Richard Beddard: a new ranking for one of my favourite stocks

This small company’s financial numbers have gone the wrong way, but our columnist likes the business and believes this is probably temporary. Here’s why he scores it 9 out of 10.

15th December 2023 14:27

by Richard Beddard from interactive investor

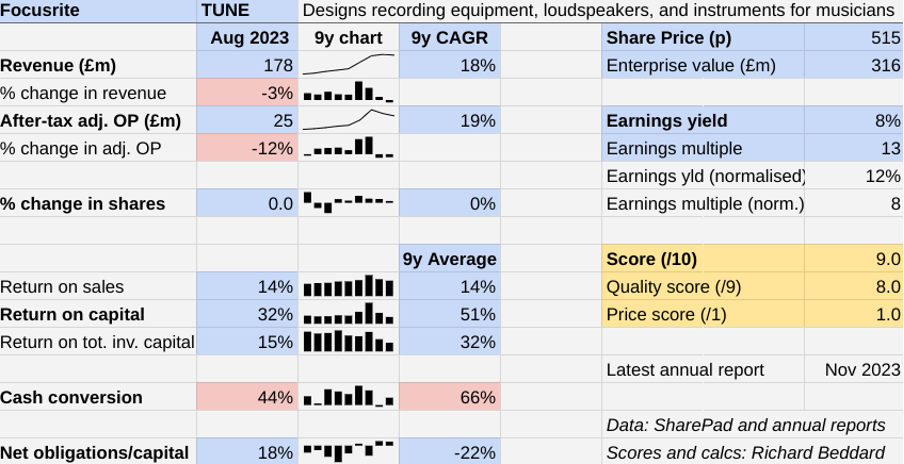

Two years of lower profits have removed some of the lustre from Focusrite (LSE:TUNE)’s numbers, but that is no reason to give up on the business.

Focusrite invents technology for audio artists, from bedroom beat makers to bands, podcasters to broadcasters, and Sydenham to Sydney. Its biggest markets are North America and Europe.

The company divides its brands into two categories: Content Creation and Audio Reproduction.

- Invest with ii: Open a Stocks & Shares ISA | ISA Investment Ideas | Transfer a Stocks & Shares ISA

Producing and reproducing

Focusrite’s most popular product is Scarlett. Scarlett is a range of digital interfaces for home producers that connect instruments, microphones, and headphones, to computers. Its higher-specification sibling Clarett is for professionals, and Vocaster is an interface for podcasters.

Interfaces enable producers to record and edit music and audio. Other brands in the Content Creation division design and manufacture music making software and machines like synthesisers and groove boxes. Adam Audio makes studio monitor speakers, also used in music production.

The Audio Reproduction division designs and manufactures sound systems comprising loudspeakers and amplifiers. They are used at live events and venues like places of worship, stadiums, clubs and restaurants. Martin Audio, the division's main subsidiary, powered five of the top six stages at Glastonbury earlier this year.

- How to beat the market: Rolls-Royce among seven momentum stock picks

- Investor poll: predictions for FTSE 100, best assets and regions in 2024

While the Content Creation division sells through distributors, retailers, and direct to musicians and podcasters, large sound systems are sold to rental and installation companies. These companies work with systems integrators to kit out music events and venues.

Taking away barriers

Apart from sound, Focusrite’s brands have other things in common. They are recognised and respected by musicians and incorporate decades of expertise and hard-won intellectual property. Its high-end synthesiser brands include Sequential, inventor of the famous Prophet series, and Oberheim.

High-end or low-end, the company seeks to increase the popularity of its products by taking away barriers to creativity. In practice this means simplifying products so they work out of the box, and providing worldwide support 24 hours a day, seven days a week.

It adopted this philosophy, for example, when it created Optimal, a sub-brand of Martin Audio for smaller venues like restaurants.

Some brands are manufactured in the UK and Europe, but for high volume products like Scarlett, Focusrite uses contract manufacturers.

The company says more than 50% of its products are sourced in China, so it is reassuring that it is thinking hard about the risk that supply could be disrupted by geopolitics.

This year’s annual report includes a summary report on the feasibility of reducing the China dependency. Although Focusrite concluded its manufacturing partners provide the best value, it is working with them to manufacture closer to home.

Focusrite says it is “confident in establishing” dual sourcing of its largest product line, probably Scarlett, in China and Malaysia. It is also considering sourcing Martin Audio in the UK as well as China, and Sequential in the US as well as China.

After Focusrite, Martin Audio is the group’s second-biggest business.

Breaking out of niches

To grow, the company needs to invent new products.

With 30% of over 500 staff working in research and development, Focusrite has the resources. It spent about 8% of revenue on product development in 2023 and launched 32 new products.

One of them was the fourth generation of Scarlett. Characteristically, the company says the new version promises professional level performance and unprecedented ease of use. Judging by the reviews, it is another hit.

But Focusrite’s strongest products are so popular already, their growth may be limited. Some have a 30% market share and Scarlett, for example, has been market-leader for eleven years.

So Focusrite has launched new brands, Ampify, which makes music creation apps, and Optimal. It has also acquired venerable brands. The first was studio monitor speaker Adam Audio in 2019. The second was Optimal’s parent Martin Audio in the same year.

The acquisition of Martin Audio created the Audio Reproduction division. It is smaller than Content Creation, responsible for 23% of revenue in 2023, but it may present a bigger opportunity. Focusrite estimates the size of the Audio Reproduction market is between £3 billion and £3.5 billion, compared to less than £2 billion for Content Creation.

The pace of acquisitions has been dramatic compared to what went before. Focusrite’s only acquisition prior to 2019 was its original synthesiser brand, Novation in 2004. Since 2019, the company has spent a little more than it has earned in free cash flow on six businesses.

- Sector Screener: two property stocks with long-term growth potential

- Top share picks for 2024: FTSE 100 stocks among nine to own

It is early days for the acquisition strategy, but the signs are good. Focusrite has not broken the bank. It is only 18% funded by debt and leases. The company is also earning decent returns. Its Return on Total Invested Capital (ROTIC) in 2023 was 15%. Unlike most measures of capital employed, ROTIC includes the original cost of acquisitions, so it is a tough measure.

Founder and non-exec chairman Phil Dudderidge, something of an industry luminary, says: “Focusrite plc is becoming recognised in our industry as a successful and friendly home for complementary branded businesses.”

Perhaps his reputation and the reputations of the gaggle of entrepreneur founders that have stayed with Focusrite after it has bought them out, are a magnet for would-be sellers.

In 2023, Focusrite acquired audio software company Sonnox. It supplies applications for music production, live sound, TV and film. True to form, Sonnox’s heritage goes back to the Oxford OXF-R3 digital mixing console, a mainstay of recording studios worldwide in the 1990s and early 2000s.

The acquisition strategy is demanding though, not just in terms of money invested but also in the extent of the subsequent integration. Focusrite has not only combined administrative functions like finance and human resources, it is restructuring sales teams along regional lines so the group does not have multiple relationships with the same resellers.

Deep integrations can be costly, and not produce the intended efficiencies, so there is an element of risk. That said, Focusrite is seeing the benefits. Output at amplifier maker Linea Research, a supplier to Martin Audio, has doubled since acquisition in 2022, and Linea benefits from the group’s buying power for raw materials and logistics.

Negative numbers misleading

You might be thinking that the numbers do not back up the mostly positive story I have been telling.

Since 2022’s peak, revenue is down 3%. Since adjusted profit peaked the year before, profit is down 26.2%. By a very thin margin, Return on Capital of 32% in 2023 was the lowest Focusrite has achieved in its 9 years as a listed company. 2023 was also the second year running of relatively poor cash conversion and the more important long-term average has fallen to 66%.

Investors do not like it when numbers go the wrong way, unless they believe it is temporary. It probably is.

During the pandemic, locked down musicians took to Focusrite in a big way but by the year to August 2022, the company was beginning to feel the hangover. Revenue increased as resellers restocked after the high demand and supply shortages of the pandemic, but surging freight and component costs cut into profit.

With customers’ inventory levels high, demand for Content Creation products fell in the first half of 2023 and revenue did too as the company discounted products.

It was a different story in the smaller Audio Reproduction division. Its Loudspeaker systems are in demand due to the return of live events.

Cash conversion is my biggest concern.

In 2022, Focusrite used up cash replacing stock during the pandemic boom. It was also holding more stock because it is selling more direct to dealers and consumers.

- Five outperforming AIM shares that could keep rising

- Stockwatch: is the writing on the wall for this small-cap?

In 2023 it used up even more cash, holding higher than normal levels of Scarlett stock while it phased out the third generation and introduced the fourth.

This increase in working capital accounts for about half of the discrepancy between adjusted profit and cash returns.

A quarter of the discrepancy is explained by the capitalisation of development costs.

The company treats the cost of developing new products as an investment. This means it is not charged immediately to profit but recorded as an asset on the balance sheet and amortised over time.

Because the company is growing, it is spending more on product development than it is charging in amortisation of previously capitalised costs.

The remaining quarter of the discrepancy is explained by other capital expenditure and also exceptional costs, which are ignored in the adjusted profit figure.

Theoretically these accounting decisions make it easier for us to see how well the business has performed, but they can also flatter profit if the judgments the accountants make are too optimistic.

None of Focusrite’s decisions look particularly suspicious, and hopefully working capital will normalise, improving cash conversion.

As for falling profit, it can be misleading to measure changes from a particular point in time.

Adjusted profit is more than double the level it was in the year to August 2019, the last full year before the pandemic.

And the compound annual growth rate (CAGR) in revenue and profit since the company floated almost nine years ago is nearly 20%.

Something could be going wrong at Focusrite, but the most obvious conclusion is profitability has fallen to more normal and sustainable levels from which growth can resume.

Scoring Focusrite

I like Focusrite. It is run by enthusiasts for enthusiasts. Tim Caroll, chief executive, is a former professional keyboard player. The Global Head of Sustainability joined the Service Department in 2010, where he fixed products to component level.

The company aims to promote from within and uses Net Promoter Scores (NPSs) to track employee and customer satisfaction.

When it comes to customers, its score of +70 is really good. The range is from -100 to +100.

Its employee NPS is positive, at +21, and the good news is the company recognises it needs to improve it.

The Past (dependable) [2.5]

● Profitable growth: Nearly 20% CAGR revenue and profit [1]

● Strong finances: Not reliant on debt [1]

● Through thick and thin: Pandemic weirdness [0.5]

The Present (distinctive) [3]

● Discernible business: Famous brands [1]

● With experienced people: Run by enthusiasts [1]

● That creates value for customers: ease of use, quality sound, 24/7 support [1]

The Future (directed) [2.5]

● Addressing challenges: Niche markets, China supply [0.5]

● With coherent actions: Innovates new products, acquires old brands [1]

● That reward all stakeholders fairly: Good NPS scores, great annual report [1]

The price (discounted?) [1]

+ Yes. A share price of 515p values the enterprise at £316 million, about 13 times normalised profit.

A score of 9 out of 10 indicates Focusrite is a good long-term investment.

It is ranked 4 out of 40 stocks in my Decision Engine.

Richard owns shares in Focusrite.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

More information about Richard’s investment philosophy and how he implements it.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.