Richard Beddard: this highly ranked FTSE 100 company has our eyeballs

4th August 2023 15:18

by Richard Beddard from interactive investor

It dominates the industry and is initiating change to make sure it stays that way. Our columnist explains why this impressive business has a lot going for it.

It is not often you find a statement like this in the section on competitive threats in a company's risk report: "Our data continues to show that there is a low competitive threat..."

But it is in Auto Trader Group (LSE:AUTO)'s annual report, and it appears to be true of the UK classified advertising marketplace.

Although direct competitors include Amazon (NASDAQ:AMZN), eBay (NASDAQ:EBAY), and Facebook, or Meta Platforms Inc Class A (NASDAQ:META), the company says 75% of all minutes spent on automotive classified websites in the UK were spent on Auto Trader. It claims to be seven times larger than its nearest competitor, and its search volume for cars is four times that of Google.

- Invest with ii: Share Dealing with ii | Open a Stocks & Shares ISA | Our Investment Accounts

Auto Trader is, substantively, the online market for used cars in the UK. Everybody has heard of it, even me, and my car is 15 years old.

The difficulty for competitors, even powerful ones, is that to attract lots of car buyers to a platform you need lots of retailers on it. To attract lots of retailers, you need lots of car buyers.

Auto Trader solved this Catch 22 as it grew its audience to become the UK's dominant listings magazine in the last century, and over the past fifteen years or so, it has transferred its audience and grown it on the Web.

Adding more value

To grow profit, the company can increase prices, sell more advertisements, or develop add-on products.

The first route to growth is limited by what the marketplace will bear, although Auto Trader’s dominant position helps.

The second is temporarily hampered by the two-year long shortage of new cars, caused by a shortage of semiconductors, which has also had a knock-on effect on the used car market.

The most reliable and sustainable route to growth is to add more value, and in 2023 sales of add-on products contributed to 60% of the 10% growth in Auto Trader’s average revenue per retailer (ARPR). The rest was down to price increases.

Auto Trader has a three-pronged route to product growth.

The tried and tested way is premium advertising packages. These give advertisements more prominence in search results and advertising slots. 33% of customers were on these packages in the year to March 2023.

A more novel approach is the sale of data products to retailers, to improve the quality of their adverts and the efficiency of managing them.

The company launched the first module of Auto Trader Connect in April 2022. This integrates Auto Trader’s data with customers’ stock keeping systems, allowing listings to be updated in real-time.

The second module, Valuations, was launched in April 2023. This helps retailers price cars more keenly by providing specification adjusted valuations based on daily activity on Auto Trader.

Strategically, the most significant prong may be the third, which is to bring more of the process of buying a car online.

Auto Trader is trialling a service called DealBuilder with retailers, and expects to start charging for it this year. It wants us to be able to do as much of the used car buying journey online as we are comfortable with, which means offering part-exchange, the ability to reserve a car, and finance.

Historically, the advertising stock of new cars has only been a relatively small proportion of the total (6% in 2023). But as more people choose to lease cars, Auto Trader sees an opportunity to bring the whole new car buying experience online.

To accelerate that process, last year it acquired Autorama, a van leasing marketplace, and it has already implemented the leasing process on Auto Trader.

By the numbers

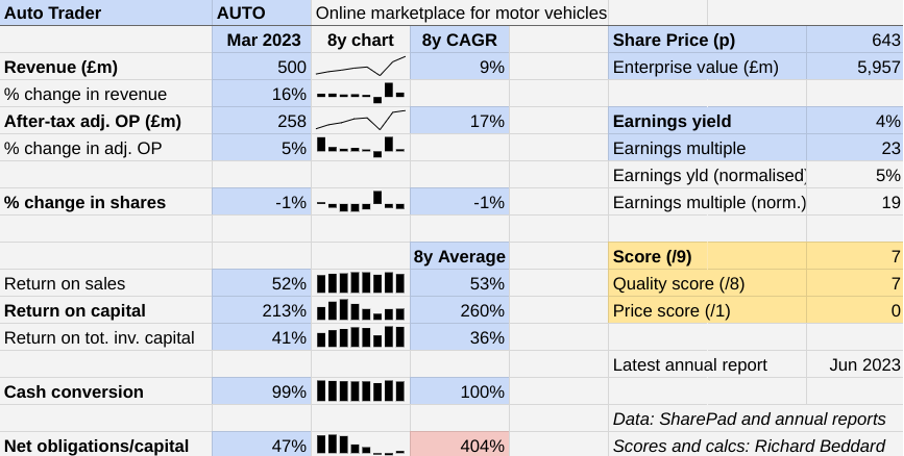

The numbers bear out the story. Revenue and profit declined during the pandemic as demand fell and Auto Trader supported retailers by subsidising advertising, but a dramatic recovery in 2022 means revenue and profit are higher than ever.

In the year to 2023, profit growth was below par at 5%, partly explained by the acquisition of Autorama, which contributed a loss, exaggerated by the shortage of vehicles, of £11.2 million.

But for Autorama, Auto Trader might have grown profit by 10% in 2023. It remains immensely profitable and cash generative.

Although Auto Trader does not expect the stock of advertising to increase strongly in 2024, it expects to grow the same way it did in 2023: by selling more add-on products and raising prices.

Into retail

Longer term, the demand for cars fluctuates in recessions. Retailers may reduce their spending on advertising and data subscriptions, but used cars are cheaper and therefore more popular when money is tight, so Auto Trader’s skew should protect it somewhat. The same should be true when the ban on selling new petrol and diesel cars comes into effect in 2030.

The higher cost of cars is increasing the popularity of leasing and, potentially, subscription, which bundles the cost of insurance, roadside assistance and maintenance into the monthly fee. Auto Trader may have covered leasing with acquisition of Autorama, but it has little to say about the nascent subscription market.

Perhaps the biggest risk facing the company relates to its ambition to do more of the retailing. Retailers are also building out their direct sales capabilities and it remains to be seen how much of the transaction they are willing to outsource to the marketplace.

Some manufacturers, led by electric brands such as Tesla (NASDAQ:TSLA) and Polestar (NASDAQ:PSNY) are relegating retailers, Auto Trader's biggest customers, to a support role, by moving to an agency model of distribution where they too sell me cars online.

The potential for change is bewildering, but reassuringly Auto Trader is alive to the risks and explains them well in its annual report.

It has changed before, and its strategy shows how it is changing now.

Getting the balance right

While retailers, manufacturers and marketplace jockey for position, another challenge Auto Trader faces in the used car market may be finding a balance between the interests of its two sides: car buyers and retailers.

Compromise is an inevitability. Promoting advertisements reduces the purity of search results, but consumers accept this. Likewise, to keep retailers happy, Auto Trader only offers car buyers finance options from a broker if the car buyer is not eligible for finance from the retailer’s own finance partner.

In managing these challenges, Auto Trader has a lot going for it.

Chief executive Nathan Coe was appointed in 2007 to oversee the transition to digital and he leads an experienced group of executives.

According to internal statistics and Glassdoor, employees are loyal and proud to work for the company. And consumer reviews in app stores and review sites indicate that we hold Auto Trader in high regard.

Most of all, Auto Trader has our eyeballs.

Does the business make good money? (2)

+ High return on capital

+ Excellent profit margins

+ Strong cash conversion

What could stop it growing profitably? (1)

+ Strong finances, somewhat recession resistant

+ Little competition

? Online competition may intensify

How does the strategy address the risks? (2)

+ Investing in consumer experience

+ Data add-ons for retailers

? Bringing more of new car buying journey online

Will we all benefit? (2)

+ Experienced management

+ High employee satisfaction

+ Excellent annual report

Is the share price low relative to profit? (0)

+ It is probably fair. A share price of 643p values the enterprise at about £6 billion, 19 times normalised profit.

A score of 7 out of 9 indicates Auto Trader is a good long-term investment.

It dominates the classified advertisement marketplace, but its aspiration to do more of the retailing means it has a delicate line to tread between facilitating its customers, dealerships and manufacturers, and competing with them.

It is ranked 12 out of 40 stocks in my Decision Engine.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in Auto Trader.

More information about Richard’s investment philosophy and how he implements it.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.