Richard Beddard: is this FTSE 100 stock one to buy and hold?

Our columnist analyses this ‘steady Eddie’ stock.

26th March 2021 11:26

by Richard Beddard from interactive investor

Our columnist analyses this ‘steady Eddie’ stock.

Page 210 of Bunzl (LSE:BNZL)’s annual report lists its subsidiaries by country from A to F. Argentina has one, Australia has 14, Austria has two, and so on. France has 34.

The list does not stop there of course. Page 213 finishes the French subsidiaries and lists those in countries beginning with the letters G to S, for Slovakia.

Page 214 continues with Spain and contains most of the Us, the UK and the USA, which have enough subsidiaries to fill a page between them.

Our journey through pages of subsidiaries only stops on page 215 with Steelpro Safety SA, the company’s only Uruguayan business.

The length of this list is the result of a roll-up strategy that has been in place for nearly two decades.

Bunzl, a distributor of consumables used by businesses and other organisations, buys similar but smaller distributors, and assimilates them into its efficient network. It has made 172 acquisitions since 2004.

Investors should not expect Bunzl to do as well in 2021 as it did in the year to December 2020, when increased sales of high margin personal protection equipment outweighed lower sales of food packaging, disposable tableware, and other supplies for retailers and restaurants. There were also increased provisions for insolvencies in afflicted sectors.

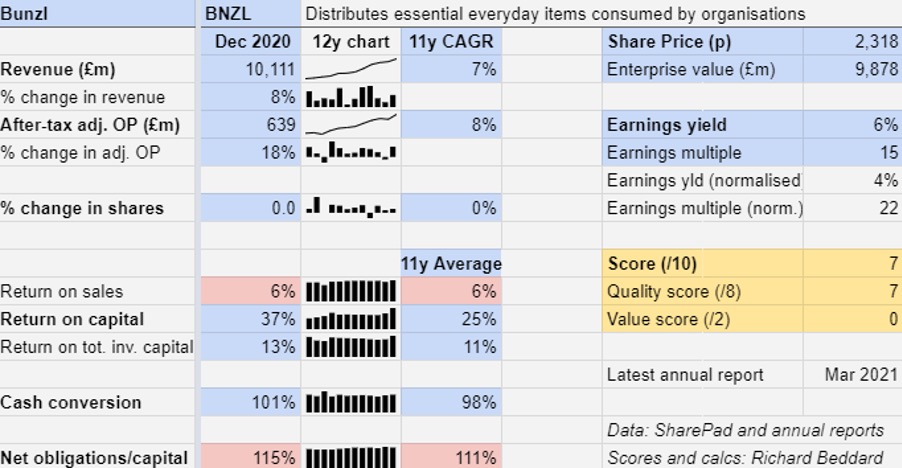

Profit rose by 18% in 2020, but if it were to fall in 2021 it should not fall far. Over the years Bunzl has been a stalwart, earning metronomic returns in terms of profit and cash flow and growing revenue and profit pretty steadily.

One thing is for sure: The acquisitions continue unabated. In the year to date, Bunzl has already chalked up three.

Where is the beef?

The value in Bunzl is in the huge scale it has already achieved, principally in Europe and North America, and the internal processes that enable it to source and distribute products and assimilate businesses with the minimum of fuss.

Scale means Bunzl can source products cheaply and pass on some of the benefits to customers. It means it can supply a wide variety of products often in the same delivery. And it can consolidate warehouses and provide central administrative services to its subsidiaries.

- Shares round-up: three FTSE 100 stocks with optimism

- Richard Beddard: first time scoring this hugely predictable FTSE 100 stock

It can do all this because a distributor of basic but essential goods does pretty much the same thing wherever it is, which means Bunzl can help local managers get on with running its subsidiaries.

Bunzl has been scaling up successfully for the best part of two decades, but to keep growing it must find increasing numbers of acquisitions, or gobble up larger companies.

This was evident in the year to December 2020 when, despite temporarily pausing acquisitions in the early days of the pandemic, Bunzl spent £445 million, its second-biggest annual haul ever.

To my mind the names of the acquired companies barely matter. They are documented in Note 26 of the annual report, and they serve to illustrate Bunzl’s diversity.

Two operate in Brazil, two in the UK, and two in the US. The other three are in Canada, Denmark and Ireland. Four of them supply safety products, perhaps reflecting the focus of the company’s expansion currently, and others supply grocery, healthcare, and cleaning and hygiene products.

The company can afford to acquire on this scale. The £445 million was considerably less than the cash the company earned after paying operating costs, capital expenditure and tax (free cash flow).

Neither does Bunzl appear to be paying too much for acquisitions. Including their value at cost in the return on capital, calculation results in a healthy 13% return and an 11% average over the last 12 years.

Bunzl’s operating capital is entirely funded by debt of one kind or another, a risk the company must believe it can take because reliable profits and cash flows mean it can easily afford the interest.

The good news is confidence has not encouraged the company to borrow appreciably more in relation to capital employed over the years.

Scoring Bunzl

The simplicity of the business model, and Bunzl’s track record are beguiling, and surely connected.

But there is a price for reliability. Bunzl is never going to set the stock market alight. It is an accretive business, not an explosive one.

Does the business make good money? [2]

+ High and stable returns on capital

+ Excellent cash conversion

? Modest profit margins

What could stop it growing profitably? [1]

+ Business holds up in recession

? Must find more acquisitions or bigger ones to keep growing at same rate

? Relatively high financial obligations

How does its strategy address the risks? [2]

+ Acquisitions increase range and reach

+ Operational efficiencies improve profitability

? Financial discipline ensures Bunzl does not overreach

Will we all benefit? [2]

+ Decentralised organisation gives managers autonomy

+ About 80% of employees would recommend to a friend

? Total remuneration of CEO is 137 times the median UK employee’s

Is the share price low relative to profit? [0]

? The share price looks low compared to 2020 earnings, but the company’s enterprise value is 23 times normalised earnings - assuming Bunzl had earned its average return on capital in 2020.

I rushed to profile Bunzl immediately after the publication of its annual report because I hoped to add the shares to the Share Sleuth portfolio.

With a total score of 7/10 it sits on the cusp of good value. It is probably a good long-term investment, which gives me something to think about.

Socially Responsible Decision Engine

Tony asks: “Given the importance of ESG, even allowing for all its problems, for the future of the planet and company success, I wondered if you have considered adding ESG or something like it to your scoring system.”

Environmental, Social, and Corporate Governance (ESG) criteria help measure the sustainability of a business.

Though I do not mention ESG by name, the Decision Engine is designed to find good long-term investments, by which I mean businesses we can buy and hold, hopefully in most cases for more than 10 years.

This is reflected in the factors I score, particularly the final one, fairness. To receive a high score for fairness a company must treat all stakeholders well, principally customers, employees, suppliers, shareholders, but also society in general.

Imagine a business that ripped off its customers and suppliers, lied to shareholders, bullied staff and polluted the local area. It is hard to believe it could be sustainable, and even if somehow it was, I would not want to own the shares.

The strategy factor also touches on the E in ESG because I favour businesses that are efficient and innovative. These are likely to have a diminishing environmental impact.

Bunzl may be a case in point. Its annual report devotes many pages to sustainability. Over the last 10 years it has doubled revenue while keeping total carbon emissions stable, although it acknowledges there is more it can do.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.