Richard Beddard: scoring a music stock with Beatles connections

Being For The Benefit of Focusrite - plus a reader question on Dewhurst.

19th February 2021 14:45

by Richard Beddard from interactive investor

Being For The Benefit of Focusrite - plus a reader question on Dewhurst.

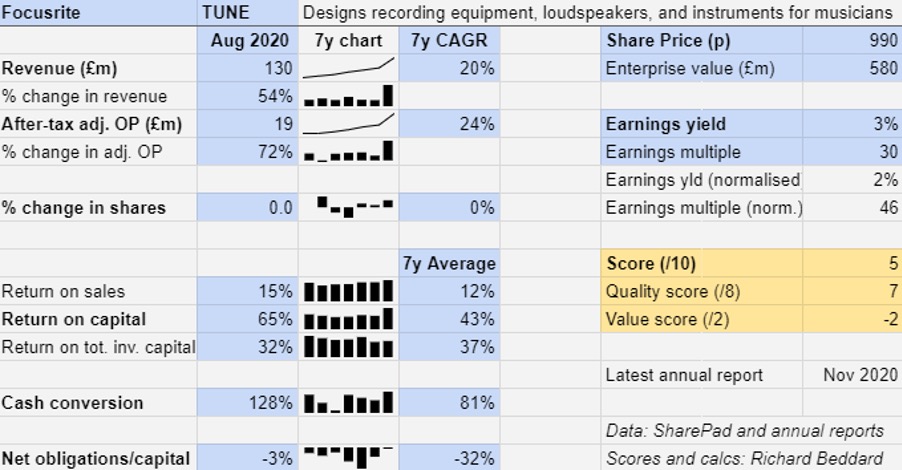

This is the first time I have scored Focusrite (LSE:TUNE), a company with a perfect stockmarket ticker code: TUNE. It makes recording equipment, loudspeakers, and instruments such as synthesisers and grooveboxes for making electronic music.

Clear vision

The striking thing about Focusrite is the clarity of its vision, which underpins everything it does. Its goal is to remove barriers to creativity. It does this by making its products easier to use, through ‘plug and play’ functionality, strong online capability and good technical support. It caters to enthusiasts, and knows there is no better way to deter new ones than to make the kit finicky.

Focusrite mostly makes hardware, but its Ampify music creation apps get beginners playing with samples on their mobile phones and computers, some of whom become hardware customers. It is growing the market by making more musicians.

The first Focusrite product was a module for a mixing desk built in the 1980s at the request of Sir George Martin (pictured above), former producer and ‘fifth member’ of the Beatles. The company went on to manufacture the lauded Focusrite Console, but the giant analogue mixing desks used by studios quickly gave way to digital processes controlled by computers.

Focusrite adapted, embracing the explosion in home recording with products such as Scarlett, which is reputed to have a very large market share, and Clarett, an upmarket sibling. Like the console modules Focusrite started making, Scarlett and Clarrett use microphone preamplifiers to boost the signal of the music we play for recording. The much smaller (in terms of sales) Focusrite Pro brand still caters to professional recording studios.

In 2004, Focusrite bought synthesiser company Novation. In 2014, it floated on the stock market and then Focusrite acquired ADAM Audio and Martin Audio in 2019. ADAM Audio makes studio monitors (speakers) and is famed for its air-motion transformer tweeter, but its product range also embraces the bedroom producer. Martin Audio makes loudspeaker systems that are installed anywhere music is played, from coffee shops to auditoria and places of worship.

The two recent acquisitions were substantial but mostly self-funded. Focusrite paid for ADAM in cash, and the debt used to part-fund the Martin Audio acquisition was repaid by the end of the same financial year in August 2020.

Despite the impact of Covid 19, which reduced sales at Martin Audio, both companies earned high profit margins in 2020 (before central distribution and administrative costs).

Judging by Focusrite’s rhetoric and the apparent quality of these businesses, it is seeking to acquire respected firms it should be able to grow as separate entities.

The two acquisitions were not obvious bargains though. At over £15 million, ADAM cost more than 15 times profit before tax. At nearly £39 million, Martin Audio cost more than 13 times profit before interest and tax.

Focusrite did very well during the pandemic, as locked down musicians recorded more music. It also found a burgeoning market in podcasting, and artists embraced Zoom and other methods of performing online.

Buoyed by acquisitions and the impact of the pandemic, Focusrite’s performance is even more impressive than it has been since in previous years:

Excluding the acquisitions, Focusrite grew revenue 21%, mainly due to the launch of the third generation of its popular Scarlett recording unit. Profit margins are improving as Focusrite sells more products direct from its online store, or direct to dealers rather than through distributors. The company’s growth in cashflow was even more remarkable than profit growth because it sold so much stock.

In a trading update published today (19 February), the company says it expects to earn revenue of more than £90 million in the half-year ending at the end of February, more than £30 million more than the same period a year earlier.

Scoring Focusrite

I know nothing of preamplifiers, let alone grooveboxes. My music playing days ended with the recorder in primary school and my experience of recording got no further than the tape-to-tape cassette players we used to edit out the presenters from recordings of Top of the Pops. So I rely on the buzz around the products to decide whether they are any good.

Music and review sites give a strong impression of respected and coveted brands. Trawling YouTube for videos of its founder and executive chairman Phil Dudderidge and chief executive Tim Carrol creates a good impression too.

Dudderidge started out as a sound engineer, founded a company that made consoles and mixing desks and sold it to its US distributor. Then he bought the assets of Focusrite in 1989 with some of the proceeds.

An Interview with Carroll on the US National Association of Music Merchants website establishes his bona fide status. Twenty years a session and touring keyboardist, he switched to selling kit in the late 1990s.

A 2014 YouTube homage to the famous Focusrite Studio Console (mixing desk) includes interviews with some of the people who designed and built it twenty years earlier. One is Focusrite’s technical director, who according to LinkedIn still works there. Enlightened employment policies and its industry leader status probably mean Focusrite’s pool of skilled and experienced employees is deep.

Both the chairman and the chief executive have sold shares in recent months. Dudderidge’s holding reduced by nearly 3%, but he still owns over 33% of the shares. While they may have been motivated to sell in part by the soaring share price, I doubt the sales are a reflection on the long-term prospects of the business.

That is pretty much how I view Focusrite. It is a good business with a great past, and it explains itself well, but I am not sure about the price.

Does the business make good money? [2]

+ Decent profit margins

+ High returns on capital

+ Good cash flow

What could stop it growing profitably? [1]

+ Popular brands resistant to competition

? Acquisitions may reflect limited organic opportunities

? Cost of acquisitions may not be justified by returns

How does its strategy address the risks? [2]

+ Innovation: Spends 7% of revenue on R&D

+ Commitment to lifetime customer support

? Acquiring high quality businesses it can grow

Will we all benefit? [2]

? Focused on end customer: High net promoter score (+75)

? Chairman is major shareholder, experienced management

? Generous benefits, rated highly by staff

Is the share price low relative to profit? [-2]

? A share price of 990p values the enterprise at about 46 times normalised adjusted profit, and 30 times adjusted profit in 2020.

A score of 5/10 means Focusrite may well be a good long-term investment even at the current heady share price.

But according to my Decision Engine there are 27 shares that score more highly.

Dewhurst’s spread

Ian Oxley, a reader, emailed me about Dewhurst (LSE:DWHT)’s spread. At the time, interactive investor was quoting a price to buy of £18.50 per share, and a price to sell of £17. He wanted to know whether I factor spreads into my scoring system, and wrote that it was putting him off buying the shares.

The spread is the difference between the buy price and the sell price. For most companies the difference is tiny, but it can yawn wide for shares that are not traded much.

Dewhurst’s spread was 8% of the buy price, a 4% deviation from the mid-price used to calculate a share’s price multiple in the Decision Engine, which is insufficient to affect the score significantly.

I can understand the hesitancy to trade though. If we were to sell the shares immediately after buying them and the price had not changed, we would incur an 8% loss. But when I add a share to the Share Sleuth model portfolio I do not intend to remove it immediately.

In the Share Sleuth portfolio, I add shares with the intention of holding for 10 years or more. Over that time I would expect them to double at least. It does not always happen, sometimes they go down, but over the last 12 years the aggregate performance of the portfolio has been much better than that.

Dewhurst is a good example. I added it to the portfolio on 9 September 2009 and again on 31 January 2011. I have never reduced the portfolio's holding. You can see what happened next in this chart:

Including dividends the return from the investment has been 555% - marginally better than the return on the whole portfolio (517%). In that context I am glad I did not worry about the spread.

For people who routinely trade shares for smaller gains, I doubt Dewhurst is attractive because the cost of the spread would form a greater proportion of subsequent gains or losses, which is perhaps one of the reasons we hear so little about it.

Richard owns shares in Dewhurst. He wishes he had taken the trouble to investigate Focusrite a few years ago. Maybe he will get the opportunity to become a shareholder in the future.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.