Richard Beddard: numbers only tell half the story at this top-ranked stock

10th September 2021 15:47

by Richard Beddard from interactive investor

Our ‘Decision Engine’ columnist tackles this top-scoring industrial business engaged in a turnaround.

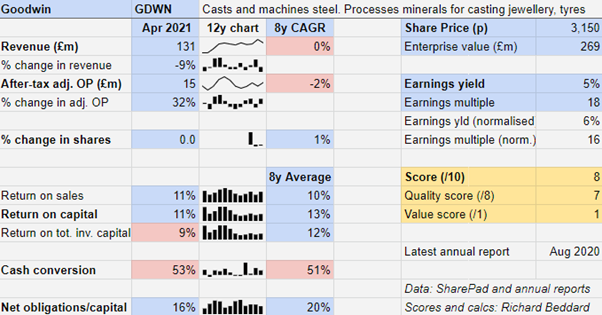

Judging by the numbers, Goodwin (LSE:GDWN) is currently not a particularly remarkable business or necessarily undervalued. However, I believe the numbers only tell part of the story.

The company’s attraction as an investment lies in the actions of management, which is turning around unprofitable businesses and keeping the profitable ones healthy.

A tale of two turnarounds

The problems lie in the Mechanical Engineering half of the business, which is the only UK company that can cast high performance alloy in sizes of up to 35 tonnes. I believe it is one of only a handful of companies worldwide that can do this.

Much of the output of its foundry, Goodwin Steel Castings, is destined for its machine shop, Goodwin International, which is suffering losses due to the declining oil and gas industry.

The company is seeking to replace falling revenues from products like check valves, which control the flow of oil in pipelines. Reduced investment by oil companies since the oil price crash of 2015 has been exacerbated by a scramble by the same companies to invest in green energy.

Goodwin has pivoted into the military and nuclear sectors by winning orders for components for nuclear propulsion systems and nuclear waste containment boxes.

The first nuclear waste containment boxes have been delivered by Goodwin Steel Castings to Goodwin International for machining and assembly when they will begin the fulfillment of the largest order in the company’s history.

Winning these orders has taken years, and the company expects its naval and nuclear programmes to span decades.

- Check out our award-winning stocks and shares ISA

- Read more of our content on UK shares here

- Richard Beddard: can this firm keep delivering magic for investors?

Another Goodwin business involved in a protracted turnaround is EASAT. Formerly a supplier of mechanical components (antennae) for air traffic control systems, the company has spent the last five years developing full-blown systems using the software and sensor capabilities it acquired with NRPL in 2016.

Vertical integration is a strategy favoured by most of the company’s many subsidiaries and the sale of a system is worth ten times the components Goodwin would have supplied for it, the company says.

Although the pandemic has reduced demand for air traffic control equipment, Goodwin expects to make more sales in the Far East following the commissioning of two systems in 2021.

Improvement in the numbers

The question is, can Goodwin return these businesses to decent levels of profitability and the group to high levels of profitability, without suffering sustained reversals in its many other businesses.

Before 2015 it was not uncommon for Goodwin to achieve a 20% return on capital. Since then it has managed about 10%, which is viable, but by no means remarkable.

The numbers this year offer some reassurance.

The fact that Goodwin has not grown revenue or profit since its heyday in the middle of the last decade is perhaps less remarkable than the fact that it has not contracted as it has reorientated the Mechanical Engineering business away from oil and gas.

In the year to April 2021, Goodwin earned 32% more profit despite a 9% decline in revenue. It lifted return on capital from 9% to 11%.

The company explains in its annual report that new naval and nuclear contracts are beginning to pay off. A surge in profit from the Mechanical Engineering division was “a result of the higher margin contracts for nuclear decommissioning and naval vessel building programmes starting to ramp up as compared to the margins available in the declining oil industry”.

Weak cash conversion over the last eight years is explained by the investment required to re-equip Goodwin’s foundry in Stoke, enabling it to cast in larger sizes, and many other investments.

Goodwin was quick to recognise the challenges it faced at Goodwin International and EASAT, and the strategies it has employed probably address them.

But through no fault of Goodwin, things are moving slowly because of the time it takes to accredit new and highly technical products, which has been exacerbated by delays due to the pandemic .

Meanwhile, Goodwin has its fingers in lots of other healthy pies.

Also in the Mechanical Engineering division Goodwin says it is generating more income from servicing its well established fleet of submersible slurry pumps in operation in mines around the world.

Submersible pumps contributed 14% to profit in 2021, and thanks to high mineral prices, Goodwin expects substantial investment from its customers.

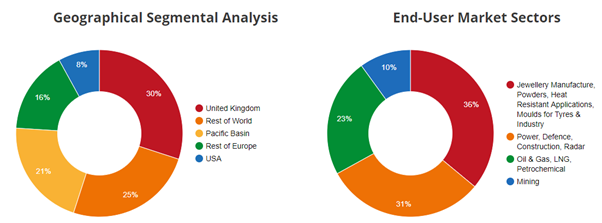

Source: Goodwin

The other half of the business, Refractory Engineering, made a record profit in 2021. It has been growing in recent years as the company has made acquisitions, vertically integrated operations, and innovated.

Refractory Engineering supplies minerals, primarily used in the casting of jewellery and tyres, but also in many other niche applications. Goodwin says sales of fire extinguishers made by a subsidiary, Dupré, are gaining momentum. They contain a mineral, vermiculite, processed by Dupré and also used in insulation and friction brake linings.

- Shares for the future: taking on the Decision Engine critics

- 10 speculative high-flying stocks beating the market

- Open an ISA with interactive investor. Click here to find out how

- Read more Richard Beddard articles here

It is one of many examples of Goodwin’s industry and entrepreneurialism. Another that may pay off further in the future is the company’s investment in a production process for high temperature polymers. It would open up yet another materials market to Goodwin.

Scoring Goodwin

Any business refocusing on new markets is taking risks, however Goodwin has a long pedigree, having reorientated the business to supply the military during two world wars and as the age of steam gave way to the age of oil.

It is currently run by the sixth generation of the Goodwin family and with the workforce it has nurtured over the decades it has great engineering and entrepreneurial expertise.

While owning so many subsidiaries makes Goodwin a complicated business, its large board should help manage that complexity.

Does the business make good money? [1]

? Recent returns on capital undistinguished

? Weak average cash flow

+ Potential for improvement in both

What could stop it growing profitably? [2]

+ Nuclear and military contracts less cyclical

+ Strong finances

? Complex business

How does its strategy address the risks? [2]

+ Diverse industrial and geographical markets

+ Vertical integration of both divisions

+ Focus on markets where competition is limited

Will we all benefit? [2]

+ Goodwin family owns more than 50% of the shares

+ Experienced management and workforce

? Need to keep an eye on incentives

Is the share price low relative to profit? [1]

+ A share price of £31.50 values the enterprise at about £269 million, about 18 times adjusted profit.

A total score of 8 out of 9 suggests Goodwin shares are a good long-term investment.

If Goodwin’s new business lifts profitability, shareholders should be rewarded more handsomely than they have been in the recent past.

I think Goodwin is one of those “heads I win, tales I do not lose” stocks, with the coin weighted towards “heads I win”.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in Goodwin

For more information about Richard’s scoring and ranking system (the Decision Engine) and the Share Sleuth portfolio powered by this research, please read the FAQ.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.