Richard Beddard: this high-scoring company is a rare thing

21st July 2023 15:49

by Richard Beddard from interactive investor

A business that has successfully navigated economic cycles, continues to thrive, and even underpins society. Our columnist explains why he likes it so much.

Bloomsbury Publishing (LSE:BMY) prospered through the pandemic, and it is now doing very well despite rolling economic problems.

It appears to be that rare thing, a company that can prosper through thick and thin.

Affordable fun and facts

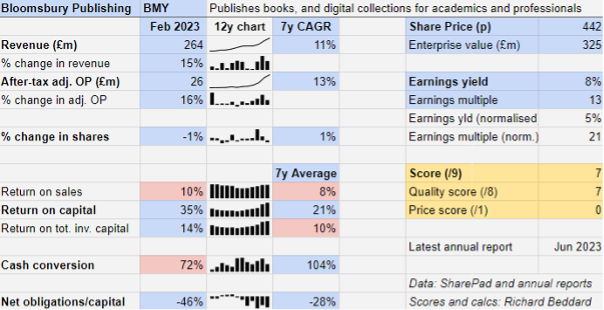

Revenue and profit increased by 15% and 16% respectively in the year to February 2023. The publisher achieved a record return on operating capital of 35%. Including the cost of acquisitions its return on total invested capital was a healthy 15%.

Cash conversion was below par, but far from alarmingly low. Mostly, Bloomsbury used up cash to secure stock, and invest.

- Invest with ii: Top UK Shares | How to Start Trading Stocks | Open a Trading Account

At its Annual General Meeting earlier this week, Bloomsbury reported revenue growth of 9% for the first four months of the current financial year, compared to the same period in the year just gone.

The company has prospered because academic libraries accelerated their adoption of digital resources, reading has proved to be a cheap and available form of entertainment during lockdowns and inflationary times, and social video platform TikTok emerged as a force in marketing books, especially to Bloomsbury’s large young adult readership.

Another good year is a testament to the maturation of Bloomsbury’s investment in digital resources for academic and school libraries, the continuing health of blockbuster franchise Harry Potter (Bloomsbury owns the print rights to the original series of books except in the US), and the stunning popularity of the fantasy fiction author Sarah J Maas.

Bloomsbury earns mightily from blockbuster fiction franchises and niche academic databases. The former is lucrative, but the company must fund a long tail of also-ran and unprofitable titles because it does not know where the next hit will come from.

The latter is a much less established business, but it already looks like a steady earner.

Critical Maas

Incredibly, the Harry Potter books remain among the top-selling books in the UK, but sadly the company did not report growth in Harry Potter sales in this year’s annual report as it usually does. Bloomsbury reported strong growth in its results for the first half of the financial year, though.

Sarah J Maas had four books in the New York Times bestseller list, and even though none of them were published during the financial year, sales increased 51% year-on-year. Bloomsbury says her books have amassed a cumulative 11.5 billion views on TikTok!

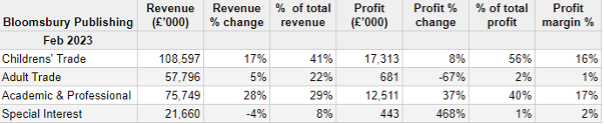

A private investor, Abs, whose intricate spreadsheets reveal more of the internal dynamics of Bloomsbury than my own, reckons Harry Potter revenue (£39 million in 2022) was probably eclipsed for the first time by Sarah J Maas (£53 million in 2023). Together they likely account for the majority of the £109 million sales of the Children’s Trade division (trade is a synonym for general interest books).

Children’s Trade is Bloomsbury’s biggest division, and only Bloomsbury Digital Resources’ (BDR’s) profit margins rival it.

We need to treat these figures with caution. Bloomsbury does not disclose the revenue for these franchises. Abs’ spreadsheet uses the revenue growth figures Bloomsbury discloses, and calculates revenue from them. Any error, or change in the basis for measurement, would change the result.

Although the figures may not be sacrosanct, I think they do give us an idea of how significant these franchises could be, which leads to some interesting conclusions.

- Should you bookmark this small-cap with record growth?

- Shares for the future: five factors I use to score shares

After a big lurch upwards in 2017 and 2018 (the 20th anniversary of the first book), Harry Potter revenue has been pretty stable. There have been no new Harry Potter books in the series since Harry Potter and the Deathly Hallows in 2007 and Bloomsbury is keeping the franchise alive with special editions. The Harry Potter Wizarding Almanac is slated for publication in autumn.

Interest is likely to be strengthened too by a forthcoming decade-long HBO Max television series. Each season will be devoted to one of the seven books.

The popularity of Sarah J Maas has grown explosively. Abs reckons revenue from the franchise was a little less than £9 million in 2017.

Although the popularity of early titles is enduring, growth has also been propelled by new books, so it will be sensitive to the schedule. The only book to be published in the current financial year is House of Flame and Shadow in January 2024, perhaps just in time to add a flourish to the numbers.

There are 15 books in Bloomsbury’s Sarah J Maas backlist and seven more under contract. A Hulu streaming series is in the making too.

If, as Abs calculates, Sarah J Maas revenue has grown by £44 million since 2017, the franchise alone accounts for more than a third of Bloomsbury’s revenue growth over the same period.

While the Adult Trade division does not have blockbusters like these, its performance in recent years has at least improved since 2017 and 2018, when it lost money. Bloomsbury believes the publication of Nobel Prize winners and critically acclaimed authors enhances its reputation.

The trade divisions have one customer, probably Amazon, that is responsible for 26% of revenue, but Bloomsbury has lived with Amazon for decades, and regards this dependency as a reducing risk. In BDR it has a product that is independent of the e-commerce behemoth. It is sold directly to academic institutions.

Source: Bloomsbury Annual Report 2023

Driving Digital

Although Bloomsbury still earns 70% of revenue from print titles, its other source of rapid growth is BDR.

Helped by two acquisitions in the previous financial year, revenue from BDR increased 41% to over £26 million. This business has grown from almost nothing in 2017 and accounts for much of the growth in its parent division, Academic & Professional. With operating profit margins of 30% plus, BDR is also driving the division's profitability.

BDR becomes more distinctive, valuable and indispensable as Bloomsbury adds new material to it because its arts, humanities and social sciences niches have been neglected by other publishers.

But there is a limited number of institutions teaching subjects like Drama and Fashion, and Bloomsbury reckons it already sells one of its many products to half of its potential customers. Perhaps limits to growth in universities is one of the reasons the company acquired US publisher ABC Clio last year. It also publishes titles and databases for schools.

BDR’s wings may be clipped by Open Access (OA), which requires free access to publicly funded research, and is increasingly required by public funders of research.

Bloomsbury can still profit from OA by providing publishing services (editing and peer review) for a fee, and combining OA texts with BDR collections. To help fund open access projects, Bloomsbury is bringing academic libraries together to pool their resources.

Growth may slow, but Bloomsbury expects BDR revenue to be 40% higher in 2028, before the impact of any acquisitions.

Acquiring growth

Bloomsbury’s other source of growth comes from the acquisition of rights. In the consumer divisions it is looking for potential new bestsellers, and in the academic world it is looking for print titles that it can digitise and slot into BDR, where they are more valuable.

These rights are won by negotiating with authors and rights owners, or by acquiring publishers and imprints.

In total, Bloomsbury has acquired 33 publishers and imprints in its 37 year history, financing the deals largely from its own cash flow.

Since the company has a large cash surplus, we can look forward to more.

Fairness

Bloomsbury's blockbuster Trade publishing business model is unnerving. It does not seem to be producing satisfactory returns in the Adult Trade division, but this does not put me off.

Education, literacy, and culture underpin society and Bloomsbury exists to publish works of "excellence and originality".

Artificial intelligence may only be a distant threat judging by its current guise: a technology that mashes up and regurgitates the internet sometimes nonsensically.

Intriguingly, chief executive Nigel Newton, reckons AI will be a productivity aid, streamlining the production of marketing information, for example.

Employee well-being is central to Bloomsbury’s strategy and internal surveys indicate employees are content. The company claims an industry leading bonus scheme, and allows its mostly female workforce to work flexibly. Median total pay and benefits of £40,000 in 2023 are high enough to provide a financially, as well as intellectually, rewarding career.

Mr Newton, though, received more than 50 times that much, an eyebrow-raising £2.1 million.

Maybe he is worth it. When Bloomsbury acquired book publisher Head of Zeus in 2021, the outgoing boss remarked: “I have known Nigel Newton for more than 30 years. We share many of the same values: creative publishing, unique content and beautiful books. And an entrepreneurial spirit that values innovation above conformity.”

One up from bottom: a work of excellence and originality

As a reader, I find myself nodding in agreement, and I imagine many of its authors do too.

Scoring Bloomsbury

Does the business make good money? [2]

+ High return on capital

+ Improving profit margin

+ Strong average cash conversion

What could stop it growing profitably? [1]

+ Strong finances, resilient sales

? Competitive threats: Amazon, Open Access, AI

? Maturation of BDR

How does its strategy address the risks? [2]

+ Development of authors and works

+ International growth (73% non-UK)

+ Self-financed acquisitions

Will we all benefit? [2]

+ Very experienced management

+ Engaged employees

+ Works of excellence and originality

Is the share price low relative to profit? [0]

+ It is about right. A share price of 442p values the enterprise at £325 million, about 21 times normalised profit.

A score of 7 out of 9 indicates Bloomsbury is a good long-term investment.

It is ranked 22 out of 40 stocks in my Decision Engine.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in Bloomsbury Publishing.

More information about Richard’s investment philosophy and how he implements it.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.