Richard Beddard: a high-scoring stock with a trick up its sleeve

23rd July 2021 16:40

by Richard Beddard from interactive investor

Our companies analyst thinks this small company is a good long-term investment. Find out why here.

At the beginning of the pandemic, when bookshops closed and Amazon prioritised so-called essential items over books, it did not look like publisher Bloomsbury (LSE:BMY), which still earns 76% of revenue from print, would emerge financially stronger and more profitable.

It did:

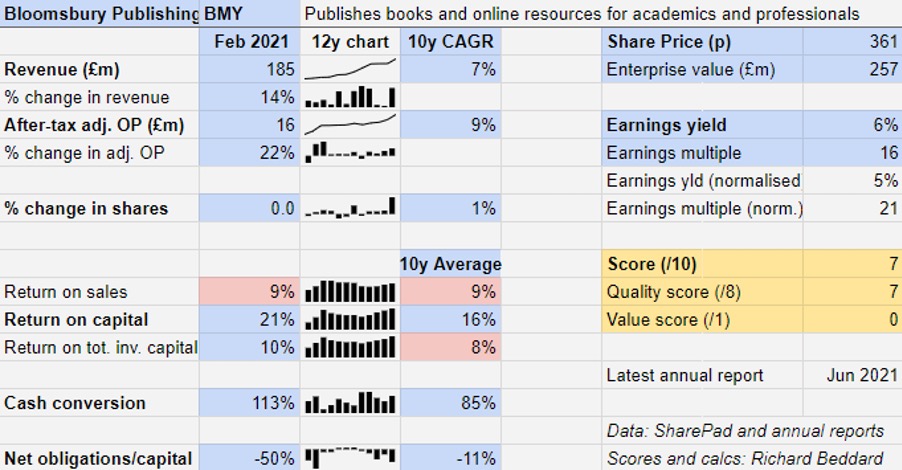

Revenue for the year to 21 February increased 14%, adjusted profit increased 22% and the company earned a return on capital of 21%, significantly above its 10-year average of 16%.

Faced with a sudden reduction in things to do, people fell back on reading, but perhaps more significantly for Bloomsbury’s long-term prospects, sales and profits of a different product serving a different market rose even more strongly.

Digital Resources

Perhaps unsurprisingly, the pandemic accelerated adoption of Bloomsbury Digital Resources (BDR). Currently, the publisher sells 34 collections of primary documents, academic works, textbooks, and audio and visual material to educational establishments.

Among its market-leading collections are Drama Online, Fashion Central, Screen Studies and Theology and Religion Online. Drama Online contains more than 3,000 play texts, 400 audio plays, 345 hours of video and 400 books of criticism.

BDR, a recipient of significant investment since it was conceived six years ago, made a profit of £2.9 million, up from its maiden profit in 2020 of £0.7 million. BDR revenue was £12.4 million, up from £8.3 million.

Although BDR revenue only accounts for 7% of total revenue, it already accounts for 18% of total profit.

- Shares for the future: building a forever portfolio

- Read more Richard Beddard articles here

- Check out our award-winning stocks and shares ISA

BDR’s growth and a profit margin of nearly 25% gave shareholders a taste of what Bloomsbury has been promising for years: £15 million revenue and £5 million profit in the current financial year to February 2022.

Figures for the first four months of 2021 indicate it should meet this target. BDR revenue from March to June was 41% higher than the company achieved over the same period in 2020.

Bloomsbury is achieving its goal of creating a new high-margin income stream, so it is less reliant on UK trade publishing (books for a general audience). 81% of BDR sales come from overseas.

The surge in revenue and profit offset the decline in academic print sales as universities, schools and academic libraries closed their doors, resulting in a 3% increase in sales for Bloomsbury’s Academic and Professional Division.

Old-fashioned books and newfangled e-books

While trade publishing is highly profitable when your authors include JK Rowling, Sarah J Maas (a popular fantasy writer) and Tom Kerridge (whose new book Outdoor Cooking is selling well), the long tail of potential bestsellers that do not make it sometimes drags on profitability.

That said, 2021 was a banner year for Bloomsbury’s trade divisions. If books did not fly off the shelves of bookshops, they flew out of Amazon’s warehouses.

Children’s Trade remains the company’s biggest and currently most profitable division because it incorporates the highest-selling children’s series of our time, Harry Potter.

Bloomsbury Publishing | Revenue (£’000) | Profit (£’000) | Profit margin |

Feb 2021 | Feb 2021 | % | |

Children's Trade | 74,599 | 10,542 | 14 |

Adult Trade | 43,761 | 3,965 | 9 |

Academic & Professional | 44,307 | 4,368 | 10 |

Special Interest | 22,469 | 1,172 | 5 |

Source: Bloomsbury Annual report 2021

The company’s dependence on Harry Potter does not concern me as much as it once did.

The emergence of BDR as a second profit centre is one reason. Another is Bloomsbury’s Harry Potter revenues are durable. They grew 7% in 2021 after a flat year in 2020. Incredibly, Harry Potter and the Philosopher’s Stone was the third best-selling book in the UK, 24 years after it was first published.

Bloomsbury has very successfully kept the franchise flowing with box sets, illustrated and anniversary editions, and spin-offs such as the forthcoming Harry Potter - A Magical Year, a book of illustrations and Potter ephemera for every day of the year.

Seven of the publisher’s top 10 print titles were Harry Potter books in 2021. Bloomsbury does not own the digital rights (JK Rowling retained them), but the situation is replicated in the ebook charts where Sarah J Maas appears six times (she is also number two in the print chart).

- Subscribe to the ii YouTube channel and catch all our latest interviews and video content

- Read more of our content on UK shares here

Bloomsbury does not say how much revenue Harry Potter brings in, only the annual growth in revenue, but Dexter Burt, an analyst who publishes as Ciphersense Research, reckons he has worked it out from a figure he found on the Linkedin resumé of a Bloomsbury employee.

According to this scuttlebutt, Harry Potter earned Bloomsbury £12 million revenue in 2016, and from this Dexter calculates Bloomsbury’s Harry Potter revenue in 2020 was £22 million.

That being the case, in 2021 Harry Potter contributed about £24 million, 13% of total revenue. I would expect the franchise brings in a bigger proportion of profit given the economies of Potter’s great scale and the fact that the books sell themselves.

Receding risks

There are risks I am edgy about, even though Bloomsbury has coexisted with some of them for a long time now.

The first is the dominance of Amazon, which is surely Bloomsbury’s biggest customer (Bloomsbury discloses this customer is responsible for nearly £69 million of revenue, 37% of the total).

BDR, which Bloomsbury sells directly to institutions and through partnerships with other publishers, is also a helpful diversification in this respect.

The second is the growing popularity of Open Access, an alternative electronic publishing model through which authors, or their funders, pay for the editing and peer review of academic texts and make them available for free.

Bloomsbury still profits from OA by providing the editing and peer review, and by mixing OA titles with proprietary content in its collections, boosting the value of the collection.

The third is that Bloomsbury Digital Resources collections are sold two ways. Perpetual access is similar to selling a print book.

The customer buys a collection of electronic publications and keeps it forever. The alternative is subscriptions, where the customer pays annually per learner and benefits from updates to the collection.

Subscription revenue is probably more sustainable and the renewal rate is high, but it is only responsible for 39% of BDR revenue.

The fourth concern is receding. Historically, Bloomsbury’s Return on Total Invested Capital (ROTIC), which includes the cost of acquisitions, has been low.

This implies it may have overpaid for businesses or bits of them. Many of these acquisitions, including Red Globe Press just after the year end, have been the building blocks of the Academic and Professional Division.

Now we are beginning to see the potential of BDR realised, and ROTIC is in double figures, I am more comfortable that Bloomsbury is a good acquirer.

Scoring Bloomsbury Publishing

All businesses face challenges, the important thing is that they face up to them. Reassurance comes from Bloomsbury’s results and its strategy, which is to nurture intellectual property in two markets with different characteristics.

Ultimately the success of its strategy depends on employees, and reassurance about them comes from reviews on recruitment sites.

Until last year ratings had been falling but following something of a cultural renaissance in which Bloomsbury made employee engagement and benefits central to its strategy, they are back at creditable levels.

More reassurance about Bloomsbury’s culture comes from an erstwhile rival. Last month Bloomsbury acquired Head of Zeus, a genre fiction publisher with rights to Cixin Liu's bestselling science fiction trilogy, The Three-Body Problem, which is soon to be a Netflix series.

The comments of Anthony Cheetham, Head of Zeus’ founder and the serial founder of a series of significant book imprints before that, tell us more about Bloomsbury and its founder, Nigel Newton. He said he had found a long-term home for his business, and: “I have known Nigel Newton for more than 30 years. We share many of the same values: creative publishing, unique content and beautiful books. And an entrepreneurial spirit that values innovation above conformity.”

I don’t think this is just flattery. Bloomsbury’s longstanding mission is to produce works of excellence and originality and in my experience it does.

Other independent publishers in Bloomsbury’s sights, and indeed potential employees and authors, may feel the same way.

Does the business make good money? [2]

+ Good returns on capital

+ Good cash conversion

? Reasonable profit margin

What could stop it growing profitably? [1]

+ Stable finances

? Market risks like Open Access and Amazon

? Modest subscription sales

How does its strategy address the risks? [2]

+ Develops existing IP and discovers/acquires new authors and titles

+ Diversification through Digital Resources

+ As Digital Resources mature, profit margins should increase

Will we all benefit? [2]

+ Publishes works of editorial excellence and originality

+ Employee engagement is part of core strategy

+ Founder and chief executive is highly experienced (and highly remunerated...)

Is the share price low relative to profit? [0]

? A share price of 361p values the enterprise at £257 million, about 16 times adjusted profit and 21 times normalised profit (assuming the company had earned its average return on capital over the last decade).

A score of 7 out of 9 suggests Bloomsbury is a good long-term investment.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in Bloomsbury Publishing.

For more information about my scoring and ranking system (the Decision Engine) and the Share Sleuth portfolio powered by this research, please read the FAQ.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.