Richard Beddard: a long-time favourite and my no.3 share

14th July 2023 15:51

by Richard Beddard from interactive investor

Our columnist likes this company so much he gives it one of his highest scores. Even friends and family are getting in on the act.

Despite being better prepared than rivals, Churchill China (LSE:CHH)’s factory endured a testing year as it failed to keep up with demand for tableware in 2022. This year it should sell plates more profitably.

- Invest with ii: Top UK Shares | Share Tips & Ideas | Open a Trading Account

Temporary inefficiency

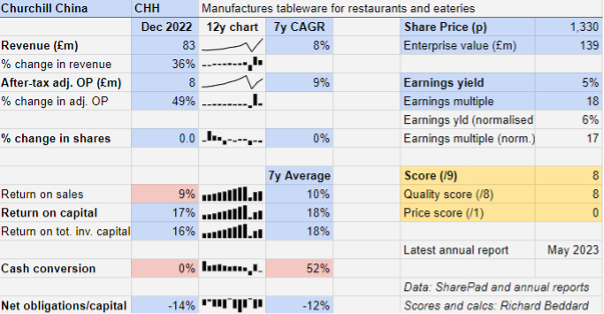

Revenue in 2022 significantly surpassed pre-pandemic levels, but profit is still below its high in 2019. Churchill China did not convert revenue into profit as efficiently as it once did, therefore, and both profit margins and return on capital lagged the long-term average slightly.

The pandemic dented the more than decade-long steady improvement in Churchill China’s performance because restaurants, pubs and hotels, the company’s end-customer, closed.

Commercial kitchens are repeat purchasers, because they buy replacement plates to match the patterns they already own. This gives suppliers a regular stream of revenue, although it can make it difficult to win new customers over.

Downturns, when potteries cut back production or go out of business, can therefore be an opportunity to steal the businesses of suppliers not in a position to supply.

In 2021, Churchill China deliberately overproduced to keep factory efficiency levels up and enable it to meet demand when it returned.

But although high stock levels helped initially, by 2022 the company could not keep up. Staff shortages plugged with inexperienced workers and contract labour, and higher materials and energy prices, meant the factory in Stoke on Trent operated inefficiently, and Churchill China’s distributors had to wait longer for orders.

The company must have been disappointed as it puts much store in meeting customer expectations, but at least we know it did better than rivals because it increased market share.

- Share Sleuth: why I’ve trimmed one of my best performers

- Stockwatch: a growth share thriving on our obsession with status symbols

- Insider: directors think these shares are a bargain

The ructions in the economy also depressed cash conversion as Churchill China rebuilt stocks of finished goods from depressed levels, increased stocks of raw materials to mitigate shortages, and invested in its factory as it focused on growth again.

Although the company’s defined benefit pension is in surplus, it is making payments into the scheme, which also reduces cash flow in comparison to profit.

Despite these pressures on the business, Churchill China performed well. Even with the pandemic, it has grown revenue and profit at a compound annual growth rate of 8-9% over the last seven years, and while it is a smidgen below average, it earned a handy 17% return on capital in 2022.

Churchill China says efficiency is gradually returning as it has rebuilt stock, become less reliant on short term contract labour, and energy prices have stabilised.

Demand in the UK may fall though, should a much-feared recession come about.

Stealing repeat business

Churchill China’s success has come from coloured and textured plates, a superior product in terms of design and durability, that it can, due to British clays and unique manufacturing processes, make relatively inexpensively.

Sales of patterned tableware, so-called value-added products, to the hospitality industry have increased from less than 20% of total revenue to over half.

Durability is important because tableware for commercial settings must survive many dishwasher cycles per day. It is achieved by incorporating the pattern beneath the glaze rather than on it.

A few years ago, Churchill China secured its ceramic supply by acquiring the shares it did not already own in Furlong Mills, which mixes clay and other raw materials into ceramic bodies to be manufactured into tableware.

The company also expects to use Furlong Mills’ expertise to develop materials and processes that take less energy to manufacture.

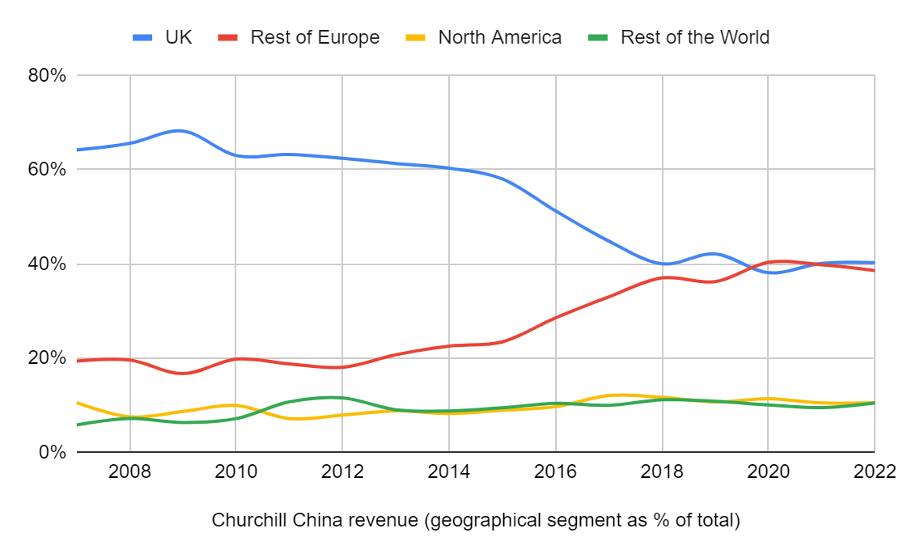

While European competitors dish out plain white plates with Teutonic efficiency, Churchill China’s coloured and textured plates are so good most of its growth has come from European sales.

Sales to Europe have increased from less than 20% of total revenue just over a decade ago to 39% of revenue in 2022, and near-parity with sales in the UK where Churchill China claims market leadership.

UK revenue by contrast has grown much more modestly, but this is not because Churchill China is less popular among commercial customers. The company has substantively withdrawn from the retail market which does not enjoy the same level of repeat purchases, service is less important, and where cheap imports are keenly priced.

Along with the development of the product the company has consistently invested in its workforce and automated the factory. This capital expenditure reduces cash flow in the short term, which is another reason Churchill China has relatively modest average cash conversion, but it should be laying the groundwork for growth.

Long-term perspective

Churchill China’s long-term ethos, evident in its prudent balance sheet and its commitment to investment, probably stems from centuries of family ownership currently represented on the board by James Roper, the sales and marketing director who owns a 9% stake in the business.

He is far from being the most experienced board member.

After 31 years, 30 of them on the board, finance director David Taylor stepped down in April, but even he was not the first of his contemporaries to join the business.

Chief executive David O’Conner joined the business one year before Mr Taylor, and the board six years after him. He has been chief executive since 2014.

Scoring Churchill China

Churchill China is a long-time favourite. Just as we cheer Howden Joinery Group (LSE:HWDN) and Next (LSE:NXT) lorries on the motorway, friends and family have become accustomed to me turning over plates in restaurants to see whether they have good taste in tableware.

My kids still do it now that they have grown up and have the temerity to go to restaurants without me. This summer my daughter shared a picture from Croatia. There was good news on the bottom of her boyfriend’s plate!

Good news from Dubrovnik. Source: Ellen Beddard :-)

Does the business make good money? [2]

+ High Return on capital

+ High Profit margin

? Pension payments reduce cash flow

What could stop it growing profitably? [2]

+ Strong finances, invests through cycle

+ Unique product

? Cost inflation

How does its strategy address the risks? [2]

+ Focus on hospitality customers

+ Innovation and automation

+ European growth

Will we all benefit? [2]

+ Experienced management

+ Staff development central to strategy

+ Communicates well with shareholders

Is the share price low relative to profit? [0]

+ It is not too high. A share price of £13.30 values the enterprise at about £139 million, 17 times normalised profit.

A score of 8 out of 9 indicates Churchill China is a good long-term investment.

It is ranked 3 out of 40 stocks in my Decision Engine.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in Churchill China.

More information about Richard’s investment philosophy and how he implements it.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.