Richard Beddard: a new company, and I like it

It’s a small tech business with a coherent strategy and is probably a good long-term investment.

17th July 2020 15:42

by Richard Beddard from interactive investor

Largely unaffected by Covid-19, this small tech business has a coherent strategy and our companies analyst thinks it is probably a good long-term investment.

For a company so small, D4t4 (LSE:D4T4) mission is surprisingly defensive: To retain technology leadership in Customer Data Platforms (CDPs). A CDP is software that gathers information about customers so companies can better interact with them.

With annual sales of £22 million in 2020, D4T4 is a technology minnow, but it has grown impressively since it acquired Celebrus, a CDP, in 2015. Industry analysts predict 34% compound annual growth in CDP sales to 2025 as companies demand more of their websites and other digital information channels.

Celebrating Celebrus

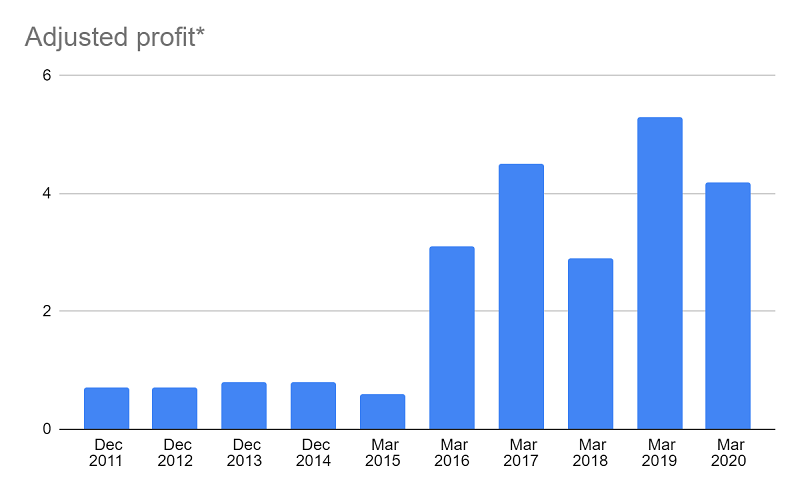

What a difference a Celebrus makes. Source: SharePad and annual reports. Profit is before interest but after tax at the standard corporate tax rate.

Celebrus is a 20-year-old patented software platform. Unlike rivals, D4T4 says it captures all our behaviour on websites, every browse, click, search and mouse-over, rather than requiring companies to decide what they want to know and tag web pages to record it. Tagging, it says, is costly and inflexible. Untagged data is lost even though companies might need it in future. If a company’s requirements change, it has to retag the website.

Celebrus streams data in real-time into its customers software systems, combining it with data companies already hold on customers like their age, gender, credit score, and transactions, to sell products and detect fraud “in the moment”. The latest incarnation of Celebrus (9.2) uses Natural Language Processing to detect and report emotion in customers’ conversations with chatbots, allowing a human to take over if necessary. It can also enable decisions on credit-worthiness in real-time.

This level of sophistication has yet to be embraced by many ecommerce businesses, but the financial services industry is in the vanguard. Most of Celebrus’ clients are famous banks like HSBC and Bank of America although retail companies with financial arms, like Toyota, are also clients.

Many Celebrus clients are banks. Source: d4t4solutions.com/data-capture/

Keeping it simple

The company was founded in 1985 by current chief executive Peter Kear and his predecessor, who is now a non-executive director. It started life as a hardware reseller but this century D4T4 has gravitated towards systems integration, building the digital infrastructure for companies. Prior to 2015, when, as IS Solutions, D4T4 acquired Celebrus, one of the software products it integrated, the company was profitable, but not very. And it wasn’t growing.

As IS Solutions, D4T4 was a systems integrator. Now it is “all about the data”. Source:d4t4solutions.com

In some ways D4T4 is still a systems integrator, much of its revenue comes from configuring Celebrus and integrating it into client’s systems rather than licence fees, but D4T4 is simplifying the proposition so it is less bewildering for customers.

It has folded its own data management platform into the Celebrus brand, and together they account for 80% of D4T4’s total revenue. The next step in the evolution of Celebrus is to provide it in three flavours: Celebrus for customer experience, Celebrus for risk, and Celebrus for fraud.

This should make it easier for customers to get started with pre-programmed “use cases” and, ultimately once the system has proven its worth in one capacity, for customers to extend it to other aspects of their business.

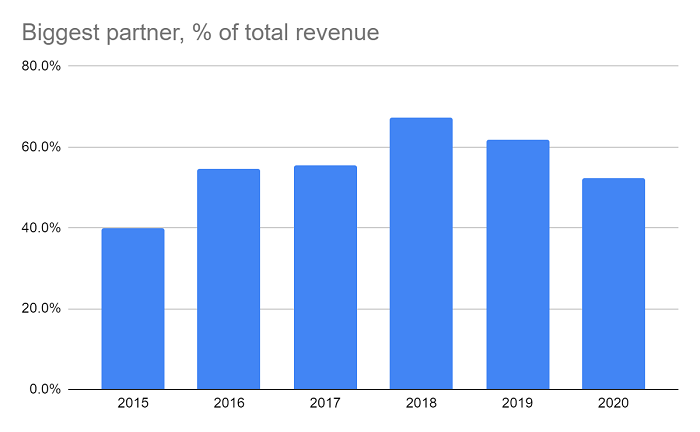

But there is one somewhat unnerving complication. Selling and implementing software that exists as part of much larger corporate software ecosystems around the World is challenging for a relatively small firm. D4T4 relies on partners.

Companies like new partner Pegasystems, a Customer Relationship Management (CRM) platform, sell Celebrus alongside other software products and services. D4T4 says Celebrus is “front and centre” of Teradata’s plans to target large enterprises.

D4T4 works closely with these partners, sometimes winning new customers for them, but one partner is responsible for approximately 50% of D4T4’s revenue. This probably explains why D4T4 is partnering up with more software providers and appealing to clients directly. In 2020, it says it closed a number of large direct accounts.

Source: D4T4 annual reports. In most years, one other partner contributed more than 10% of revenue.

Strong financials

D4T4’s performance since the acquisition of Celebrus in 2015 has been remarkable. At 63%, return on capital is five times higher than it was. Revenue has nearly doubled, even though it was lower in 2020 than it was in 2019, and profit is up sevenfold.

The company didn’t sell fewer licenses in 2020. It lost revenue because it is changing the way it sells software, licensing it for a term (typically annually) instead of in perpetuity. The company receives less money for an annual license, but expects it to be renewed every year. That means a new customer brings in less revenue immediately, but revenue should build up over time as D4T4 earns money each year from renewals as well as new customers.

Had the majority of term contracts been agreed on a perpetual basis, D4T4 is confident revenue would have grown significantly in 2020 and it thinks several contracts that would have closed on a perpetual basis were delayed as companies scrutinised the new terms.

Cash flow was weak in comparison to adjusted profit in 2020 because there was a £4m increase in receivables due to strong sales in the final quarter. The sales were recognised as profit, but the company had yet to be paid in cash. It has probably already collected most of the money.

Historically, cash flow has been sensitive to the timing of sales in the fourth quarter, resulting in big swings from year to year. Although average cash conversion of 62% between 2015 and 2020 is fairly modest, the starting point, 2015 was a year of negative cash flow and things seem to be improving.

Since 2016, D4T4 has achieved a healthy cash conversion ratio (81%), and as the company earns more recurring revenue, cash flow should become more stable.

So far, trading has been largely unaffected by Covid-19, which has increased the need for companies to deal with customers more intimately online.

Scoring D4T4

This is my first time scoring D4T4, but I like it. The company appears to have a coherent strategy to broaden the customer base of a unique product.

Does the business make good money? [2]

+ High return on capital

+ High profit margin

+ Prospects of improved cash flow

What could stop it growing profitably? [1]

+ Very strong finances

? Dependent on sales partners

? Alternative technologies may develop

How does its strategy address the risks? [2]

+ Partnering with more software firms

+ Engaging directly with clients

+ Innovating to stay ahead of competitors

Will we all benefit? [2]

+ Experienced board own 9.3% stake

+ Executive pay is reasonable

+ Staff are a strategic priority

Are the shares cheap? [1]

? A share price of 234p values enterprise at £82 million, about 19 times adjusted profit.

I haven’t been following D4T4 for long, so my conclusion is tentative. But I think it is probably a good long-term investment.

Richard does not own shares in D4T4 (yet!)

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.