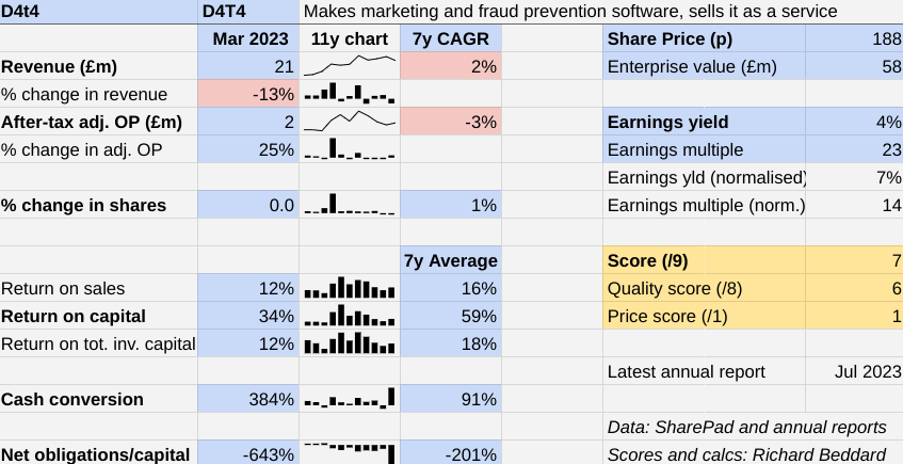

Richard Beddard: a good long-term investment at a firm undergoing rapid change

Stagnant sales, but this UK company remains profitable and has a coherent strategy with a 2024 goal of ‘significant growth’, says our columnist.

25th August 2023 15:00

by Richard Beddard from interactive investor

D4t4 Solutions (LSE:D4T4) is an exciting business to follow because it is changing so rapidly, but this makes it a somewhat speculative business to invest in.

- Invest with ii: Top UK Shares | Share Tips & Ideas | Cashback Offers

It is transforming itself from a systems integrator, a business that knitted together software and hardware into IT systems, into a cloud-based software company.

Marketing and fraud protection

D4t4 has developed patent-protected marketing and fraud prevention software under the Celebrus brand, and hosted customer data management that integrates Celebrus with a customers’ other data repositories.

Celebrus builds up a profile of the customer from biometrics: the clicks, mouseovers and touchpad pressure we exert when we navigate a website or app, and by deriving meaning from the words we type in forms and chat interfaces.

Real-time data capture means the system can make decisions and instantly respond to customers.

Celebrus does not fall foul of privacy laws and the deprecation of third-party cookies because it relies on first-party data (collected by the company, or indeed the program itself).

And the software is tagless, which means websites do not have to be configured with tags to collect information. It can be deployed in a matter of minutes.

Celebrus helps customers, traditionally banks and insurance companies but also retailers and travel companies, to deal with customers more effectively, steering them through the sales process, offering recommendations, transferring them to call centres, and stopping fraudsters.

Lighting up sales

The challenge facing D4t4 has been stagnant sales and dwindling profit as it re-engineered Celebrus into a cloud-based system.

Typically, customers pay annually instead of for perpetual licences like they used to. This means the company is collecting less revenue when it signs up new customers in the expectation that revenue will build over time.

It also means D4t4 is supplying less hardware because it is only offering the cloud solution to new customers. Existing customers will continue to receive hardware to refresh or replace legacy systems for many years.

- Stockwatch: a buying opportunity at two UK shares

- Richard Beddard: this smooth operator is not without a few wrinkles

The difficulty facing investors is deciding whether there is any more to D4t4s lacklustre performance, or whether the steady build-up of annual payments will reveal itself in growing revenue and profit now that most of its revenue is recurring.

What D4t4 needs to light up profit growth is more Celebrus sales, which the company believes will happen now the software is easier to update and augment online.

This is why D4t4 has acquired more salespeople, is selling “use cases”, portions of the software rather than the whole package - a strategy it dubs “land and expand”, and is selling direct as well as to the partners it currently relies on and new partners.

These partners are business software companies such as SAS, Pega Systems and Teradata that incorporate Celebrus in their offerings. In the year to March 2023, it added Salesforce to the roster, and it has also added consultancies to its sales channels.

Although the split in revenue between D4t4’s two biggest partners shifted markedly in 2023, the combined dependency reduced from 68% of revenue to a still very significant 63%, another good reason to get closer to the end customer.

To my mind, the strategy coheres, but after only a year or two of sharpened sales focus, the numbers present a confusing and incomplete picture.

Sales down, profit up

It is always dangerous to read too much into a single year’s results, but even more so for D4t4 in the year to March 2023 when it did not earn revenue it expected from a delayed one-off contract that included a lot of low-margin hardware.

D4t4 achieved a 13% fall in revenue and a 25% rise in profit.

This delayed contract has now been signed, so the revenue boost should be accounted for in 2024. But hardware is D4t4’s lowest priority, so it is not much to crow about (and will reduce the company’s profit margin).

Looking at “underlying” measures of revenue is more reassuring.

Helped by the delayed contract, revenue from software licences increased from 25% to 38% of the total in 2023.

- The fund managers who hunt for AIM winners, and where they are finding the best opportunities

- AIM ISAs are 10 years old: these shares are the big winners

Annual recurring revenue (ARR), which includes lower margin hosting, support and maintenance contracts as well as Celebrus sales, increased 19% to 89% of total revenue, following on from a 32% increase in 2022.

Profitability in terms of return on capital and profit margins improved for the first time in five years, partly because the company did not sell much hardware, but also because the proportion of licence revenue increased against maintenance and support contracts.

By these measures the strategy has notched up early success. D4t4 is selling more Celebrus, and profit margins have improved.

The company says its goal for 2024 is “significant growth” from a sales pipeline 27% more valuable than it was a year ago.

Scoring D4t4

Although D4t4 has not convincingly grown revenue or profit through its transformation, it has remained profitable, the strategy is coherent, and the early indications are positive.

Although the competitive landscape is bewildering, managing customer data and fraud prevention are critical to the success of online businesses, a huge market, and although I cannot be sure, the company makes a good case that its solution is capable and different.

Despite all the change, D4t4 says employee retention in 2023 was 90%, which along with the extensive reporting of an employee engagement survey in the annual report, suggests the company is carrying its most valuable resource with it.

The long-term chief executive bowed out in 2021 and his replacement, Bill Bruno, was previously D4t4’s North American vice-president. North America is D4t4’s biggest geographical segment. Chief financial officer, Ash Mehta, was also appointed in 2021.

Non-executive chair Peter Simmonds lends experience. He joined the board eight years ago and is a former chief executive of DotDigital, a UK software success story.

Does the business make good money? [1]

? Good return on capital, but it has declined

? Stagnant growth

+ Strong cash conversion

What could stop it growing profitably? [1]

+ Strong finances

? Bewildering competitive landscape

? Dependent on large partners

How does its strategy address the risks? [2]

+ Continuous development of product

+ “Land and expand”

+ Selling direct to end customers

Will we all benefit? [2]

+ Board has a blend of experience

? Directors are not major shareholders

+ Emphasis on culture

Is the share price low relative to profit? [1]

+ Yes. A share price of 188p values the enterprise at about £58 million, 14 times normalised profit.

A score of 7 out of 9 indicates D4t4 is probably a good long-term investment.

It is ranked 25 out of 40 stocks in my Decision Engine.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in D4t4.

More information about Richard’s investment philosophy and how he implements it.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.