Richard Beddard: a high scoring small-cap I really like

22nd April 2022 14:21

by Richard Beddard from interactive investor

This small UK business, which makes vital parts for a range of industries, is one of our equity analyst’s favourite companies. Here’s why.

Porvair (LSE:PRV) does two of the most reliable things businesses do: to grow steadily and profitably.

It makes small and relatively inexpensive bits of much larger and more expensive pieces of equipment that are nevertheless vital.

And the company has grown by developing more of these components as well as acquiring smaller rivals, financed by its own activities.

Filters and laboratory equipment

Porvair manufactures filters that protect equipment and the environment from impurities in liquids and gases, reducing downtime, maintenance costs and pollution.

These filters have a wide range of applications in industry and laboratories.

Filtration systems supplied by the company’s Aerospace and Industrial division remove aerosols from steam vented by nuclear reactors, for example, and filter radioactive particles from nuclear waste.

The Metal Melt Quality division specialises in the removal of contaminants from molten metal in aluminium cast houses and iron foundries.

The filters need replacing after they have been used or on a regular schedule, providing Porvair with a reliable stream of income.

The company also has a Laboratory division, which principally supplies water testing equipment and filters.

It makes automated water analysers, robotic sample handlers, and consumables used in sample preparation like microplates (plates with small wells that contain the samples being tested).

Mixed fortunes for filtration

The Aerospace and Industrial division was at the sharp end of the pandemic.

Porvair filters are specified in most commercial airframes for applications like fuel tank inerting: the replacement of oxygen in fuel tanks with a gas like nitrogen to reduce the risk of accidental combustion. They are also used in coolant systems, fuel lines and hydraulics.

- Richard Beddard: a small-cap share with plenty of questions to answer

- Richard Beddard: look at the right numbers and this stock will impress

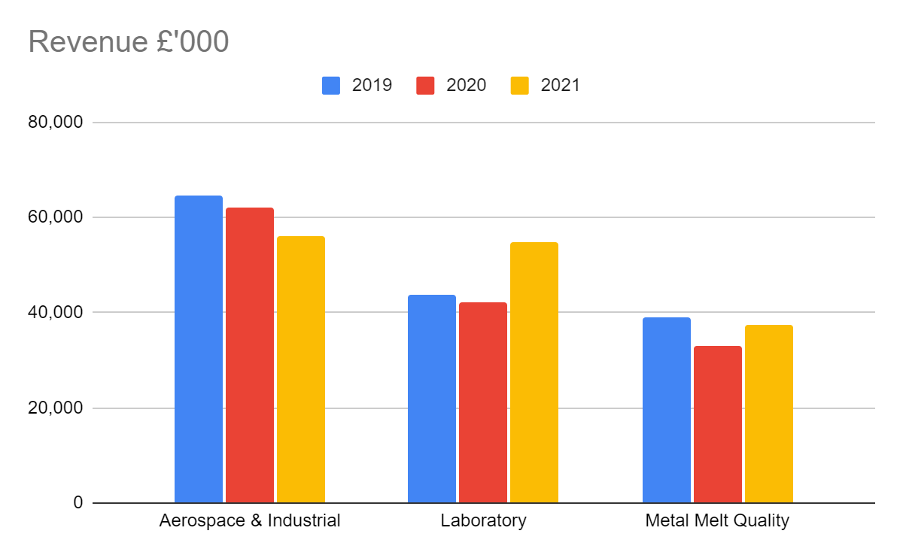

Since fewer planes were being flown, and fewer were being made, revenue from aerospace fell 25% in the year to November 2020, and another 4% in 2021.

Despite the acquisition of Royal Dahlman in 2020, a Dutch filtration company that supplies oil refineries, and a recovery in other industrial markets, aerospace’s continued decline combined with zero income from gasification resulted in a second year of falling revenue and profit for the division.

Porvair has a few large contracts to provide spares for gasification plants that remove ash from synthetic gas. Orders for gasification spares are irregular.

A spike in the sale of consumables for laboratories, partly because they are used in Covid-19 testing, and an acquisition, Kbio, in 2021 meant the Laboratory division almost reached parity with the Aerospace and Industrial division in terms of revenue.

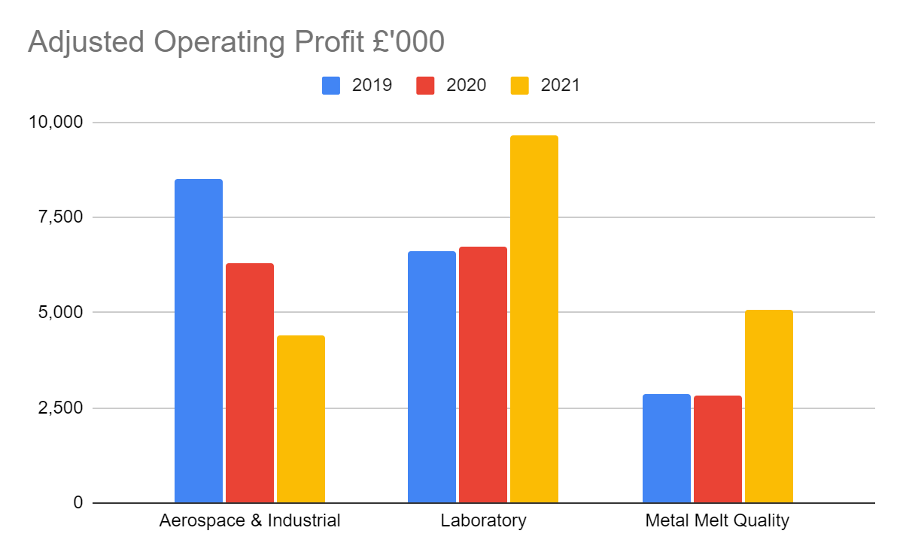

Spikes in profitability at the Laboratory division and the Metal Melt Quality division due to pandemic shortages meant that, unusually, Aerospace and Industrial made the smallest contribution to profit in 2021 and the lowest pre-tax profit margin, 7%, compared to 14% for the Metal Melt Quality division and 18% for the Laboratory division.

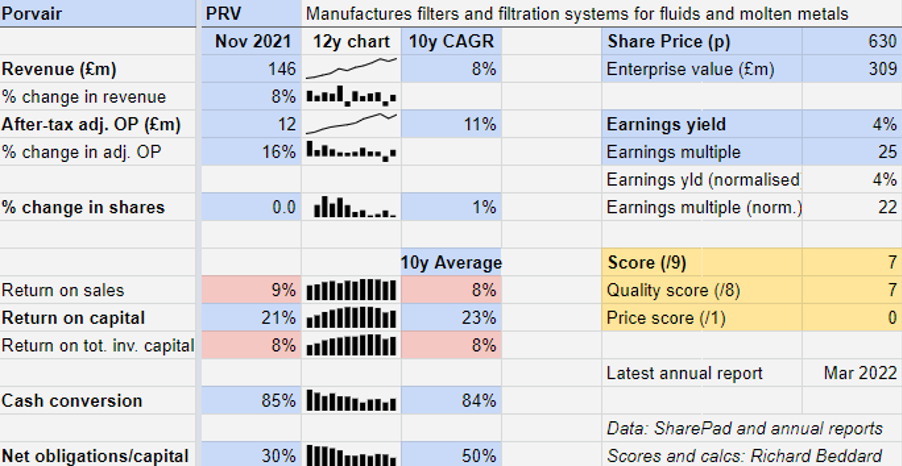

Overall, revenue increased 8% in 2021, slightly ahead of its pre-pandemic benchmark in 2019, and profit increased 16% to just below the pre-pandemic level. Porvair earned an after-tax Return on Capital of 21% and an after-tax adjusted profit margin of 9%, both close to historic norms.

The company has maintained its reputation for good cash conversion and restrained borrowing through the pandemic. It had no bank debt at the end of the year. Financial obligations comprised leases and a pension deficit.

Aerospace is beginning to recover although profitability in the Metal Melt Quality division is expected to soften as shortages ease. Porvair believes it should be able to sustain somewhat higher profit margins than it typically has though.

Perhaps it is not fanciful to imagine steady growth of about 10% a year (CAGR) in future as in the past.

Tilting towards the future

In the immediate future Porvair faces challenges from rising energy, material and labour costs and the possibility of further disruption if the pandemic should intensify again.

But its performance during the pandemic suggests the business will cope with these challenges.

Long term, some of Porvair’s filtration markets are likely to diminish as power generation, transport and industry go green. Porvair itself is considering switching from gas powered foundries to electric.

In the future, Porvair believes there will be fewer internal combustion engines, fewer petrochemical processes and a reduction in the use of some oil-based polymers, all currently big users of filtration products.

- Find out what is now being tipped to be the best investment of 2022

- Insider: trio buy this AIM share and a £500k bet on FTSE 100 firm

But Porvair should also benefit from the pressure to reduce emissions during the transition, the increase in use of aluminium to reduce the weight of electric vehicle components, and the development of greener aviation fuels and hydrogen power.

It thinks the opportunities will outweigh the risks, and while we cannot be sure of that, its strategy will allow it to adapt by developing or acquiring products in diverse growth markets governed by tightening environmental regulation, demand for clean water, and manufacturing efficiencies.

My biggest concern about the strategy is the cost of acquisitions. The company has amassed a highly profitable collection of businesses. However, factor in the cost of acquisition and it earns a more mundane 8% Return on Total Capital.

Nevertheless, Porvair has managed to grow revenue at a Compound Annual Growth Rate (CAGR) of 8%, and profit at a CAGR of 11% over the last 10 years. Its reliance on external funding has reduced.

Scoring Porvair

I like Porvair. The filters are consumable so customers must replace them to continue operating their equipment.

They are relatively inexpensive so customers are unlikely to skimp on quality to save money.

The strategy of developing and acquiring niche businesses has delivered profitable growth since the financial crisis, and has been overseen by chief executive of 24 years Ben Stocks.

It is rooted in the specialist knowledge of employees and the opportunity Porvair, which manufactures and sells around the world, has to turn local businesses it often acquires into exporters.

The company judges its own performance using measures that should promote long-term growth.

The clarity that comes from such an established and repeatable process is well articulated in the annual report.

Does the business make good money? [2]

+ High Return on Capital

+ Good cash conversion

? Profit margin improving

What could stop it growing profitably? [1]

+ Resilient business can withstand recessions in key markets

? Return on Total Invested Capital (ROTIC) of 8% suggests acquisitions do not come cheaply

? Transition to lower carbon economy

How does its strategy address the risks? [2]

+ Focus on consumables in niche markets

+ Funds acquisitions from cash flow

+ Developing and acquiring in new markets

Will we all benefit? [2]

+ Ben Stocks, chief executive, owns 1.5% of the shares

+ Employee focus (voluntary resignations to be disclosed from next year)

+ Key performance indicators should encourage long-term growth

Is the share price low relative to profit? [0]

+ Low enough. A share price of 630p values the enterprise at about £309 million, about 22 times normalised profit.

A score of 7 out of 9 indicates Porvair is a good long-term investment.

It is ranked 16 out of 40 stocks in my Decision Engine.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in Porvair

For more information about Richard’s scoring and ranking system (the Decision Engine) and the Share Sleuth portfolio powered by this research, please read the FAQ.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.