Richard Beddard gives this top AIM share the thumbs up

After years of ruminating, our companies analyst lets this ‘terrific’ business into his Decision Engine.

12th June 2020 15:40

by Richard Beddard from interactive investor

After years of ruminating, our companies analyst lets this ‘terrific’ business into his Decision Engine.

Judging by results for the half-year to March 2020 and two acquisitions in June, translator RWS (LSE:RWS) is still making the right strategic choices.

Inoculated against Covid-19

Previous acquisitions extended the company’s capabilities from a highly profitable niche in patent translation to life sciences, for example the translation of clinical trial reports, and the localisation of software and marketing content, often for technology companies.

By focusing on highly technical and critical industries, RWS inadvertently shaped the business to prosper through a pandemic it could not have foreseen.

Two new acquisitions should help with more predictable challenges: technological disruption and global ambition.

RWS reports only a small decline in demand due to Covid-19, restricted to its IP (patent) division. Moravia, which provides localisation services to large technology companies, and Life Sciences, which works for pharmaceutical and medical companies, are busy.

A modest decline in profit overall was as much the result of unusually high patent demand due to a backlog at the EU Patent Office last year, as a Covid-19 related slowdown in patent activity this year. RWS was confident enough in its financial strength to pay a dividend and splurge on Iconic Translation Machines and Webdunia.

Source: Iconic Translation Machines

March of the machines

The attraction of Iconic is its software and expertise, not its revenue and profit, which are negligible. Iconic was already working with RWS Life Sciences, but now its machine translation software platform will service all three RWS divisions.

Although it has long used technology like translation memory databases (repositories of translated text) and Moravia already uses machine translation, RWS is still heavily dependent on human translators to translate and check texts.

Automation is increasing though, and Iconic will enable translation in large volumes, a requirement due to globalisation and the company’s prodigious growth. Technology is likely to be a cornerstone of competitive advantage, so RWS is bringing it in-house.

Webdunia is an Indian localisation business, which RWS has bought to bolster Moravia’s presence in the country.

It seems likely that RWS is experiencing the benefits of scale, able to provide large multinational clients wherever they operate with a growing range of patent, translation and localisation services, while keeping costs down through automation.

The bigger the company gets, the fewer rivals are able to match it for the quantity and variety of work it can do, and its geographical reach.

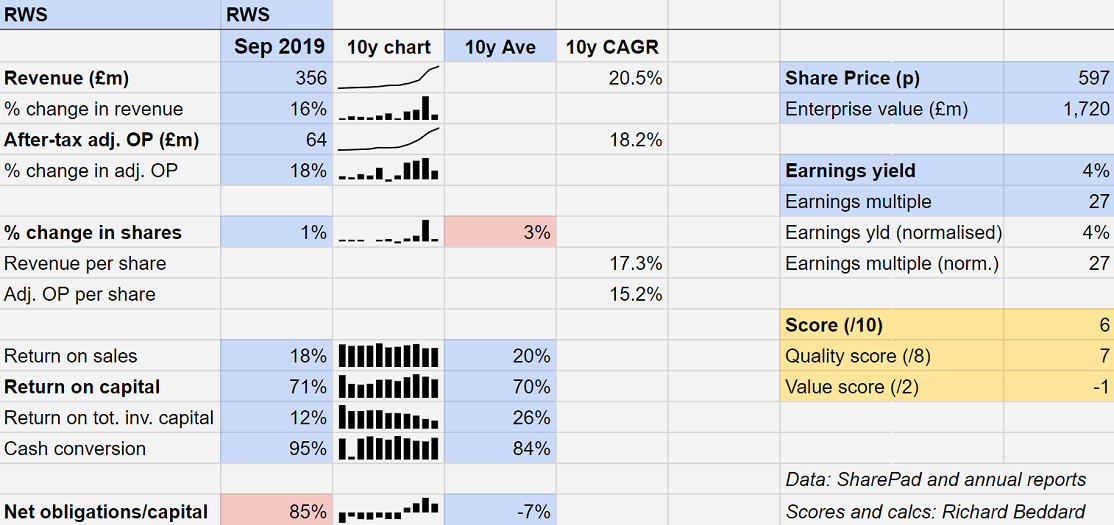

The company’s financial performance through to the end of September 2019 suggests RWS has been doing something special:

Rapid and long-lived growth and extraordinarily high and stable returns in profit and cash terms, all point to a vigorous and resilient business. Two statistics, though, have deteriorated since RWS made its big acquisitions, starting with life sciences translator Luz in 2017 and reaching its apogee (so far) with Moravia later the same year.

ROTIC v ROOC

RWS largely used debt to fund the acquisitions, which along with increased rental obligations mean its operations are mostly financed by debt as opposed to equity. High levels of debt only become a problem though, if a company cannot afford the interest payments, or debt repayments when they fall due. RWS’ prodigious cash flow makes this an unlikely prospect.

There is also a discussion to be had about profitability. The Return on Operating Capital (ROOC) measure uses operating capital as the denominator and profit as the numerator. The former excludes assets created to account for acquisitions and the latter excludes the associated amortisation costs.

This is the best measure of how efficiently a business is performing, but it ignores the historical cost of the acquisitions. What if RWS is not earning an adequate return on the purchase price of these businesses, as opposed to the investment required to operate them?

- Stock market rally poll: too much too soon, or only the start?

- Chart of the week: my most important post for some time

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

RWS’ Return on Total Invested Capital (ROTIC) is much lower, having fallen way below its impressive 10-year average of 26% to a somewhat more humdrum 12%. This ratio compares profit to the value of a company’s operating capital plus acquired intangible assets stated at their original (unamortised) cost.

The relatively modest level of ROTIC may not be problematic. It’s depressed because of heavy investment in acquisitions. The investment is made all at once, but the returns should continue to grow for many years. Profitable growth is, of course, not a given, but the early signs are good.

Meanwhile, RWS is getting to grips with some risks, the acquisition of Iconic shows it is addressing the potential for a shift in power to software companies offering machine translation, while other risks, like the European Unitary Patent, may be receding.

One patent for all? Most? Some? Any?

Eventually, a European Unitary Patent should enable companies to file a single patent for all European countries that sign up for it. I say eventually, the regulations establishing the system have been in place since 2013, but it cannot come into force until 13 EU member states have ratified them, including the three biggest patent filers, currently France, Germany and the UK.

RWS has long believed its customers will be cautious about adopting an untried system while it runs alongside the existing one and some European nations are getting cold feet. The UK is leaving the EU and has announced it no longer intends to participate, and Germany’s biggest constitutional court has upheld a complaint that the Unitary Patent is unconstitutional. Spain and Croatia will not participate either. RWS thinks the new system will be delayed for years, and may not ever happen.

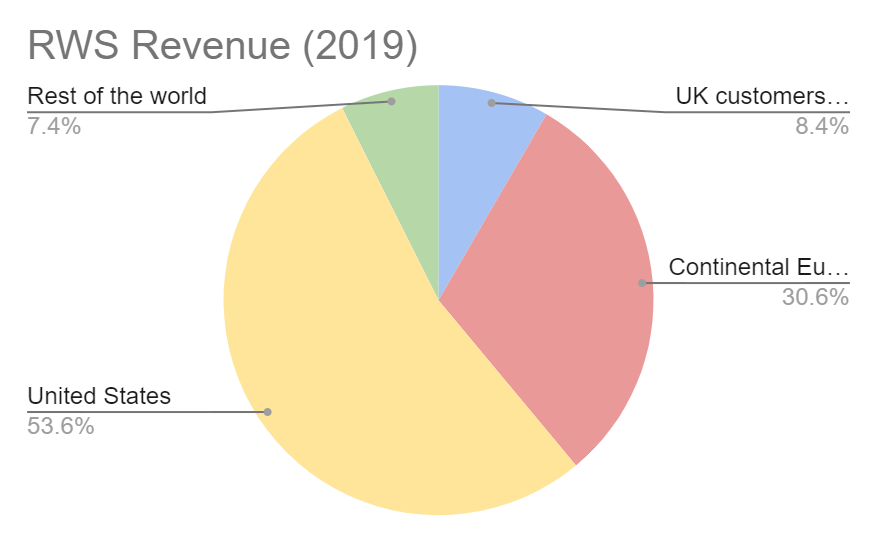

The company has diversified anyway and is far less dependent on Europe and patents. Having focused its geographical expansion initially on the US, the next stage is China:

Source: The author, from data in the 2019 annual report.

Culture of copy & paste

But there is a circle I can’t fully square: RWS’ culture. The company says little apart from the obligatory thankyou to the staff of its “quintessential people-focused business”. Chairman Andrew Brode is committed, he owns a majority shareholding, the company operates a Save-As-You-Earn share scheme, is investing to make its offices a better place to work, and it throws legendary parties.

In the eyes of staff, though, this is scant compensation for the boring repetitive nature of much of the work and relatively low pay. RWS translators must not only be linguists, often they have a legal or a science background. Reading between the lines of staff reviews many of them feel they’ve squandered these talents on a white-collar version of manual labour, copying and pasting pre-translated text.

Maybe there’s not much the company can do about that, but its score of 2.8 out of 5 on review site Glassdoor is improving, and so is RWS Moravia’s score, which is a respectable 3.5.

For many years, I’ve flirted with allowing RWS to join the Decision Engine, which in turn enables me to include the shares in my portfolios, but I have felt there were too many unknowns. Today that changes. This is my score:

Does the business make good money? [2]

+ Consistently high returns on sales and operating capital

+ Strong cash flows (except 2010, when RWS bought a new HQ)

What could stop it growing profitably? [1]

+ Not very cyclical. Was highly profitable during the financial crisis, and has a flexible freelance cost base

? Relatively high financial obligations

? Acquisition costs must be justified by performance

? EU Unitary Patent may reduce demand

? Machine translation may disrupt the business

How does its strategy address the risks? [2]

+ Geographical diversification reduces dependence on Europe

+ Industry diversification reduces reliance on patent business

+ Automation drives down cost, increases volumes

Will we all benefit? [2]

+ Chairman and majority shareholder Andrew Brode is experienced

+ Employee share option scheme

+ Initiatives to make RWS a great place to work

? Mixed reviews on recruitment websites

? Reporting is not explicit enough on advantages of business model

Are the shares cheap? [-1]

+ No. A share price of nearly £6 values the enterprise at £1.7 billion, or about 27 times adjusted profit. The earnings yield is 4%.

RWS is probably a terrific business and good long-term investment. Its acquisitive strategy adds an element of risk (but may be securing the future) and the shares trade on a lofty valuation.

A total score of 6/10 ranks RWS at number 25 out of the 32 shares I track.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.