Richard Beddard: a new addition for my Decision Engine

17th December 2021 15:03

by Richard Beddard from interactive investor

This company’s cutting-edge technology may be challenging to understand, but the business model is sound, according to our shares analyst.

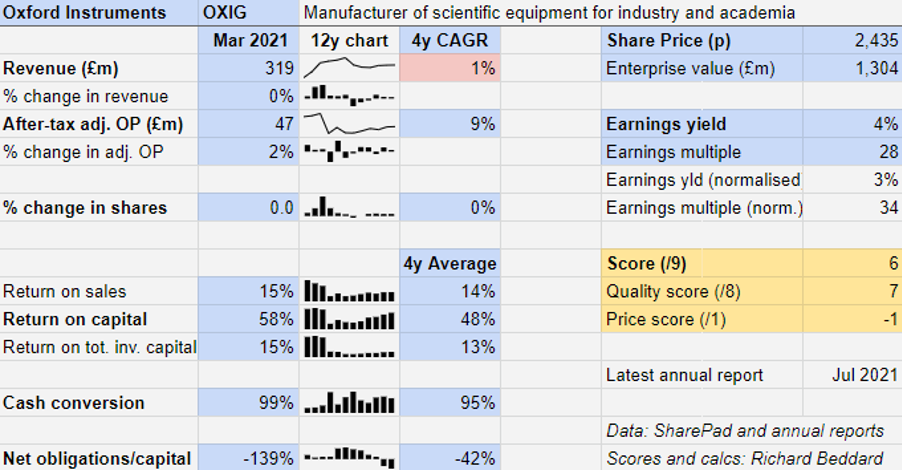

This is my first time scoring Oxford Instruments (LSE:OXIG). The company is four years into a back-to-basics strategy that promises long-term growth while helping to advance science and technology.

Hi-tech picks and shovels

Oxford Instruments’ subsidiaries manufacture hi-tech picks and shovels – equipment that enables manufacturing, analysis and fundamental research down to the atomic level.

These instruments help scientists to see, measure and characterise pharmaceuticals, foods, materials such as super-alloys and organisms such as viruses. They include semiconductor etching and deposition equipment, cameras, microscopes, x-ray equipment, nano-engineering tools and the cryogenic environments required to reduce temperatures close to absolute zero. Such incredibly low temperatures are required to remove heat ‘noise’ and make sense of the very small.

- Richard Beddard: why this restless innovator could clean up

- ii’s Festive Star Fund Manager Video Series

Applications developed by Oxford Instruments’ customers in industry and academia improve the performance of materials, making them lighter, stronger, cheaper and purer.

They are helping to solve some of the technological challenges facing humanity: making compound semiconductors for faster battery chargers, measuring the quality and composition of food, understanding and combating disease, and developing quantum computers, which are widely predicted to be the next big leap forward in computing.

If society in the future is more technologically sophisticated, Oxford Instruments will have played a part in it.

Internal focus

The company has recently published results for the six months to September 2021, which reported double-digit growth in revenue and profit over the comparable period two years earlier, i.e. before the pandemic.

Strategically, the most remarkable development was the acquisition of WITec, a German manufacturer of Raman microscopes, which are used in chemical analysis. It took place in June and had little effect on the results.

On the face of it WITec is a sensible acquisition. Raman microscopy is a new but closely related market, and the purchase was fully funded by the prodigious cash flows that Oxford Instruments has earned in recent years. So what is remarkable is not this particular choice, but the fact that an acquisition has been made at all. It is the company’s first since Ian Barkshire took over as chief executive in 2016.

The company’s strategy since then, dubbed Horizon, has been focused internally on developing deeper relationships with customers, from which it has developed a better appreciation of their requirements. It uses that knowledge to guide research and development, which has increased from 7% to 9% of turnover.

- Richard Hunter: should investors be CIRCUMSPECT in 2022?

- Friends & Family: ii customers can give up to 5 people a free subscription to ii, for just £5 a month extra. Learn more

Increased innovation has been funded by greater efficiencies, as the company has consolidated suppliers and encouraged subsidiaries acquired in previous years to work more closely together. Another aspect of the strategy is the development of better after-market services for its sophisticated equipment, which in turn should further deepen customer relationships.

It is a customer-first and investment-led strategy that is enabling Oxford Instruments to make the most of its businesses. Because aspects of the strategy reinforce each other, it could be a powerful enabler of growth. Notably, the strategy barely mentions acquisitions, which in the past have grown the company but reduced its focus and efficiency.

Getting the balance between internal investment and acquisitions right is critical, and as chief executive Barkshire has tilted Oxford Instruments towards internal investment. In retrospect he was the ideal person to do that. He joined the company in 1997 and had previously been technical director and chief operating officer, responsible for building rather than buying businesses.

It is unlikely he will return the business to an acquisition-first strategy, especially as an internal focus is baked into its Key Performance Indicators (KPIs).

Improving performance

Oxford Instruments has two strategic KPIs and both are internally focused. “Inventing the Future” measures the proportion of revenue earned by products launched in the previous three years. A contribution of 38% in 2021 compares favourably to 30% in 2017.

The second, “Adding personal value” measures the value of the contribution of employees by comparing operating profit plus employee costs to employee costs. According to Oxford Instruments, employees added 52% of value in 2021 compared to 44% in 2017.

The company’s record up to the end of the last financial year in March 2021 shows that after an acquisitive period when the financials deteriorated, performance is improving again.

Revenue growth has been fairly flat, impacted by the pandemic, which shut some of its customers down, but compound annual growth in profit of 9% since 2017 suggests the company is operating more efficiently.

The growth in profit has been driven by sharply improving return on capital (58% in 2021) and matched by very strong cash flows. Those cash flows have easily eclipsed the company’s financial obligations, putting it in a very strong position.

Looking ahead to March 2022, the company strikes a confident tone. It reports growth across most of its markets; but the acquisition of WITec has drained some cash, the resumption of capital expenditure will drain more as Oxford Instruments builds a new semiconductor facility, and increases in stock to support revenue growth is also using up cash.

The company’s reliance on remote communications during the pandemic has opened up new channels with customers, and allowed employees of different subsidiaries to collaborate even more. So far, closer relationships with fewer suppliers has shielded it somewhat from supply shortages. The order book is strong.

Scoring Oxford Instruments

I am a sucker for companies pushing forwards the boundaries of what is technologically possible, but only if they can grow profitably.

Oxford Instruments has grown profit without recourse to acquisitions in recent years, but revenue has grown more slowly. Perhaps that is changing given its performance so far this year, probably as the investments guided by the Horizon strategy begin to pay off.

As an agglomeration of scientific instrument manufacturers, it is similar to Judges Scientific (LSE:JDG). That company supplies workhorse equipment in niches that are not very glamorous, though, requiring it to invest less in research and development and, perhaps, making it easier to run.

Oxford Instruments’ position at the forefront of technology makes me wonder whether it operates in more competitive markets and is more complex to run.

Does the business make good money? [2]

+ High returns on capital employed

+ Decent profit margin

+ Good cash conversion

What could stop it growing profitably? [1]

+ Very strong finances

? Complexity

? Competition

How does its strategy address the risks? [2]

+ Investment in R&D keeps it at the forefront of science and industry

+ Close relationships with customers guides investment

+ Operational efficiency releases funds for investment

Will we all benefit? [2]

+ Chief executive Ian Barkshire is very experienced

+ Company wants staff to be proud of working for it, and 84% are

+ Communicates well with shareholders and customers

Is the share price low relative to profit? [-1]

− No, a share price of £24.35 values the enterprise at £1.3 billion, about 35 times normalised profit.

In recent years I have allowed Oxford Instruments’ indebted past to put me off investigating further, but that was a result of an acquisition-led policy to which I doubt the company will return while it is employing the Horizon strategy.

Another reason why I dithered is rule number one in investing, which is to understand the investment. Since Oxford Instruments operates near the frontiers of science, it has taken me a while to muster the confidence to take it on.

While I doubt I will ever understand quantum mechanics, I have enjoyed learning a bit about it, enough to be confident the company understands the commercial opportunity. I have added Oxford Instruments to the Decision Engine.

A score of 6 out of 9 suggests it is probably a good long-term investment. It is ranked 26 out of the 41 shares I have scored in the last year or so. In reaching that verdict I have been cautious in awarding a score of 1 out of 2 for risks, which reflects my unfamiliarity with the business.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

For more information about Richard’s scoring and ranking system (the Decision Engine) and the Share Sleuth portfolio powered by this research, please read the FAQ.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.