Richard Beddard: mixed feelings about this popular operator

10th February 2023 15:21

by Richard Beddard from interactive investor

Our columnist has doubts about this business, which is why it appears near the bottom of a long list of stocks he covers. Here are the reasons why he needs convincing.

On the eve of the pandemic in March 2020, Hollywood Bowl (LSE:BOWL) was the UK’s biggest chain of ten-pin bowling alleys. That month, it opened the first of five mini-golf centres. Then in May last year, it acquired a chain of six Canadian bowling centres and a Canadian bowling equipment supplier.

The company reckons it can use what it has learned by growing its estate of ten-pin bowling alleys in the UK, to develop other competitive leisure concepts and roll out versions of its format abroad.

- Invest with ii: Share Dealing with ii | Open a Stocks & Shares ISA | Our Investment Accounts

Scoring a strike

The growth of out-of-town retail and leisure parks in the UK has created an opportunity for operators of experiences like ten-pin bowling. Hollywood Bowl has focused on a family friendly format in popular locations. It operates 64 of the 327 ten-pin bowling alleys in the UK, more than any other operator, and locates them near cinemas and restaurants.

Rivals rarely set up near each other, so they compete for locations more than bowlers. Since property companies favour profitable tenants they know well, Hollywood Bowl, the biggest operator, appears to be in a good competitive position. Remarkably, it says it is the second biggest ten-pin bowling operator in the world.

Scale brings other advantages. The cost of developing formats and systems like integrated scoring and marketing, dynamic lane pricing, and menus that nudge people to buy snacks at busy times and meals at quiet times, is spread across a large estate.

- Share Sleuth: fully invested, but here’s what I would buy

- Shares for the future: the 22 stocks I think are good value now

The family friendly ethos has enabled the company to broaden the appeal of ten-pin bowling and deliver it more efficiently through, for example, pins on strings, a mechanism for resetting bowling pins. Pins on strings is controversial among enthusiasts because it alters the trajectory of the pins when the ball strikes them, and it sounds different.

Casual players do not care though, and pins on strings are cheaper to run and interrupt bowling less often than traditional pinsetters.

Bounce back

Hollywood Bowl got through the pandemic barely profitably and with money to invest thanks to the support of the government, the confidence of investors who stumped up cash in two placings, and lenders, banks and landlords, who relaxed the terms of their agreements.

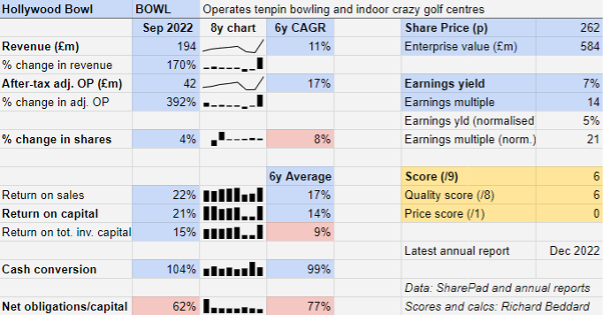

The circumstances were exceptional, and despite earning very little profit in the years to September 2021 and September 2022, a strong bounce back in the year to September 2023 means average return on capital in the six years since the company floated in 2016 is a healthy 14% despite those bad years.

Helped by a small contribution from Splitsville and Striker, the Canadian bowling centre and supplies businesses it acquired in May, and the tail end of VAT reductions to support businesses through the pandemic, Hollywood Bowl is performing better than it did in 2019, the last full year before the pandemic.

The executives strike a confident tone in the annual report, with three formats to grow, the energy bill hedged, and the impact of wage rises muted by the fact that wages are a relatively small proportion of running costs.

Although there was a surge of enthusiasm for bowling when pandemic restrictions were removed, there was no sign of it dampening in December when the annual report was written.

Splitsville and Striker are modest operations in comparison to the mothership, but they should contribute more profit in future, because they were only owned for part of 2022.

We should probably mute our expectations though, the post Covid buzz around bowling may recede, the reduced VAT regime ended last April so the company’s VAT bill will increase this year, and there is the potential for Hollywood Bowl’s utility bills to rise in September 2024 after its hedges mature.

Assessing resilience

The company’s ratio of net financial obligations to capital is higher than my arbitrary benchmark of 50% of operating capital, but it does not appear to be taking big financial risks.

At the year end, the only financial obligations Hollywood Bowl had were to its landlords, partially offset by a substantial cash balance. It had no bank debt, a position it intends to maintain. The pandemic showed that in extreme circumstances landlords can be flexible for good tenants, but to remain one of those Hollywood Bowl must withstand the normal ups and downs of the economy.

This is not something we can easily assess. Judging by its profitability it should be resilient, but Hollywood Bowl’s business model has not experienced a severe recession. Bowling centres have gone bust many times in the past, but they were smaller and less professional operations.

The company says a family of four can bowl for £22, which people may be able to afford even if they are hard up. It also believes custom is resilient in its prime locations.

Risks in roll outs

The growth strategy is becoming more complex, and probably more risky. After a hiatus in 2021, Hollywood Bowl is rolling out of new centres again. The Hollywood Bowl brand is tried and tested, but its plans also include Puttstars and Splitsville.

With the help of Striker, which builds and modernises bowling centres, Hollywood Bowl believes it can roll out at least 20 new Splitsville centres in Canada over the next 10 years because the market is fragmented and underinvested, like the UK a decade ago.

The cost of the acquisitions was modest, less than half a year’s profit, but Hollywood Bowl, which plans to introduce a family friendly format, will be operating in a different environment. Splitsville’s centres are located at standalone sites, or with retail, and they currently cater more to enthusiasts than families.

The company says the Puttstars roll-out, though hampered during the pandemic, is going well. Customers like the format and it is tweaking it to encourage them to return more often, but Hollywood Bowl is also moderating expectations.

It is slowing the roll-out, prioritising Hollywood Bowl centres, and planning to open Puttstars where there is not enough space for bowling, or where it can include a mini-golf course in a bowling centre.

Maybe this reduced ambition is because Puttstars did not make as much money as the company expected it would in 2022, a fact only made explicit in the company’s auditor’s report.

Performance culture

The trio of chairman, chief executive, and chief financial officer are very experienced. They guided Hollywood Bowl through its flotation in 2016 and developed its people focused strategy, which has earned it a high customer net promoter score of 66%. Without putting a number on it, the company says staff turnover is lower than at many peers in the hospitality industry.

People have the opportunity to build careers at Hollywood Bowl. Forty percent of new centre and regional managers were promoted from within the company in 2022, a proportion it expects to increase through training schemes. Centre manager is a position worth aspiring to as managers received 135% of their base salaries in bonuses in 2022.

Although Hollywood Bowl says executives are paid below the median for a smaller listed company, they are highly incentivised too. The hospitality industry is a low paid one and executive remuneration is impressive compared to the people serving food and doling out shoes to people who have come in heels.

This very unequal structure is producing results, but I wonder if such a disparity can, or should, be sustained. Median total pay is £17,300, while the company’s chief executive earned £1,138,300. He did so well because Hollywood Bowl exceeded all performance related pay targets in 2022.

Executive pay is about to get more lucrative as the company has increased the maximum Long Term Incentive Plan (LTIP) payout from 100% to 150% of the executives’ salaries. Seventy per cent of the payout for the 2022 scheme, which will vest in 2025, is also based on a statistic, adjusted earnings per share (EPS), that the company adjusted in a questionable way in 2022.

Hollywood Bowl chose to exclude exceptional costs relating to the acquisition of the Canadian businesses, which improved EPS, while including a large and exceptional one-off gain from a VAT rebate, which also had the effect of improving EPS.

Being selective about which exceptional items to include in adjusted profit, I think, gives a false impression of underlying profitability and although adjustments in 2022 will not affect the EPS outcome in 2025, we will have to look carefully at the adjustments the company makes then.

Mixed feelings about Hollywood Bowl

I have mixed feelings about Hollywood Bowl.

A combination of factors: the availability of prime locations in out-of-town leisure hubs, professional management, improvements in technology, and peoples’ preference for experiences over things, have made a somewhat down at heel pastime more viable and accessible.

But it concerns me that Hollywood Bowl emphasises the positive so powerfully over the negative, whether it is in the annual report’s commentary or their adjustments to EPS. I wonder if I might have missed anything else in the small print.

I also wonder about Hollywood Bowl’s experiments with mini-golf and its expansion in Canada, which at two centres a year is just as ambitious as the established and successful UK bowling centre roll-out.

These diversifications could be a sign that there is a limit either to the supply of ten-pin bowling sites or demand for the pastime in the UK.

Does the business make good money? [2]

+ High return on capital

+ Decent profit margins

+ Good cash conversion

What could stop it growing profitably? [1]

? Recession risk

+ Strong competitive position

? Geographical and format diversification

How does its strategy address the risks? [2]

+ Net cash position

+ Optimisation and roll out of Hollywood Bowl

? Riskier rollouts are just as ambitious

Will we all benefit? [1]

+ Experienced management

? Performance culture

? Boosterism

Is the share price low relative to profit? [0]

+ It is reasonable. A share price of 262p values the enterprise at about £584 million, about 21 times normalised profit.

A score of 6 out of 9 indicates Hollywood Bowl may be a good long-term investment, but the lustre is wearing off and it is in the bottom quartile of quite a long list.

It is ranked 34 out of 40 stocks in my Decision Engine.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in Hollywood Bowl.

More information about Richard’s investment philosophy and how he implements it.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.