Richard Beddard: look at the right numbers and this stock will impress

25th March 2022 14:06

by Richard Beddard from interactive investor

Our columnist likes this company’s business model built on simplicity – so will a range of new initiatives detract from that vision?

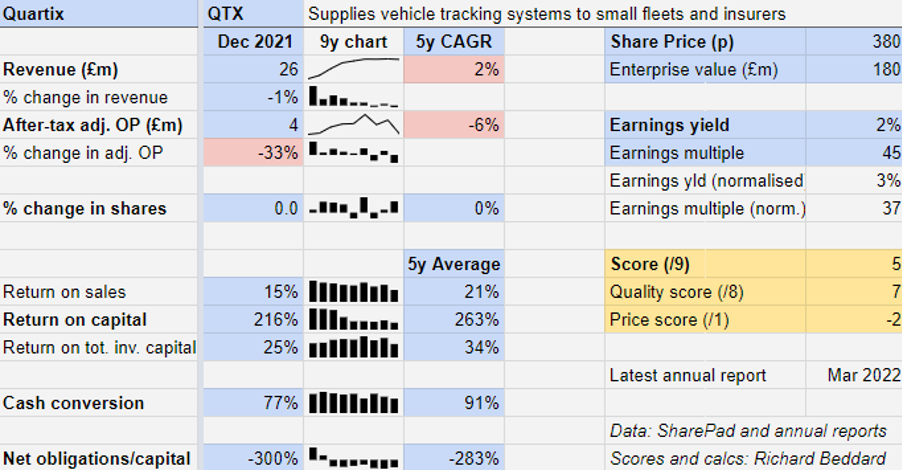

Investors looking at the headline financial metrics – revenue and profit, for example – will likely be unimpressed by Quartix (LSE:QTX)’s performance over the last few years. But maybe they are looking at the wrong numbers.

Falling prices, growing revenue

Quartix mostly sells vehicle tracking on subscriptions to small and medium-sized businesses in the UK, Europe and US.

Richard Lilwall, Quartix’s new chief executive, refers to the devices and cloud-based tracking and reporting software as a “fleet visibility platform”. It helps fleet owners – a wide range of businesses from plumbers and bakers to road-mark painters – keep tabs on their vehicles. It ensures they are being driven efficiently and safely, reducing fuel consumption, idle time, driver overtime, miles driven and road traffic accidents.

A slightly unsettling aspect of this market is that the devices are cheap to manufacture from off-the-shelf components. Strong price competition means Quartix has not been able to raise prices for a long time. Prices of new subscriptions have been static for three years. Before that they were in decline, which means the company is still experiencing an element of price erosion as it loses customers on higher tariffs or they renegotiate prices down.

The only way Quartix can grow profitably is by keeping costs low and selling sufficient additional units every year to more than make up for lost customers and lower prices.

- Six value share tips for 2022 – and beyond

- How and where to invest £50k to £250k for income

- Shares, funds and trusts for your ISA in 2022

In the year to December 2021, it increased the number of units installed by 17% but subscription prices fell 6%, resulting in an increase in total fleet revenue of nearly 8%.

On the face of it, the growth in the subscription base is significantly outpacing the decline in prices, but Quartix’s revenue growth has actually stalled. Total revenue fell 1% in the year to December 2021 and has only grown at a compound annual growth rate (CAGR) of 2% over the last five years.

The cause is a second part of the business: insurance. Quartix was withdrawing from the insurance market even before the pandemic accelerated the process. In the year to 2021, demand for trackers from Quartix’s reseller Wunelli fell because driving tests were cancelled.

Due to supply shortages, Quartix terminated its agreement to supply new devices to Wunelli to prioritise the higher-quality fleet business. It will only supply data services for existing insurance policies until September. In 2021, revenue from insurance fell 53% to £1.8 million, just 7% of Quartix’s total revenue.

Quartix’s adjusted profit fell 33%. However, not all of that decline can be explained by £1 million of lost profit from insurance. There was also a big increase in costs.

Past performance is not a guide to future performance.

Quartix spent £1.6 million more on acquiring new customers in 2021 than it did in 2020, principally by recruiting more salespeople. This, the company anticipates, will result in more revenue and more profit from 2022, as the company’s growth curve falls into line with the growth of the fleet business.

The board has also grown in size and cost, as founder and former chief executive Andy Walters has moved to a non-executive role and the company has brought a chief technology officer on board. Walters made very modest salary demands on the business.

Quartix’s strategy is to sacrifice profit now for more profit in future. The rationale is that customers are hellishly expensive to acquire but highly sticky: Quartix typically retains 88% or more of its fleet customers every year.

Scoring Quartix

For Quartix to be a good long-term investment, it must continue to grow its installed base at a faster rate than prices decline, and deliver increasing profit as well as revenue.

Now the insurance business has shrunk to the point of insignificance, Quartix expects revenue to grow perhaps by 7% or so in 2022, similar to the growth of the fleet business in 2021.

But it does not expect to grow profit much this year because sales and marketing costs continue to grow, with substantial increases in its UK and French field sales capability and the annualisation of the increased spend in 2021.

Quartix is also absorbing somewhat higher costs: all new units will soon incorporate 4G technology so they don’t go obsolete as UK and European providers shut down 2G networks, a process that may start as early as 2025 in some countries.

Longer term, with selling prices stable and the number of existing customers paying higher prices diminishing, Quartix expects the average price of a Quartix subscription to gradually stabilise.

It may even be possible to raise prices in an inflationary environment where fuel economy becomes a greater priority for vehicle fleets.

However, the company must also contend with the cost of replacing obsolete devices, probably in the second half of this decade. In the US, which is retiring the 3G network this year, the company has decided to swap out customer units free of charge so it does not lose business.

These costs are treated as exceptional items and therefore not deducted from adjusted profit measures.

Change afoot?

My confidence in Quartix comes from its business model, which is focused on standardisation, simplicity, service and overseas expansion.

These attributes dovetail. Quartix sells a generic device and service to relatively unsophisticated customers with common requirements. It is designed to be simple enough to self-install and configure, which makes it easy to support and export, and keeps costs low.

Its main cost is sales and marketing, which, due to the simplicity of the service, is highly automated for some channels (for example the company’s own ecommerce site and direct marketing database). This allows Quartix to sell profitably to very small fleets, which might of course grow into larger ones.

Its overseas sales office in the US is serviced from Newtown in Wales, as its new French sales office will be.

But Quartix is making decisions that may increase cost and complexity. The beefing up of its presence in France is required because Quartix is finding it difficult to recruit people with the language skills to serve European markets from Newtown. This has been exacerbated by Brexit and the pandemic, which has prompted some UK resident EU citizens to return home.

The company is increasing field sales staff in the UK and France, which is costly but, Quartix says, the most efficient way of winning the business of larger customers, which it is increasingly targeting.

It is also introducing new products.

Quartix will use customer data to help customers visualise the environmental impact and cost of running an electric fleet, including vehicle recommendations, compared to their existing fleets.

Quartix CHECK is a ‘walkaround’ app that helps drivers check if their vehicle is safe before they set off, and records accidents and near misses.

And it is introducing a low-priced in-cab camera solution in the US, that works with the Quartix system.

These products have a reassuringly low-cost ring to them. Since it already has the customer data, Quartix believes the fleet migration product will be cheaper to deliver than its main competitor’s services, consultancies who must collect the data before doing the analysis. The company says the in-cab camera system is low-cost.

This, I suppose, is key: the company’s success to date has been built on its founder’s almost singular vision to keep things simple and generate recurring revenue streams. Walters once told me Quartix would not introduce a feature unless at least 80% of customers wanted it.

The new initiatives, some born of necessity and others of opportunity, may be deviations from that vision. Whether they are good deviations or bad deviations remains to be seen. The proof of the pudding will be a resumption of profit growth as well as revenue growth.

Traders seem to have decided this is going to happen. The shares are priced at about 45 times adjusted profit in 2021 (35 times normalised profit).

Does the business make good money? [2]

+ High return on capital

+ High profit margin

+ Good cash conversion

What could stop it growing profitably? [2]

+ Strong finances

+ Low cost business model is key to competitiveness

? Sunsetting of 2G networks could increase costs again

How does its strategy address the risks? [1]

+ Generic product addresses needs of diverse customers

? Increasing complexity

? Incorporation of 4G technology in new installations

Will we all benefit? [2]

ᐩ Founder and major shareholder Andy Walters still on board

+ Company communicates well with shareholders

? New management team

Is the share price low relative to profit? [-2]

+ No. A share price of 380p values the enterprise at about £180 million, about 35 times normalised profit.

A score of 5 out of 9 indicates Quartix may be a good long-term investment.

It is ranked 33/40 stocks in my Decision Engine.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

For more information about Richard’s scoring and ranking system (the Decision Engine) and the Share Sleuth portfolio powered by this research, please read the FAQ.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.