to the transport industry. Having laid out the results for many years and adjusted them to check 2019 was no fluke, I’ve established it wasn’t:

2020 will bring its own challenges, but expect a score from me soon.

Richard owns shares in Portmeirion.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.