Richard Beddard: this £2bn company is a winner and good value

One of the country’s biggest companies also happens to be one of our columnist’s favourite businesses. It manages the things it can extremely well and he thinks it’s probably a good long-term investment.

6th October 2023 15:01

by Richard Beddard from interactive investor

When I wrote recently about focusing more intently on “The Crux” - a strategic challenge that if resolved offers big rewards (or conversely if unresolved may undermine the investment case) - I received an email from SM saying: “So Jet2’s Crux will be ‘how do we address the impact of climate change on our business?’. That one should keep you busy for a while.”

- Invest with ii: Top UK Shares | How to Start Trading Stocks | Open a Trading Account

I struggle with calamitous risks. I ignore the possibility of war, plague and so on, believing them to be both unlikely, unpredictable, and, usually, not as calamitous as people think. Covid-19, for example, scared most of us for a while, and the model Share Sleuth portfolio I manage here on interactive investor prospered because I did not allow it to influence my decisions, not even concerning Jet2 Ordinary Shares (LSE:JET2), whose planes were grounded while the portfolio continued to hold the shares.

Unlike the other existential threats I mentioned, the scientific consensus is that global warming has been happening for a long time and the impact is not transitory (at least not in my lifetime!).

SM is right, investors in air travel cannot ignore climate change, and I have been busy trying to reconcile one of my favourite businesses with its uncertain future.

Mission accomplished

When I scored Jet2 last year, I recognised that climate risk outshone other risks, like competition and recession, not just because it is potentially calamitous, but also because to my mind the competition issue is settled.

Online travel agents (like On The Beach Group (LSE:OTB)) and low cost airlines (like Ryanair) are competitors, but in growing from nothing to the largest UK tour operator since its package holiday business was founded in June 2007, Jet2 has more than demonstrated its competitiveness.

I witnessed this when I returned from Turin only a few weeks ago, when a Jet2 representative was gathering up passengers just after passport control. Sadly, as my delayed flight spewed out weary travellers in the early hours of the morning, I was not one of them.

Feet on the ground is one way Jet2 differentiates itself from other tour operators and airlines that fly holidaymakers. The degree of vertical integration - it owns most of its own planes - gives it a high degree of control over seat supply and quality of service. Its family friendly focus - it flies at reasonable times and offers generous baggage allowances - and its near-blanket coverage of British regional airports, has allowed it to prosper by putting customers first. Next March, it starts flying from Liverpool, its 11th UK base.

- Share Sleuth: the big ballsy contrarian decision I’ve made

- Stockwatch: are 10% yields in this sector an invitation or warning?

The fact that Jet2 has achieved pre-eminent status is not just reflected in the financial results, it is reflected in its ATOL licence, which allows it to fly more passengers than any other tour operator, a slew of awards from Which? and review sites, Net Promoter Scores of over 70 (meaning customers highly recommend Jet2), the highly rated mobile app (built in-house), and the positive press it received for refunding cancellations during lockdowns.

Being big has brought new advantages, for example, the frequency of Jet2’s flights means it can offer greater variability of holiday duration and destination.

The Climate Crux

Jet2 wants to become the leading brand in sustainable air travel and package holidays, but it currently does this mainly through emissions trading and carbon offsets, which account for every tonne of carbon it emits but are much less effective than simply not creating emissions in the first place.

Although offsets are better than nothing - they fund renewable energy projects - Jet2 is taking steps to reduce emissions directly. As promised, it has invested in a Waste-to-Fuels plant, Fulcrum NorthPoint, which should begin production by 2027 and reduce the airline’s emissions by 400,000 tonnes of CO2 over the 15-year term of the agreement with the plant’s developer.

The aviation industry hopes such Sustainable Aviation Fuels (SAFs), which can reduce emissions by up to 80% compared to aviation fuel but need to be blended with it, will give the industry time for other sustainable technologies to develop. But production needs to be geared up enormously, and opinions differ on whether that is even feasible.

Jet2’s total scope 1 and scope 2 emissions in the year to March 2023, 99% arising from aircraft operations, were over 2.6 million metric tonnes of CO2, so perhaps the NorthPoint investment and the promised reductions are best described as “a start”.

- Q3 results preview: profit expectations and an upgrade for UK stocks

- Merryn Somerset Webb: a commodities supercycle like never before

Jet2 is also lobbying for an Air Traffic Management reform initiative known as “Single European Sky”, and for the modernisation of UK airspace, which will enable more fuel-efficient routes.

And a large order of new more efficient planes, and programmes lightweighting and streamlining planes, will also help.

An indication of how seriously Jet2 takes climate change risk may be contained in the risk management section of its annual report, where it is identified as the most significant of all high-likelihood/high-impact risks.

Slightly unnervingly though, the report says the pace of technological advancement, such as the development of Sustainable Aviation Fuel, and improvements in aircraft efficiency is slow, and, the company, which excels when it is in control, reveals that that in this respect it is dependent on government, which it says is not investing meaningfully.

Jet2 would like the government to ringfence the money it spends on carbon taxes to fund decarbonisation of the aviation industry, for example to fund the development of SAF production. But even more radical solutions are required in the long term, perhaps involving currently undeveloped technologies like hydrogen and carbon capture.

What 2023 tells us about the future...

The year to March 2023 was an incredible year for Jet2, almost as incredible as the previous two years when the company lost large amounts of money, but this time in a good way.

Enabled by its decision to retain staff through the pandemic, Jet2 earned 40% more revenue and 39% more profit than it did in the year to March 2020, the last pre-pandemic year.

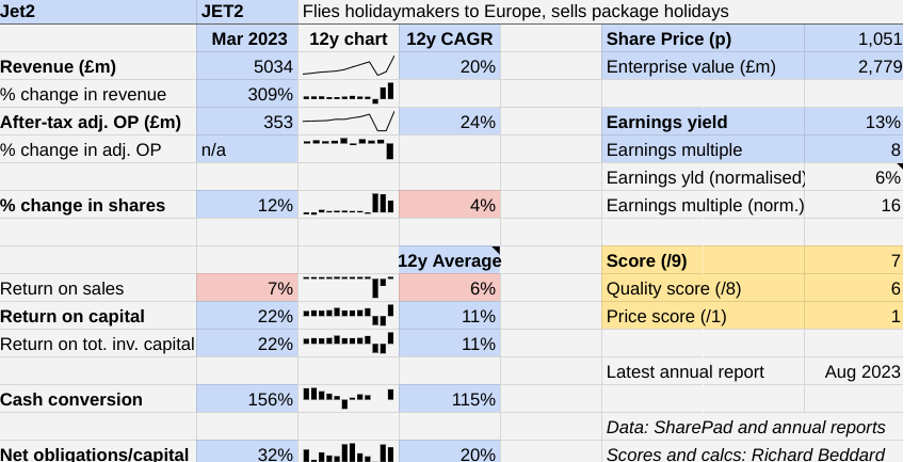

Return on capital was an unprecedented 22% and Jet2 converted 156% of profit into cash.

It flew 11% more passenger sectors (i.e. individual journey legs) than it did in the year March 2020, the previous record year. According to OAG, a travel data company, it was the only UK airline not to cancel flights during the highly disrupted summer of 2022. There were delays though, as airports, who had cut ground staff, failed to meet demand.

Jet2’s results have been so wild, it is difficult to imagine what a typical year might be. March 2022 to March 2023 was a great reopening when people returned to travel after two years stuck in the UK.

I use averages over a long period of time to judge a company’s performance but the impact of the pandemic, which grounded planes repeatedly for months at a time, may mean the average is tainted. In the previous 15 years, the most disruptive event was the eruption of Eyjafjallajökull, an Icelandic volcano that threw an ash cloud over Europe and resulted in a six-day airspace ban.

I do not believe 6% return on capital, the average profitability Jet2 has achieved over the last 12 years, fairly represents Jet2’s earning power in future.

- The four FTSE 100 income stars returning big money in October

- Autumn Statement 2023 preview: what might Jeremy Hunt have in store?

Jet2 is in a stronger position now than before the pandemic. Not only has it become the leading package tour operator, but these high-margin holidays have increased as a proportion of revenue, to 70% of all bookings in summer 2023.

On the other hand, climate change, and our efforts to mitigate it, could disrupt the business. Wildfires this year have shown us how inhospitable Jet2’s Mediterranean destinations can be in a warming world. Some people are already flying less as a matter of conscience, and governments are likely to impose higher costs on polluters as the reality of climate change asserts itself.

So much of the investment case depends on these imponderables, I have hedged my bets by using the 11% average return on capital for the eight-year period to March 2020 as my estimate of future profitability.

In other words, I am treating the pandemic as a one-off event, and I am guessing that the potential negative impact of climate change on profitability negates the fact that the company is more competitive than ever.

Scoring Jet2

Set against the imponderable future is the fact that Jet2 is a winner. It manages the things it can extremely well, often by bringing them in-house.

Although founder and chairman Philip Meeson has retired from the board (he remains an adviser), the company is run by very experienced executives, chief executive Stephen Heapy and chief financial officer Gary Brown.

Its customer focus starts with employees as part of what it describes as a “People, Service, Profits” ethos. Employees were retained during the pandemic, albeit on reduced pay, and participate in share-save and profit-share schemes.

These and many training initiatives make Jet2 an attractive employer. It claims the highest rating from recruitment site Glassdoor in the industry, and in 2023 received 140,000 job applications (it took 5,800 of them on).

Typically, Jet2 took over security referencing for new applicants after the third-party provider failed to cope with demand in summer 2022, causing staffing shortages. It is a small part of a complex risky business, but the company’s explanation says a lot about the way it conducts itself.

By ensuring it controls the process, the timely provision of airside passes means new colleagues “are able to provide our award-winning service to our customers considerably quicker than before”.

Does the business make good money? [1]

? Highly variable return on capital

? and profit margin

? and cash conversion!

What could stop it growing profitably? [1]

? Recession

+ Competition

? Climate change

How does its strategy address the risks? [2]

+ Vertical integration

+ Service culture

? Sustainability strategy requires new technologies

Will we all benefit? [2]

+ Experienced board

+ Looks after employees

+ and customers

Is the share price low relative to profit? [1]

+ Yes. A share price of £10.51 values the enterprise at about £2.8 billion, about 16 times normalised profit, where normalised profit is derived from the average return on capital between March 2011 and March 2021.

A score of 7 out of 9 indicates Jet2 probably is a good long-term investment.

It is ranked 30 out of 40 shares in the Decision Engine.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in Jet2

More information about Richard’s investment philosophy and how he implements it.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.